Intraday Market Thoughts Archives

Displaying results for week of Jul 20, 2014USD Unleashed ahead of Big Week

Which pair has just broken above its 55-WMA for the first time in 10 months, produced two major Golden Crosses in less than 5 weeks and, which is currently sitting on 130-140 pips gain in our Premium Insights? Wednesday's triple US release of ADP, GDP & FOMC (Wednesday) & NFP (Friday) may unleash fresh USD buying, with GDP likely show a 2.9% bounce and the Fed due to affirm the inevitable step towards the end of tapering, alongside some positive colour on jobs. NFP impact may not be too clear, but expectations are looking brighter, considering the clues from ADP and recent trend in jobless claims. Gold selling is seen stabilizing around 1285 as yields are unable to to make any sustainable recovery should help gold remain supported. We remind our subscribers that they are free to hold their longs until the final target, open various positions are different levels aimed at targets around the final objective, or close positions to lock up profits 50-80 pips before the final target in order to re-open fresh trades aiming at around the final objective.

Jobless Claims Give USD a Pulse, Japan CPI Next

The US dollar gained 20-40 pips across the board in NY hours in a steady grind after initial jobless claims improved to 284K from 303K. The reaction was an immediate rise in the dollar followed by a steady climb.

The data was strong enough that markets cast aside other, softer figures. June new home sales plunged to 406K from 475K and the Market manufacturing PMI slipped to 56.3 from 57.5 expected.

One of the main victims of USD strength was gold as it fell below the July low to the worst levels in one month at $1287. The 200-dma just below cushioned the losses and will be a key support line in the days ahead.

Taking a broader view of gold the inability to sustain a rally on a variety of geopolitical crises and repeated dovish headlines from the Fed is a discouraging signal and points to the downside potential.

Other news came from the IMF as global growth forecasts were cut in a widely expected move. US GDP was lowered to 1.7% from 2.8% in the most dramatic change. Emerging markets, especially Latam, was also downgraded. The good news was in the UK and Spain were forecasts for this year and next were boosted.

Looking ahead, the yen enters the spotlight with CPI numbers due at 2330 GMT. USD/JPY has risen for 5 straight days and touched a 3-week high Thursday and crossed the 55-dma. A weak CPI would start to kindle the fires for more QE or other measures. At the very least it could boost USD/JPY toward the June high at 102.50.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Tokyo CPI (JUL) (y/y) | |||

