Intraday Market Thoughts Archives

Displaying results for week of Jun 26, 2016Boris Bails, Carney to Cut

The two-way showdown between Boris Johnson and Theresa May was over before it started with Johnson opting not to enter the race for UK PM. We take a closer look at May's gameplan. The main market mover Thursday was a strong hint at an impending BOE rate cut from Carney. A huge day of economic data awaits Asia-Pacific traders, including the Tankan survey. Silver outperformed all currencies and commodities by suging to fresh 3-year highs above 18.70s, helping Ashraf answer why he re-entered silver last Friday rather than gold, which lost $30 since. GBPUSD dropped 300 pips.

The Boris-exit from the Conservative race makes Theresa May an overwhelming favourite. Of course, anything can happen in UK politics but we take a close look at her comments and how she is likely to shape a Brexit.

The headline-grabber from her speech was that there can be no turning back on a Brexit but in subtler tones she left the door open. She focused almost entirely on the anti-immigrant and border control angle of the Brexit debate while repeatedly highlighting the importance of trade.

The easy solution would be for the EU to relent on immigration but that would open similar challenges from other countries. Given May's bias towards trade, the EU may offer very little and call her bluff. If that's the case, she will probably lose.

The outcome is unknowable but it's increasingly unlikely that whoever heads the Conservative party isn't willing to disrupt or even to risk full access to the EU.

The month ends with the yen as the top performer and GBP as a laggard. The pair made a 2300 pip swandive in the month with almost the entire move taking place after the Brexit vote.

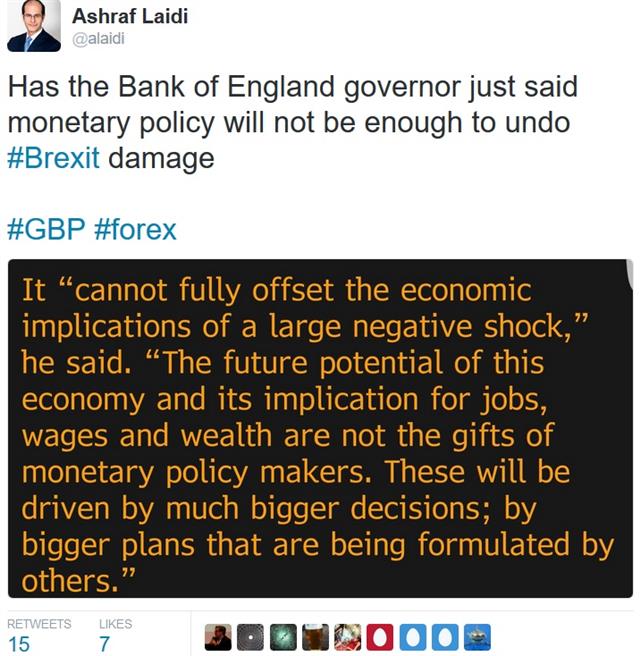

The final flurry of selling came after Carney said some monetary stimulus is likely to be needed over the Summer. He then doubled down and said easing is not just about the bank rate.

Cable tumbled to 1.3206 after the comments from 1.3420 beforehand. It later recovered to 1.3300, in part because he warned that cutting rates too low would wreck bank profitability.

In the hours ahead, we shift our attention to Asia for a huge day of economic data. Japanese figures include the employment report, CPI and the Q2 Tankan. For China, the official PMIs and report from Caixin are due. All the numbers are possible market movers but the Tankan large manufacturing index is the most important. It's expected at +4 from +6 and a miss. Or soft numbers throughout could push the BOJ towards easing in July.

Note that Friday is a holiday and Canada and trading will be shortened in some US markets because of the holiday on Monday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI (JUN) | |||

| 56.8 | 50.8 | 49.3 | Jun 30 13:45 |

A Look at the Post-Brexit Signs Outside FX

The Brexit bounce continued for a second day, although GBP slipped late in the day. Sterling was still the top performer and the yen lagged for the second day in a row. Japanese industrial production and Australian credit data is due later. A new trade was issued in USD, shaped by the conspiring 55-WMA.

The sterling story is well-established and we continue to await the declarations from the Conservative leadership --Johnson and May ahead of the Thursday deadline.

In the meantime, other markets are sending notable and at times conflicting signals. Signs from the bond market are clear, US 30-year yields fell to the lowest since Jan 2015 in an indication that the Fed hiking cycle will be shallow if it's not yet over.

That dovetails with the rebound in stock markets. The S&P 500 finished 35 points higher Wednesday in the second large gains. It also closed above the 61.8% retracement of the Brexit decline.

The commodity market in many cases has exceeded pre-vote levels. Copper is at the best level since early May. WTI crude climbed to $50, just 45-cents from the high on the eve of the referendum.

In turn, USD/CAD struggled above 1.30 and fell to a session low at 1.2934 late in the day.

Predictions of central bank easing may prove to be overstated. ECB sources stories said Draghi is planning to wait and see for the economic data, rather than responding to markets. Carney has scheduled a speech for Thursday.

If other central banks brush aside the vote, the US dollar could still have some upside but it's still early days. We worry that quarter-end could be sending muddied signals.

