2.40% Hangs on Dual Fed Decisions

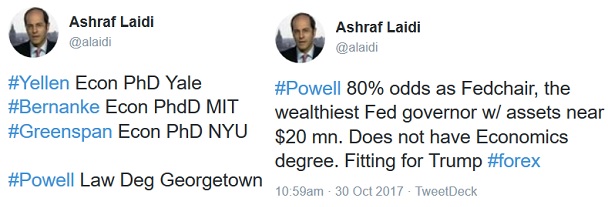

Fresh reports that Jerome Powell is the front-runner to lead the Fed (whose odds are currently at 80%) put a bid back into bonds and weighed on the US dollar Friday. At the moment, GBP is the strongest performing currency ahead of Thursday's much anticipated BoE rate hike. US core PCE came in at 1.3% as expected, while German CPI weakened to 1.5% from 1.8% but EUR regained lost ground after Trump's former campaign manger Manafort has been charged in probe. CFTC positioning data highlights a potential squeeze. New analysis for Premium members with 7 charts & notes highlighting whether USDX is indeed heading for an inverse head-&-shoulder formation.

Bloomberg, citing three sources, reported on Friday that Powell is the favourite to be named Fed Chair this week. Earlier in the week, reports that Taylor had won a straw poll among Republican Senators had boosted the US dollar and pushed 10-year yields above the critical 2.40%. The news that Powell could win sent yields to a 2.40% finish on the week, highlighting his primary support for tax reform. The report also helped to boost stocks and weighed on the US dollar.

The USD pullback comes after four days of gains and despite a 3.0% rise in the first look at Q3 GDP. That was better than 2.6% expected and showed the economy weathered the hurricanes, but the weakest final sales figure (after inventories) in nearly 2 years dragged USD on Friday.

The choice for Fed chair via announcement or leak could come any day this week and one of the first spots we will be looking after the news is if 10s can definitely break above 2.40%. At the same time, the FOMC decision on Friday could be a place for Yellen to tee-up a December hike and send yields and the dollar higher anyway.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +84K vs +90K prior GBP -1K vs +5K prior JPY -116K vs -101K prior CHF –12K vs -5K prior CAD +72K vs +75K prior AUD +57K vs +62K prior NZD +1K vs +7K prior

The moves are modest overall. In cable, the quick backtrack to net-short after two weeks of net-longs is a reminder of how Brexit worries outweigh a possible rate hike. Looking ahead, the real spot to watch is CAD and AUD. They are struggling and increasingly vulnerable. Positioning was flat the last time USD/CAD was at 1.29 so all of the 72,000 net longs might be underwater.

Latest IMTs

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10