Intraday Market Thoughts Archives

Displaying results for week of Apr 24, 2016The Lessons From the Carnage

The BOJ and RBNZ yesterday were a shining example of just how much dovishness the market demands from central bankers. The yen rocketed higher after the BOJ and the kiwi was the next best performer while the US dollar lagged. We take a look through the wreckage of the yen pairs. There are 2 JPY Premium trades, one taken today after the BoJ, the other 24 hours prior to the BoJ on expectations the BoJ would nothing.

The Bank of Japan decision to leave policy unchanged was merely a postponement of more action but the market crushed yen shorts in 200-400 pips moves. It's a lesson in the fallibility of CFTC futures positioning data. Those numbers show a crowded yen long trade but they don't reflect the build-up of structural and real-money bets on the yen to fall. Those trades were running for the exits Thursday.

The tell was the comment from Abe advisor Honda who correctly predicted the BOJ wouldn't act this time around and correctly forecast the surprise cut in January.

Ashraf also correctly predicted the BOJ and was quick to sell AUD/JPY after soft Australian CPI.

What's striking is how aggressively currencies are rallying when central banks don't act. The RBNZ tried to replace action with a dovish bias and jawboning but it wasn't nearly enough. Stevens has used the same playbook for years but the market has grown immune to it. If he doesn't deliver action then Australian dollar will surge but the good news for AUD bears is that he will now surely recognize what's at stake.

The stakes have surely been raised in yen trading after Thursday's moves. The spot to watch in the day ahead is USD/JPY as it flirts with the April low of 107.60. It has 55 pips of breathing room at the moment but the lack of a sustained bounce in US hours isn't comforting for the bulls. Real money tends to chase big breaks so the pain could be far from complete.

Data to watch in the hours ahead includes the 0130 GMT Australian PPI report. The prior year-over-year reading was 1.9%. A soft number would add even more weight to the CPI miss. The other data point at the same time is private sector credit, which is expected up 0.5%.

Most important will be a speech from the RBA's Debelle at 0345 GMT. Watch for clues about the May 3 RBA decision, they could be a major AUD mover.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Producer Price Index (Q1) (q/q) | |||

| 0.3% | Apr 29 1:30 | ||

| Producer Price Index (Q1) (y/y) | |||

| 1.9% | Apr 29 1:30 | ||

| Private Sector Credit (MAR) (m/m) | |||

| 0.6% | Apr 29 0:30 | ||

| Private Sector Credit (MAR) (y/y) | |||

| 6.6% | Apr 29 0:30 | ||

| RBA Assist Gov Debelle Speech | |||

| Apr 29 3:45 | |||

Fed and RBNZ Dovish, BOJ Next

The Fed continues to make a mockery of its dot plot. The forecast collectively calls for two rates hikes this year but the FOMC statement made it clear there are no plans to hike.

The market was caught wrong-footed on the release because headlines highlighted the removal of the line referring to global events posing risks. But that was essentially stating the obvious. The more important lines referred to a continued 'accommodative' stance and slower growth.

After jumping a half-cent the US dollar retraced. Choppiness and indecision followed but the dollar finished close to pre-FOMC levels.

The RBNZ decision was released in early Asia-Pacific trading. The market was leaning toward a decision not to cut rates but there was enough belief that it was possible that the kiwi popped 75 pips on the announcement. That was despite waves of dovish rhetoric and anti-NZD jawboning in the statement. It just goes to show how anything but a sprint to the bottom is cause for a currency rally.

That theme is likely to be underscored by today's Bank of Japan decision. The BOJ has been highly unpredictable over the past year so no one is comfortable. The belief is that they will unleash another round of easing or save it for a few months from now.

The last-minute thinking is that the dovish Fed will prompt the BOJ to act. As Abe advisor Honda outlined earlier in the week, the argument for waiting is that the government could unveil a package along with the BOJ. It's a close call.

The final decision may also sway by CPI data to be released at 2330 GMT. The national reading is expected flat year-over-year. Excluding food and energy, the forecast is for a 0.8% rise.Durables Add Doubt, Aussie CPI Next

Another soft US durable goods orders report may leave the Fed with second thoughts about a hawkish bias. The pound was the top performer while the dollar was generally softer and the Japanese yen lagged. The Australian CPI report and another round of US primaries are due later. There are currently 6 Premium trades in progress, 3 of which are in profit (one includes AUD), 2 in a loss and 1 at breakeven. Today's Premium video focusing on FX trades & charts pre-central banks is posted below.

