Intraday Market Thoughts Archives

Displaying results for week of Mar 27, 2016Ashraf's Real Vision TV Interview

Here is the direct link to Ashraf's interview on Japan, intermarket cycles, FX approach and Gold. Real Vision TV is a growing online channel for interviews & discussions with some of the best minds in finance & hedge fund community. Non-members to Real Vision can obtain a free password from the website to watch the interview.

USD Recovers Ahead of NFP, Tankan Next

The US dollar was battered in European trading but finally found some support ahead of non-farm payrolls. The Swiss franc was the top performer while the yen lagged. The critical Q1 Tankan survey is due up next nefore China's PMIs. After closing the Premium EURUSD long with 188 pip gain, a special note on why tomorrow's March NFP will surprise has been issued to Premium clients. The chart below describes this statistical anomaly with full details/analysis found in the latest Premium section.

The first quarter wrapped up with choppy reversals in US trading as the Dollar regained its footing after hitting fresh cycle lows on a few fronts.

Economic data was mixed. Initial jobless claims deteriorated to 276K from 265K and that sent a mild shudder through the market ahead of tomorrow's non-farm payrolls report. It was balanced out by the Chicago PMI, which improved to 53.6 from 47.6 and beat the 50.7 consensus estimate.

The US dollar bottomed for the day shortly after the Chicago PMI. EUR/USD had risen above 1.14, taking out the Feb high of 1.1376 but then retreating to close at 1.1378. The lack of follow through higher ahead of NFP isn't a big surprise. The market will want to wait-and-see the number – and especially the wages number – before making a definitive break.

The Canadian dollar was whipsawed. USD/CAD dropped to 1.2855 after Canada's Jan GDP report showed 0.6% growth compared to 0.3% expected. The move later reversed and more to finish at 1.3000, in part because the report is dated and in part because oil prices gave up gains. Quarter-end no doubt played a factor as well.

Early in Asia-Pacific trading the Fed's Dudley said the US economy was in a relatively good place and that fears of runaway inflation have proven unfounded. Those two statements offer something for everyone but moved the market little.

The major report to start the quarter in Japan is the Q1 Tankan at 2350 GMT. The large manufacturing index is expected at +8 from +12 in Q4. All industry capex is forecast to fall 0.7% while the small manufacturing index is expected at -2. The deteriorating numbers ratchet up the pressure on the government and BOJ to reach back into their bag of tricks.

The other main event to watch is the China manufacturing PMI at 0100 GMT. The consensus call is a small improvement to 49.4 from 49.0 but that could have an outsized impact on markets is China breathes a sigh of relief after a tough quarter. Watch the Caixin PMI 45 minutes later to confirm the result. It's forecast at 48.3 from 48.0.

Q1 performance JPY +6.8% EUR +4.8% CAD +6.4% GBP -2.5% Gold +16.2% S&P 500 +0.77% UK FTSE -1.1% German DAX -7.2% Nikkei 225 -11.9% Shanghai Comp -15.1%

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Nonfarm Payrolls (MAR) | |||

