Tech Levels Break But Questions Remain

The US dollar suffered one of its worst days since the dawn of the pandemic on Tuesday as commodity FX surged on a better risk tone. US indices eased off the highs, but SPX & DOW30 are on course to complete the best May performance since 2009. Will it be sustained? More below. The Australian dollar was the top performer while the US dollar lagged. USD sustained its biggest percentage daily drop since Mar 27. The Richmond Fed is due on Wednesday. A new Premium Insights' trade was issued right ahead of the NY Close, supported by 2 charts and 5 notes.

Closely-watched technical levels in the commodity currencies and elsewhere gave way on Tuesday but some late-day price action raised new questions.

USD/CAD slowly turned into a textbook consolidation pattern in the past six week and after testing 1.3850 three times, the pair finally broke down in a 220 pip tumble. One of the catalysts was a reasonably optimistic take on loan-loss provisions from one of Canada's largest banks. But Ashraf tells me to beware of the 1.3760/70 confluence support.

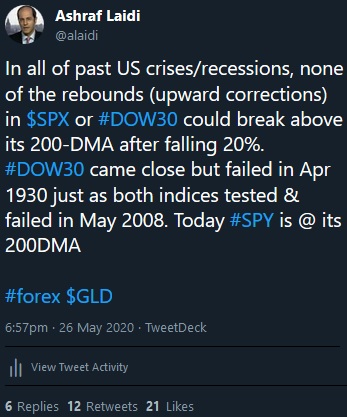

The main theme was better risk sentiment as the S&P 500 tested above 3000 and its 200-day moving average. Late in the day some skepticism crept in. Oil failed to hold the bulk of its gains and the S&P 500 halved the rally to finish back below the 200-dma. Here is Ashraf's subsequent thoughts on that.

The catalyst was a report saying the US plans sanctions on Chinese individuals and companies in retaliation for the Hong Kong security law. In addition, economic data was mixed with consumer confidence at 86.6 vs 87.0 expected and virtually flat compared to a month earlier. On the other side of the ledger was a very strong new home sales report, suggesting that low interest rates are pulling in buyers.

Elsewhere the Australian dollar also edged above the 200-dma and completed the virus round-trip to return to mid-February level Looking ahead, the technicals will remain front-and-centre including EUR/USD, which is having yet-another look at resistance in the 1.1000/20 range.

On the economic data front, the US calendar is lighter Wednesday but features the Richmond Fed for May. The consensus is an improvement to -40 from -53.

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40