Intraday Market Thoughts Archives

Displaying results for week of May 24, 2020Why the Euro Broke Higher

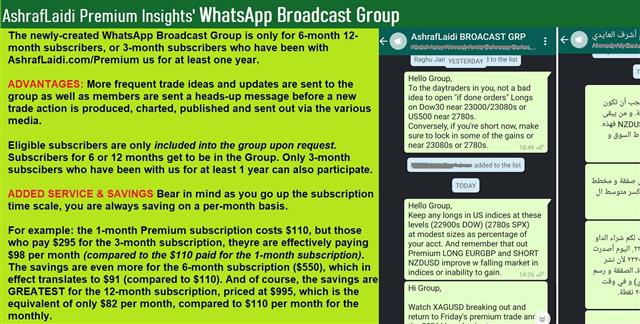

EUR/USD finally cut through resistance in the 1.1000/20 zone on Thursday as the euro led G10 FX. USDX is on course for its biggest monthly fall of the year. The Canadian and US dollars were the laggards as risk trades dipped late on China worries. The April US PCE report and comments from Powell are due on Friday along with a Trump announcement on China. The Premium Dow30 short was stopped out at 25700, while the EURUSD long is a few pips away from 200-pip gain. Today's Premium FX trade is currently 130 pips in the green. Below are screenshots from Ashraf's WhatsApp Broadcast Group, whose members received a trade heads-up alert nearly 1 hr before the actual trade was issued to the Premium Subscribers.

The thinking in the market at the moment is that economies are opening up and that the virus isn't so dangerous after all. There are reasons to doubt that and to fear a second wave but that's clearly the mode the market is in. And let's not forget the bigger than expected EUR 750 bn loan package from the EU, whose initial announcement coincided with EURUSD's first jump.

US markets staged a remarkable rally, but EU has more upside ahead. Italy's MIB is just testing the 38.2% retracement of the pandemic fall and that comes after a week of strong gains. If everyone is going to open up and recover, then the catch-up trade is outside the US. Needless to say there are undoubtedly differences because the eurozone doesn't have the same fiscal capacity but at the same time, debt monetization is a lower risk.

On net, European stock markets are better value right now than US markets if you assume a full reopening. Again, it would be easy to make arguments against that statement but that's where the market is at for the moment and it's what finally boosted EUR/USD above 1.10.

The pair rose as highs as 1.1093 before a sag late in the day. Risk trades were hit and stock markets reversed into negative territory when Trump said he will announce something on China Friday, presumably some kind of retaliation for the Hong Kong security law. All evidence points to some ineffectual sanctions against individuals and companies but Trump is unpredictable and this is a chance for him to flex his 'tough on China' muscles ahead of the election.

There's no set time yet for the press conference and there's a high risk of leaks. The day will also feature the April US PCE report and the focus will be on spending, which is forecast to contract by 12.7%. Fed Chair Powell will also speak at 1500 GMT. This is his last opportunity to send a message ahead of the blackout period and given the positive tone in markets, the risk is that he dampens expectations for future FOMC action.

ندوة أشرف العايدي مع أوربكس مساء اليوم

انضم لهذه الندوة الالكترونية المجانيّة مع أشرف العايدي للتعرُّف على كيفية وأهمية قياس اتساع المشاركة والزخم في المؤشرات. موعدنا مساء اليوم في تمام الساعة 9 مساءً بتوقيت مكة المكرمة للتسجيل من السعودية و للتسجيل من باقي دول العالم

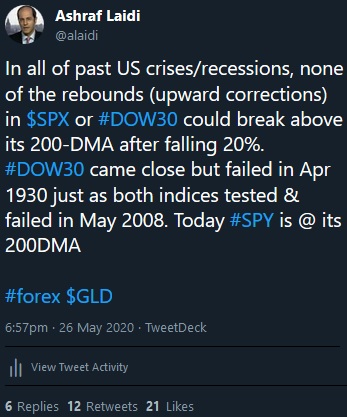

اختبار قاعدة الـ ٩٠ سنة في المؤشرات

هناك قاعدة في التحليل الفني استمرت صلاحيتها لعدة سنوات. فهل ستنتهي صلاحية هذه القاعدة؟ أم ستستمر؟ في كلتا الحالتين، سيكون للإجابة النهائية آثار هائلة على مؤشرات الأسهم الرئيسية. التحليل الكامل

