Intraday Market Thoughts Archives

Displaying results for week of Mar 02, 2014Bullish Engulfing Candles we can't Ignore

As the US jobs report beat expectations in the way of NFP with 175K, here is a look at these rare charts patterns in USDJPY, 10-year yields and AUDCAD. Full charts & analysis

Recording of Last Night's Webinar

Here is the link to the recording of my pre-NFP webinar last night with Fari Hamzei and George Cavaligos. I gave the rationale to my trades including longs EURUSD, AUDUSD and AUDNZD. 1 of EURUSD longs hit its final target at 1.3900 (entry at 1.3750). My recording gets cut off 40 mins down the session before I return to the webinar once George concluded his session. Full link here

Highest EUR Close Since 2011, Yen Crosses Jump

A healthy dose of volatility gripped markets as Draghi boosted the euro and yen crosses slumped. The Australian dollar was the top performer while the yen lagged. RBA Governor Stevens tried to jawbone down AUD in early Asia-Pacific trading to no avail.

The moves on Thursday in the FX market were as large as any day this year. The action started with the best jobless claims data since November as the 323K beat expectations of 336K. The numbers boosted USD/JPY by 40 pips and above 103.00 for the first time since January.

It also highlights the divergence we've highlighted in economic data. On soft releases, namely the ADP and ISM data this week, USD/JPY was reluctant to fall. Now with an upbeat number, the pair surged.

Strength in the yen crosses was aided by a major move higher in EUR/JPY on Draghi's comments. Or more accurately, his lack of comments. The market was looking for a hint at further action but the ECB President said upside and downside risks to inflation are limited and broadly balanced over the medium term. EUR/JPY jumped 230 pips to 142.90 and EUR/USD closed at the highest level in more than 2 years.

Other yen crosses took out the recent highs as well and NZD/JPY was particularly noteworthy, hitting the highest since 2007.

If the market can hold these levels through non-farm payrolls, this could be the start of some extended trends.

The Asian schedule is typically light as the week winds down. The focus will be AUD/USD after it rose above the Jan/Fed double top to form a bullish inverted head and shoulders pattern.

RBA Governor Stevens is speaking in parliament but the early lesson is that if we've heard it before, it's not good jawboning and that was the case early in Steven's 3 hour appearance as he repeated the same concerns about a high AUD to no avail. Stevens also forecast a period of stability on interest rates but warned that inflation is not rising as fast as the data would suggest.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Nonfarm Payrolls (FEB) | |||

| 150K | 113K | Mar 07 13:30 | |

| Eurozone ECB Interest Rate Decision (MAR 6) | |||

| 0.25% | 0.25% | 0.25% | Mar 06 12:45 |

| Challenger Job Cuts (FEB) (y/y) | |||

| 41.835K | 45.107K | Mar 06 12:30 | |

| Continuing Jobless Claims | |||

| 2,907K | 2,973K | 2,915K | Mar 06 13:30 |

| Initial Jobless Claims | |||

| 323K | 338K | 349K | Mar 06 13:30 |

| Jobless Claims 4-Week Avg. | |||

| 337K | 339K | Mar 06 13:30 | |

Ashraf's Webinar Tonight

Ashraf's Webinar with Fari Hamzei And George Cavaligos starts at 16:00 ET, 21:00 GMT. Registration link Covering Friday's release of the US and Canada jobs report, Ashraf will go through the existing trading calls in EURUSD, AUDUSD, AUDNZD, AUDCAD and USDJPY and shedding light on the latest in USDCAD. Today's calls include 2 trades on AUDUSD and AUDNZD with 3 relevant charts.

When Something Can’t Fall on Bad News…

The US dollar shrugged off weak ADP and ISM data in an impressive showing. The Canadian dollar was the top performer after the BOC decision while the yen lagged.

The US dollar had to contend with some weak figures and its resilience was impressive. ADP employment rose 139K compared to 160K expected and the previous reported was revised down by nearly 50K. The ISM non-manufacturing report slid to 51.6 compared to 53.5 with employment tumbling to 47.5 from 56.4.

