Intraday Market Thoughts Archives

Displaying results for week of Mar 28, 2021Quarterly Closes Point to More Ahead

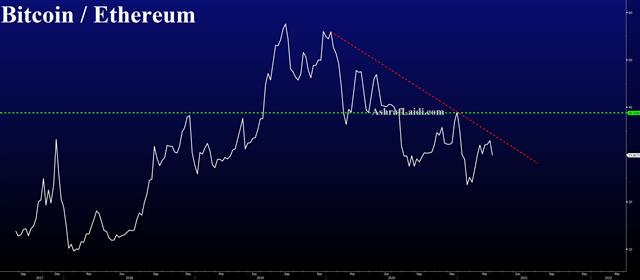

As risk on is empowerd ahead on the 1st day of Q2, let's assess a few items. The euro closed Q1 at its lowest since November among those crucial charts closing at extremes. OPEC+agreed on gradual hikes. (more below). On the day and on the quarter, CAD was the best performer and the yen lagged. Below is the latest Bitcoin/Ethereum ratio chart.

Quarter-end was a typically messy affair that saw some back and forth nonsensical 30-40 pip moves throughout the FX market. What stands out is how many charts finished at the extremes – something that's generally a continuation sign.

Given that we're right in the middle of the recover/reopening trade that's a good thing to keep in mind into Q2. CAD/JPY was the best trade in the quarter and it touched a fresh extreme on Wednesday. A number of currencies also hit new highs against the yen and Swiss franc. Both of these lagged badly in the quarter in a reminder that yield differentials are extremely powerful. EUR/USD also closed on the lows as Macron announced a one-month lockdown for France and the recovery fund efforts plod along.

Thursday's rally is interesting because non-farm payrolls will be released Friday with the market closed. One would expect some risk being pulled off the table in stocks and bonds. Yet we saw little in the way of portfolio rebalancing flows.

موعدنا اليوم في غرفة شركة إكس أم لجلسة الأسواق

ننتظركم اليوم الساعة الخامسة مساءا بتوقيت مكة في غرفة إكس إم مع أشرف العايدي .أنقر على الرابط للمشاركة

Onto April Seasonal Winds

Declines in gold and a rise in USD/JPY above 110.00 appeared to confirm the breakout in Treasuries but the bond market had other ideas. Some of the reversal might be flows with large quarter-end rebalancing leading to bond buys and stock selling.

At the same time, the fundamental picture continues to improve and there's talk of a huge non-farm payrolls number that will land Friday in a market that will be largely closed. The latest bit of good data was the March consumer confident report, which jumped to 109.7 from 90.4; far exceeding the 96.9 consensus.

Even in Europe, optimism appears to be building with the German DAX rising above 15,000 for the first time. It's up nearly 8% from the second week of the month.

Some caution continues to be warranted around month and quarter-end but seasonal signals for risk appetites in April are positive. It's the best month on the calendar for equities.

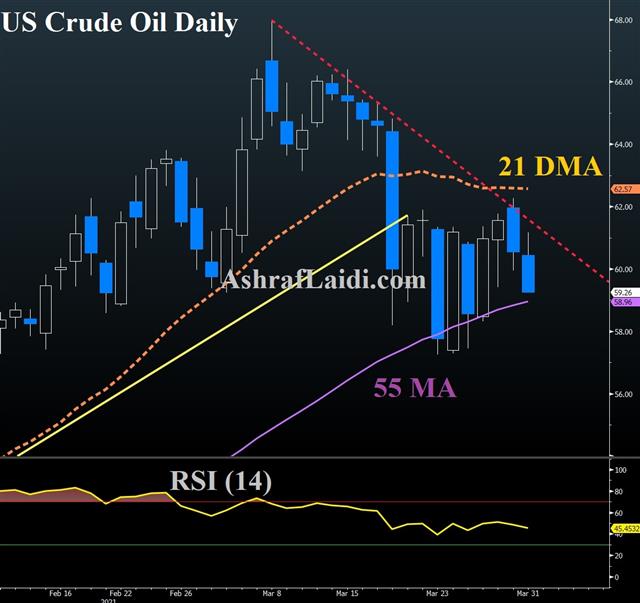

It's also the second-best month for oil and will kick off with Thursday's OPEC+ decision. They're widely expected to maintain quotas for May but could pre-commit to unchanged production in June as well on account of fresh European lockdowns.

As you might expect with both oil and equities strong in April, it's the best month on the calendar for CAD, averaging a 1.2% gain over the past 20 years.

One warning sign for the rising-yield story is that it's the second-worse month for the dollar index. One area to watch closely is cable, which has risen in April in 16 of the past 20 years. It's easily the best month for GBP/USD, averaging a 1.3% gain in that span.مستويات الذهب وبرنامج التحفيز الجديد

Gold Catching Knives & Headfakes

New Fed Governor Chris Waller made his debut appearance on Monday and his comments touched on a looming problem. The Swiss franc led the way on Monday while the euro lagged. US consumer confidence is due up next.

On the surface, the comments from Waller were a non-event. He repeated the standard Fed lines that it will be a long time before it's appropriate to raise rates. He said that rising yields were a sign of economic confidence and he point to well-anchored inflation expectations. There were some hints he will be a more-hawkish governor but it's way too early to judge.

What stood out though was that the topic of his first speech was central bank independence. Waller's term runs until 2030 and he'll surely going to be tested on that front.

The long arc of the last 35 years of monetary policy is towards lower rates. That means that by-and-large central banks have been an ally for treasury departments.

The next era – and we got a taste of that with Trump – will be a more antagonistic relationship as central bankers slowly raise rates or ar at least forced to adjust to contain rising inflation.

For politicians, that's often a disastrous outcome. That push-and-pull has been clear in Turkey in recent years as the government meddles with central banking.

At the moment, the market is enjoying the confluence of easy money fiscal and monetary policies as global disinflationary trends converge but the crest of all those trends is near.

Tuesday's US economic calendar picks up after a quiet day to start the week. A pair of indications on house prices will be a reminder of the new spending power of consumers.CNH Hit & Leverage Lessons

It's rare for a fund that large to use leverage and the events of late last week demonstrated why. A handful of concentrated bets in Chinese and US companies were swamped by forced selling. Shares of ViacomCBS fell 50% over two days, while Discovery dropped 27% on Friday alone. Hwang was also behind heavy selling in Baidu and Tencent.

There are some obvious risk management lessons here as one of the great traders of this era was ruined.

For the broader market, news of forced liquidation from a single fund is comforting. It means that nothing has changed in the bigger picture and given that the selling completed on Friday, there will be dip buying in those names. The broader market will also benefit as people pick up the scraps.

The market hates uncertainty and unknown sellers but once it gets a grip on what's driving the selling, the mood quickly flips. There's likely what happened as rumours about the selling began to percolate late on Friday, leading to a record close in the S&P 500.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +93K vs +90K prior

GBP +22K vs +29K prior

JPY -53K vs -39K prior

CHF +3K vs +5K prior

CAD +5K vs +10K prior

AUD +6K vs +8K prior

NZD +5K vs +6K prior

The big story in the past two weeks is the dramatic positioning shift in the yen as it shifted rapidly to a large net short position. The yen and Swiss franc are rapidly regaining their positions as funding currencies and