| 3% | Jul 24 23:30 | ||

| Tokyo CPI ex Food, Energy (JUL) (y/y) | |||

| 2% | Jul 24 23:30 | ||

| Tokyo CPI ex Fresh Food (JUL) (y/y) | |||

| 2.7% | 2.8% | Jul 24 23:30 | |

| National CPI (JUN) (y/y) | |||

| 3.7% | Jul 24 23:30 | ||

| National CPI Ex Food, Energy (JUN) (y/y) | |||

| 2.2% | Jul 24 23:30 | ||

| National CPI Ex-Fresh Food (JUN) (y/y) | |||

| 3.3% | 3.4% | Jul 24 23:30 | |

| GDP (Q2) (q/q) [P] | |||

| 0.8% | 0.8% | Jul 25 8:30 | |

| GDP (Q2) (y/y) [P] | |||

| 3.1% | 3.0% | Jul 25 8:30 | |

| Manufacturing PMI [P] | |||

| 56.3 | 57.5 | 57.3 | Jul 24 13:45 |

| Nomura/ JMMA PMI Manufacturing (JUL) [P] | |||

| 50.8 | 51.5 | Jul 24 1:35 | |

| New Home Sales (m/m) | |||

| -8.1% | -5.3% | 8.3% | Jul 24 14:00 |

| Continuing Jobless Claims | |||

| 2,500K | 2,510K | 2,508K | Jul 24 12:30 |

| Initial Jobless Claims | |||

| 284K | 308K | 303K | Jul 24 12:30 |

| Jobless Claims 4-Week Avg. | |||

| 302.00K | 309.25K | Jul 24 12:30 | |

Euro's PMI Squeeze, GBP Awaits GDP

Euro's reprieve from better than expected PMI data proved short-lived, while GBPUSD selling intensified today ahead of Friday's release of UK Q2 GDP. 1 of 2 GBUSD trades has been stopped out. We issue fresh trades in EURUSD and GBPUSD with four new charts ahead of Friday's UK data. Our Premium trades in EURJPY remain in progress, while our two EURAUD shorts, are +500 pts in the money, with the 1.4600-1.4630 short entry on Tuesday, targeting 1.4200 missed its final target by 12 pips (today's low was 1.4212). Similarly, our long in AUDNZD issued on Tuesday at 1.0830 produced a high of 1.1016 on Thursday, 4 pips short of the final 1.1020 target. The trade remains intact. All charts & trades are found the Trades section.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone - Indice PMI des services allemand (JUL) [P] | |||

| 56.6 | 54.5 | 54.6 | Jul 24 7:30 |

| Eurozone PMI Manufacturing [P] | |||

| 51.9 | 51.7 | 51.8 | Jul 24 8:00 |

| Eurozone Services PMI [P] | |||

| 54.4 | 52.7 | 52.8 | Jul 24 8:00 |

| GDP (Q2) (q/q) [P] | |||

| 0.8% | 0.8% | Jul 25 8:30 | |

| GDP (Q2) (y/y) [P] | |||

| 3.1% | 3.0% | Jul 25 8:30 | |

Silver's Soaring Specularive Sentiment

Silver's net speculative commitments rocketed 436% from a net long balance of 766 contracts in the week of June 3rd to a net long position of 4,106 contracts. Net longs went on to rise 224% and 120% in the subsequent two weeks. What's going on? Full charts & analysis.

Why the Kiwi Rolled Over After Rate Hike

The RBNZ hiked rates but the New Zealand dollar plunged early in Asia-Pacific trading. On Wednesday, the Australian dollar led the way while the pound lagged in the sixth day of declines. Japanese trade balance is due later.

A hike from the RBNZ wasn't a sure thing – the OIS market was only pricing an 86% chance and 1 of 15 economists surveyed by Bloomberg predicted no change. Yet when Wheeler boosted rates to 3.50% from 3.25% the kiwi plunged to 0.8610 from 0.8700.

Two factors weighed. The first was a fresh and aggressive effort to jawbone. Wheeler said the current NZD level is unjustified and unsustainable. He added that the kiwi could have a big fall. Some jawboning was expected but it's a tactic that tends to work best when it's going with the momentum of the market and the recent failure at the 2011 high has awakened the bears.

The second factor was likely the larger one and it was Wheeler saying the “The speed and extent to which the OCR will need to rise will depend on the assessment of the impact of the tightening in monetary policy to date.”

What changed from the previous statement was the second half of that statement. In sum, “assessing” is something that will take time and it's a hint that the RBNZ is now on the sidelines.

The market had been pricing in another 40-50 bps in rate hikes in the coming year but that's now less certain.

We have been bearish on the New Zealand dollar and the fundamental case is now beginning to align with the technical picture. The fall today also breaks the 100 and 55-day moving averages with no firm support below.

Up next is Japanese trade balance at 2350 GMT. The market is looking for a 642-yen deficit.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Adjusted Merchandise Trade Balance (JUN) | |||

| ¥-862.2B | Jul 23 23:50 | ||

| Merchandise Trade Balance Total (JUN) | |||

| ¥-642.9B | ¥-909.0B | Jul 23 23:50 | |

| Trade Balance (JUN) (m/m) | |||

| $150M | $285M | Jul 23 22:45 | |

| Trade Balance (JUN) (y/y) | |||

| $1.15B | $1.37B | Jul 23 22:45 | |

Euro Cracks, Aussie CPI Next

You would think some negative Eurozone headline would have been the catalyst for EUR/USD finally closing below 1.35 but it was simply the weight of the market that pulled it through. On the day, the Australian dollar led the way while the Swiss franc led. The focus will remain on the Aussie with CPI due later.

It's been a grinding battle for euro bears since the ECB cut rates and introduced TLTROS but they can finally claim a small victory as the solid zone of support around 1.35 and the Feb low of 1.3477 finally gave way. Selling continued down to 1.3459 and the euro closed on the lows.