The US dollar hardly budged despite the numbers and that reflects a few factors:

- The market is convinced the Fed's taper is on autopilot

- Traders want to wait-and-see NFP before drawing conclusions

- Weather

It's impossible to get away from discussions about Mother Nature and the economy and the Beige Book mentioned weather 119 times.

The Bank of Canada decision gave the loonie a half-cent lift and CAD/JPY, in particular, is showing signs of a turnaround. Despite the currency optimism the BOC didn't paint a rosy picture. They essentially reiterated the outlook from January despite some upbeat numbers and officials will continue to watch the data.

The focus will stay on Canada and the US in Asian trading with the Fed's Fisher (0000 GMT) and Williams (0130 GMT) scheduled to speak. BOC #2 Macklem is sandwiched in at 0115 GMT. In China, the National People's Congress continues until March 13 and today, the finance minister is speaking at 0100 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change | |||

| 139K | 160K | 127K | Mar 05 13:15 |

| Retail Sales (JAN) (m/m) | |||

| 0.5% | 0.5% | Mar 06 0:30 | |

| ISM Non-Manufacturing Employment | |||

| 47.5 | 56.4 | Mar 05 15:00 | |

| ISM Non-Manufacturing New Orders | |||

| 51.3 | 50.9 | Mar 05 15:00 | |

| ISM Non-Manufacturing Prices | |||

| 53.7 | 57.1 | Mar 05 15:00 | |

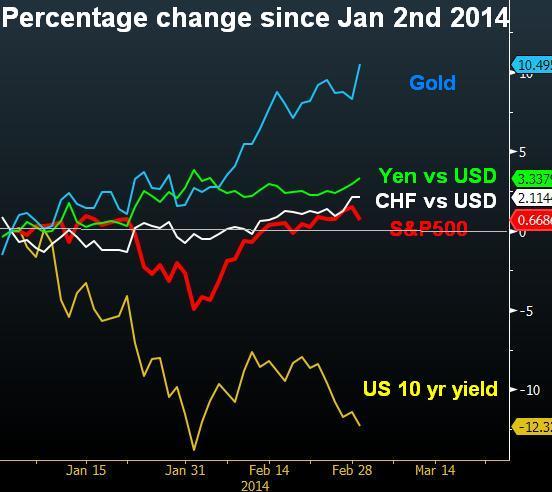

Fear No Match For This Market

A small de-escalation in the Ukraine was all risk trades needed to rip higher. The classic carry trade of NZD/JPY was tops in the FX market while the S&P 500 rallied 1.5% to a record high. Australian GDP and the start of the Chinese National People's Congress are events to watch in the hours ahead.

We wrote yesterday about how the declines in FX risk trades, especially the yen crosses, were surprisingly small considering the fear in markets. That proved to be a prescient signal with sentiment completely reversing on Tuesday and the yen trades rebounding.

USD/JPY is flirting with Friday's high of 102.29 after falling as low as 101.20 on Monday. A litany of risk events remain on the schedule for the week so volatility is sure to continue.

Fundamentally, little changed in the day but it was a great example of how fear, especially geopolitical fear, can cause the market to overreact. Another small example came in US trading: risk trades shuddered on reports of Russia test firing intercontinental missiles but it turned out to be a long-planned test and the US had been notified long before any tensions in the Crimea.

Headlines from the Ukraine will keep traders on edge but markets have probably learned a short-term lesson from this episode and unless bullets fly, the fear trade is unlikely to take hold again, at least in the way it did on Monday.

Instead, fundamentals will be a driver and in Australia that means Q4 GDP at 0030 GMT. The consensus is for a 0.7% q/q rise, a slightly better pace that 0.6% climb in Q3. The RBA is in data-watching mode so every release takes on more importance.

