Intraday Market Thoughts Archives

Displaying results for week of Apr 26, 2020Yen Slumps in Month-End, Beware of Gap Misinterpretations

Month-end added another dose of volatility to the FX market. In early Friday, JPY is leading across the board as futures drop after worrying earnings statements from Amazon, The week wraps up with the April ISM manufacturing report (more below). This week's Premium Video (below) examines the widespread question on whether today's selloff in indices marks the start of the return to the March lows, or whether it's a pause before further ascent. Be careful. Tuesday's DAX long hit its final target of 11230, which is the high on the cash, but 100 pts below the high in futures/CFDs. The March 8 gap down was not filled, but Ashraf warns against getting hasty in the Premium video below.

The yen is leading today but was sold heavily into month end as the market continued to contemplate the economic data picture. US data showed a 7.5% drop in March personal spending, much worse than the 5.0% decline expected. Initial jobless claims were moderately worse than expected at nearly 4 million, taking the US total above 30 million.

That comes on the heels of a miss in GDP on Wednesday and Fed commentary that warned that Q2 may be the worst quarter on record. The equity market acknowledged the risk and the S&P 500 fell back below the 61.8% retracement of the March rout.

On the month, the Australian dollar was easily the top performing major while the euro lagged. The theme right now is undoubtedly the incredible amount of stimulus from central banks and governments. The thinking is that taxpayers will bear the losses from the virus rather than investors.

The big question now is the duration of the slowdown. Economies are going to open in May and we don't know how the consumer will respond. The Chinese experience shows some trepidation and that was in a seemingly-safer environment, at least in the vast majority of the country.

In the day ahead we will get another reading how bad the situation is for factories. The Chicago PMI on Thursday was at 35.4 compared to 47.8 in March and the 37.7 consensus. On Friday, the ISM manufacturing report is forecast to fall to 36.0 from 49.1. Traders will watch the New Orders and Prices Paid components for the internals of the report. But bear in mind that the services print of the ISM remains above at 50 (50.2), highlighting the strength of tech and internet industry during the Covid-19 era.

Fed "Put" Pedal to the Metal

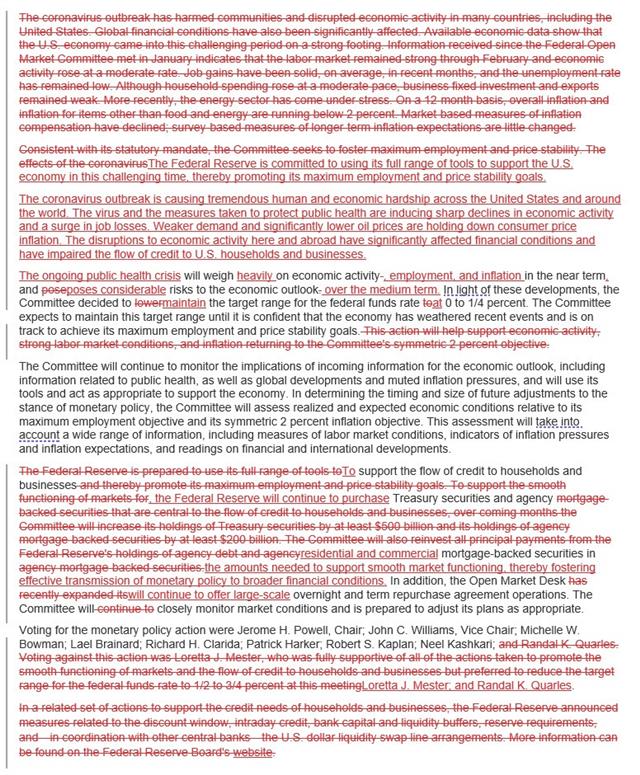

Powell left no doubt that the Federal Reserve will support risk assets no matter how the virus evolves in comments after the FOMC. Bitcoin lead cryptos to hit 8950. The New Zealand dollar was the top performer while the US dollar lagged. The ECB is up next. Tuesday's Premium long in the DAX hit its final target 11240, while the USDJPY short from 108.60 and Long Bitcoin at 6200 remain both open. Three other trades remain open. Below is the strikethrough comparison text from today's FOMC meeting and the March meeting.

