Intraday Market Thoughts Archives

Displaying results for week of Jun 23, 2019انتهاز البيانات لمضاربين الين

نبدأ الفيديو بالأرقام الأولية للتضخم في منطقة اليورو، ثم نتطرق إلى عقود شراء الين وكيف يستفيد منها المضاربين في تداولاتهم. تابعوا الفيديو المفتوح للجميع

G20 Battle Lines Leak, Data First

Mixed and contrasting leaks regarding Saturday's US-China meeting at the G20 hint at a ceasefire but also at disaster. The Australian dollar was the top performer Thursday while the pound lagged. UK Q1 GDP was unrevised at 1.8% and Ezone flash CPI came in at 1.2%, while core rose to 1.1% from 0.8%. Canadian GDP and the US PCE report will be market movers ahead of month-end. A new trade was issued with 2 charts & 3 key notes, updating last week's trade. Key data coming up from the US and Canada (see below).

تحديد الصفقة الثانية - فيديو المشتركين

The South China Morning Post reported Thursday that a precondition of Xi accepting talks with Trump was that the US would rule out any additional tariffs during a new round of negotiations, with a tentative timeline of six months. That would undoubtedly be a positive outcome at this stage and might lead to an initial spike in risk assets. At the same time, it would cut the Fed's appetite for easing so the optimism could be short lived. Such a scenario would lead to a rally in the dollar and gold may be vulnerable.

A separate report from the WSJ said another precondition was removing a blockade on US firms selling technology to Huawei. That would be a step back for Trump and something tougher to agree with. The same report also said Beijing wants the US to lift all punitive tariffs and drop efforts to get China to buy more US products than were agreed in December.

The reports were accompanied by the usual denials, along with others that said China won't give into demands to change its laws on intellectual property.

The most-likely outcome is a neutral-positive because these matters are routinely agreed on ahead of time, yet at at this stage there lacks any guarantees and jitters will be high heading into the weekend, with more leaks likely to come.

Ashraf's Tweet on indices here.

Looking ahead, North American traders will have plenty to digest on Friday aside from the G20. The US PCE report is the penultimate look at the Fed's preferred inflation measure ahead of the July 31 FOMC. San Francisco Fed President Daly highlighted inflation as a key concern again on Thursday but prices were adjusted higher in the Q1 GDP print. The deflator and core measures are both expected at 1.5% y/y and a 0.2-0.3 pp miss to the upside would raise instant questions about Fed cuts.

Also released at 1230 GMT (13:30 London) will be the Canadian April GDP report. It's expected at 0.2% but risks are to the upside after a strong wholesale trade report earlier in the week. Another strong number would solidify the CAD bid and the belief that the BOC won't follow other major central banks with cuts, at least not any time soon.

Note that Monday is a holiday in Canada and that Friday is the final trading day of the month and the quarter. Aside from G20 positioning, fund rebalancing flows will be in play. The outsized rally in US stocks means the dollar is most likely to come under pressure, especially into the London fix.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final GDP (q/q) [F] | |||

| 3.1% | 3.1% | 3.1% | Jun 27 12:30 |

| GDP (m/m) | |||

| 0.2% | 0.5% | Jun 28 12:30 | |

أشرف العايدي على سي ان بي سي العربية

مقابلتي على سي أن بي سي العربية مع جو الهوا و مي بن خضراء توقعاتي للقاء ترامب/تشي، الذهب و اليورو. فيديو المقابلة

Fast Times at Bitcoin High - Charting the Big 4

Bitcoin rallied more than 22% on Wednesday only to give half of it back in a heartbeat in wild trading. In FX majors, the pound is the highest performer, edging over the Aussie and Kiwi, while the CAD and JPY are the biggest losers. EUR firms after higher than expected (unharmonized) German CPI (1.6% over 14% and harmonized CPI holds at 1.3%). US jobless claims and final Q1 GDP revision is up next, followed by pending home sales.

The Facebook move into crypto has sent Bitcoin parabolic in a move that has largely left the rest of the crypto market behind. At its peak on Wednesday it hit $13850 as part of an astonishing virtually one-way move that started in early April at $4000. However a further reminder of the risks came in a drop to $1800 drop in just 11 minutes at the end of the Wall Street trading day.

Technically, the reversal came just above the 61.8% level of the all-time peak to the December low.

Fundamentally, it's once again a market that defies explanation and is characterized by moves that would be unthinkable in most other markets. One notable change this time around is that data shows much of the buying interest is money being swapped into Bitcoin via Ethereum. That suggests it's mostly been fueled by crypto enthusiasts rather than new entrants to the market. If it can recapture the public's imagination, it could soar to new highs.

Elsewhere, US economic data continues to paint a mixed picture. The goods trade deficit missed estimates of a $71.8B deficit and instead expanded to $74.5B, leading to lower GDP estimates. However core durable goods orders were stronger, excluding soft Boeing orders.

