Intraday Market Thoughts Archives

Displaying results for week of Apr 28, 2019المضاربة داخل مؤشر داو جونز

نلقي نظرة على مؤشرداوجونز ثم ننتقل لمؤشرالداكس لنتكلم عن الهبوط الحاصل في الأسواق والاغتنام الصحيح لفرص البيع. شاهدوا الفيديو الكامل

Payrolls, Earnings & 8 Speakers

US payrolls and earnings (wages) figures are due today, but also watch the chorus of 8 speakers from the Fed (more below) and the extent to which they may differ slightly from Powell's take on rate cuts in Wednesday's press conference. A jump in US factory orders on Thursday clouds the picture for the sector just after the ISM survey stumbled to a two-year low. US payrolls are due at 13:30 BST/London and US services ISM is due at 15:00 BSt/London. A Premium Insight trade was issued yesterday.

Yesterday, US factory orders rose 1.9% in March compared to 1.5% while the ex-transport measure was up 0.8% versus the +0.3% consensus. In addition, revisions and core durable goods orders were also higher.

The report paints a solid picture for manufacturing but it strongly contrasts with this week's manuf ISM report, which unexpectedly sank to the lowest since November 2016. Both have forward-looking elements but the mixed picture adds to confusion about the US and global economic direction.

The report helped to keep a bid under the US dollar but overall shifts were less than 25 pips across the board.

One notable move was in oil, which fell 4% to drop Brent briefly back below $70. The trade is tense at the moment with Iran oil sanctions going into effect Friday and extreme uncertainty around Venezuela and Libya. US inventories have swelled but the end of April is typically the annual peak.

Next up is the April non-farm payrolls report at 1230 GMT. The consensus is for a 190K reading, just below the 196K print in March. Watch out for a boost from goverment workers as US census hires ahead of the 2020 count. The ADP number earlier in the week was 275K so there probably an upward bias priced into the market. Avg Earnings are exp 3.3% y/y from 3.2% y/y and on a month/to/month basis up 0.3% from 0.1%. Also watch the services ISM, exp 57 from 56.1.

Other Fed Speakers' Take

Today is the first opportunity for other Fed members to voice their opinion on the outlook for rate cuts, which Powell shot down on Wednesday. These include Chicago Fed's Evans at 15:15 BST, Fed Vice Chair Clarida at 16:30, NY Fed's Williams at 18:45, Fed gov Bowman at 20:00, St Louis Fed's Bullard, Celeveland Fed's Mester, San Francisco Fed's Daly and Dallas Fed's Kaplan.There isn't a strong focus on this particular report on either jobs growth or inflation but the risks may be to the upside for the US dollar. The Fed pulled back the odds of a rate cut on Wednesday and those will come down further if jobs growth is particularly strong or wage indications rise.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Evans Speaks | |||

| May 03 14:15 | |||

| FOMC's Clarida Speaks | |||

| May 03 15:30 | |||

| FOMC's Williams Speaks | |||

| May 03 17:45 | |||

| FOMC's Bowman Speaks | |||

| May 03 19:00 | |||

| Factory Orders (m/m) | |||

| 1.9% | 1.0% | -0.3% | May 02 14:00 |

USD Strength ‘Transitory’ on FOMC, BoE Next

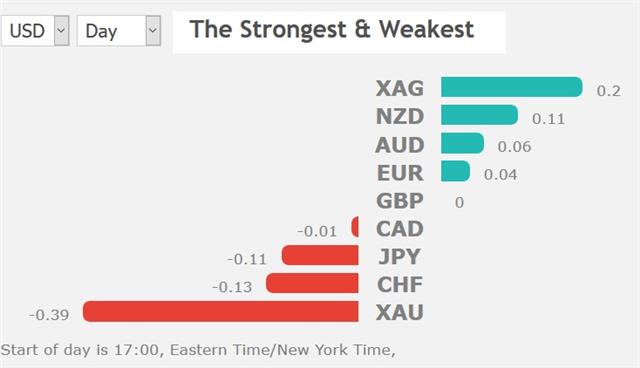

The Fed statement and press conference sent markets in different directions on Wednesday but eventually helped to clarify the underlying stance. NZD and Aussie are at the top of the day's FX perfomers, JPY and CHF are the only losers vs USD. The Bank of England decision is up next. A new Premium trade has been issued to subscribers.

The Fed decision Wednesday unfolded just as we anticipated in yesterday's IMT. The cut to IOER and statement was interpreted as mildly dovish by the market and the initial reaction in the US dollar was lower. However, as we warned, Powell used the statement to lean against the idea of cuts and the dollar quickly reversed.