Any hawkish hint from the Fed would have been a threat to suddenly-cheerful financial markets at Wednesday's FOMC but there was nothing of the sort from Powell. The Fed chair was abundantly clear that they are prepared to do more if there is a stumble; and that they're prepared to keep rates at the bottom longer than typically to support a strong recovery.

It's a classic Fed put and markets sniffed it out ahead of time with the help of strong earnings. The US dollar was soft ahead of the FOMC and drifted lower afterwards. Interesting spots to watch in the day ahead will be gold, silver and bitcoin.

The day ahead features another round of US initial jobless claims but despite the eye-watering numbers, it hasn't failed to dent sentiment at any time during the pandemic. The larger event will be the ECB at 1145 GMT and Lagarde at 1230 GMT.

The ECB President will see Powell as a blueprint for how to communicate but the market is also expecting action to pull down Italian yields. The ECB doesn't have the same powers and flexibility as the Fed so threats of action don't carry the same weight; the market will want action.

إلى أين و متى إرتداد المؤشرات؟

تقلبات عديدة شهدتها مؤشرات الأسهم العالمية في الفترة الأخيرة بفعل جائحة فيروس كورونا إلا أنها عادت وتداولت بإيجابية مع بداية جلسة تداول يوم الإثنين. فما هي الأسباب وراء ارتفاع هذه المؤشرات؟ وهل ستستمر بالارتفاع في الفترة المقبلة؟ تابعوا التفاصيل في الفيديو المفصل

More or Less from the Fed?

The Fed has done more in the past six weeks than any time in its history in a series of moves that has broken all pre-Covid19 era rules. Wednesday's FOMC decision is a chance to outline the post-virus playbook. The Australian dollar was the top performer Tuesday while the US dollar lagged. A new Premium trade was issued for clients with the rationale highlighted in the subscribers' video below.

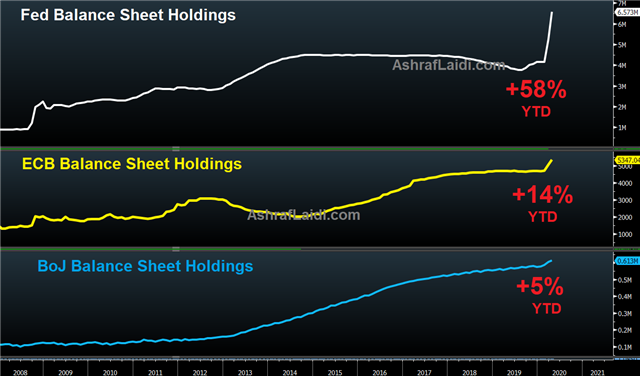

The US central bank has rolled out nearly 20 new programs since the epidemic, most of them with little scrutiny or long-term planning. Make no mistake, the Fed's actions saved the financial system but the fragility in the system was also a product of the past decade of central bank policy.

On the face of it, Wednesday's Fed announcement is less-important because it is unlikely there'll be any new policy actions, and certainly nothing major. But the guidance will be critical, right down to the tone.

The Fed is no-doubt cognizant at the risks of overshooting and setting up future problems. It's undoubtedly heard the criticisms about the truly astonishing pace of QE and bond-buying programs. This is a chance for them to tap the brakes and guide towards less-aggressive policy, even if that's months away.

There's also the possibility of guiding towards something like yield-curve control and Powell should face questions about debt monetization.

One major question is how much in US Treasuries the Fed will buy. The first QE foray during this crisis was capped at $500B, then the caps were removed and the Fed started buying $75B per day. That's tapered to $10B per day, which is still 7.5x the pace of QE3. There is little consensus on where this is going but given that long-term rates in the US are still at crisis bottoms, the market isn't expecting a big taper.

Much of the market reaction will come down to tone. We don't think it's a coincidence that the S&P 500 sits right at the key 61.8% retracement of the virus rout. The tone from the Fed up-to-now has been unambiguously supportive of all financial assets. Make no mistake, any hint of any limits at all could send the market into a tantrum.

