Intraday Market Thoughts Archives

Displaying results for week of Apr 22, 2018US Dollar Rethink?

US Q1 GDP weakened to a better than exp 2.3% (exp 2.0%) from 2.9%, while personal consumption dropped as exp to 1.1% from 4.0%. USD momentum dissipated across the board folllowing the figures, while gold was the biggest winner of the day. In the UK, a soft UK GDP reading might have put a nail in the coffin of a May 10 Bank of England rate hike. The pound plunged on Friday as the two-week rout continued. US GDP beat estimates but that only fueled fears of excessive rate hikes. An additional Premium video "After the stops" has been posted following the US figures the latest thinking regarding the US dollar. بعد الخسائر (فيديو ايضافي للمشتركين)

On April 16, cable was trading at a post- Brexit high of 1.4376 and the OIS market was pricing in a 96% chance of a May 10 rate hike. Just hours after hitting the high, Carney appeared on the BBC to talk about the economy. He said “that although people should be prepared for a possible rate rise this year, there was still a lot of data to consider before they needed make the decision.”

That was hardly a signal about a retreat on hikes but it was a warning to markets that 96% was too high. His focus on data was followed by poor inflation and retail sales numbers among others. As those rolled out, cable began to roll over. On Friday, GDP was just +0.1% q/q compared to +0.3% expected. The ONS cited poor weather but the sense from the market is that Carney wanted to focus on data and the data didn't deliver. The odds of a hike have fallen to just 23% in what has been a complete rethink.

Cable has fallen every day except one since Carney's BBC appearance and is down to 1.3790 from 1.4376. It's now closing in on the February low of 1.3711, which will be in play along with the BOE decision.

The UK data calendar is light in the week ahead, so the market will stew over these figures for some time.

The other side of the cable equation will be in sharp focus with a heavy slate to come. Friday's US GDP report showed growth at 2.3% q/q annualized compared to 2.0%. That helped to stoke optimism initially but there is a growing fear the Fed could hike three more times this year and that's more likely to stoke risk aversion than smooth path for USD higher.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Advance GDP (q/q) [P] | |||

| 2.3% | 2.0% | 2.9% | Apr 27 12:30 |

| Prelim GDP (q/q) [P] | |||

| 0.1% | 0.3% | 0.4% | Apr 27 8:30 |

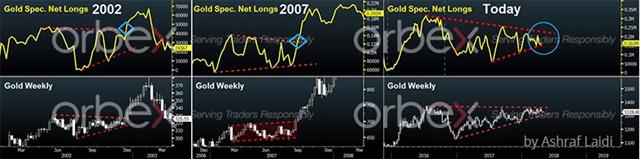

Monitoring Gold's Breakout

Most gold bulls have been holding on to long positions for months, if not years anticipating the next big breakout. It was almost one year ago when gold made a successful break above the six-year trendline resistance, extending from the $1921 high. But how long must we wait for a clear break above $1400? Full analysis.

أين إختراق الذهب؟

يبقى معظم مؤيدي المعدن الأصفر مقيدين بإحكام لصفقات الشراء لشهور ، إن لم يكن سنوات ، حيث يتوقعون أن تكون القفزة الكبيرة القادمة وشيكة. منذ ما يقرب من عام مضى ، عندما حقق الذهب اختراقًا ناجحًا فوق مستوى مقاومة خط الاتجاه الذي دام 6 أعوام. إلى متى يجب علينا الانتظار لكسر واضح فوق 1400 دولار؟

(التحليل الكامل)

Profitable Pitfalls

A slump in equity markets was the dominant theme Tuesday despite some upbeat consumer and corporate numbers. The pound was the top performer while the New Zealand dollar lagged. AUDUSD was stopped out. A new Index was posted before the London close, prior to the stocks rout. Both Premium shorts in indices are in the green.

Caterpillar is a great proxy for global growth. The heavy equipment maker's machines are in high demand when the economy is strong and that's exactly what the company reported late Tuesday. The news sent shares of CAT to $162 from $153 in what looked like great news. But markets are forward looking and worries about Caterpillar's borrowing costs started to quickly appear in markets. A positive start for the S&P 500 began to sour and shares of CAT dropped to $144. The main index eventually finished down 36 points to 2634.

The pop-and-drop is increasingly familiar as earnings season ramps up. It started with a string of great numbers from financials that sparked rallies and then reversals.

It's not a sign of a struggle in the global economy but rather a worry that equity market valuations are too high and that central banks – especially the Fed – may tighten too much. Economic data was glowing with consumer confidence at 128.7 vs 126.0 expected and new home sales at 694K compared to 630K expected.

At the very least, the latest moves are a sign of a market that's tough to please. As we often repeat, the ultimate signal in a market is one that falls despite good news. It may be time to take heed.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| All Industries Activity (m/m) | |||

| 0.4% | 0.6% | -1.1% | Apr 25 4:30 |

3% Pulls Dollar Higher

Bonds remained the dominant driver on Monday as US 10-year yields close in on 3%. The US dollar led the way while the yen lagged. Australian CPI is due up next. Below is the video for Premium subscribers clarifying Ashraf's take on USD in terms of price and time.

