What’s Next for The Dollar

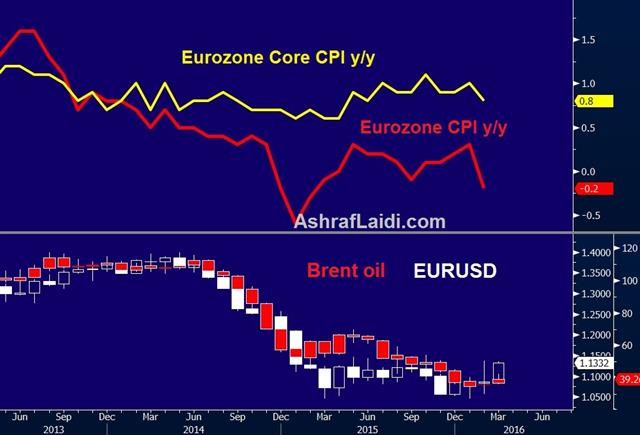

The post-Yellen US dollar selling stalled late Wednesday. We look at what's coming next. The New Zealand dollar was the top performer for the second day while USD and GBP lagged. Australian job vacancies and private sector credit reports are due later. Thursday morning is the Eurozone flash CPI, detailed in Ashraf's Premium Video on Monday. 2 new Premium trades have been issued since yesterday's EURUSD trade. Both trades are currently netting +70 pips in the green.

The US dollar reaction following Yellen's speech is reminiscent of the post-FOMC move. It included two days of heavy USD selling until it was exhausted and slowly reversed.

Once again hike expectations have been dashed and now the market sees just a 20% chance of a hike in June from 33% prior to Yellen's speech and a 50/50 possibility of no rate rise before year end. Essentially, Fed expectations have been wiped out.

Contrast that with the generally solid tone of US economic data (at least relatively) and there's a case for wading back into US dollar longs against EUR, JPY and GBP. The market might be hesitant this week because of risks from non-farm payrolls.

One small reassuring signal was in the ADP report. It showed 200K new jobs in March, slightly more than the 194K expected. Fed dove Evans kept the door open for two rate hikes this year but coupled that with a warning that risks were to the downside.

The outperformers against the US dollar have been commodity currencies and that's understandable. The Fed and other global central banks are working to rekindle global growth. Many of the tail risks from 6 weeks ago have diminished and the relatively high-yielding kiwi has now broken out to the highest since June. The ANZ business confidence report for New Zealand for March is due at 0000 GMT (1:00 BST). The prior reading was +7.1.

The Australian dollar is in focus in the hours ahead with the Feb job vacancies report and the Feb private sector credit report both due at 0030 GMT (1:30 BST). The latter is expected to rise 0.5% m/m.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Private Sector Credit (FEB) (m/m) | |||

| 0.5% | Mar 31 1:30 | ||

| Private Sector Credit (FEB) (y/y) | |||

| 6.5% | Mar 31 1:30 | ||

| Eurozone CPI (MAR) (y/y) [P] | |||

| -0.1% | -0.2% | Mar 31 9:00 | |

| Eurozone CPI - Core (MAR) (y/y) [P] | |||

| 1.0% | 0.8% | Mar 31 9:00 | |

| NBNZ Business Confidence (FEB) | |||

| 7.1 | Mar 31 0:00 | ||

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40