Tech Levels Break But Questions Remain

The US dollar suffered one of its worst days since the dawn of the pandemic on Tuesday as commodity FX surged on a better risk tone. US indices eased off the highs, but SPX & DOW30 are on course to complete the best May performance since 2009. Will it be sustained? More below. The Australian dollar was the top performer while the US dollar lagged. USD sustained its biggest percentage daily drop since Mar 27. The Richmond Fed is due on Wednesday. A new Premium Insights' trade was issued right ahead of the NY Close, supported by 2 charts and 5 notes.

Closely-watched technical levels in the commodity currencies and elsewhere gave way on Tuesday but some late-day price action raised new questions.

USD/CAD slowly turned into a textbook consolidation pattern in the past six week and after testing 1.3850 three times, the pair finally broke down in a 220 pip tumble. One of the catalysts was a reasonably optimistic take on loan-loss provisions from one of Canada's largest banks. But Ashraf tells me to beware of the 1.3760/70 confluence support.

The main theme was better risk sentiment as the S&P 500 tested above 3000 and its 200-day moving average. Late in the day some skepticism crept in. Oil failed to hold the bulk of its gains and the S&P 500 halved the rally to finish back below the 200-dma. Here is Ashraf's subsequent thoughts on that.

The catalyst was a report saying the US plans sanctions on Chinese individuals and companies in retaliation for the Hong Kong security law. In addition, economic data was mixed with consumer confidence at 86.6 vs 87.0 expected and virtually flat compared to a month earlier. On the other side of the ledger was a very strong new home sales report, suggesting that low interest rates are pulling in buyers.

Elsewhere the Australian dollar also edged above the 200-dma and completed the virus round-trip to return to mid-February level Looking ahead, the technicals will remain front-and-centre including EUR/USD, which is having yet-another look at resistance in the 1.1000/20 range.

On the economic data front, the US calendar is lighter Wednesday but features the Richmond Fed for May. The consensus is an improvement to -40 from -53.

Optimism Reigns, Technicals the Tell

Holidays in the UK and US kept a lid on trading to start the week but the overall tone remained positive. In a classic risk-on mode, NZD and AUD led the FX winners, while JPY, CHF lagged with gold and silver. Oil regained $34 on after a Russia issued a positive price outook. CL1 is nearing its 100 DMA at 36.60. CFTC positioning data continued to show largest bets against commodity FX. The S&P500 is retesting its 200-DMA for the first time since March 5th, while DOW30 attempts to fill the down-gap created on that same fateful OPEC weekend. The NASDAQ Premium short was stopped out at 9555 before falling to 9440s, while other tech-related indices have yet to fill their gaps. Below is the English+Arabic video for Premium subscribers.

مؤشرات البورصة تحت غطاء محرك القطاعات (فيديو المشتركين)

The FX market was locked into a tight range to start the week but the broader tone was positive despite the continued tensions surrounding Hong Kong. At this point, it doesn't appear as though the US will hit back with anything that makes China think twice. USD is the weakest of the day as risk-on chases commodity FX.

As a result, European equities stormed higher to start the week. The DAX gained 2.8% to the best levels since the pandemic.

A continued technical spot to watch is in USD/CAD with the pair breaking the post-pandemic low of 1.3850s. The low was rejected again last week but remains within striking distance. Aside from the economic calendar, events to watch this week are earnings from the major Canadian banks. Last week Canada's government-backed mortgage insurance company forecast a 9-18% decline in housing prices and if banks forecast higher loan losses, the market could quickly sour on the loonie. Alternatively, a rosier scenario could be what breaks the range.

On the US front, consumer confidence rebound by less than expected, while new home sales jumped by more than expected with +0.6% vs exp -23%. Markets continue to shake of poor data, but there have been fewer opportunities to evaluate the reactions to surprisingly strong numbers.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +72K vs +78K prior GBP -19K vs -14K prior JPY +28K vs +28K prior CHF +9K vs +7K prior CAD -35K vs -32K prior AUD -39K vs -35K prior NZD -16K vs -16K prior