Fed "Put" Pedal to the Metal

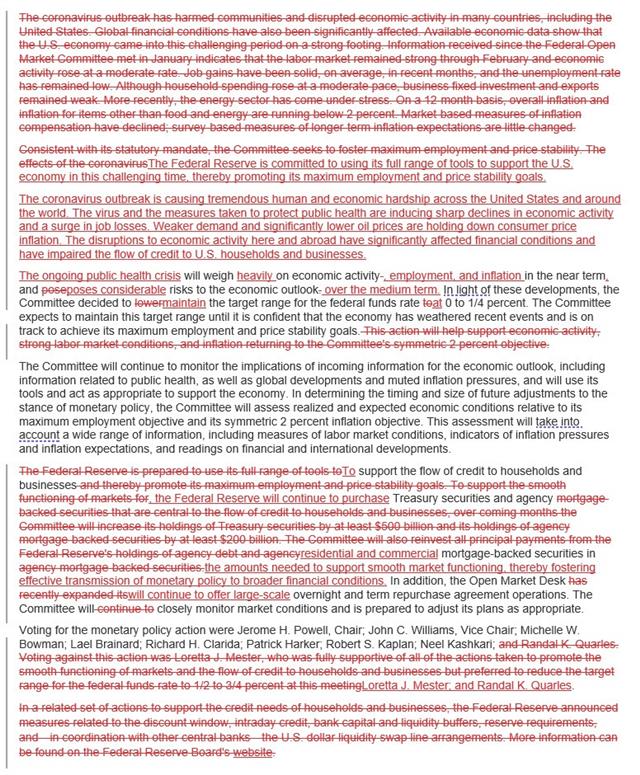

Powell left no doubt that the Federal Reserve will support risk assets no matter how the virus evolves in comments after the FOMC. Bitcoin lead cryptos to hit 8950. The New Zealand dollar was the top performer while the US dollar lagged. The ECB is up next. Tuesday's Premium long in the DAX hit its final target 11240, while the USDJPY short from 108.60 and Long Bitcoin at 6200 remain both open. Three other trades remain open. Below is the strikethrough comparison text from today's FOMC meeting and the March meeting.

Any hawkish hint from the Fed would have been a threat to suddenly-cheerful financial markets at Wednesday's FOMC but there was nothing of the sort from Powell. The Fed chair was abundantly clear that they are prepared to do more if there is a stumble; and that they're prepared to keep rates at the bottom longer than typically to support a strong recovery.

It's a classic Fed put and markets sniffed it out ahead of time with the help of strong earnings. The US dollar was soft ahead of the FOMC and drifted lower afterwards. Interesting spots to watch in the day ahead will be gold, silver and bitcoin.

The day ahead features another round of US initial jobless claims but despite the eye-watering numbers, it hasn't failed to dent sentiment at any time during the pandemic. The larger event will be the ECB at 1145 GMT and Lagarde at 1230 GMT.

The ECB President will see Powell as a blueprint for how to communicate but the market is also expecting action to pull down Italian yields. The ECB doesn't have the same powers and flexibility as the Fed so threats of action don't carry the same weight; the market will want action.

Latest IMTs

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10