Intraday Market Thoughts Archives

Displaying results for week of Dec 20, 2015CAD, Oil Divergence & Mixed US Data

A highlight from mixed bag of US economic data might be shipments numbers that will weigh on GDP. The Canadian dollar was the top performer on Wednesday while the euro lagged. The BOJ minutes from the November meeting and a speech from Kuroda are due later. A new Premium trade has been issued and filled, bringing the number of trades to six.

A wave of US economic data was delivered ahead of the holidays. New home sales were soft at 490K compared to 503K expected. The U Mich consumer sentiment report improved to 92.6 compared to 92.0 expected.

The top data was the durable goods report and the core component fell 0.4% versus the 0.2% consensus. It's normally the key headline from the report but what grabbed our attention in the November data was the 0.5% decline in shipments compared to +0.5% expected. That was compounded by a revision on Oct shipments to -1.0% from -0.5%. The number point to a high risk Q4 growth is below 2% and will concern the Fed and leaves the dollar vulnerable.

Another interesting divergence on Wednesday was in CAD. The loonie rallied despite a weak GDP report that stoked speculation about a BoC cut. It was outweighed by a nearly 5% rally in oil on tighter inventory data. It's a reminder that all Canadian data is lagging in relation to real-time commodities prices.

Looking ahead, Japan is in focus with the minutes of the Nov meeting due at 2350 GMT. Note that this wasn't the meeting last week with the surprise introduction of some technical QE measures so the risks are low. BOJ Gov Kuroda speaks at 0400 GMT but he also spoke late last week in a press conference so the probability of any kind of fresh signal on central bank policy is low.

What the BOJ will do in the year ahead is an underappreciated risk. The USD/JPY range this year was the narrowest since before the crisis and that's taken away some of the focus from the pair. There's a strong consensus that the BoJ is heading towards more easing but there's an undercurrent suggesting that bond supply constraints and the lack of effectiveness of QE and FX weakness might inspire a different bold direction from Abe. Ashraf has issued detailed analysis on this topic in the latest USDJPY Premium trade.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Bank of Japan Governor Kuroda Speech | |||

| Dec 24 4:00 | |||

It’s a 2% US Economy

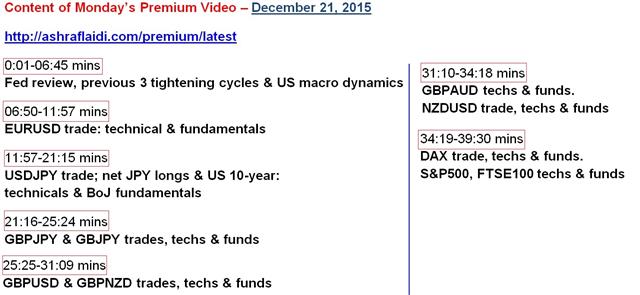

US GDP was revised slightly lower on Tuesday as the focus moves from the Fed to the economy. The march towards year-end continues but markets remain robust including solid market moves. New Zealand trade data is due later. 4 out of the 5 Premium Trades currently open are showing a profit, the highest outperforming trade is GBPNZD at 398 pips; the only lower is the Dax at-110 pts. The complete table of content of the Premium Video--where current and potential trades are discussed--is found below.

The third reading on US GDP was shaved to 2.0% from 2.1% but it was slightly better than the 1.9% consensus estimate. Personal consumption was strong but corporate profits were modest.

Later, the Richmond Fed showed better signs in manufacturing as it improved to +6 from -3. The big surprise in today's data was a 10.5% drop in existing home sales compared to a -0.2% reading expected. It has weighed on the US dollar but a National Association of Realtors spokesman said sales were “without a doubt” heavily impacted by new federal rules regarding home sale closings.

In the big picture, US economic data in the weeks ahead will be critical. The Fed's Lockhart said Monday that 'gradual' hikes to him mean every second meeting. That puts March and June hikes on the table but the Fed may need to signal that at the Jan 27 meeting and that leaves just one month of economic data to weigh the variables.

So far, the fourth quarter appears similar to Q3. The consensus estimate is around 2.2% while the Atlanta Fed model puts it at 1.9%. With inflation pressures low, it will take a string of good data and good Q4 corporate earnings to ramp up hike expectations (and the US dollar).

In markets at the moment, the US dollar is under some pressure but we're skeptical about minor market signals at this time of year.

