Quarterly Closes Point to More Ahead

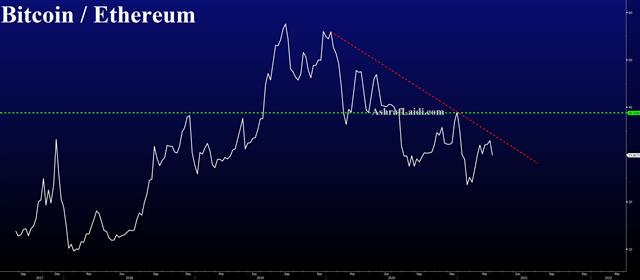

As risk on is empowerd ahead on the 1st day of Q2, let's assess a few items. The euro closed Q1 at its lowest since November among those crucial charts closing at extremes. OPEC+agreed on gradual hikes. (more below). On the day and on the quarter, CAD was the best performer and the yen lagged. Below is the latest Bitcoin/Ethereum ratio chart.

Quarter-end was a typically messy affair that saw some back and forth nonsensical 30-40 pip moves throughout the FX market. What stands out is how many charts finished at the extremes – something that's generally a continuation sign.

Given that we're right in the middle of the recover/reopening trade that's a good thing to keep in mind into Q2. CAD/JPY was the best trade in the quarter and it touched a fresh extreme on Wednesday. A number of currencies also hit new highs against the yen and Swiss franc. Both of these lagged badly in the quarter in a reminder that yield differentials are extremely powerful. EUR/USD also closed on the lows as Macron announced a one-month lockdown for France and the recovery fund efforts plod along.

Thursday's rally is interesting because non-farm payrolls will be released Friday with the market closed. One would expect some risk being pulled off the table in stocks and bonds. Yet we saw little in the way of portfolio rebalancing flows.

Latest IMTs

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35

-

How I Grew the Account 5x

by Ashraf Laidi | Mar 2, 2026 11:54