US durable goods orders have struggled for two years and the March report once-again raised doubts about the economy. Overall orders were up 0.8% compared to 1.8% expected and the core measure was flat compared to +0.6% expected. The misses were compounded by small downward revisions to the February data.

The US dollar came under immediate pressure after the release. EUR/USD eventually hit 1.1339 from 1.1275 before the release. Later in the day the pair retraced all the gains, likely on Fed speculation.

There is major indecision about what the Fed could signal Wednesday. Fed funds futures are pricing in just a 19.6% chance of a hike. One reason they could wait is uncertainty about the Brexit vote, which is a week after the June 15 FOMC.

The 'leave' side got a boost Tuesday with a new poll showing them with a slight lead. The market sensitivity to the numbers is growing and cable immediately fell 35 pips on the headlines.

Other US economic data was mixed. The Richmond Fed was at 14 vs 12 expected. Consumer confidence improved to 94.2 but not as much as the 95.8 consensus. The Markit services PMI was at 51.1 vs 52.0 expected.

The Fed gets the advance trade balance report but it's unlikely to make a difference in deliberations. The data in Q1 has been weak but worries about global financial conditions have certainly ebbed. Resource prices will boost inflation as well.

The Fed wants the opportunity to hike in June and a less-dovish statement tomorrow is a pre-requisite. However, there is a chance they punt on the decision for another six weeks because of worries about unsettling stock markets.

Other central banks are struggling with similar dilemmas. The RBA will be closely watching Q1 CPI data due at 0130 GMT. The consensus is for a 1.7% y/y rise and a 2.0% y/y climb in the trimmed mean. Look for a significant AUD reaction to any miss.

At 0430 GMT, the BOJ will be watching the Feb all industry activity index. Their decision is due about 11 hours after the Fed and may depend on the signals Yellen sends.

The final set of events to watch are Republican primaries in Connecticut, Delaware, Maryland, Pennsylvania and Rhode Island. The announcement of mild cooperation by Kasich and Cruz this week to deny Trump the nomination could get uglier before it gets better.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Durable Goods -ex transportation (MAR) | |||

| -0.2% | 0.5% | -1.3% | Apr 26 12:30 |

| Durable Orders (MAR) | |||

| 0.8% | 1.7% | -3.1% | Apr 26 12:30 |

| Consumer Price Index (Q1) (q/q) | |||

| 0.4% | Apr 27 1:30 | ||

| RBA trimmed mean CPI (Q1) (q/q) | |||

| 0.6% | Apr 27 1:30 | ||

| Consumer Price Index (Q1) (y/y) | |||

| 1.7% | Apr 27 1:30 | ||

| RBA trimmed mean CPI (Q1) (y/y) | |||

| 2.1% | Apr 27 1:30 | ||

| Goods Trade Balance (MAR) | |||

| $-63B | Apr 27 12:30 | ||

| All Industry Activity Index (FEB) (m/m) | |||

| -0.9% | Apr 27 4:30 | ||

| CB Consumer Confidence (APR) | |||

| 94.2 | 96.7 | 96.1 | Apr 26 14:00 |

Arabic Webinar Today

ندوة قبيل لقاء الاحتياطي الفدرالي

ما هي الأسباب لتوقع سعر الفائدة؟ هل يؤدي قرار البنك الفيدرالي إلى تراجع جديد للدولار؟سجل للمشاركة في ويبينار اليوم 20:00 توقيت السعودية

Why the BOJ could Wait

A hint on Bank of Japan thinking added more intrigue to this week's full slate of central bank decisions. Markets were contained on the day as the yen rebounded and was the top performer; a slide in oil prices made CAD the laggard. Australia and New Zealand return from holidays but the Asia-Pacific calendar is quiet. There are no JPY trades in the Premium trades but Tuesday's upcoming video for subscribers will hint at whether new trades will open ahead of the Fed, RBNZ and BoJ meetings. There are currently 6 Premium trades in progress.

A story flew under the radar on Monday was hint from Etsuro Honda that the BOJ may not ease on Thursday. He is a top adviser to the Prime Minister and sometimes called the architect of Abenomics. He said it would be an 'acceptable judgement' for the BOJ to wait before easing further. Aside from his insider status, that comment carries special weight because he correctly predicted the surprise BOJ easing in January.

