Intraday Market Thoughts Archives

Displaying results for week of Aug 25, 2019Riding the Inverted H&S into the Weekend

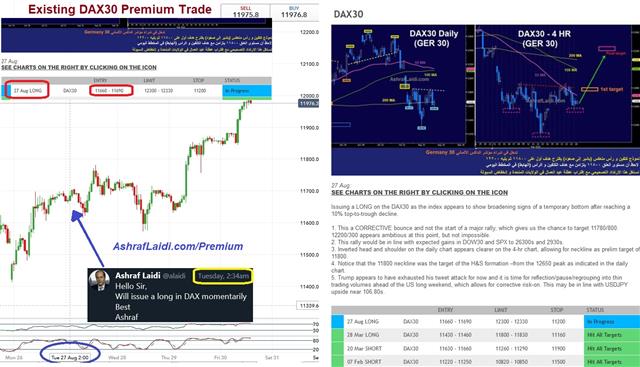

Some subscribers complained that Tuesday's Premium trade in the DAX30 was issued too early in the morning (many did not hear the SMS, see the email, Tweet or Telegram notification), but the market did pull back for at least 2-3 hrs to get everyone (at every timezone) at the stated price range. The trade is currently about +300-pts in the green. We'll risk sticking to the trade into the weekend, while cautioning in favour of taking partial profits ahead of today's close and keep 1/2 or 1/3 of the trade, depending on your positioning/sizing. As in all Premium trades, technical and fundamental rationale is laid out below in English and Arabic.

Risk Rebounds, PCE Next

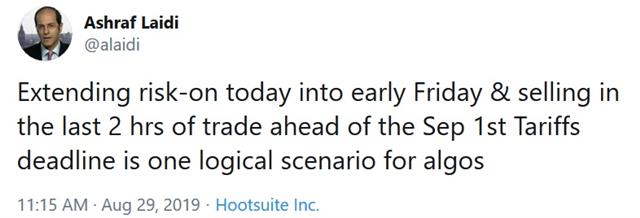

The US dollar was boosted by recovering risk trades on Thursday on an ebb in trade tensions. The Canadian dollar was the top performer while the Swiss franc lagged. Week-to-date, silver and CAD are the only gainers versus the greenback. The week wraps up today with Canadian GDP and the US PCE report. US traders in need of a rest, looking forward to a Labour Day weekend, which coincides with the Sep 1st Chinese tariffs on US imports. A new Premium trade in FX was published before the close of Thursday trade. The chart below highlights August's volatility, showing the S&P500 had three days of 2.5% declines or more --the highest since the ugly December 2018--while also containing seven days of 1.0% gains or more -- the highest since the fateful February 2018. Such 2-way volatility bears reason for concern.

The equity market continues to bite on headlines that suggest calls and meetings between the US and China. On Thursday that resulted in a 36 point jump in the S&P 500 as all the main global markets made strong gains.

Meanwhile, the bond market remains unimpressed. Treasury yields moved up briefly on a 2 basis point tail at a 7-year auction but the moved didn't last as yields finished the day up 1-2 bps across the curve.

In FX, risk trades were also tepid. AUD and NZD failed to make any headway against the field. It all suggests that flows and month-end rebalancing are bigger factors than any genuine change in sentiment.

A long weekend in North America now looms with drama in UK parliament likely to greet the return on Tuesday. The pound has held up admirably in the turmoil this week and positions remain deeply short. Some headlines suggest that Corbyn could have support from at least one Conservative in a caretaker government and Spearker Berkow is reportedly scheming with Conservative remainers. The pound could jump on legislation ruling out a no-deal Brexit.

Economic data springs to the forefront today. The July US PCE report is another critical look at the US consumer. It's expected to show personal spending up 0.3% with inflation running up 0.2% m/m. Any disappointment would harden calls for Fed cuts.

The Bank of Canada is a tougher central bank to handicap, in large part because there has been zero communication from the BOC since July 10. The market is pricing in a 15% chance of a cut on Sept 4 but that could shift depending on Q2 GDP data due Friday. The consensus is for a health 3.0% annualized pace.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (m/m) | |||

| 0.1% | 0.2% | Aug 30 12:30 | |

ركز على الحركة السعرية وليس الإخبارية

يتوقع خبير الأسواق العالمية أشرف العايدي أن مؤشرات الأسهم ستواصل ارتفاعاتها في الأسواق حتى الساعات المبكرة من يوم الجمعة وبعد ذلك ستبدأ عملية البيع، فهل يجب على المتداولين التركيز على الحركة السعرية أم الإخبارية؟ لمعرفة الإجابة تابعوا هذا الفيديو الحصري

A Franc Discussion

The Swiss franc has quietly climbed for four consecutive months but it's still a middling performer this year; that could soon change. The US dollar led the way Wednesday while the pound lagged. The second look at Q2 US GDP is due up next. The Mystery Chart below is the basis of Tuesday's Premium Insights trade, which is already 200-pts in the green. Care to guess what it is?