One clearer signal came from the BoE's Weale. He was a consistent hawk in 2014 and even dissented in favor of rate hikes. In an interview Monday, however, he took a surprising dovish stance and warned that disinflation pressures are stronger. Ashraf explored that point further in his latest Premium Video and the implications forexisting GBP crosses.

His comments were slow to sink in but helped to push cable to the lowest since April at 1.4823. The pound has now declined in seven straight sessions. Normally, that might be a warning sign that a retracement is coming but around year-end momentum often counts more than oversold/bought conditions.

Looking ahead, the next data on the agenda is at 2145 GMT when New Zealand releases November trade data. The consensus is for exports at 3.9B and imports at 4.75B. Wheeler has been upbeat about trade ex-commodities and this is a key metric for NZD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core PCE - Price Index (NOV) (m/m) | |||

| 0.1% | 0.0% | Dec 23 13:30 | |

| PCE - Price Index (NOV) (m/m) | |||

| 0.1% | Dec 23 13:30 | ||

| Core PCE - Price Index (NOV) (y/y) | |||

| 1.3% | Dec 23 13:30 | ||

| PCE - Price Index (NOV) (y/y) | |||

| 0.2% | Dec 23 13:30 | ||

| New Home Sales (NOV) (m/m) | |||

| 0.505M | 0.495M | Dec 23 15:00 | |

| New Home Sales Change (NOV) (m/m) | |||

| 2.0% | 10.7% | Dec 23 15:00 | |

| Exports (NOV) | |||

| $3.90B | $3.83B | Dec 22 21:45 | |

| Imports (NOV) | |||

| $4.75B | $4.79B | Dec 22 21:45 | |

Sentiment Sours, Yen Shorts Scramble

We look at the potential factors behind the late-week risk aversion in markets. The Canadian dollar is the early-week leader while the yen lags. Coming up in Asia-Pacific trading are reports on the Japanese and New Zealand economies. On Friday, Ashraf's Premium Insights closed GBPJPY short at 181.07 (instead of the stated 176.20) from 185.80 entry, for 473 pips gain. On Thursday, GBPUSD short was closed at 1.4885 for a 225 pips gain. And on Wednesday, GBPNZD SHORT was closed at 2.2055 (instead of the stated 2.1300) from the 2.2440 entry for a 385-pip gain. There are currently five trades in progress 2 of which are at a loss.

Weekend news was light. Spain's election was in focus and it largely followed the polls as the ruling conservative party held power but lost its majority. The market may focus on how a coalition is formed but the euro is largely unchanged to start the week.

Last week the US dollar was the top performer while the pound lagged. The concern was the sharp deterioration in sentiment right until the end of trading. The S&P 500 finished at the lows for the second day in the worst two-day slide since August. The close was the lowest since Oct 14.

The Fed is the natural catalyst on a classic trade. The rhetoric and dots accompanying the hike were more hawkish than expected. Another factor could have been options and futures expirations on Friday. Finally, year-end flows make for whippy trading, even when the Fed isn't involved. The S&P 500 is now down 2.6% year-to-day and asset managers might be shifting away from risk.

The next two weeks will be tough trading as flows overshadow fundamentals. Momentum tends to last so that's one factor to keep in mind.

In the short-term, Asia-Pacific markets will turn to New Zealand data on credit card spending at 0200 GMT. The prior reading was a healthy +7.8% y/y in a sign that New Zealanders aren't hurting despite cratering dairy prices.

Up next, the Japanese all industry index is due at 0430 GMT. The BOJ introduced some surprising minor easing last week but it was billed as more of a technical adjustment by Kuroda and he remained upbeat on the economy. The index is expected to rise 0.9% m/m.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -160K vs -172K prior JPY -27K vs -68K prior GBP -17K vs -24K prior AUD -10K vs -34K prior CAD -51K vs -40K prior CHF +2K vs -26K prior NZD +1K vs +9K prior

Dollar longs headed to the exit, especially USD/JPY. The numbers are pre-FOMC decision and could reflect worries about how the market would react. It could also be a reflection of year-end positions squaring. The squaring of trades ahead of the Fed helps to explain some of volatility in the lead-up to the decision.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| All Industry Activity Index (OCT) (m/m) | |||

| -0.2% | Dec 21 4:30 | ||