Intraday Market Thoughts Archives

Displaying results for week of Oct 29, 2017US Tax Cut, BoE Hike

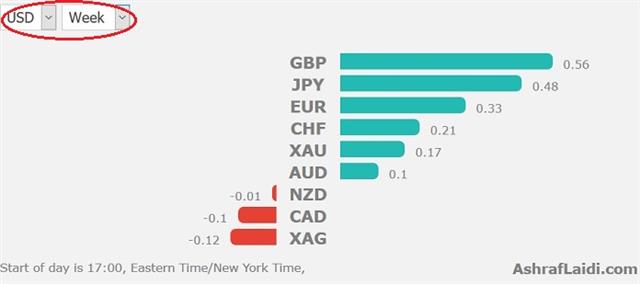

The US House of Representatives released details of the tax cut plan Thursday and the market reaction showed a confused market. The commodity currencies were the top performers while the pound lagged after the BOE rate hike was accompanied with downward revisions in growth and inflation. Australian retail sales are up next.

USD/JPY fell more than a half-cent after the tax plan was released but slowly recovered over the remainder of the day. Part of the reason is that stock markets turned around to finish slightly higher after a 13 point dip in the S&P 500 to start the day.

The tax measures are undoubtedly stimulative and it appears as though the corporate tax rate will be cut to 20% immediately and permanently. That's a powerful boost for stocks. On the personal side, lower tax cuts are partly balanced by the elimination of deductions so economic gains might not be as robust.

On the question of whether it will pass, that likely depends on impending changes. Given some of the reaction, however, Trump's timeline of passing it before month-end is overly ambitions.

The trade may be to watch the bond market. Ten-year yields continue to flirt with 2.40% but have backed away, including a 2.5 bps dip to 2.35% on Thursday. The ebb and flow of the plan and various breaks are going to cause major volatility in the weeks ahead.

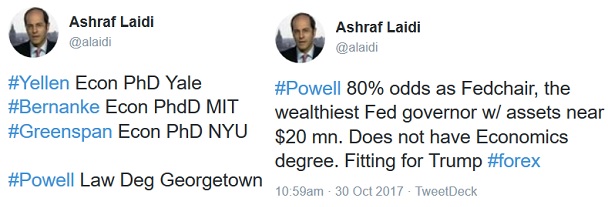

One thing that won't be causing further volatility is the Fed chair decision. Powell was introduced as the new leader on what was a telegraphed decision in the end.

The BOE stance is far less certain. The guidance was that future hikes will be limited and gradual. That sent cable more than 180 pips lower on the day. The pair is currently testing the Oct low of 1.3027 and that will be a key level into the weekend.

Looking ahead, the next event is Australian retail sales. AUD posted a strong day Thursday but a second consecutive soft reading could undercut the move. The consensus is for a 0.4% increase after a -0.6% reading in August.

In Friday's US jobs report, wages will remain the top market-mover in the non-farm payrolls report, where revisions will be closely scrutinized.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 0.4% | -0.6% | Nov 03 0:30 | |

Fed Waits, BOE Next

The Fed touted better growth but the FOMC statement reiterated concerns about low inflation. The New Zealand dollar was the top performer after solid jobs figures, while the Swiss franc lagged. Australian trade balance is due next followed the BoE decision on Thursday. 2 GBP and 1 FTSE trades are in progress.

The Fed decision was a bit of a dud in terms of market moves. The initial reaction was to sell the US dollar as the Fed indicated inflation has declined this year but it quickly rebounded on an upgrade in the growth assessment to 'solid' from 'moderate'.

USD traders now shift to Thursday's tax plan. A Congresswoman said the details will be released at 9 am ET (1300 GMT). The drawback to much details is disappointment. Political spin is sure to come from deficit hawks. The grandstanding will be intense and that might prompt a move to safe havens.

The other US news to come on Thursday will be the Fed chair decision. However, a late-breaking report says Powell has been told the job is his. That decision was mostly priced in and the attention will now turn to his comments during confirmation and signals on future hikes.

Before that, data on Australian trade balance is due at 0030 GMT. The consensus is for a surplus of A$1.2B and any miss could send another jolt through AUD trading.

The bigger market mover will be the Bank of England decision. The market is pricing in a 90% chance of a hike so the bigger driver will be signals about what's next. The BoE Minutes will show the extent of unanimity, the BoE inflation report should enlighten on inflation and growth revisions and forecats, while Carney's testimony never disappoints.

Plenty of market watchers are talking about a one-and done but the market is pricing in a 37% chance of a second hike in February. That's a low bar. Carney could sound his usual neutral stance, but if he's constructive about growth then it would leave the door open for that second hike.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Dudley Speaks | |||

| Nov 02 16:20 | |||

| Trade Balance | |||

| 1.42B | 0.99B | Nov 02 0:30 | |

ثلاثة مؤشرات تستحق الاهتمام

من أي مستويات قد تشهد أسعار المؤشرات تراجعا تصحيحيا ؟ هل ما زال هناك فرصة للأستفادة من زخم الصعود , أم أن الوقت قد حان للأستفادة من تراجع ممكن لأسعار المؤشرات ؟ الفيديو الكامل

Soft Signals

Soft US economic data sent incorrect signals over the past year but the mounting strength of survey data is increasingly difficult to disregard. For the second day in a row both the pound was the leader and the loonie was the laggard. Higher than expected employment figures and lower than expected jobless rate from New Zealand gave the kiwi a much-needed respite. The FOMC decision is due on Wednesday. The Dow "divergence" addressed in today's Premium video (below) has grown deeper today, setting up for suitable 2nd-half-of-the-week.

