It’s a 2% US Economy

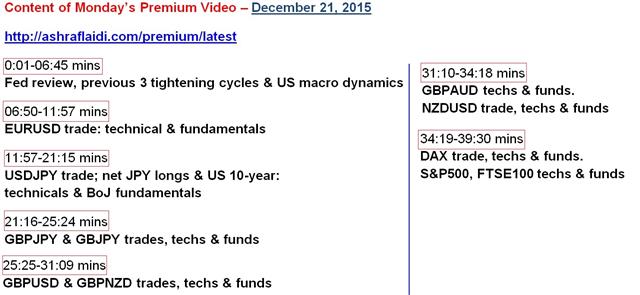

US GDP was revised slightly lower on Tuesday as the focus moves from the Fed to the economy. The march towards year-end continues but markets remain robust including solid market moves. New Zealand trade data is due later. 4 out of the 5 Premium Trades currently open are showing a profit, the highest outperforming trade is GBPNZD at 398 pips; the only lower is the Dax at-110 pts. The complete table of content of the Premium Video--where current and potential trades are discussed--is found below.

The third reading on US GDP was shaved to 2.0% from 2.1% but it was slightly better than the 1.9% consensus estimate. Personal consumption was strong but corporate profits were modest.

Later, the Richmond Fed showed better signs in manufacturing as it improved to +6 from -3. The big surprise in today's data was a 10.5% drop in existing home sales compared to a -0.2% reading expected. It has weighed on the US dollar but a National Association of Realtors spokesman said sales were “without a doubt” heavily impacted by new federal rules regarding home sale closings.

In the big picture, US economic data in the weeks ahead will be critical. The Fed's Lockhart said Monday that 'gradual' hikes to him mean every second meeting. That puts March and June hikes on the table but the Fed may need to signal that at the Jan 27 meeting and that leaves just one month of economic data to weigh the variables.

So far, the fourth quarter appears similar to Q3. The consensus estimate is around 2.2% while the Atlanta Fed model puts it at 1.9%. With inflation pressures low, it will take a string of good data and good Q4 corporate earnings to ramp up hike expectations (and the US dollar).

In markets at the moment, the US dollar is under some pressure but we're skeptical about minor market signals at this time of year.

One clearer signal came from the BoE's Weale. He was a consistent hawk in 2014 and even dissented in favor of rate hikes. In an interview Monday, however, he took a surprising dovish stance and warned that disinflation pressures are stronger. Ashraf explored that point further in his latest Premium Video and the implications forexisting GBP crosses.

His comments were slow to sink in but helped to push cable to the lowest since April at 1.4823. The pound has now declined in seven straight sessions. Normally, that might be a warning sign that a retracement is coming but around year-end momentum often counts more than oversold/bought conditions.

Looking ahead, the next data on the agenda is at 2145 GMT when New Zealand releases November trade data. The consensus is for exports at 3.9B and imports at 4.75B. Wheeler has been upbeat about trade ex-commodities and this is a key metric for NZD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core PCE - Price Index (NOV) (m/m) | |||

| 0.1% | 0.0% | Dec 23 13:30 | |

| PCE - Price Index (NOV) (m/m) | |||

| 0.1% | Dec 23 13:30 | ||

| Core PCE - Price Index (NOV) (y/y) | |||

| 1.3% | Dec 23 13:30 | ||

| PCE - Price Index (NOV) (y/y) | |||

| 0.2% | Dec 23 13:30 | ||

| New Home Sales (NOV) (m/m) | |||

| 0.505M | 0.495M | Dec 23 15:00 | |

| New Home Sales Change (NOV) (m/m) | |||

| 2.0% | 10.7% | Dec 23 15:00 | |

| Exports (NOV) | |||

| $3.90B | $3.83B | Dec 22 21:45 | |

| Imports (NOV) | |||

| $4.75B | $4.79B | Dec 22 21:45 | |

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46