Breaking the Ultimate Taboo

Global indices resume their advances while USD extends selloff as optimism broadens from positive news on the Coronavorus cases front. Although the number of confirmed cases worlwide passed 3 million, new cases in Italy hit the lowest in seven weeks, while the number of deaths in the UK dropped to its lowest since March. Bank Indonesia will become the first of a wave of central banks to buy debt directly from the government in what is a case of breaking the ultimate taboo of central banking. A new Premium trade was posted.

Direct debt monetization is the oldest trick in the monetary playbook but it's suddenly back in vogue as government spending explodes. Bank Indonesia will become the first of a wave of central banks to buy debt directly from the government. The Australian dollar was the top performer on Monday while the Swiss franc lagged.

For centuries governments have tried to engineer tricks to spend more while paying less. Some have even worked. China was able to finance an export boom buy buying US Treasuries to keep the yuan low. The US directly monetized debt in WWII but engineered an escape because of the dollar's newfound reserve status and the economic boom of the 1950s.

Japan has never admitted to monetary financing but it's hardly plausible that government debt will ever fall to manageable levels, or that the BOJ's balance sheet will significantly decline. So far it's arguably worked.

The examples of it failing in economic history are countless.

Now that we find ourselves in the midst of a long-term disinflationary period and with a global human catastrophe, central banks are going to push the envelope. Tuesday's planned purchases in Indonesia break all the rules of modern central banking.

This is the culmination of a 10-year period of QE that started with central banks saying it was a temporary measure to suppress long-term yields. They said assets would be allowed to run off. Those illusions have faded and central banks have purchased an ever-increasing pool of assets. The ultimate taboo is buying debt directly from the government. At least by selling it to the public at auction and then to the central bank in the secondary market, there's some illusion of free-market policies. Now with this – and in so many other instances – that myth is shattered.

This is a crisis in the making; it will end disastrously. But a look at history shows that the illusion of money is powerful and the charade can go on for many years. In particular, if everyone is doing it, then all currencies tend to fall together.

The playbook now isn't so much betting on a bad outcome; it's betting on government deficits never seen before outside of wartime. It's betting that fiscal conservatism is dead and that any spending project is in play. That's a powerful force; at least for awhile.

Searching for Drivers, Winners and Losers

The two main factors that drive currencies are interest rates and growth but rates are now zeroed out and growth is contracting everywhere. That's left the FX market decidedly uncertain. The risk trade and politics are short-term drivers but have failed to spark any lasting trends. The Australian dollar might be a hint of where the market is looking next. AUD is leading today's rally vs USD after 2 territories (states) announced they will ease social distancing restrictions. Gold and oil push lower, with US Crude hitting a 5-day low at $11.88 as excess supply becomes too great of a reality for producers mulling any further cuts.

Elsewhere, US Treasury Secretary Mnuchin said that “over time” the US will need to look into dealing with the surge in budget deficits created by the multi-trillion- dollar stimulus packages. The statement is a reminder of the deteriorating debt situation at the US Federal level at a time, when foreign purchases of US securities have continues to decline.

By the usual playbook, the Australian dollar is a terrible place to be right now. It's a classic growth-sensitive currency that's highly reliant on exports. Yet since the chart bottomed on March 18 at 0.5506, it's shown few signs of looking back. It's steadily climbed to 0.6445 in mid-April and is now a half-cent away from that high. It's also only 200 pips from mid-February levels.

The case for owning AUD is that internal domestic growth could leave the country in a stronger position than elsewhere because the economy could realistically reopen. The number of Coronavirus cases have been minimal in Australia and New Zealand, explaining why both nations are discussing plans to winding back restrictions sooner than anticipated. Given the lack of land borders for either country, they could realistically operate at nearly full-speed in the weeks ahead. Of course, the demand for antipodean exports is severely hampered but that may still be a much better picture than elsewhere in the world.

Rises in AUD and NZD would undoubtedly be pain trades in the FX market but in a world without interest rate differentials and export growth, a country that can operate decently-well in a bubble begins to look pretty good. That doesn't follow the classic rules but it's time for outside-the-box thinking.

If it continues, it will be an early sign that the real driver in FX markets for the remainder of the year will be how countries handle the virus.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +87K vs +87K prior GBP -1K vs +3K prior JPY +26K vs +22K prior CHF +5K vs +5K prior CAD -24K vs -24K prior AUD -35K vs -36K prior NZD -14K vs -15K prior