Treasuries Bite, Euro Longs Hit Record

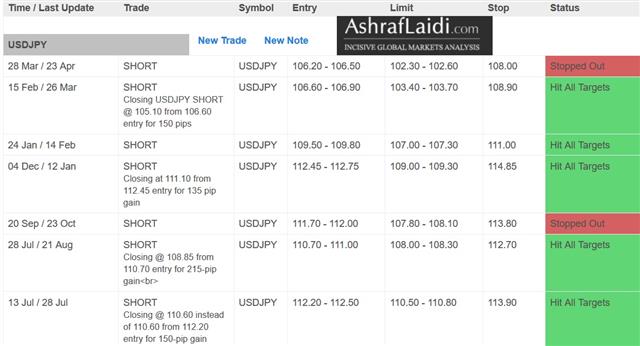

The positive USD-Yields narrative makes a noisy comeback as US 10-year yields touches 2.99% on a combination of eroding risks on the geopolitical and trade front. CFTC positioning showed euro longs at a record. The USDJPY Premium trade was stopped out, while the risk parameters on the GBPUSD trade were adjusted. Below is the performance table indicating our the outcome of the last 7 Premium trades in USDJPY, with 5 trades closed at a profit & 2 stopped out.

Oil, N. Korea & US-China

Rising oil prices combined with reports that North Korea will suspend its nuclear testing activity and continued negotiations between the US and China with regards to trade and tariffs helped to elevate bond yields across the board. Unlike the February episode of surging bond yields, this one does not include evidence/fear of high inflation.The US dollar also began to get a lift from the bond market as the spread over German equivalents rises to long-term extremes at various points on the curve. Add in the extremely crowded positioning in euro longs (see below) and there is an elixir for a near-term move.

Another development on Friday was disappointment for Canadian dollar bulls. Poloz put the focus squarely on data and numbers on CPI and retail sales were soft, sending USD/CAD up to 1.2760 – more than a cent higher on the day.

In the UK, the confusion about what the BOE will do next continued to undercut cable and the pair fell below 1.40 to start the week. On Thursday, Carney will get a chance to massage the message.

CFTC Commitments of TradersSpeculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +151K vs +147K prior GBP +48K vs +43K prior JPY +3K vs -4K prior CAD -30K vs -32K prior CHF -11K vs -11K prior AUD -10K vs -3K prior NZD +27K vs +22K prior

The slight rise in the euro net position pushed it to an all-time record. Given the recent string of poor data, that is a precarious position.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.5% | 0.6% | Apr 24 1:30 | |

Latest IMTs

-

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22