Intraday Market Thoughts Archives

Displaying results for week of Feb 24, 2019See you in New York Next Week

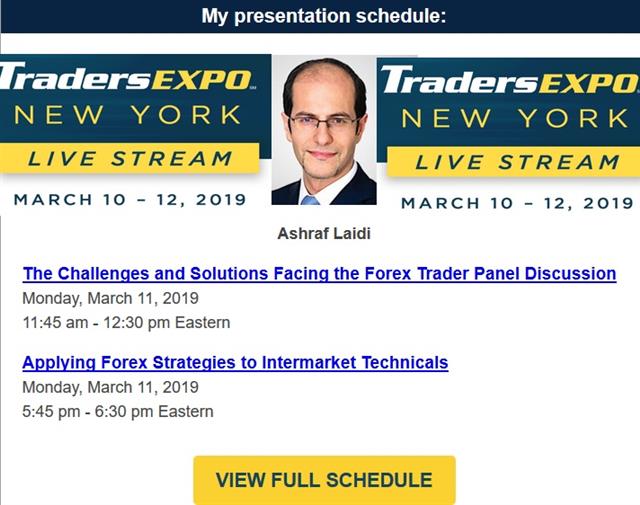

A few major market events are expected in mid-March. Brexit-related votes, the Fed meeting and the US det ceiling. And don't forget this year's New York Traders' Expo in NYC - March 10-12. It's one of the longest running expos on trading around and a great meeting place for traders, analysts and programmers. I strongly encourage you to reserve your free seat, and join me at the ultimate educational event for active traders in 2019. Full Program. In case you can't make it to NY, here's the link to the Live Streaming.

Gold Requires More Pullback

Gold posts its biggest weekly decline since August. Bulls will tell you a pause in gold is long overdue after 4 consecutive monthly gains – not seen since spring 2017. Technical bears will tell us 1350 proved to be the end of a Cup formation, which could lead to the start of a handle formation (consolidation for the next 2-3 weeks). Fundamental bears will point to USD being the strongest of the rest, which is indicated by the recent run-up in US 10-year yields.

So what's likely to happen? With regards to US relative strength, that is changing. The left charts indicate that the US economic surprise index (according to Citi) has fallen recently to the extent of closing its advantage over its Eurozone counterpart to the smallest level since September. Whether this suggests that any upside in the US-Eurozone yield spread is limited, it remains to be seen.

As for gold, we have a long trade in gold for our Premium subscribers at 1280, which hit the initial target of 1350 but not yet the final target of 1380. We'll watch 1296 as the area to defend the weekly close, a break of which should transition to 1276. Keep an eye on the returning deadline of the US debt ceiling, this month's Federal Reserve press conference/dot plot and the progress on the US-China trade negotiations. More importantly, we'll keep on the support levels in silver and copper as we did in this situation with silver.

النفط و الداو جونز

كيفية إستخدام القوة النسبية في السباق بين النفط ومؤشر الداو جونز. الفيديو الكامل

Macro-Market Divergence: Trade Deficit

Trump abruptly cut the peace summit with North Korea without a deal. Ray Dalio, the hedge fund giant said odds of US recession before the next US presidential election have declined to 35% from 50% six months ago. The Swiss franc is the best performer, bringing our CHF Premium deeper into the green. China's February PMI slumped further to reach 49.2, highlighting the divergence between the economy and financial markets. US Q4 GDP finallly was released, coming at 2.6% (vs exp 2.2%) from 3.4% in Q3. Yesterday, we shed light on the slwdown in US housing. Today we take a look at the swelling US trade deficit.

كيفية مواجهة الذروة و التصحيح (فيديو للمشتركين)

One of the core elements of Trump's political brand is closing the trade deficit, especially in goods. Yet on Wednesday the US trade deficit sprang to $79.5B compared to $73.9B expected. That will be a further drag on Q4 and along with other soft recent data it means that growth in 2018 will likely be below 3%.

