Intraday Market Thoughts Archives

Displaying results for week of Sep 27, 2020How to Monetize Fractals تحويل الرسوم البيانية إلى أفكارمربحة

Recording of Ashraf's TraderSummit Presentation

US Left Out on Stimulus

The US is at risk of being left behind in this round of stimulus. A number of developed countries are working towards more spending, including Canada and Japan where there were signs of more on Thursday.

Late in the day, there were some signs of an easing in the Senate Republican position, perhaps in light of falling poll numbers. The problem is that at the same time, Democratic numbers are rising and that's less of an incentive for them to compromise. It continues to be tough to see how a deal is made.

The stimulus story is bouncing US stocks around but the FX market has mostly ignored it. A lack of stimulus will certainly raise the stakes for markets in the election. A Democratic sweep would ensure a large package in January, while a divided Congress would mean something significantly smaller.

Growing debt will be a long term problem but it's tough to see the market focused on it any time soon. Instead the next year will be all about growth and money will flow to places that spend and places that benefit from stimulus spending, like emerging markets and commodity FX.

Another spot we're watching closely is economic data. The latest numbers out of China continue to reflect an impressive comeback. There are also great signs on manufacturing in the US and globally. The Markit Canada and US PMIs were strong Thursday. The ISM manufacturing survey was a touch below estimates but still at a very-strong +55.4 level.

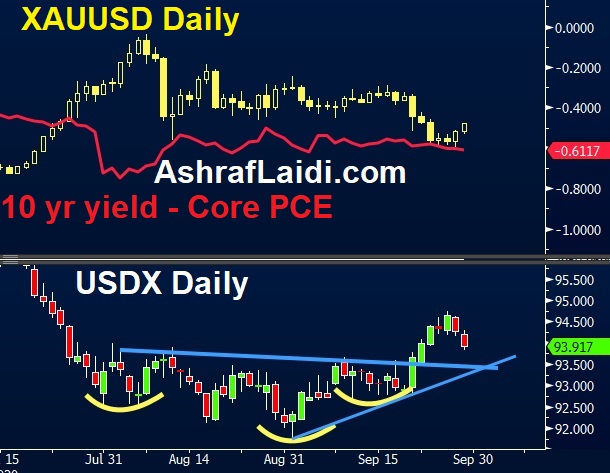

One issue that's completely off the radar is inflation. US PCE core rose 1.6% in August compared to 1.4% expected. The PMI surveys all showed pressures as well, with the ISM prices paid component at the highest since October. Much of that comes from supply chain disruption but it risks becoming entrenched but in Q2 of next year we will start to run into some very soft y/y comps, perhaps just as US stimulus starts to hit and a vaccine comes. That's a dangerous mix.

As we enter October, note that it's generally a positive month for the S&P 500 but there is one critical exception: It's usually a poor month in election years.2016 -1.94% 2012 -1.98% 2008 -16.94% 2004 +1.4% 2000 -0.49%

The other negative headline Wednesday was Moderna saying its vaccine won't be approved for emergency use until at least Nov 25. That leaves Pfizer's version as the lone candidate for before the election.

Finally, quarter-end flows appeared to be a significant drag for the dollar. Even with higher stocks and Treasury yields, USD/JPY struggled. For Q3 as a whole, the euro was the top performer while the US dollar lagged. In stocks, the S&P 500 gained 8.5% and the FTSE 100 fell 4.9%.Disorderly Debate Clash w/ Quarter End

Given the polls, Joe Biden should be a prohibitive favourite but a series of voting surprises have shaken confidence in pollsters. That uncertainty is going to linger right up until the vote but in Tuesdays' debate, Biden likely removed some linger doubts from the few undecided voters and he took another step towards the Presidency.

The inevitable response to polling leads is that Hillary Clinton was also ahead. That's true but she wasn't this far ahead. The RealClearPolitics average puts Biden at 49.4% and Trump at 43.3%. A month ahead of the election in 2016, Clinton was up by 1 point. In 2016 there were also far more undecided voters than today. Swing state polls are less reliable but there are enough to draw the same conclusion.

Ahead of the debate, the attack against Biden has been that his mental acuity is in steep decline. Watching it, that was clearly not the case. He's not as sharp as he was a decade ago, but he handled the non-stop barrage of interruptions, conspiracy theories, lies and insults with some deftness and while he stumbled on the odd word, he was far more coherent than his detractors would like you to believe.

Betting markets showed an uptick in Biden's odds after the debate to put him around 60/40. The odds in the Senate are tighter and the result there will determine if Democrats have any real power.

As for markets, it's not going to be as simple as some would portray. Biden has promised to raise the corporate tax rate but if the market was truly fearful of that, equities would crater as Biden climbs. The reality is that Congress would need to hike rates and there are far too many congressmen who have been bought off on both sides to let that happen.

In the shorter term, policy is a secondary concern and the real risk is the election itself. It's extraordinarily difficult to handicap the odds of turmoil following the vote but Trump once again sowed doubt about the transfer of power in the debate and raised more questions about whether he will accept the outcome of the vote. Similar comments weighed on markets earlier this month.

That talk from Trump won't go away and could have repercussions way beyond the election. Even if he's thrown out by both parties he will still hold an incredible amount of power among his die-hard supporters.

There will continue to be opportunities in trading around this trainwreck but the main takeaway from here is that the temperature is going to continue to rise and that will mean a steady stream of investors to the sidelines or safe havens in the month ahead.Real Yields & Fed Take Away

Last week included a non-stop parade of Fed speakers but the underlying message was unusually coherent. There were debates about raising rates in 2023 but very little to suggest any near term action. On more QE, a number highlighted that it would do little because yields are already so low. Others emphasized that yield curve control would also have only marginal benefits.

Powell highlighted that they have already done almost anything they could think of. On business loans, he suggested there could be some flexibility to make them more attractive but suggested it may take an act of congress; something that isn't coming any time soon.

It all begs the question: How much of the recent turmoil in markets is a by-product of Fed reluctance to ease further? The realistic scope for more was certainly seen as limited before the FOMC and their points on the inability to further lower rates is well taken but more action would have worked through a different channel: the dollar.

It may not be a coincidence that the dollar has been strong since the FOMC and the comments last week underscoring a wait-and-see approach added further fuel to the trade.

For those watching the Fed closely, nothing they've said or done is a surprise but the market has been conditions for more and more. Contrast that with the BOE talking negative rates and other banks finding ways to ease and there is a case to be made that the latest dollar rally isn't about just politics and the virus.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +191K vs +179K prior GBP +3 vs +2K prior JPY +30K vs +23K prior CHF +16K vs +12K prior CAD -19K vs -17K prior AUD +16K vs +16K prior NZD +5K vs +3K prior

Euro longs backed off two weeks ago but the latest data show a rebound and it's once again within striking distance of the 212K record set earlier this year. Aside from the euro, it was generally a 'stand pat' week, which is a bit surprising given the USD volatility.