The Swiss National Bank once again finds itself in the unenviable position of trying to restrain franc gains. After hitting 1.20 last year the pair has slipped to 1.0875 with relatively little fanfare. It's been consolidating around that level for the past two weeks.

One interesting aspect of the franc strength is that it has not been driven by specs. As we noted at the start of the week, CFTC positioning still shows a net short in the franc.

That may be a result of the long memories of FX traders but it also reflects the possibility of fresh intervention. EUR/CHF has fallen below 1.10 in the past month and is at the lowest since June 2017. Levels to watch include the 2017 low of 1.0637 and mid-2015 low of 1.0230. It was a quick spike down close to parity in 2011 that prompted the SNB to institute the floor to begin with.

Note that both the dawn of the floor and the break of it were in response to extraordinary policy from the ECB. With Draghi preparing for his final act of 'whatever it takes' on Sept 12, the risks are greater than they appear.

The SNB has no doubt noticed and has lightly been active in the FX market according to sight deposit data. On Wednesday, the SNB's Maechler highlighted that there is still plenty of room for intervention.

Looking ahead, US revised Q2 GDP is due at 12:30 GMT/13:30 London, expected to trim growth to 2.0% from 2.1%, annualized. Personal consumption continues to be the main driver of growth with that component at 4.3% in the preliminary report.

Market risks around the report are minimal. We know that consumers were strong and the economy was solid in the quarter; the market is more concerned about late this year as trade weakness potentially spreads.

ملتقى التداول الإلكتروني مع أشرف العايدي

ملتقى التداول الإلكتروني مع إكس تي بي يوم الثلاثاء 3 سبتمبر الساعة 9 صباحاً بتوقيت مكّة المكرّمة بوجود 10+محاضرين و منهم أشرف العايدي الذي سيبدأ محاضرته الساعة 3 عصرا بتوقيت مكة المكرمة و للمشاركة في البث المباشر إضغط هنا

Johnson Set to Block Parliament

Sterling is the biggest loser while silver continues to soar amid reports that UK PM Boris Johnson will suspend parliament in order to block MPs' efforts to pass legislation aime at avoiding a no-deal Brexit. Parliament returns next from the summer holiday but now it's expected to be suspended for longer than usual. More below. The US yield curve inverted more deeply and in new ways after a controversial OpEd by the former head of the NYFed.

فيديو المشتركين الآن جاهز- إستغلال التذبذبات و سرعة الخروج

The news of Parliament suspension come less than 24 hours after UK opposition parties released a joint statement saying they would fight to block a no-deal Brexit. Yesterday's statement lifted GBPUSD to 1.2300 – the highest since July 28. UK govt officials confirmed parliament would return next Tuesday, but would likely be suspended again around Sep 9-10 until October 14, when a new Queen's Speech will be held. All eyes shall turn to and Labour leader Corbyn who is expected to lead a vote of no-confidence vote in Johnson's government next week.

Destabilizing Confidence

A strong consumer confidence reading on Tuesday raised the risk that the Fed might not be as dovish as expected. We warned about the counterintuitive market reaction to a strong consumer confidence print and that's exactly what unfolded yesterday. The reading of 135.1 was much higher than the 129.0 consensus. It was compounded by the present situation index rising to the highest since 2000.US stock markets had been higher ahead of the report but slowly sank afterwards to finish lower. The spillovers were smaller in FX but the dollar was generally stronger and gold rallied once again. A number of Fed officials highlighted the importance of the consumer at Jackson Hole and the strong reading will spark some arguments that the Fed is loosening rates when the data doesn't warrant it.

That sentiment helped to pin the front end of the bond curve close to unchanged on the day while the long end rallies on fear that it would eventually prove to be a mistake. That pushed 2s10s five basis points below inversion and also inverted 3-month bills below the 30-year bond for the first time since 2007.

Looking ahead, we will hear from the Fed's Daly and Barkin in the day ahead in what could add further Fed uncertainty.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CB Consumer Confidence | |||

| 135.1 | 129.3 | 135.8 | Aug 27 14:00 |

Calm Prevails Ahead of Confidence

A call for calm from China's top trade official stalled risk aversion throughout financial markets on Monday. A critical report on US consumer confidence is coming up next. Friday is the last trading day of the month in which JPY and CHF are the top FX performers, while silver and gold were the biggest commodity winners. AUD and NZD are the biggest losers of the month. Traders will keep an eye on 106.80 resistance in USDJPY, 105.40s support, while indices may retest 26200 and 2930s on DOW30 and SPX. A new Premium trade has been issued in early Tuesday Asia trading. The mystery chart below is one of the two charts used to back the Premium trade.

Short-term trading in 2019 continues to be overwhelmingly driven by trade headlines. Market sentiment turned positive Monday after Liu He called for calm. Trump also revealed that Chinese officials had called their US counterparts in Washington. Chinese media tried to downplay those moves but risk trades cheered for now.

