Intraday Market Thoughts Archives

Displaying results for week of Jan 26, 2014Crashes & Crises after January

Stocks post their first negative January performance since 2010. Declines in January have more commonly involved high-risk declines during the in the year – but not necessarily a decline for the rest of the year as the “January Barometer” suggests with its 73% accuracy. Here's a look at equities, using the Dow Jones Industrials index. 2010 – The last time stocks fell in January (-3.5% due to Volcker PropTrading speech) — Eurozone crisis kicked off and the May Flash Crash hit partly due to (GS DoJ investigation). 2000 – The bust of the dotcombust was kicked off by a 7% decline in January. 1998 – Another year of spectacular losses when the Asian currency crises coincided with damage in Russia and Brazil, a classic case of emerging markets collapse. 1990 – The year of the US Savings & Loans crisis and Saddam Hussein's invasion of Kuwait started off with a 6% January fall before leading to a 17% decline in Aug-Nov.

We expect the current downleg will stabilize near 1700 for the S&P500 and 15300 for the DJIA, coinciding with stabilization at 2.45% for 10-year yields.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (y/y) [P] | |||

| 0.7% | 0.9% | 0.8% | Jan 31 10:00 |

| Core CPI (y/y) [P] | |||

| 0.8% | 0.8% | 0.7% | Jan 31 10:00 |

Japanese CPI Hits 5-Year High

Middling data on US GDP and initial jobless claims couldn't stifle a rebound in risk sentiment and USD/JPY and EUR/USD finally broke down. The Australian dollar was the top performer Thursday while the safe-haven Swiss franc lagged. Early in Asia, Japan's unemployment rate tumbled and inflation beat expectations. The 5-year high figure of 1.3% y/y boosts both of our Premium longs in USDJPY. USDCAD, EURUSD, AUDPY, NZDUSD and gold shorts remain in progress in our latest Premium Insights.

The first reading on fourth quarter US GDP matched expectations at 3.2% but the details raised questions. Consumption fell short of estimates and instead inventory building added a boost. High inventories could lead to a payback with slower growth in Q1 and some economists lowered expectations.

Employment also remains a spot of contention as jobless claims at 348K were worse than the 330K consensus. The Fed continues to blame poor weather for the weak Dec non-farm payrolls report but stubbornly high jobless claims hint at other problems.

In any case, the data was good enough to sustain a relief rally in stock markets and USD/JPY. Another positive factor was a pledge from Russian leaders to defend the ruble. The weakness of RUB in 2014 is on par with declines in ZAR and TRY and the Russian announcement calmed worries about more emerging market pain.

In Japan, Abe and Kuroda likely smiled after seeing employment and CPI data. The jobless rate fell to 3.7% compared to 3.9% expected and CPI rose to a 5-year high of 1.6% y/y beating the 1.5% reading expected.

The risk for USD/JPY traders is that better data could lead the BOJ or MOF to scale back stimulus plans, although at the moment that's a low percentage risk. The key zone of support for USD/JPY remains 101.77/102.00 while a break above 103.00/50 would nullify the latest round of risk aversion.

Friday is the final day of trading for January so beware of month-end flow driven trade.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| National Core CPI (y/y) | |||

| 1.3% | 1.2% | 1.2% | Jan 30 23:30 |

| Tokyo Core CPI (y/y) | |||

| 0.7% | 0.7% | 0.7% | Jan 30 23:30 |

| Tokyo CPI (y/y) | |||

| 0.7% | 0.9% | Jan 30 23:30 | |

| National CPI (y/y) | |||

| 1.6% | 1.5% | Jan 30 23:30 | |

| GDP (q/q) [P] | |||

| 3.2% | 3.2% | 4.1% | Jan 30 13:30 |

| GDP Price Index (q/q) [P] | |||

| 1.3% | 1.3% | 2.0% | Jan 30 13:30 |

| Continuing Jobless Claims | |||

| 2,991K | 3,020K | 3,007K | Jan 30 13:30 |

| Initial Jobless Claims | |||

| 348K | 330K | 329K | Jan 30 13:30 |

| Jobless Claims 4-Week Avg. | |||

| 333K | 332K | Jan 30 13:30 | |

| Unemployment Rate | |||

| 3.7% | 3.9% | 4.0% | Jan 30 23:30 |

Falling Yields vs Taper-Autopilot

The pullback in US Q4 GDP to 3.2% from 4.1% in Q3 was offset by the highest reading in personal consumption expenditure in 3 years at 3.3%. Yields are no longer rising. Here's our take on yields and equities. full chart & analysis

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (q/q) [P] | |||

| 3.2% | 3.2% | 4.1% | Jan 30 13:30 |

| GDP Price Index (q/q) [P] | |||

| 1.3% | 1.3% | 2.0% | Jan 30 13:30 |

| Core PCE - Price Index (DEC) (m/m) | |||

| 0.1% | 0.1% | Jan 31 13:30 | |

| PCE - Price Index (DEC) (m/m) | |||

| 0% | Jan 31 13:30 | ||

| Core PCE - Price Index (DEC) (y/y) | |||

| 1.1% | Jan 31 13:30 | ||

| PCE - Price Index (DEC) (y/y) | |||

| 0.9% | Jan 31 13:30 | ||

Fed Tapers, RBNZ Holds, Markets Worried

The Federal Reserve tapered another $10 billion but the biggest surprise was that officials offered nearly nothing to the doves. The key parts of the statement were unchanged but slightly more hawkish was introduced with officials saying risks to the growth and employment outlook were 'more nearly balanced.'