The main newsflow in US trading was negative for the US dollar, not the euro. Core CPI rose 1.9% versus 2.0% expected and the dollar took a broad 20-40 pip swoon. What was telling (at the time) was that the euro didn't participate in the rebound as sellers continued to hammer the earlier break of 1.3500. That indicates a heavy selling hand in the market.

An initial level to watch is the 200-week moving average at 1.3426. The selling wasn't limited to EUR/USD; the euro also fell to a 7-month low even as stocks and broad risk appetite improved. Aside from some oversold indications, there is very little going for the euro bulls at the moment.

Ashraf wrote about the upcoming Australian CPI report and some tell-tell signals about which way the report will go in the Premium Section. The report is due at 0130 GMT and expected to rise 3.0% y/y and 2.7% on the trimmed mean.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Price Index (Q2) (q/q) | |||

| 0.6% | 0.6% | Jul 23 1:30 | |

| RBA trimmed mean CPI (Q2) (q/q) | |||

| 0.6% | 0.5% | Jul 23 1:30 | |

| Consumer Price Index (Q2) (y/y) | |||

| 3.1% | 2.9% | Jul 23 1:30 | |

| RBA trimmed mean CPI (Q2) (y/y) | |||

| 2.7% | 2.6% | Jul 23 1:30 | |

Tonight's AUD CPI & Tomorrow's RBNZ

RBA governor Glenn Stevens was unusually silent last night with regards to talking down the Aussie. Does that mean tonight's Q2 CPI figures will be soft? And what do we make of tomorrow's RBNZ decision? Will the central bank go for the much telegraphed fourth rate hike despite an 8% decline in milk prices and escalating financing costs to dairy producers? Less than four weeks after we closed both of our AUDNZD longs at a profit, we issue 2 new trades on the pair, ahead of tonight's Aussie Q2 CPI and tomorrow's RBNZ decision with 3 charts highlighting the latest decline in dairy prices and technicals in AUD vs NZD. Meanwhile, our 2nd Premium short in EURUSD at 1.3610-1.3640 has hit its final target of 1.3460, for a total of at least 170 pips. This happened after the other EURUSD short from June 5th at 1.3660-1.3690 hit its final target of 1.3530 on Jul 16. Both EURAUD shorts are currently netting a total of 250 pips. Finally, the Premium Insights are also currently short EURJPY, with one trade at an entry of 137.40-137.70 and another trade at an entry of 138.00-138.30, netting a current running profit of 250 pips. Full full access to subscribers' Premium trades, please click here

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Price Index (Q2) (q/q) | |||

| 0.6% | 0.6% | Jul 23 1:30 | |

| RBA trimmed mean CPI (Q2) (q/q) | |||

| 0.6% | 0.5% | Jul 23 1:30 | |

| Consumer Price Index (Q2) (y/y) | |||

| 3.1% | 2.9% | Jul 23 1:30 | |

| RBA trimmed mean CPI (Q2) (y/y) | |||

| 2.7% | 2.6% | Jul 23 1:30 | |

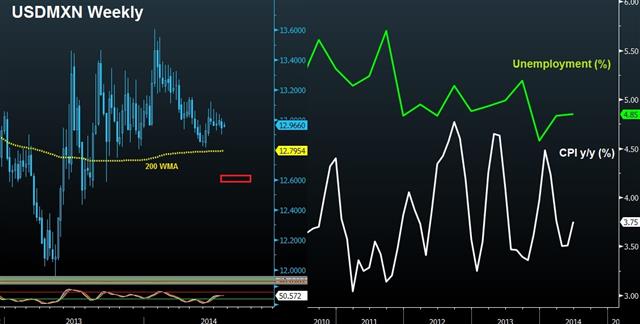

Mexican Peso Running on Automode

As we approach today's release of Mexican May retail sales, the peso is further gaining ground, partly on booming auto production exceeding that of Brazil. Full charts & analysis.

Putin Not Backing Down, Stevens Up

At the moment the Ukraine story is all about tone. On Friday, Obama resisted the temptation to point fingers at Russia and a call for peace from Putin raised hopes that the Malaysian Airlines disaster could be the event that ends the violence. But on the weekend Secretary of State Kerry ramped up rhetoric and Russia began a campaign to spread the blame.

European stock markets soured to start the week and US 10-year yields fell once again, hitting as low as 2.445%. That put some pressure on the yen and boosted oil prices.