| 205K | 242K | Apr 01 12:30 | |

| Markit Manufacturing PMI (MAR) | |||

| 51.4 | Apr 01 13:45 | ||

| ISM Manufacturing PMI (MAR) | |||

| 51.0 | 49.5 | Apr 01 14:00 | |

| RBC PMI Manufacturing (MAR) | |||

| 49.4 | Apr 01 13:30 | ||

| Markit PMI Manufacturing (MAR) | |||

| 51.1 | 50.8 | Apr 01 8:30 | |

| Nikkei PMI Manufacturing (MAR) | |||

| 49.1 | Apr 01 2:00 | ||

| SVME - PMI (MAR) | |||

| 51.6 | Apr 01 7:30 | ||

| PMI (MAR) | |||

| 49 | Apr 01 1:00 | ||

| PMI (MAR) | |||

| 52.7 | Apr 01 1:00 | ||

| PMI (MAR) | |||

| 48 | Apr 01 1:45 | ||

| Eurozone Markit PMI Manufacturing (MAR) | |||

| 51.4 | 51.4 | Apr 01 8:00 | |

| Germany Markit PMI Manufacturing (MAR) | |||

| 50.4 | 50.4 | Apr 01 7:55 | |

| Tankan Large All Industry Capex (Q1) | |||

| -0.7% | 10.8% | Mar 31 23:50 | |

| AIG Performance of Manufacturing (MAR) | |||

| 53.5 | Mar 31 23:30 | ||

| Tankan Large Manufacturing Index (Q1) | |||

| 8 | 12 | Mar 31 23:50 | |

| Tankan Large Manufacturing Outlook (Q1) | |||

| 6 | 7 | Mar 31 23:50 | |

| Tankan Non - Manufacturing Index (Q1) | |||

| 24 | 25 | Mar 31 23:50 | |

| Tankan Non - Manufacturing Outlook (Q1) | |||

| 21 | 18 | Mar 31 23:50 | |

What’s Next for The Dollar

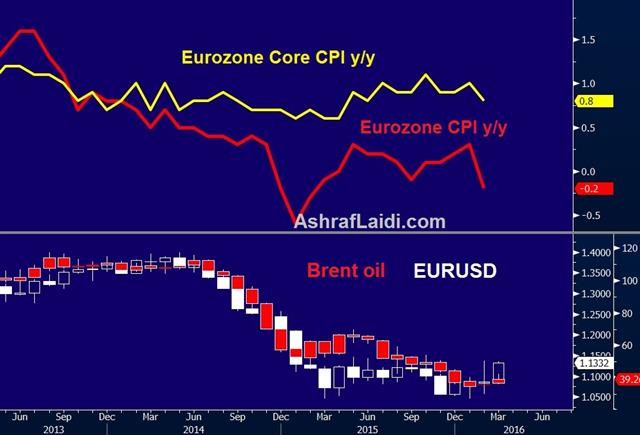

The post-Yellen US dollar selling stalled late Wednesday. We look at what's coming next. The New Zealand dollar was the top performer for the second day while USD and GBP lagged. Australian job vacancies and private sector credit reports are due later. Thursday morning is the Eurozone flash CPI, detailed in Ashraf's Premium Video on Monday. 2 new Premium trades have been issued since yesterday's EURUSD trade. Both trades are currently netting +70 pips in the green.

The US dollar reaction following Yellen's speech is reminiscent of the post-FOMC move. It included two days of heavy USD selling until it was exhausted and slowly reversed.

Once again hike expectations have been dashed and now the market sees just a 20% chance of a hike in June from 33% prior to Yellen's speech and a 50/50 possibility of no rate rise before year end. Essentially, Fed expectations have been wiped out.

Contrast that with the generally solid tone of US economic data (at least relatively) and there's a case for wading back into US dollar longs against EUR, JPY and GBP. The market might be hesitant this week because of risks from non-farm payrolls.

One small reassuring signal was in the ADP report. It showed 200K new jobs in March, slightly more than the 194K expected. Fed dove Evans kept the door open for two rate hikes this year but coupled that with a warning that risks were to the downside.

The outperformers against the US dollar have been commodity currencies and that's understandable. The Fed and other global central banks are working to rekindle global growth. Many of the tail risks from 6 weeks ago have diminished and the relatively high-yielding kiwi has now broken out to the highest since June. The ANZ business confidence report for New Zealand for March is due at 0000 GMT (1:00 BST). The prior reading was +7.1.

The Australian dollar is in focus in the hours ahead with the Feb job vacancies report and the Feb private sector credit report both due at 0030 GMT (1:30 BST). The latter is expected to rise 0.5% m/m.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Private Sector Credit (FEB) (m/m) | |||

| 0.5% | Mar 31 1:30 | ||

| Private Sector Credit (FEB) (y/y) | |||

| 6.5% | Mar 31 1:30 | ||

| Eurozone CPI (MAR) (y/y) [P] | |||

| -0.1% | -0.2% | Mar 31 9:00 | |

| Eurozone CPI - Core (MAR) (y/y) [P] | |||

| 1.0% | 0.8% | Mar 31 9:00 | |

| NBNZ Business Confidence (FEB) | |||

| 7.1 | Mar 31 0:00 | ||

The Best of a Bad Bunch

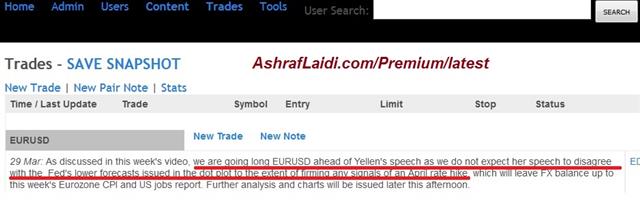

No one wants a strong currency. The dollar bulls tried to bid up the currency ahead of Yellen but she punished bets on the US dollar for the second time in three weeks. We break down the efforts central bankers and market forces are taking to undermine currencies. Japanese industrial production is due later. Ashraf's Premium Insights issued a long in EURUSD 1 hour before the Yellen speech. Various technical and fundamental reasons were cited but Ashraf kept it short and straightforward when he pulled the trigger below.

In the lead-up to Yellen's speech on Tuesday the main line of thinking was that she would walk back from dovish talk after regional Fed Presidents took a more constructive tone. We warned yesterday that was unlikely and that's what happened. She said caution on raising rates was 'especially warranted', was concerned by low inflation and once again expressed worry about the global economy.

The US dollar slumped in response. The immediate move was 40-70 pips across the board and that extended to upwards of 100 pips by the day's end.

We anticipated and understand the reasons for selling USD today but the problem going forward is that it's tough to buy anything else. USD/JPY slid back below 113.00 but the Japanese government is desperate to keep it above 111.00.

It's the same story in Europe where the ECB is pushing rates ever lower. Spanish 5-year yields hit a record low of 0.375% on Tuesday.

Sterling is at the mercy of Brexit talk as polls show a close contest or the camp that wants to leave in the EU in the lead.

