Intraday Market Thoughts Archives

Displaying results for week of Feb 27, 2022Misleading USD Signs

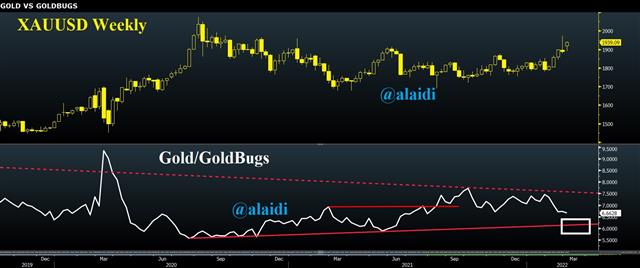

The case for metals and rest of commodities remains the following: Fed tightening will cap inflation at its 5-6% high, and any pullback will settle at a higher low of 3-4%. Once the Fed is forced to “fiddle” with the yield curve (prevent it from inverting), the short-end will peak out, letting 2-year-breakevens extend higher, to the benefit of metals. The above prospect is considered as a durable positive for metals, overriding any double-blow from a nuclear deal with Iran and cease-fire in Ukraine as is shown here.

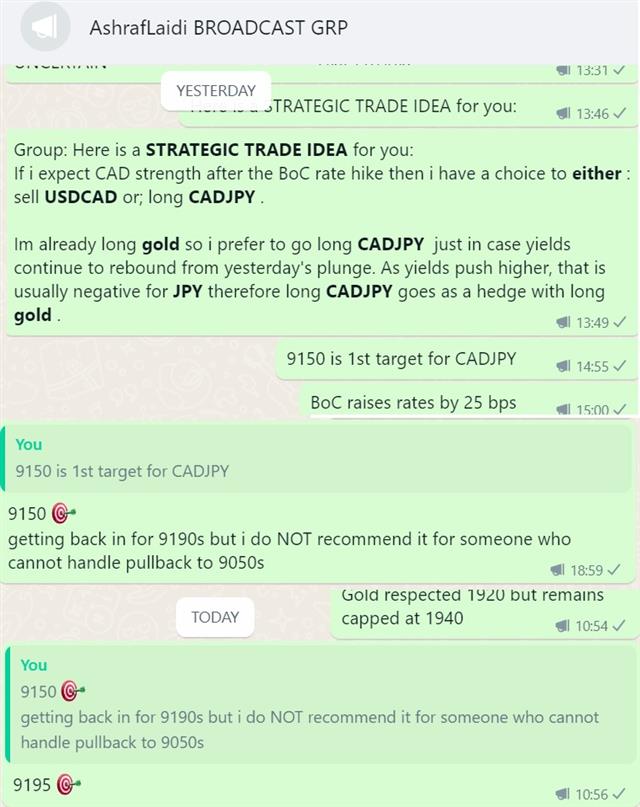

Putting strategies to work

Here is the rationale (below) behind opting for CADJPY yesterday ahead of the BoC rate decision for our WhatsApp Brodcast Group

Meanwhile, equity indices are charting a gradual bottoming, consistent with Bitcoin and Ethereum.

Back to the GoldBugs Ratio

As gold rises along gold stocks (metals and miners), the latter tends to rise faster relative to bullion. I've shown in past youtube video how to use the relationship (specifically in 6:47 mins of this video)

With the goldbugs ratio in the lower panel suggesting further declines towards the 6.0 trendline support, it could argue for $2000 as early as this quarter. And it so appears that we're well on our way of getting ride of that 2013/14 fractal of horror as affirmed last week in here. Let's see what Biden/Powell have to say before buying any gold dips.