Yet the key reason the dollar has remained so solid is that growth in the high 2% range, which remains better than other developed countries. That's all the reason that the deficit keeps rising.The risk shifts what kind of drastic measures will be taken by the White House to close the gap, and weighing on global growth. It's a potential viscous circle that would intensify if Trump were to win reelection.

In terms of market moves, yields are a driver once again. US 10-year yields rose 4.6 bps to 2.68%. Yields have been chopping near 2.60% for weeks but may have found a bottom and that may lead to a bounce, particularly if the US and China can make a trade deal. On that front, Lighthizer was hawkish in his comments to Congress Wednesday but said he believed a deal was likely.

The US gets a lift from higher than expected US Q4 GDP, but with the figure coming in well below Q1 supports the notion of US growth converging down with the rest of the world.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI | |||

| 58.1 | 56.7 | Feb 28 14:45 | |

| PMI Manufacturing | |||

| 53.8 | 54.3 | Mar 01 8:30 | |

| PMI | |||

| 48.7 | 48.3 | Mar 01 1:45 | |

Housing Hurting, GBP above 1.33

The British pound rally goes from strength to strength as the choice appears to be increasingly between a delaying Brexit and a 2nd referendum. Another round of soft US housing data raises short-term questions about the health of consumers and long-term questions about the ceiling for interest rates. GBP is the strongest of the day, followed closely by CHF, which is flexing its safe haven muscle on the India-Pakistan tensions. The Dax30 Premium trade hit the 11550 stop, posting a high of 11560 before dropping off 100 points. The GBP trade is +250 pips in the green and remains open. The detailed Premium video on existing trades is found below.

US housing starts fell more than 11% in December to an annual pace of 1078K, far short of 1256K expected. It was the worst month since 2016 and it was accompanied with two other soft housing numbers on Tuesday. The Q4 FHFA house price index was up 0.3% compared to +1.3% expected and the December Case-Shiller 20-city index was up 0.19% compared to 0.30% expected. Shares of Home Depot also fell after disappointing results and poor guidance related to slowing demand for renovations.

The theme on housing crept up throughout 2018. It had been expected to be another strong year for housing due to low unemployment and rising wages. Instead, housing stumbled. Part of the story is undoubtedly supply. It's difficult to build homes and tariffs on lumber pushed up new home costs. Yet, during the past 12 months, existing home sales are also down 8.5%.

A long-term worry would be that US consumers are overburdened with debt and can't afford mortgages. In Q4, the cost of a 30-year fixed mortgage rose to 4.9% in the US and that coincided with a sharp drop in activity. It's since fallen back to 4.3% on the Fed U-turn.

If rates above 4.5% (or even 4%) sparked a buyers strike that could have vast long-term implications for the Fed and US dollar. It would essentially cap the Fed funds rate at these levels. On Tuesday the dollar sold off on the housing data despite strong consumer confidence numbers. That helped to boost EUR/USD above the 55 and 100-dma and added a few more pips in a runaway day for cable.

قفز الإسترليني مع الابتعاد من البركزيت القاسي

لقد دخلنا أخيرًا إلى نهاية لعبة الدراما في بريكسيت وقد دمج الأجزاء الرئيسية من اللغز بعد أن أعلن جيريمي كوربين ، زعيم حزب العمال المعارض (أكبر حزب في بريطانيا) ، أنه سيدعم رسمياً فكرة إجراء استفتاء جديد حول ما إذا كانت بريطانيا يجب مغادرة الاتحاد الأوروبي. و انتج ذالك الى إختبار الاستريني/ دولار مستوى 1.32 لأول مرة منذ أكثر من اربعة أشهر. للتحليل المفصل.

Sterling Sparks up as Hard Brexit Backs Down

Sterling roars back to regain the 1.32 level for the first time since October as Labour shakes up Brexit negotiations with a plan to call an amendment blocking a no-deal Brexit and calling for a second vote. GBP is now the strongest currency YEAR-to-date, MONTH-to-date and week-to-date. Traders turn to Fed chair Powell's testimony later on today, shedding light on when and how it will end the sale of its $4 trillion balance sheet later this year. The Premium long trade in cable is now over 150 pips in the green one week after we highlighted our decision to lower the stop from 1.2800 to 1.2740. The Premium video will be sent to subscribers ahead of the NY Close.

