Real Yields & Fed Take Away

Last week included a non-stop parade of Fed speakers but the underlying message was unusually coherent. There were debates about raising rates in 2023 but very little to suggest any near term action. On more QE, a number highlighted that it would do little because yields are already so low. Others emphasized that yield curve control would also have only marginal benefits.

Powell highlighted that they have already done almost anything they could think of. On business loans, he suggested there could be some flexibility to make them more attractive but suggested it may take an act of congress; something that isn't coming any time soon.

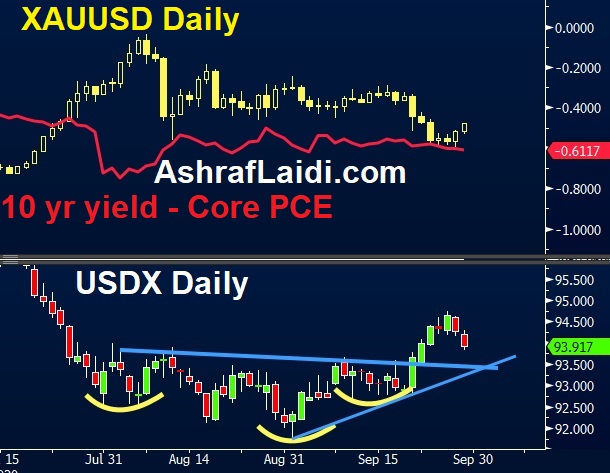

It all begs the question: How much of the recent turmoil in markets is a by-product of Fed reluctance to ease further? The realistic scope for more was certainly seen as limited before the FOMC and their points on the inability to further lower rates is well taken but more action would have worked through a different channel: the dollar.

It may not be a coincidence that the dollar has been strong since the FOMC and the comments last week underscoring a wait-and-see approach added further fuel to the trade.

For those watching the Fed closely, nothing they've said or done is a surprise but the market has been conditions for more and more. Contrast that with the BOE talking negative rates and other banks finding ways to ease and there is a case to be made that the latest dollar rally isn't about just politics and the virus.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +191K vs +179K prior GBP +3 vs +2K prior JPY +30K vs +23K prior CHF +16K vs +12K prior CAD -19K vs -17K prior AUD +16K vs +16K prior NZD +5K vs +3K prior

Euro longs backed off two weeks ago but the latest data show a rebound and it's once again within striking distance of the 212K record set earlier this year. Aside from the euro, it was generally a 'stand pat' week, which is a bit surprising given the USD volatility.

Latest IMTs

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22

-

Warsh Odds Hit Metals

by Ashraf Laidi | Jan 30, 2026 10:56