هل حان وقت البيع؟ (فيديو للمشتركين فقط)

How strong is the US economy? If the consumer confidence survey from The Conference Board is an indication, it's at the best level since December 2000. The index hit 125.9 in October compared to 121.3 expected. Manufacturing sentiment is also bubbly with the Chicago PMI rising to 66.2 compared to the 61.0 consensus. That's the best since March 2011.

The reports are a continuation of a string of solid data points that are simultaneously turning higher. Combine that with optimism about a tax cut and the US dollar is in a sweet spot.

USD/JPY climbed a half-cent on Tuesday as October came to a close. The pound also continued to benefit from speculation that Carney will hike this week with the possibility of hawkish commentary.

USD/CAD jumped after Canadian GDP contracted 0.1% in August compared to +0.1% expected. Poloz also reiterated that inflation risks are balanced and that the BOC will be cautious going forward. That virtually rules out a December rate hike.

Wednesday's FOMC decision is largely seen as a non-event but we think that's a mistake. The market is pricing in just a 0.8% chance of a hike and while it's still remote, the possibility of a hike is higher than indicated. Yellen may decide she doesn't want to hamstring her successor into only raising rates at meetings with a press conference.

Still, what's most likely is a continued pledge to gradually hike rates with hints of optimism on the economy but caution about the slow rise of inflation. That should be enough to keep a bid in the dollar.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI | |||

| 66.2 | 60.2 | 65.2 | Oct 31 13:45 |

| ISM Manufacturing PMI | |||

| 59.5 | 60.8 | Nov 01 14:00 | |

| GDP (m/m) | |||

| -0.1% | 0.1% | 0.0% | Oct 31 12:30 |

| FOMC Statement | |||

| Nov 01 18:00 | |||

| CB Consumer Confidence | |||

| 125.9 | 121.1 | 120.6 | Oct 31 14:00 |

| Employment Change (q/q) | |||

| 2.2% | 0.8% | -0.1% | Oct 31 21:45 |

Russia Redux But Focus Elsewhere

The front-page news this week might be the Trump-Russia drama but the US dollar will move on the FOMC, Fed chair and tax reform news. The pound was the top performer while the Canadian dollar lagged. Japanese jobless numbers are due later. A new Premium trade has been posted and sent, supported by 3 charts and 4 technical reasons. It will be explained in detail in Tuesday's Premium video.

سيتم شرح صفقة هذا المساء بالتفصيل في الفيديو العربي يوم الثلاثاء للمشتركين

The indictment of Trump's campaign manager Paul Manafort and another top aide along with a guilty plea from a foreign policy advisor will breathe fresh life into the election story but traders may be wise to ignore it. The playbook earlier this year was to fade any moves on the investigation, especially in stocks markets. That won't change unless the scandal reaches the President or his family. In the meantime, the market has far more direct and near-term news to drive trading.

One story is the Fed chair decision, which will is expected on Thursday. A further leak Monday suggested that Powell is the likely pick and that's probably 70% priced in now. It's part of the reason that 10-year yields fell back below 2.40% to 2.36%.

Another part of the reason is that the corporate tax cut might take years. A report indicated that the plan – which will be released Wednesday – may phase in the drop to a 20% corporate rate over four years. That's still good for corporate USA but not as quick and powerful as hoped.

In turn, the US dollar fell through most of the session. Sterling, in particularly, took advantage in an 80 pip rally. That may also reflect a sense in the GBP market that it can focus on the BOE rather than the endless bad Brexit news.

In the near-term, Asia-Pacific traders will look to Japanese data on jobs at 2330 GMT and industrial production 20 minutes later.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (m/m) [P] | |||

| -1.5% | 2.0% | Oct 30 23:50 | |

2.40% Hangs on Dual Fed Decisions

Fresh reports that Jerome Powell is the front-runner to lead the Fed (whose odds are currently at 80%) put a bid back into bonds and weighed on the US dollar Friday. At the moment, GBP is the strongest performing currency ahead of Thursday's much anticipated BoE rate hike. US core PCE came in at 1.3% as expected, while German CPI weakened to 1.5% from 1.8% but EUR regained lost ground after Trump's former campaign manger Manafort has been charged in probe. CFTC positioning data highlights a potential squeeze. New analysis for Premium members with 7 charts & notes highlighting whether USDX is indeed heading for an inverse head-&-shoulder formation.

Bloomberg, citing three sources, reported on Friday that Powell is the favourite to be named Fed Chair this week. Earlier in the week, reports that Taylor had won a straw poll among Republican Senators had boosted the US dollar and pushed 10-year yields above the critical 2.40%. The news that Powell could win sent yields to a 2.40% finish on the week, highlighting his primary support for tax reform. The report also helped to boost stocks and weighed on the US dollar.

The USD pullback comes after four days of gains and despite a 3.0% rise in the first look at Q3 GDP. That was better than 2.6% expected and showed the economy weathered the hurricanes, but the weakest final sales figure (after inventories) in nearly 2 years dragged USD on Friday.

The choice for Fed chair via announcement or leak could come any day this week and one of the first spots we will be looking after the news is if 10s can definitely break above 2.40%. At the same time, the FOMC decision on Friday could be a place for Yellen to tee-up a December hike and send yields and the dollar higher anyway.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +84K vs +90K prior GBP -1K vs +5K prior JPY -116K vs -101K prior CHF –12K vs -5K prior CAD +72K vs +75K prior AUD +57K vs +62K prior NZD +1K vs +7K prior

The moves are modest overall. In cable, the quick backtrack to net-short after two weeks of net-longs is a reminder of how Brexit worries outweigh a possible rate hike. Looking ahead, the real spot to watch is CAD and AUD. They are struggling and increasingly vulnerable. Positioning was flat the last time USD/CAD was at 1.29 so all of the 72,000 net longs might be underwater.