The New Zealand dollar was up 2% on the day as it benefitted from a technical breakout and its high yield advantage. It was lifted further early in Wed trade by a 10.8% m/m jump in building permits. That runs in contrast to the RBNZ, which delivered a surprise rate cut this month along with a dose of jawboning.

The RBA's Stevens is so fond of jawboning he had is wrist slapped by the US but continues it anyway. On a growth and investment perspective, perhaps AUD and NZD remain best but the central bank and risk aversion trades always make it a dangerous game.

That leaves CAD, which has had a great month, but do you really want to bet on oil?

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (FEB) (m/m) [P] | |||

| -6.0% | 3.7% | Mar 29 23:50 | |

| Industrial Production (FEB) (y/y) [P] | |||

| -3.8% | Mar 29 23:50 | ||

Dollar Trade Thinned Ahead of Yellen

Weak readings on US personal spending and inflation underscored the two of the main Fed worries ahead of a Tuesday appearance from Yellen. The dollar was beaten up after the data, especially against GBP but it was holiday-thinned trading. Japanese job and retail data is next. A new video for Premium subscribers on "FX ahead of Yellen, Euro CPI, Tankan & NFP" has been posted.

US core PCE rose 1.7% y/y in February compared to 1.8% expected. That was accompanied by personal spending one tick above the consensus at 0.2% but the prior reading was revised to +0.1% from +0.5%.

The market reaction was unwavering US dollar weakness. The euro gained 60 pips and cable eventually climbed a full cent to erase nearly half of the six day losing streak that started March 18.

The moves had all the hallmarks of a thin-liquidity squeeze because many markets were closed for Easter Monday. Still, the data highlights two of the weak spots on the Fed's radar – inflation and consumer spending. After the report, the Atlanta Fed downgraded its Q1 GDP tracker to just 0.6% from 1.4%.

That's not enough growth to justify a rate hike and that's something Yellen may re-emphasize in a speech in New York Tuesday. The market has bought dollars over the past week after regional Fed Presidents hinted at hawkish outlooks. Given the latest economic data, Yellen has no reason to shift gears. She was measured in her post-FOMC comments and it's unlikely she would want to change her message.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -66K vs -78K prior JPY +53K vs +46K prior GBP -38K vs -14K prior CHF +4K vs +5K prior AUD +18K vs +13K prior CAD -15K vs -17K prior NZD +1K vs +1K prior

The growing bets on the yen are something that will irk Japanese officials. Later today, Japan releases jobs data for Feb that's expected to show steady unemployment at 3.2%. The report to focus on is retail sales, which are expected down 0.9% m/m after a 0.4% drop the month before. Japanese leaders are almost at the point where they're out of ideas and early returns on the most-recent round of stimulus have been bleak.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Personal Spending (FEB) | |||

| 0.1% | 0.1% | 0.1% | Mar 28 12:30 |

| FOMC's Williams speech | |||

| Mar 29 9:15 | |||

| Fed's Yellen Speech | |||

| Mar 29 16:30 | |||

| Retail Trade s.a (FEB) (m/m) | |||

| -1.1% | Mar 28 23:50 | ||

| Retail Trade (FEB) (y/y) | |||

| 1.7% | -0.1% | Mar 28 23:50 | |

The Muddle Trade

The week ahead may start slowly but it will build up with a Yellen speech on Tuesday and non-farm payrolls on Friday, promising to add a dose of volatility. The larger theme that may be unfolding in the global economy isn't a good year, but it's not nearly as bad as was feared a month ago either.

European clocks go forward 1 hour, which means British Summer Time (BST) is once again 5 hours ahead of New York (Eastern Time) but Greenwich Mean Time (GMT) remains 4 hours ahead of NY Eastern Time, therefore, GMT no longer equals to BST.

Central banks have largely shown their cards for 2016, or at least for the next few months. The ECB and BOJ unleashed surprisingly large stimulus with mixed results. The Fed finished 2015 like a lion and has slowly turned lamb.

Those actions, fresh stimulus from China and a rebound in commodity prices removed many of the tail risks in the global economy but haven't spurred the economy. So the fear is largely gone but so is the optimism.

What's left is a mood that's much like the market over the past week – not particularly committed or emotional. That might be a glimpse into the coming few months. China fears faded once again on the weekend as Jan-Feb industrial profit data rose 4.8% y/y; the fastest pace since July 2014. In any case, one or two outlying economic data points won't rankle the market, volatility will diminish.

The near-term looks like 1-2% growth and the distant horizon the same. So rather than big fear and hope trades, it could mean small divergences in similar economies like EUR/GBP that offer the most value in the coming months or carry trades that hedge out commodity risk like AUD/CAD.

To be sure, many risks bear watching including a Brexit, US politics, Chinese debt and a return of the commodity collapse but the market may be less likely to leap from one to another than it was.

The market to start the week has been mild. Australia, New Zealand and Hong Kong are closed while Japan and China are open. Europe and the UK later are closed as well. There is no data on the economic calendar until the Feb PCE report in US trading.