Intraday Market Thoughts > Archives

Intraday Market Thoughts Archives

Displaying results for week of Mar 20, 2022Quadrifecta of Bottom Anniversary

Mar 24, 2022 18:14 | by Ashraf Laidi

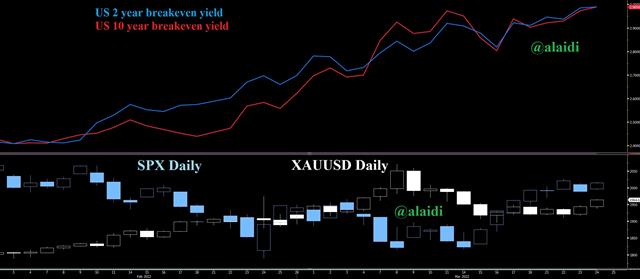

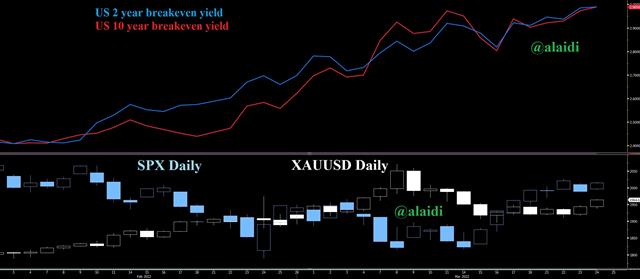

Two years to the day (minus one day) of the market bottom and strange things happen: Tech stocks outperforming, while 10-year yields retested their 3-year highs, which did not stop gold from advancing and silver from jumping 2%. Also strange because Mexico's president leaked a rate hike of his nation's own central bank; US and NATO mulling to extend sanctions onto blocking Russian sales of gold. Metals shot up on NATO's warning against possible nuclear accidents from Russia. Indices dropped rapidly before regaining lost ground, leading to a unique quadrifecta of rising metals, stocks, cryptos and yields. Any explanations on how/why?

Click To Enlarge

Fans of the “why” could look at no further than breakevens, which have hit new cycle highs, bolstering the concerns that the Fed is rather behind the curve, than too tight. This is generally good news for metals and indices. As Gold/Silver ratio drops back to its 200-DMA, watch for a possible breakout in silver above 26 to complete its cup-formation near 28.00.

Meanwhile, both Ethereum and Bitcoin are doing nicely, but with ETH/BTC outperforming and ETH breaking above its 100-DMA, this could become the start of the next secular rally in cryptos.