Powell twice repeated that the FOMC doesn't see a strong case for moving in either direction on rates and said that data so far this year had unfolded largely as expected. Importantly, he dismissed low inflation as 'transitory' and forecast a return to target.

On the whole, market pricing of a 68% chance of a Fed cut by year end remains aggressive and out-of-step with what the Fed has been signaling. For that to unfold it would take a deterioration in economic data. Indeed, that's partly what unfolded earlier Wednesday as the ISM manufacturing index surprised by falling to the lowest since 2016. Construction spending also fell 0.9% compared to a flat reading anticipated.

The Bank of England decision could unfold similarly to the Fed. The statement may contain a growth bump from 1.4% and Saunders could also dissent in favor of a hike. Both would lead to some immediate sterling gains. Nonetheless, those may unwind in Carney's press conference if he stresses global and European growth concerns along with never-ending Brexit concerns.

إستعد للكأس الذهبي

هل انتهت أسوأ مراحل الذهب؟ أتوقع أن يتبع المعدن الأصفر موجة أساسية صاعدة بعد انخفاضه لمدة ثلاثة أسابيع متتالية. ترتبط أسباب توقعاتي بعوامل أساسية وإعتبارات فنية. دعنا نركز على المعطيات الفنية.التحليل المفصل.

Eurozone Shows Life, Fed Next

Positive surprises in Eurozone GDP and German inflation lifted the euro and threaten to upend the miserable theme underpinning the region. GBP and CHF are at the top of the day's FX performance vs USD. UK April manuf PMI manuf slipped to 53,1 from 55.1 as was expected, while US April ADP shot up to 275K from 151K. All eyes turn to US services ISM, followed by the FOMC decision at 19:00 BST and Jay Powell's press conference at 19:30 BST.

تقوية وجهة نظري لهذه العملة (فيديو للمشتركين)

The advance report on Q1 GDP in the Eurozone showed growth at +0.4% q/q compared to +0.3% expected. It's a rare surprise in what has been a poor run of data in Europe. It was flanked by German HICP at 2.1% y/y compared to 1.7% expected.

The numbers allow the ECB to breathe a sigh of relief after months of insisting that a growth pickup was coming. At the same time, both of these numbers are backwards looking and it will take a turn in the PMIs to inspire genuine optimism. For now, the euro rose back above 1.12 and back into the six month range that was broken last week.

False range breaks is a major theme on the charts. Yen crosses had looked to be breaking out two weeks ago but have now reversed. Cable also posted a big gain on Tuesday that was inspired by Brexit talks and month-end rebalancing.

The dominant theme in FX was USD strength until the start of this week. Strong US readings on home sales and consumer confidence underscored the theme that USA is the most-solid developed market economy. The S&P 500 also shook off an early slump to finish higher.

The Fed decision is up next and it's a potential minefield. A number of economists expect the Fed to cut IOER by 5 basis points. It's somewhat of a technical move but will ease financial conditions and will appear to be dovish if it takes place. At the same time, the Fed has fought hard to hike rates and the dots still show a hawkish bias. Powell may use the statement or his press conference to lean against the idea of hikes and so selling the US dollar aggresively on an IOER cut might prove to be a mistake.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Manufacturing PMI | |||

| 55.0 | 55.3 | May 01 14:00 | |

| Construction PMI | |||

| 50.4 | 49.7 | May 02 8:30 | |

| PMI Manufacturing | |||

| May 02 8:30 | |||

| Eurozone Spanish PMI Manufacturing | |||

| 51.2 | 50.9 | May 02 7:15 | |

| Eurozone Final PMI Manufacturing [F] | |||

| 47.8 | 47.8 | May 02 8:00 | |

| Germany Final PMI Manufacturing | |||

| 44.5 | 44.5 | May 02 7:55 | |

| FOMC Statement | |||

| May 01 18:00 | |||

| FOMC Press Conference | |||

| May 01 18:30 | |||

Inflation Upends Central Scenario

An emerging theme of disappointing inflation readings is something to keep a close eye on. USD is down across the board amid month-end rebalancing. US consumer confidence is up next. The Weekly Premium video is posted below for subscribers, containing some crucial corrections to previously made trade focus ideas.

The undeniable theme of the past 10 years in central banking is undershooting inflation while repeatedly overestimating inflation pressures. It's been nearly universal across developed market regions with rare manifestations of higher inflation only due to FX weakness or commodity rallies.