إلى أين قمم الدولار ؟ (فيديو للمشتركين)

The US 10-year on-the-run note rose as high as 2.9957% on Monday in a 2 basis point rise. It's a fresh high this year but all the focus is on 3%, which may spark some worries about borrowing costs. It's an arbitrary number but the underlying theme is a Fed that's increasingly confident about hikes. Another level to watch is 3.22% in 30-year bonds. That level was the top in 2016, 2017 and earlier this year.

The dollar was helped along by several economic releases. The Markit services PMI was at 54.4 vs 54.1. The manufacturing PMI was at 56.5 vs 55.2 expected and existing home sales rose to 5.60m vs 5.55m expected.

Cable fell back below 1.40 in the fifth day of sharp declines on a BOE re-think. Adding to the woes is Theresa May's sudden inability to get legislation through the House of Lords.

Looking ahead, the focus will shift to the Australian dollar with Q1 CPI data due at 0130 GMT. It's a critical report that's expected to show inflation rise by 0.5% in the quarter, a slight deceleration from 0.6% in Q1. That's in contrast to the trimmed mean, which is forecast to accelerate to 0.5% from 0.4% q/q.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.5% | 0.6% | Apr 24 1:30 | |

| Flash Manufacturing PMI | |||

| 56.5 | 55.2 | 55.6 | Apr 23 13:45 |

| Existing Home Sales | |||

| 5.60M | 5.55M | 5.54M | Apr 23 14:00 |

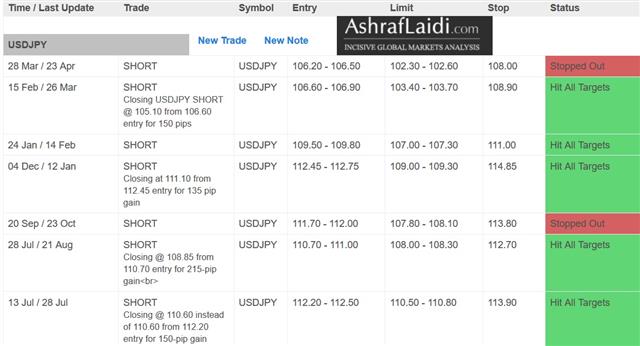

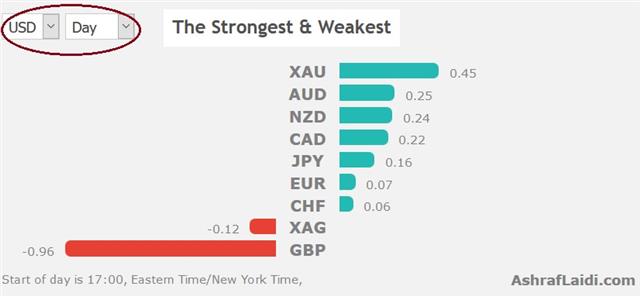

Treasuries Bite, Euro Longs Hit Record

The positive USD-Yields narrative makes a noisy comeback as US 10-year yields touches 2.99% on a combination of eroding risks on the geopolitical and trade front. CFTC positioning showed euro longs at a record. The USDJPY Premium trade was stopped out, while the risk parameters on the GBPUSD trade were adjusted. Below is the performance table indicating our the outcome of the last 7 Premium trades in USDJPY, with 5 trades closed at a profit & 2 stopped out.

Oil, N. Korea & US-China

Rising oil prices combined with reports that North Korea will suspend its nuclear testing activity and continued negotiations between the US and China with regards to trade and tariffs helped to elevate bond yields across the board. Unlike the February episode of surging bond yields, this one does not include evidence/fear of high inflation.The US dollar also began to get a lift from the bond market as the spread over German equivalents rises to long-term extremes at various points on the curve. Add in the extremely crowded positioning in euro longs (see below) and there is an elixir for a near-term move.

Another development on Friday was disappointment for Canadian dollar bulls. Poloz put the focus squarely on data and numbers on CPI and retail sales were soft, sending USD/CAD up to 1.2760 – more than a cent higher on the day.

In the UK, the confusion about what the BOE will do next continued to undercut cable and the pair fell below 1.40 to start the week. On Thursday, Carney will get a chance to massage the message.

CFTC Commitments of TradersSpeculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +151K vs +147K prior GBP +48K vs +43K prior JPY +3K vs -4K prior CAD -30K vs -32K prior CHF -11K vs -11K prior AUD -10K vs -3K prior NZD +27K vs +22K prior

The slight rise in the euro net position pushed it to an all-time record. Given the recent string of poor data, that is a precarious position.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.5% | 0.6% | Apr 24 1:30 | |