Liquid(ity) Engineering

The Chinese capture of a US drone rattled markets on Friday but the story going forward isn't about the geopolitics, it's about the outsized reaction. The yen is the early leader while the Australian dollar lags. CFTC positioning data shows the market piling into yen shorts. A new trade in NZD has been issued moments ago, while Friday's clsose of the NZDCAD trade at a profit.

The US dollar fell on Friday and risk assets reversed lower after China captured a US underwater drone in international waters. The move sparked tensions and tweets from the President-elect but it stopped there as China, on the weekend, agreed to return the vessel .

A reversal of some of that tension is the likely path for markets early in the week but the lesson is that the year is winding down and markets are less liquid. The market reaction to the drone seizure was outsized and that's no surprise as the headlines hit on a Friday afternoon with the year winding down.

The lesson for the week ahead is to keep a close eye out for news and to buy headlines. It's also a warning to remain cautious, even with the euro breaking down and the yen breaking out. Markets tend to drift at this time of year, not to race.

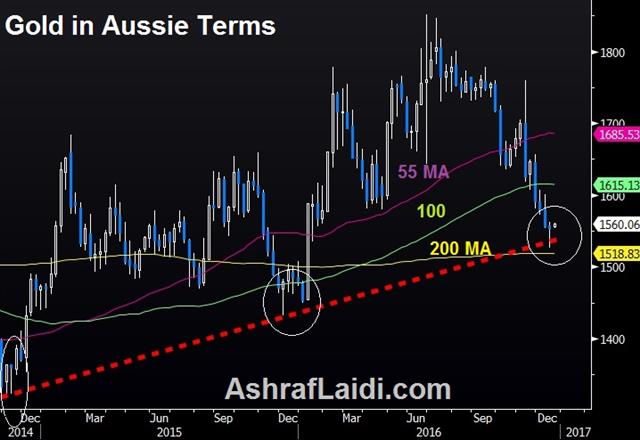

Aussie Downgrade?

The reason for some minor Australian dollar weakness to start the week was a hint from the Finance Minister that the budget is deteriorating. The update is due out in the hours ahead and the risk is that a ballooning deficit could be closely followed by a downgrade in Australia's AAA-rating. One AussieCommitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -88K vs -115K prior JPY -63K vs -34K prior GBP -72K vs -77K prior CHF -25K vs -25K prior AUD +14K vs +21K prior CAD -22K vs -18K prior NZD -4K vs -2K prior

The weekly positioning data showed a rush out of euro shorts and into yen shorts. It's the first post-ECB look at positioning. It's also the second week in a row of aggressive yen selling. Despite the fast move from flat to -63K, history shows there are likely still plenty of yen shots on the sidelines.

Latest IMTs

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35

-

How I Grew the Account 5x

by Ashraf Laidi | Mar 2, 2026 11:54