The takeaway is that conditions will need to deteriorate significantly for the Fed to reconsider the taper. That's good news for the US dollar but takes away a source of support risk assets. That's a double-dose of good news for USD/CAD.

The loonie's commodity cousin in New Zealand also had a dose of negative news when the RBNZ decided to wait before raising rates. Wheeler said a hike will come 'soon' but NZD/USD fell a half cent to 0.8180 before rebounding to 0.8216. The central bank will almost certainly hike rates at the next meeting in March as it embarks on a hiking cycle.

Aside from central banks the market focus was on emerging problems in the developing world. Turkey's dazzling effort to halt the lira's decline failed within hours. The South African rand also hit a four-year low despite a rate hike. The problems have exposed doubts in developed markets and sparked demand for yen.

Technically, USD/JPY held the short-term support zone from 102.00 to 101.77 but only barely and bounces have been thin. In addition, stocks broke down and USD/JPY fell below the 2.70% support level. Unless sentiment quickly turns, it's tough to envision yen crosses remaining buoyant.

The worries in emerging markets can be traced back to the China manufacturing PMI from HSBC. The flash reading was 49.6 for January and at 0145 GMT the final revision will be announced.

But first, at 2350 GMT, Japan will release retail sales for December. The consensus is for a healthy 3.9% y/y increase.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Trade s.a (DEC) (m/m) | |||

| 1.9% | Jan 29 23:50 | ||

| Retail Trade (DEC) (y/y) | |||

| 3.8% | 4.1% | Jan 29 23:50 | |

| Nomura/ JMMA PMI Manufacturing (JAN) | |||

| 55.2 | Jan 30 23:13 | ||

| PMI (JAN) | |||

| 49.6 | 50.5 | Jan 30 1:45 | |

Fed Tapers Despite EM (Redline Text Comparison)

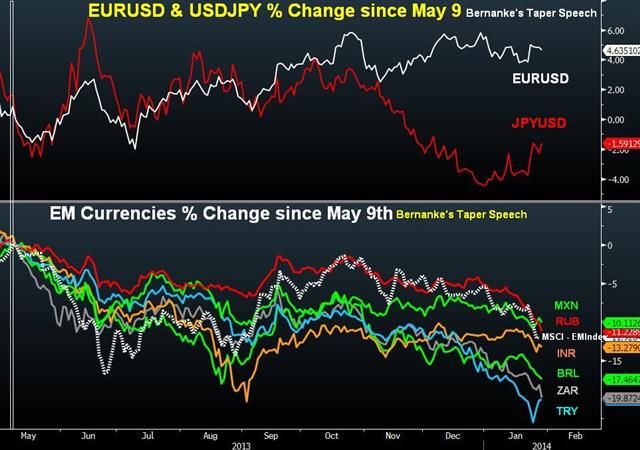

The Fed's decision to taper by another $10 billion despite the sell-off in emerging markets reflects its improved confidence in the ability to let forward guidance stir yields lower and highlight the notion that that tapering is a normalization of policy and not a tightening of financial conditions.The barrier to tapering has also being diminished by the 8% in yields since the December FOMC, which contrasts with the 82% spike in yields between May and the September decision to not taper. Full charts & analysis

Turkish Central Bank Delivers Hammer

A dramatic move to raise rates from the Turkish central bank wiped out a near-term risk. USD/JPY jumped to 103.30 from 102.90 after the decision. Asia will have the first chance to digest the news and the calendar there is quiet.

Turmoil in emerging markets has been the key market driver in the past week but a sharp hike in Turkish interest rates could stem the fall of the lira and help stabilize broader markets. In a midnight emergency meeting Turkey's central bank hiked rates to 12% from 7.75%, sailing through expectations of a rise to 10%. In a surprise move, repo, borrowing and liquidity window rates were also raised much higher.

The yen fell and stock markets rose on the news. The euro also softened in a sign that Turkish safe haven flows may have marginally favored to euros.

As reported in the MNI bullet points, ECB sources cited by MNI said the central bank is content at present with current policy and that there is no sense of urgency to act on deflation worries.

The euro was upbeat in US trading after a durable good orders report that casts doubt on the strength of US investment. The key capital goods orders nondefense ex-air component fell 1.3% compared to a 0.3% rise expected. In addition, the previous reading was revised to +2.6% from 4.5%.