The effects diminished throughout the day but keep a close eye on the changing tone in the absence of other dominant themes in the market. Those could come as US earnings season ramps up Tues/Wed and the CPI report is released in the day ahead.

Before that the focus will be on the RBA with Debelle on a panel at 2325 GMT and Stevens speaking on policy at 0300 GMT. Stevens rarely misses an opportunity to talk down the Aussie and his latest comments hinted at low rates for longer and kept pressure on AUD/USD. Perhaps this could finally be the speech that breaks its hold on 0.9400.

Another event to monitor is an 0500 GMT form RBNZ deputy Spencer. With the decision due Thursday (NZ time) the likelihood of a hint on rates is low but the market is unsure about the decision and will look for hints. The OIS prices an 86% chance of a cut but further cuts are up in the air after a low Q2 CPI print last week.| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Assist Gov Debelle Speech | |||

| Jul 21 23:25 | |||

| RBA's Governor Glenn Stevens Speech | |||

| Jul 22 3:00 | |||

Kiwi Turnaround in Focus, Specs Like CAD

It's a big week for US economic data and earnings but the most intriguing event could be the RBNZ interest rate decision. The kiwi was the worst performer last week while the yen topped the charts. Weekly positioning data shows a surprising bet on the loonie. Geopolitical risks dominated markets late last week but some positive signs on the US economy are emerging and the policy hawks are beginning to make noise about Fed ZIRP and QE.

Higher inflation and better durable goods orders will push Yellen closer to talking about rate hikes and boost the US dollar.

For traders looking for more volatility the kiwi could be spot. It fell hard last week after CPI rose just 1.6% y/y compared to 1.8% expected. Ahead of the report the OIS market was pricing a virtual certainty that Wheeler would raise rates Wednesday but that has fallen to 82%.

Technically, NZD/JPY stalled out near the highs of the year and NZD/USD has turned sharply lower after a failure to break the 2011 highs. A surprise from the RBNZ would really get the kiwi moving lower, and that's something Wheeler & Co would love to see.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -63K vs -59K prior JPY -63K vs -66K prior GBP +39K vs +42K prior AUD +40K vs +37K prior CAD +16K vs +10K prior CHF -6K vs -7K prior NZD +15K vs +14K prior

There isn't too much to takeaway from this week's report but it's a bit surprising to see cable longs cut so quickly as the pound flirts with long-term highs.

The shift into Canadian dollar longs has been rapid and nearly all of those trades were underwater on Wednesday at the USD/CAD highs. Good news for the US dollar (perhaps CPI or durable goods this week) could give the dollar some life and launch the squeeze.

Kiwi Turnaround in Focus, Specs Like CAD

It's a big week for US economic data and earnings but the most intriguing event could be the RBNZ interest rate decision. The kiwi was the worst performer last week while the yen topped the charts. Weekly positioning data shows a surprising bet on the loonie. Geopolitical risks dominated markets late last week but some positive signs on the US economy are emerging and the policy hawks are beginning to make noise about Fed ZIRP and QE.

Higher inflation and better durable goods orders will push Yellen closer to talking about rate hikes and boost the US dollar.

For traders looking for more volatility the kiwi could be spot. It fell hard last week after CPI rose just 1.6% y/y compared to 1.8% expected. Ahead of the report the OIS market was pricing a virtual certainty that Wheeler would raise rates Wednesday but that has fallen to 82%.

Technically, NZD/JPY stalled out near the highs of the year and NZD/USD has turned sharply lower after a failure to break the 2011 highs. A surprise from the RBNZ would really get the kiwi moving lower, and that's something Wheeler & Co would love to see.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -63K vs -59K prior JPY -63K vs -66K prior GBP +39K vs +42K prior AUD +40K vs +37K prior CAD +16K vs +10K prior CHF -6K vs -7K prior NZD +15K vs +14K prior

There isn't too much to takeaway from this week's report but it's a bit surprising to see cable longs cut so quickly as the pound flirts with long-term highs.

The shift into Canadian dollar longs has been rapid and nearly all of those trades were underwater on Wednesday at the USD/CAD highs. Good news for the US dollar (perhaps CPI or durable goods this week) could give the dollar some life and launch the squeeze.