AUD/JPY has been a particularly volatile trade, which is normal in high-risk moments. The pair fell below 70.00 early in Monday trade to a 10-year low but reversed to finish near 72.00 in an impressive reversal. US stocks also rebounded from recent lows with the S&P 500 climbing 31 points. It was an impressive show of resilience that shows a faith in central banks and perhaps some lingering optimism about a trade deal.

Do not forget the 10-2 yield spread, which inverted for the 3rd straight session.

US economic data was mixed. Headline durable goods orders rose 2.1% compared to 1.2% expected. Core orders also rose 0.4% compared to a flat reading forecast. Nonetheless, the core rise came as the prior reading was revised to +0.9% from +1.5%, wiping out any total boost. A soft shipments number also suggests a drag on Q3 growth.

A number of Fed speakers over the past week emphasized consumer spending as a key linchpin for their outlook. One of the best forward-looking indicators is consumer confidence and the August preliminary report from the Conference Board and it's due Tuesday at 10:00 Eastern/14:00 GMT/15:00 London. The consensus is a slide to 129.0 from 135.7. A strong reading – counterintuitively – might cause some risk aversion on fear the Fed won't ease as aggressively.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Durable Goods Orders (m/m) | |||

| -0.4% | 0.2% | 1.0% | Aug 26 12:30 |

| HPI (m/m) | |||

| 0.2% | 0.1% | Aug 27 13:00 | |

| CB Consumer Confidence | |||

| 129.3 | 135.7 | Aug 27 14:00 | |

مذكرات هامة لمتداولي الداو جونز

أصبحت قرارات “ترامب” تجاه الصين خطيرة بشكل متزايد، ليس فقط بالنسبة للأسواق العالمية، ولكن أيضاً للاقتصاد العالمي. قد تؤدي قرارات “ترامب” المتهورة إلى خسارته في الانتخابات الرئاسية العام المقبل، بينما يبقى الرئيس الصيني في مقعده لمدة خمس سنوات أخرى على الأقل. إليكم ما حدث منذ يوم الجمعة وما أتوقعه بعد ذلك في التحليل المفصل

Point of No Return?

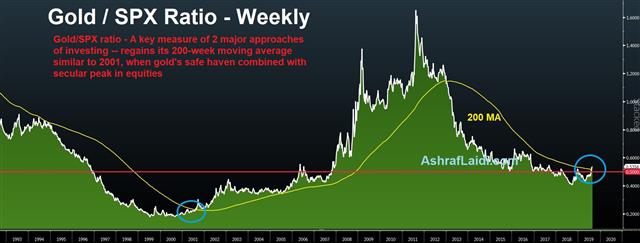

Markets are firmly in the green after Trump stated China wants to "make a deal" but no confirmation of such remarks emerged from China, except for the standard statement from Chinese Premier Liu that China opposes escalation and is willing to talk in a calm manner. Is that enough? The latest round of tariffs illustrates that there is no longer a way to de-escalate the trade war. Markets kicked off the week with cycle extremes in yields, gold and some yen crosses. CFTC positioning showed a growing divergence between low yielders. The Dow short Premium trade issued last Monday hit its final target for 900-pt gain while EURJPY was stopped out. There is currently one trade open.

Does the dramatic escalation in trade war rhetoric seen on Friday along with subsequent comments underscore that we've crossed the point of no return? Both sides are now fully politically invested in 'winning' the trade war, rather than working towards a deal.

At best, this is the start of a long stalemate that eventually fizzles out with a new US administration. At worst, the nations are headed towards a full decouple in something akin to a new cold war. At stake is the global economy (not just stocks), but markets are already placing bets. Treasury yields opened the new week lower with the 10-year plunging to 1.44%. At the extremes, gold jumped $30 to $1555, a fresh six-year high. AUD/JPY briefly broke 70.00 for the first time since 2009.

There will be undoubtedly be an ebb and flow of economic data and sentiment. The yuan fixing wasn't as low as feared to start the week at 7.0570 compared to the offshore measure at 7.1926.

US Consumers - At what Point?

Figuring out whether the Fed will cut rates deeper shall depend on when will Powell detect credible signs of a danger to the US consumer. US autos have been hit, farmers have been damaged, so when will the US growth engine be next? There are no levers to pull that can cushion the blow to global growth from the trade war but after monetary policy reaches the limit then currency intervention will be in play. The months ahead will be harrowing.CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -38K vs -47K prior GBP -92K vs -96K prior JPY +31K vs +25K prior CHF -11K vs -13K prior CAD +13K vs +14K prior AUD -63K vs -63K prior NZD -18K vs -13K prior

The lack of interest in the Swiss franc even as money pours into the yen is increasingly curious. It highlights a market that's unwilling to fight the SNB – at least for now.