The refrain has been to blame soft December economic data on weather but snow and cold hardly prevent future orders. The softness could lead the Fed to rethink a $10 billion taper by scaling it to $5 billion or adding dovish guidance.

The developments in Turkey will give the Fed comfort, especially if the upbeat tone holds up into US trading on Wednesday.

In the hours ahead the focus will be on Asian stocks but Australia skilled vacancies are on the calendar at 0000 GMT. The prior reading was -0.1% m/m.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Durable Goods Orders ex Transportation (DEC) | |||

| -1.6% | 0.5% | 0.1% | Jan 28 13:30 |

| Durable Goods Orders (DEC) | |||

| -4.3% | 1.8% | 2.6% | Jan 28 13:30 |

USD/JPY Hangs Tough

Stock market worries continued for a third day but the bond market and yen traders continue to brush them aside. The Australian dollar was the surprise best performer while JPY lagged. In Asia, economic data is light.

Traders came into the day on edge after the meltdown in stock markets on Friday and early signs pointed to a rebound in sentiment. The optimism quickly faded in stock markets; futures pointed to a 10 point gain in stocks but that quickly turned to a 15 point loss.

The turnaround in sentiment was a recipe for another breakdown in yen crosses but the declines never materialized. Instead, USD/JPY tracked down to 102.21 and then rebounded to close higher on the day. The bond market shared the same opinion with 10-year yields closing the day 4 basis points higher.

The stability in bonds and yen crosses suggests the worries in the financial press are overstated. The real question is what the Fed will do later in the week. Officials could maintain course with another $10 billion taper, scale down QE by $5 billion or add dovish guidance to the statement.

In the meantime, price action and economic news dominates. The main release on Monday was new home sales for December and it was a disappointment with sales at a 414K pace compared to 455K expected. French jobless was also weaker than forecast.

In the end, those data points had little effect on the dollar or euro. The main mover was the Canadian dollar as a rebound in USD/CAD was halted at 1.1030 and then the pair climbed to 1.1115, underscoring the problems for the loonie.

Up later, Japan releases the Dec corporate services price index and small business confidence for January. Both data points have a low market impact. Something else to watch is a speech from New Zealand PM Key ahead of Thursday razor-thin RBNZ decision on whether to hike now or wait until March.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| NAB's Business Confidence (DEC) | |||

| 5 | Jan 28 0:30 | ||

Will Bernanke Leave with a Taper Bang?

2010 was the last time stocks fell in January-- also the year the Eurozone crises kicked off and the May Flash Crash hit, partly due to Goldman Sachs DoJ investigation & Fed tightening fears. With fears of Fed taper looming, should Bernanke igbore EM & go for another taper in his last meeting? full charts & analysis

Deep Breath After A Deep Fall

Markets had a weekend to digest the big moves of late last week. Last week the yen was the top performer while the Australian dollar was the laggard and yen strength has continued in early trading. Japanese trade balance and the BOJ minutes are the first items on the agenda. 1 of the 2 AUDJPY Premium shorts from Friday hit all targets, while USDJPY was filled and in progress ahead of further Pre-FOMC volatility.1 USDCAD awaits fill. We exited tne remaining GBPUSD long at 1.6620 with 180 pips gain. Full access in the Premium Insights.

The key divergence that emerged at the end of the week was the resilience of USD/JPY despite a continued fall in stocks. The pair stubbornly held 102.00 on Friday but that changed in the thin liquidity to start the week as USD/JPY sank as low as 101.77.

The initial move points to another squeeze on risk trades to start the week but we'll remain skeptical until it takes place in high liquidity trading and for more than an hour.

The bond market was also resilient on Friday with 10-year Treasury yields holding 2.70% and only falling 5 basis points despite the rout in equities. That's a level to watch for confirmation.

Keep a close eye on the Nikkei in early trading. Later, markets may look to Dec Japanese trade data and the BOJ minutes from the Dec 20 meeting for direction. Both will be released at 2350 GMT. Exports are expected up 18% y/y with imports up 26.2% along with a 1.239 trillion yen trade deficit.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -4K vs +9K prior JPY -115K vs -118K prior GBP +9K vs +11K prior AUD -65K vs -52K prior CAD -70K vs -67K prior CHF -2K vs -3K prior NZD +5.5K vs +10K prior

The bout of risk aversion after non-farm payrolls shook a few traders out but once again the bulk of traders showed a firm hand. The awful Australian jobs report came after the data was published but neither AUD nor CAD positions are at dangerous levels.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Adjusted Merchandise Trade Balance (DEC) | |||

| ¥-1,346.31B | Jan 26 23:50 | ||

| Merchandise Trade Balance Total (DEC) | |||

| ¥-1,222.5B | ¥-1,292.9B | Jan 26 23:50 | |

| Exports (DEC) (y/y) | |||

| 17.8% | 18.4% | Jan 26 23:50 | |

| Imports (DEC) (y/y) | |||

| 26.1% | 21.1% | Jan 26 23:50 | |