The trend appears to be continuing. In Monday's US PCE report, core inflation was 1.55% y/y compared to 1.7% expected with the prior also revised lower. The inflation numbers were also soft in Friday's GDP report.Europe is also struggling with low inflation and another round of data is coming up later this week.

For most of the past decade, central bankers have been content to push out promises another year on the hope that a tighter jobs market would boost prices. That faith has been shaken, and it's causing a re-think at the Fed and globally.

There is a growing worry that central banks will go into the next recession without ever having hit their targets. That's dragged inflation expectations lower and leaves them vulnerable in the next downturn. Influential Chicago Fed President Charles Evans is increasingly highlighting this risk, along with the NY Fed's Williams.

The solution may be to allow or engineer above-target inflation for a period. The hope a few months ago was undoubtedly to simply leave rates unchanged and maintain a patient approach for longer than would normally be warranted. Yet, with prices trending lower pressure may galvanize to cut rates.

For now, policymakers will continue with patience as stock markets hit fresh records but hard questions are coming whenever the next economic or market stumble hits. It will be interesting to note how this week's Fed statement adjusts to the latest slowdown in inflation.

The day ahead features a healthy dose of economic data including US consumer confidence, pending home sales, the Chicago PMI and the Case-Shiler house price index. Canadian scheduled news includes February GDP and Poloz at parliament.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (m/m) | |||

| 0.3% | Apr 30 12:30 | ||

| Eurozone Prelim Flash GDP (q/q) [P] | |||

| 0.3% | 0.2% | Apr 30 9:00 | |

| Chicago PMI | |||

| 59.1 | 58.7 | Apr 30 13:45 | |

| HPI (y/y) | |||

| 3.7% | 3.6% | Apr 30 13:00 | |

| CB Consumer Confidence | |||

| 126.2 | 124.1 | Apr 30 14:00 | |

Onto Consumers, Month-End & Fed

The US dollar initially jumped after Friday's release of strong headline Q1 GDP number but the details sparked a rethink. CFTC positioning data hinted a why dollar bulls are so uneasy. Take a look at the chart of USDX spec net longs below. Key US data on personal spending and core PCE price index is due next. The combination of month-end flows, Wednesday's Fed statement and BoE's Inflation Report & minutes will be crucial for the markets.

The kneejerk market reaction to the first look at Q1 US GDP was to buy the US dollar. The economy expanded at a 3.2% pace, far in excess of the 2.3% expected. Immediately, the dollar just a quarter-cent across the board but almost as quickly it reversed the second move was larger and longer-lasting.

That's because one-off factors were behind the gain as inventories add 0.65 pp, net trade added 1.03 pp and government spending contributed 0.41 pp. Those are all likely to reverse. Strip them out and growth was just under 1.2%. Ashraf warned about the inventories factor on Twitter minutes prior to the GDP release on here here.

Another market mover on Friday was oil as it fell more than 4% at one point on a combination of profit taking from weeks of gains and Trump saying he “called OPEC” and asked them to lower oil prices. Saudi leaders and the OPEC secretary general both denied speaking with the President but the damage was done.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. This week's report was delayed because of the US holiday.EUR -105K vs -98K prior GBP -2K vs -1K prior JPY -94K vs -87K prior CHF -38K vs -33K prior CAD -47K vs -49K prior AUD -50K vs -47K prior NZD -5K vs -3K prior

The euro net short hit a fresh extreme since December 2016 but it's been inching along for the past few weeks as EUR/USD wilts. The bigger moves in the report are in JPY and CHF as bets against both ramp up in a sign of better risk sentiment. However that's tough to square given the large bets against commodity FX. On the whole, it's a market that's continuing to pile into dollars and the overcrowded positioning is probably the best explanation of why the market reversed on the details of the GDP report.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Prelim Flash GDP (q/q) [P] | |||

| 0.3% | 0.2% | Apr 30 9:00 | |

| Personal Spending (m/m) | |||

| 0.7% | Apr 29 12:30 | ||

ندوة مساء الثلاثاء مع أوربكس

تنصحنا أشهر الأقوال المتعلقة بالسوق المالي ببيع الأسهم في شهر مايو وإعادة الشراء في نهاية فصل الصيف، أي عند بداية سبتمبر. وتظهر الإحصائيات أن شهر أبريل هو بالفعل أفضل شهر للمؤشرات الأمريكية بشكل عام. لكن ماذا عن باقي فصل الربيع وفصل الصيف؟. "بيع الأسهم في شهر مايو وابتعد". هل ما زالت هذه المقولة المشهورة فاعلة؟ للتسجيل من السعودية فقط و للتسجيل من باقي الدول الرجاء النقر هنا