Comments from the Fed's Daly planted her as a centrist at the FOMC. She highlighted a tight US labour market but fretted about low inflation and said a cut could bring it back to target. What we're looking for going ahead is an indication of whether they're thinking along the lines of an insurance cut or a cutting cycle. The G20 will hopefully provide some clarity.

Both of the two existing Premium trades are in the green, while the unfilled trade is about to be changed so that it gets filled. Ashraf is highlighing on Twitter Tuesday's trade and the solidity of the technical rationale behind the idea.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final GDP (q/q) [F] | |||

| 3.1% | 3.1% | Jun 27 12:30 | |

| Pending Home Sales (m/m) | |||

| 1.1% | -1.5% | Jun 27 14:00 | |

| Core Durable Goods Orders (m/m) | |||

| 0.3% | 0.1% | -0.1% | Jun 26 12:30 |

Bullard Boosts Dollar, Awaiting G20

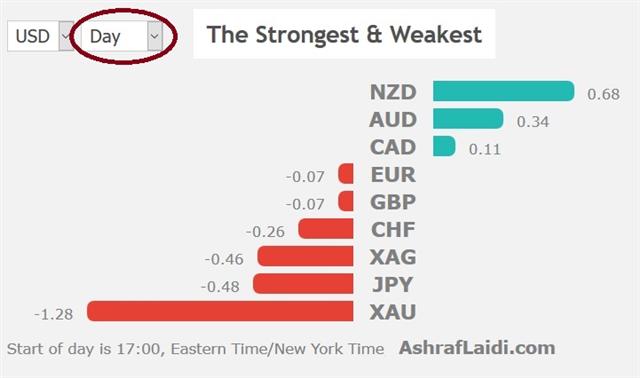

On a day filled with economic data and Fed speakers it was St Louis Fed President James Bullard who stole the market's attention with a hint that a rate-cutting cycle isn't coming. Instead of a series of rate cuts, Bullard implied there would be one or two. (More below). The kiwi and Aussie are the top performers, while silver and yen are the underperformers as equity indices push higher as seen in the chart below. Bitcoin pushed to 12970. A new Premium FX trade was issued yesterday supported by 3 charts & notes. US durable goods orders are due up next. The big event remains the Trump-Xi 2-day meeting starting tomorrow at the G20 summit.

The US economy showed fresh worrisome signs on Monday as home sales and consumer confidence sank. Sales fell 7.8% to a five month low in a sign that low rates aren't spurring activity. Consumer confidence also dove to 121.5 from 131.0 as the expectations survey cratered. Those numbers added to the pessimism in the US dollar early and lifted gold for the sixth day.

That move quickly unwound on a pair of comments from Fed super-dove James Bullard. First he said July wasn't the time for a 50 basis point rate cut. Prior to the comment the market was pricing in a 40% chance of a 50 bps move. Thus, if a dove like Bullard doesn't think it's appropriate then there is little hope that the bulk of the FOMC does. More importantly, Bullard characterized a move in July as an 'insurance' cut. That suggests only one or two cuts, not the 3-4 the market is pricing in over the year ahead.

Powell also spoke Tuesday in comments that left both sides of the Fed debate off balance. He continued to emphasize that US fundamentals are good but highlighted that many on the FOMC see a stronger case to cut and that things have changed significantly since early May. He also warned that the undershoot in inflation looks to be more persistent. All of it pointed to a high certainty of a July cut but little beyond that.

The US dollar rallied 30-50 basis points on Bullard and held the gains until fresh talk about the G20 sent the dollar lower. US officials have tried to downplay the chance of any kind of a deal. At best, the market is hoping for a promise to negotiate for a set period without any fresh tariffs. The Trump-Xi meeting is set for Saturday.

Today, the focus returns to the US economy with the durable goods report due. Manufacturing numbers have been very soft this month and that points to a weak reading. Tariffs could also be weighing on the industrial sector. The expected hit to the global economy could be as high as $1.2 trillion according to Bloomberg's economics team, a level matching that of the global financial crisis of 2008/9.

At the moment, there is a fairly straightforward trade on US economic data in that soft numbers hurt it and good numbers help it. Expect that to continue indefinitely.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Durable Goods Orders (m/m) | |||

| 0.1% | 0.0% | Jun 26 12:30 | |

| CB Consumer Confidence | |||

| 121.5 | 132.0 | 131.3 | Jun 25 14:00 |

قبيل وأثناء تخفيض الفائدة من الفيدرالي الأمريكي

مع تسجيل الدولار الأمريكي أكبر انخفاض شهري له منذ 17 شهراً بعد إشارة مجلس الاحتياطي الفيدرالي إلى تخفيضات سعر الفائدة المرتقبة، أسمع العديد من المتشككين فيما إذا كانت العملة الأمريكية ستحافظ على مزيد من الانخفاضات من هنا بناءً على توقعات بأن البنوك المركزية الأخرى جاهزة أيضاً لخفض أسعار الفائدة. هل هذا خطأ أم صحيح؟ التحليل الكامل

USD's Biggest Decline in 17 Months

Three days remaining til the end of the month (and quarter) The US dollar index is posting its biggest monthly decline in 17 months. EURUSD hit a three-month high on Monday and rose above 1.14 to hit Ashraf's target. Gold hit a fresh 6-year in Asia and returns near the highs after a 8% decline in US new home sales. Eatch out for Powell's speech about the US economy at 13:00 Eastern (18:00 London) and dissenter Bullard's speech 6.5 hrs later. The Premium short in USDCAD has been closed at 1.3160 for 200 pip-gain. The latest Premium video is below contains some impirtant mechanics about USD shifts ahead and during Fed rate cuts.