We're now clearly into the endgame of the Brexit divorce deal drama and the major pieces are being put into play. The final battle is beginning to be the two major party leaders against their own parties as both face insurrections from those ostensibly worried about a no-deal Brexit but who are pushing for no deal at all.

The resignation of 7 Labour MPs last week clearly shook Corbyn as he contemplates a U-turn on policy where Labour would support a second referendum. That threatens outrage on the Brexit wing of his party where around 25 members of his party will refuse to support it.The by-product of Corbyn's move is that it could spark a rethink among Conservative hard liners who may soon decide that taking the current deal is better than risking a re-vote.

May is facing the same pressures from pro and anti-Brexit factions in her party and a push to extend/abandon Article 50.

It is becoming increasingly clear that parliament will never allow a no-deal Brexit. Most members of the House of Commons and House of Lords are furious at the reality that we are less than one month away from the official Brexit date of March 29 and no deal is in sight. But that means the possibility of a last minute agreement on Brexit grows larger than the possibility of a no-deal Brexit as the clock ticks away. And that is of course, a positive for the British pound. The next step is a cabinet meeting where they will discuss extending Article 50. That could trigger further sparks in GBP volatility.

ندوة مساء اليوم مع أوربكس

نعرف أن الاحتياطي الفيدرالي يتميز بـ ١٢ فرع في المقاطعات المنتشرة في الولايات المتحدة. إذن ما هو الفرع الثالث عشر؟هذا ما سنتعرف عليه في ندوتنا الإلكترونية المجانية اليوم الثلاثاء ٢٦ فبراير (شباط) الساعة العاشرة مساءً بتوقيت مكة المكرمة. احجز مقعدك الآن

Delay is the Word of the Day

Delays everywhere and markets like it. The US will delay its planned March 1st tariffs on China and Theresa May could be considering a Brexit delay, according to various reports. Currencies are in a classic risk-on mode, with the Kiwi and Aussie as the top performers and the USD falling against all majors with the exception of JPY. All eyes turn to Fed chair Powell's testimony on Tuesday, which will shed light on when and how it will end the sale of its $4 trillion balance sheet later this year.

Delaying US-China Trade Talks

US-China trade talks were extended through the weekend and the verdict from Trump was positive as he announced the tariffs planned for March 1 will be postponed and that a summit with Xi will be planned “assuming additional progress.”Risk trades got a boost from the announcement, which came just after the open of markets but the moves were modest with AUD/JPY up less than 30 pips so far. Combined with the lackluster response in stock markets after upbeat trade comments from Trump on Friday, it's beginning to look like a deal is fully priced in and that there may even be a 'sell the fact' reaction once the deal is signed.

If a deal isn't fully priced in already, it will be soon. The risks may then shift to the euro and a tariff on auto imports. Trump quickly pivoted to China after he finished up on NAFTA and may now turn his attention to Europe with the Section 232 national security report in hand.

Delaying Brexit?

A different kind of delay looms for Theresa May. The Telegraph reports that she's considering a two-month delay as she attempts to quell rebellious MPs who fear the country is skirting too close to the deadline. The delay would be a backup if a newly-planned 'meaningful vote' on March 12 fails. All EU nations would have a veto on a delay and a separate report says the EU will push for a delay of up to 21 months.The FX trade isn't necessarily clear in any of the floated scenarios. On the face of it, pushing the meaningful vote to March 12 skirts dangerously close to the March 29 deadline, but it's abundantly clear that a vast majority in parliament will never allow a no-deal Brexit. Cable has been choppy in early trading without a strong trend.

مسألة الاحتياطيات

سيقدم رئيس مجلس الاحتياطي الفيدرالي جاي باول شهادة إلى الكونغرس يوم الثلاثاء حول حالة الاقتصاد الأمريكي. ما هي أهمية هذا الحدث؟ التحليل الكامل