His reasoning is that further action may have more impact if it's announced alongside a sales tax delay and government stimulus. That's something that would be possible in June.

The BOJ may also wish to wait and see what the Fed decides to shape its FOMC statement. If Yellen opts to remove the 'accommodative' bias in the statement and puts a June hike on the table, then USD/JPY may rise without Kuroda's help.

The market is pricing in just a 20% chance of a hike in June. Those who don't see a hike will ultimately be proven correct but the Fed will want to maintain the option of hiking. In order to do that, they need to send a fairly strong signal about the potential for a rate hike. In the past, delicate musings along with well-timed comments from FOMC members would be enough but the market is no longer listening to hawkish Fedspeak so they may opt for something stronger in the statement and use rhetoric to walk back later, if necessary.

Economic data was light on the day. New home sales were at 511K compared to 520K expected but the release was ignored by markets. Look for better action from Tuesday's slate of durable goods orders, consumer confidence, the Markit services PMI and the Richmond Fed.

The Asia-Pacific calendar is empty but look for more active trading in AUD and NZD as traders return from a long weekend.

Anti-Brexit Trade Boosts GBP

Brexit betting odds are falling and Obama added to the chorus of politicians warning of disaster on the weekend. Liquidity is still thin but cable is up strongly to start the week. Weekly CFTC data helped to explain why GBP/JPY jumped so much on Friday. Market turns to US new home sales but the week's biggest day is Wednesday, with Aussie CPI, UK Q1 GDP, Fed & RBNZ decisions. There are 6 Premium trades in progress after USDJPY was stopped out on Friday. Both trades opened on Thursday remain in progress.

Polls have showing the Brexit side losing momentum a month ahead of the referendum. Business and political leaders in Europe have hammered the public with economic arguments against leaving the EU and it's beginning to work. Obama added his voice on Sunday, saying it might take 10 years to negotiate a UK-US trade deal if the UK leaves.

Cable opened up 60 pips to a five-week high, breaking a potential double top at 1.4450.

Greece is back in the headlines as Germany balks at debt relief. While the story might begin to grab some broader attention, it is highly unlikely to weigh on the euro. The threat of Greece leaving the euro and other countries following remains remote.

Wednesday's main event is the FOMC decision. The risk is that Yellen tries to reclaim some credibility on rates with a hawkish statement that puts a June hike on the table. But Thursday's Q1 GDP and Friday's core PCE price index from the US will be key.

Commitments of Traders

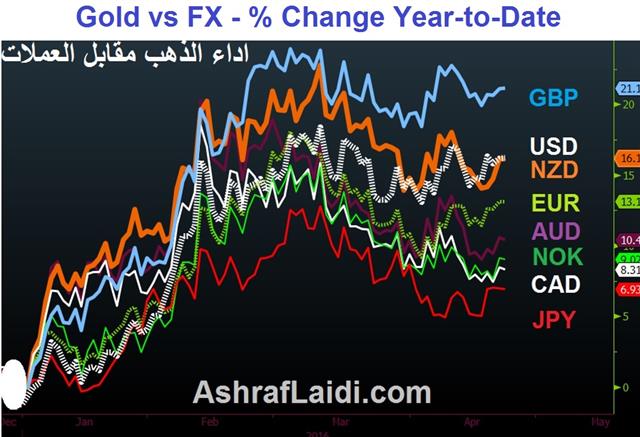

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -47K vs -52K prior JPY +72K vs +66K prior GBP -55K vs -51K prior CHF +9K vs +8K prior AUD +44K vs +35K prior CAD +7K vs +2K prior NZD +5K vs +4K prior

The yen long is at a fresh extreme since at least 1992 but that may prove to the high-water mark for the medium term after the yen selling on Friday and with the BOJ coming up on Thursday.

The other extreme is GBP as shorts continue to pile in. But with Brexit odds falling, specs began a race to the exits on Friday and the pair rallied more than 400 pips. GBP/JPY has climbed another 80 in early trade.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| New Home Sales (MAR) (m/m) | |||

| 0.527M | 0.512M | Apr 25 14:00 | |

| New Home Sales Change (MAR) (m/m) | |||

| 2% | Apr 25 14:00 | ||