The euro gain to start the week came on a solid IFO survey and continued US dollar weakness. The dollar fell after Treasury yields gave back last week's mini rally. The US 10-year yields fell 4 basis points on the day and stocks dipped modestly after an early gain.

The Fed's Kaplan argued for patience before cutting rates but also indicated that he was open to looser policy because of rising risks. Trump continued to tweet about the Fed and markets continued to ignore him. His actions on Iran had a larger effect as the White House announced fresh sanctions on Iran. That helped to reverse oil losses and boost it to a modest gain.

Overall moves to start the week were modest but gold has continued to surge, climbing another $20 on Monday. It's on track for the best month since 2016 with an 8% gain. Oil faces resistance at the 59.40 trendline resistance, hence Ashraf's closing of the Premium short in USDCAD at 1.3160 for a 200-pip gain.

Looking ahead, we await Powell's speech at 6 pm London time discussing the economic outlook, where he will surely expound on last week's broad downgrades in US growth. Also important, is St Louis Fed's Bullard speech, where he will surely present his argument for dissenting at Wednesday's FOMC decision, where he made the first dovish dissent in the era of the Powell Fed.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CB Consumer Confidence | |||

| 132.0 | 134.1 | Jun 25 14:00 | |

Lowe Asks the Question

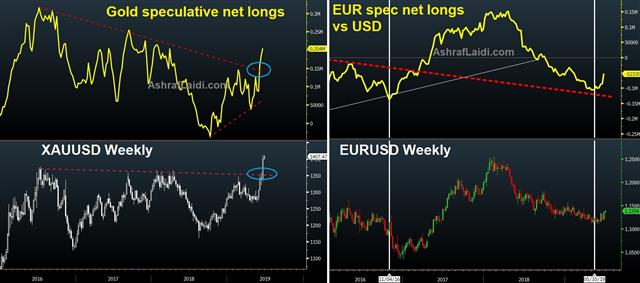

RBA Governor Lowe touched a delicate subject that his counterparts may also have to deal with, especially if this week's G20 goes well.The German June IFO survey beat expectations for the current assessment and slipped on the expectations component. We expect a period of a relative lull in the markets ahead of Trump/Xi meeting at this weekend's G20 summit. GBP pushes above 1.2740 as Jeremy Hunt and Boris Johnson battle it out for the PM race. More below. The Premium long in XRP Ripple at 0.33 entry hit the final target of 0.49. The long EURUSD Premium long at 1.1230 is a few pips away from its final 1.1400 target for 170-pip gain. Below are the chart breakouts for EURUSD and XAUUSD net longs among speculative futures traders in the IMM and Comex respectively.

In a panel discussion on Monday, RBA Governor Lowe mused that it's legitimate to ask how effective monetary easing will be globally. Domestically he also cast questions, saying the exchange rate effect of cutting rates is offset if everyone cuts. That gave the Australian dollar a boost to start the week. We ended the week with US equity markets near an all-time record and economic data still well-within the range of expansion.

The Fed is undoubtedly committed to at least one rate cut, but if US-China talks improve and data holds at these levels, the market may pare back expectations for four cuts in the year ahead. That could be the signal from bonds late in the week as long-end yield crept higher, albeit from extremely depressed levels.

At the same time, proxies for global easy money like gold and bitcoin continue to surge, with the latter touching $11,200 on the weekend and gold climbing above $1405 to start the week. Here is a useful Bitcoin factoid from Ashraf

With regards to the latest in the race for Conservative Party leader and PM, Jeremy Hunt has seen his odds improve from 8-1 on Friday morning, to 3-1 today. Reports of domestic violence related to Boris Johnson may have weighed, epecially as he avoided discussing the matter in this weekend's interviews. More on this from Ashraf.

ندوة مساء الثلاثاء مع أوربكس

لقد تابعنا في الأشهر الماضية تطورات الحرب التجارية بين الولايات المتحدة والصين ورأينا تأثيرها على الأسواق، والآن نستعد للقاء القمة بين الرئيس الأمريكي “ترامب” ونظيره الصيني “تشي” في أواخر الشهر الحالي. وتعتبر هذه القمة من أهم الأحداث المؤثرة على الأسواق في النصف الأول من العام الجاري. للمشاركة في الندوة من السعودية فقط و للمشاركة من باقي الدول