The pound and yen reversed parts of recent moves for the second day but the magnitude of the bounce pales in comparison to the fall.

In terms of economic data, the next numbers to watch are Japanese industrial production for May at 2350 GMT and Australian private sector credit at 0130 GMT. Expectations are for a 0.2% decline and 0.5% rise, respectively.

أشرف العايدي على "نيران صديقة" سكاي نيوز عربية

Two Key People to Watch

Markets bounced on the idea that a Brexit might not take place at all, we examine the two people most likely to determine whether or not it happens. The pound was the top performer on the day while the yen lagged but the overall moves were modest compared to the scope of the recent rout. Japanese retail sales are due later. Below is the link to today's Premium video, focusing on the existing trades and "Back to 2001-2008 Cycle & Gold-Oil Relation".

The Brexit headlines haven't improved despite the tone in markets. European leaders continue to drive a hard line, saying they won't give Britain a better EU deal and won't even negotiate until Article 50 is invoked.

Chancellor Osborne confirmed taxes will be raised and spending will be cut.

On the UK side, the political landscape is increasingly rudderless. Cameron will resign and it's unclear who will replace him and what they plan to do. The contest won't be decided until Sept 9 and the deadline for nominations in Thursday. The two leading candidates are Boris Johnson and Theresa May. Johnson campaigned for the Leave side but was slow to make up his mind and it may have been an opportunistic play. May was a light Remain supporter but largely stayed on the sidelines.

Polls and betting sites but May ahead of Johnson, but only fractionally. More important than who wins is where they stand on the issues. Both are likely to declare their candidacies on Wednesday and we will be listening closely to their comments to get a sense of how hard they frame their campaigns.

If they attempt to shift their focus away from a Brexit decision or open the door to remaining, then the bounce today could extend potentially much further. However if one or both candidates (among others) are ardently in favour of a Brexit, then continue uncertainty will inevitably weigh on sentiment.

In terms of economic news in the hours ahead, Japanese retail sales at 2350 GMT are a highlight. The consensus is for a 1.6% y/y drop in May sales and a flat reading m/m. Market reaction is likely to be limited with the ebb and flow of the Brexit story continuing to dominate.

اشرف العايدي على قناة بي بي سي

Real Money Move Begins

The Brexit bit another 450 pips out of cable on Monday as the pair fell as low as 1.3121 before closing a cent higher. The yen was the top performer as USD/JPY slid towards 100.00. The Asia-Pacific calendar is light but the Brexit drama will surely keep the market occupied. The Premium short Dow30 trade hit its final 17070 low target for 540-pt gain. A new GBP trade was issued, with the charts added this evening.

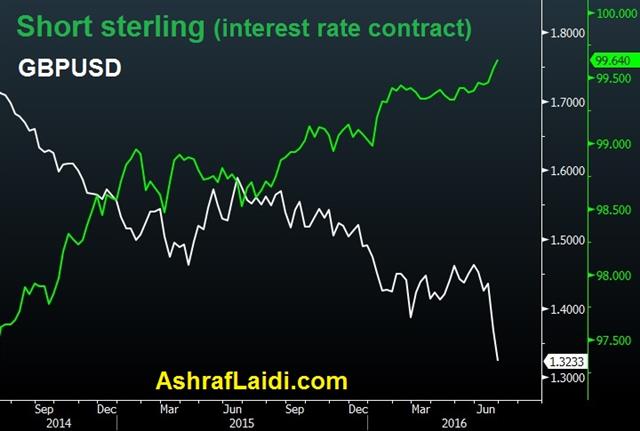

Speculators move markets quickly but real money is what sustains the momentum. Pensions and funds often wait for the headline dust to settle before slowly shifting positions. The chart above shows the short sterling contract on BoE rates has escalated, allowing for improved odds of a BoE rate cut.

That's what got underway on Monday as the Brexit vote raises a series of unanswerable questions. To top it off, England was ousted from the Euro 2016 Tournament by Iceland.

A stream of Brexit comments including a push from Europe to hurry up an Article 50 notice weighed heavily on the pound. Late in the day, S&P downgraded the UK credit rating two notches. A move was largely expected as they had been the only agency that continued to rate the country AAA but they skipped AA+ and went all the way to AA. Fitch also cut the UK to AA from AA+.

The low in the day for cable came after Scottish leaders declared they would ignore the result of the referendum and remain in the EU. Those kinds of proclamations raise constitutional issues and more uncertainty.Global stock markets continued a freefall. The S&P 500 fell 1.8% to 2000 and closed below the 200-day moving average for the first time since mid-March.

Central banks are the next focus. The market has virtually priced out the chance of an FOMC hike this year and sees a 23% chance of a cut in September.

The Bank of England meeting is scheduled for July 14 and the market has priced in a 53% chance of a cut. That probability would be 100% if not for the inflationary effects of the collapse in the pound. Carney will need to balance that out as he fights off criticism for his perceived interference in the EU vote campaign.

Looking ahead, the economic calendar is quiet until core PCE on Wednesday and Eurozone preliminary CPI on Thursday. But economic news will have very little impact at the moment and likely for the remainder of the week.

Ashraf on CNBC

Ashraf's quick on take on the British pound to CNBC.