The other event to watch is the opening of the People's Congress in China. This is a major events and in the hours ahead the economic targets and reform policies will be announced. The consensus on the GDP target is 7.5% but there is some talk that a formal target could be abandoned. A higher number could help boost AUD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Gross Domestic Product (Q4) (q/q) | |||

| 0.7% | 0.6% | Mar 05 0:30 | |

| Gross Domestic Product (Q4) (y/y) | |||

| 2.5% | 2.3% | Mar 05 0:30 | |

EURJPY Revaluated Ahead of ECB

Markets approach Thursday's ECB meeting as the first meeting in a few months when speculation of an “imminent” rate cut is out of the way following Friday's higher than expected CPI figures. But does this mean that a Thursday rally in the euro is a higher certainty event? Would that mean further gains for EURUSD, or EURJPY? What about the risk of a stronger than expected US jobs number on Friday dragging the euro. Or how about resurfacing volatility from Ukraine-Russia weighing on yen crosses? There are 2 existing longs in EURUSD in our Premium Insights. But what about EURJPY? The pair has consolidated between its 55 and 100-DMAs in a 30-pt consolidation as bond yields have returned to 4-week lows before bouncing off yesterday's 200 DMA. Does EURJPY present a bullish opportunity ahead of the ECB with the anticipation of further run-up in risk appetite? Or, is ready to dissipate near the 55-DMA as it has done on Feb 21st and Jan 29?

War and Peace and Pips

One hundred verbal volleys are fired for every bullet that starts a war. Heavy doses of rhetoric and rumors spooked markets Monday but the cannons were silent. JPY was the best performer while GBP lagged but if anything the size of the moves was surprisingly small. The market now awaits a rumored 0300 GMT ultimatum for Ukrainian troops to stand down but don't forget the RBA decision. Ahead of the RBA decision and rumoured Russia ultimatum, we have existing Premium trades in EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, NZDUSD and AUDCAD. All these can be accessed in the Premium Insights.

Risk assets took a negative turn in US trading when reports/rumours began to circulate about an ultimatum, allegedly issued by Russia's Black Sea fleet commander. It warned Ukrainian ships in the near the Crimean to stand down or face assault. Nerves were later soothed when Moscow called the report total nonsense. Sporadic reports of armed Russians crossing the border also appeared.

In short, this is the fog of war and rumors circulate quicker than ever in 2014 markets can move faster than bullets. Ultimately, unless a WW3 erupts, markets will eventually settle but until then the fear-driven media will be a fearsome market force.

What stands out from Monday's trade was the unwillingness of USD/JPY to decline. March among the best months of the year for USD/JPY including five straight years of gains and mere 35 pip decline in the pair is a sign of resilience.

Economic data was overlooked but it also painted a good picture for USD/JPY. The Feb ISM manufacturing index hit 53.2 compared to 52.0 expected and the Markit manufacturing measure rose to the highest since 2010. The PCE report showed personal spending up 0.3% m/m vs 0.2% and inflation numbers met expectations.

In Europe, stock markets were battered and the euro slumped 70 pips to 1.3730 but Draghi was behind the scenes reiterating that inflation is a phenomenon driven by adjustments in the periphery and saying the glass is 'at least' half full.

But for the short term, the trade is in Crimea and the 0300 GMT deadline/rumour rules along with whatever rumours tomorrow brings. An event that will temporarily steal the spotlight is the 0330 GMT RBA decision. The central bank has shifted to neutral and is highly likely to stay there today as officials wait and see what the data brings so watch for AUD commentary.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Manufacturing Employment | |||

| 52.3 | 52.0 | 52.3 | Mar 03 15:00 |

| ISM Manufacturing Prices | |||

| 60.0 | 58.3 | 60.5 | Mar 03 15:00 |

| Personal Spending (m/m) | |||

| 0.4% | 0.1% | 0.1% | Mar 03 13:30 |

Ukraine Discount & Russia Premium

The main reason Russia will insist on keeping Ukraine in “friendly” hands is to secure its Europe-bound gas exports, most of which pass through the Ukraine. A 1/3 of Russia's gas is exports via Ukraine. Russia is far from bankrupt, but it remains eroded by a falling currency and deteriorating current account balance. More charts & analysis