Intraday Market Thoughts Archives

Displaying results for week of Nov 29, 2015Soros' Reflexivity gone too far

Evidence of Soros' Theory of Reflexivity remaining prevalent in financial markets re-emerged this week as the euro made its biggest single day advance since the Fed's announcement of QE in 2009. Simply put, the euro soared 4% due to misplaced and unfulfilled market expectations that the ECB would increase the size of its monthly asset purchases. The crowding out of euro-short algos was pivotal in the magnitude of the resulting short squeeze. But questioning the intensity of euro shorts deserves more time and attention than criticizing or doubting a central banker's decision.

Question your Expectations, not the Central Bank Decision

Many who were “angry” at the Fed's decision to not raise rates in September –on the grounds that they got it wrong (on the grounds that they were mislead by prior Fed comments) –are the same who were critical of yesterday's ECB decision to under-deliver. I will not go into detail about how the ECB gave no reason to expect QE expansion or a bigger rate cut than 20 bps. That was the work of one or two major bank economist's forecasts, who were later followed by the rest of the pack—with a few adjustments.My colleague Adam Button and I made it clear in several Intraday Market Thoughts and tweets that QE expansion would be difficult (or impossible) to attain at the December meeting, making way for only a rate cut and/or QE extension. Markets went too far with embracing the notion of “policy divergence”, assuming QE expansion was inevitable. Once corrected by the ECB, the result was massive. At the end of day, anyone who landed on planet euro and saw the spike in the single currency and 4% tumble in the DAX, would have expected the ECB had tapered the size of QE, or ended it completely. Not at all. It was all expectations' fault. As George Soros postulated in his version of Reflexivity Theory into economics, markets are principally driven by expectations. Once the basis of those expectations is altered (ECB's policy actions), the market corrects.

Friday's Draghi Speech not so different from Thursday's

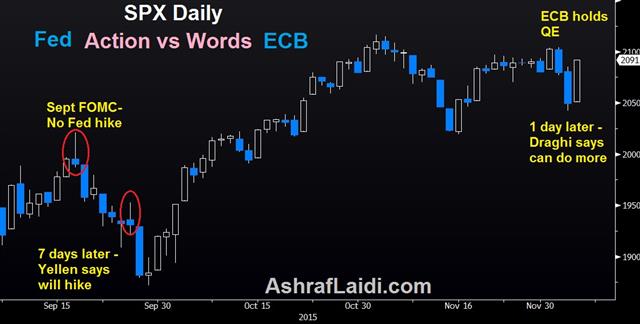

Some say expectations were fed by the central bankers themselves. Not at all (again). Today's Draghi speech in NY appears to be the main catalyst behind the 2% rally in US indices. The main reason to the rally is attributed to Draghi's statement indicating the ECB stood ready to deploy “further tools if necessary”. It may not matter that Draghi made a similar statement at yesterday's conference i.e. more measures would/could be implemented if the need arose. One day seems to be too late for traders who lost money, but not too late to make it some of it back today.A similar situation occurred on September 24, when Fed chair Yellen made a hawkish speech seven days after giving highly dovish press conference on the day of the Fed decision to not raise rates. Markets bottomed three sessions later.

Undoubtedly, Draghi's power of words continues to hold sway. But since pulling the QE trigger in March, the timing of the words becomes as important as the words themselves. This is no longer September 2012, when “we'll do what it takes” sufficed.

One other Small Detail

One overlooked item from Thursday's press conference, which Draghi did not address (or rectify) at his NY speech, was that this week's announced package of QE extension/rate cuts/ reinvesting of asset purchases, would be assessed for the next quarter. This implies that, further measures prior to end of Q1 2016 are highly unlikely, as we are constantly told that central bank monetary policy actions take time to fiter into the economy. Not to forget--the ECB's QE has had positive results, according to ECB research and market evidence (notablee rise in CPI off its 0.6% lows despite prolonged oil declines, improved growth and rising M3). Thus, any rise in QE size before April is out of the question. Another 10-bp rate cut could may not be considered before June. More evidence that EURUSD parity is far from reality.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed Minneapolis's Narayana Kocherlakota speech | |||

| Dec 04 21:00 | |||

Stocks Stopped Dead by Draghi

Suddenly, the equities market outlook has darkened considerably. We break down the reasons after a sensational day in markets where EUR/USD gained the most in six years. Aussie retail sales are up next.

We noted that there was a bearish outside day in the S&P 500 yesterday and the selling accelerated today after the ECB disappointed. The index posted its worst day in 9 weeks with a 30 point fall to 2049. Technically, it broke the 200-day moving average and it's left with little support until the November low at 2016.

The index is once again negative for the year and that may grow in importance as we near year-end. 2057 was the opening level for the year and it closed at 2049 today.The ECB missing expectations may be a sign that the easy money taps are closing. The Fed is leaning towards a hike this month and late this year the BOJ signalled that it will wait and see. Those will eventually prove to be mistakes but for now it may be an important watershed. Today's 3.6% plunge in the Dax (400 pts) as well as the selloff in all major indices is a validation the "052008 Parallel", a rare multi-year technical occurence highlighted by Ashraf in the Premium Insights, under which FTSE and DAX trades are currently in the money.

Cheap money has been the driving force in equity markets for the past 6 years. Thursday may have been a taste of the future. The US stock market decline was far eclipsed by the more than 3% declines in European stocks.

That was coupled with a massive selloff in bonds in an example of the kind of reverse QE trade that could be the shape of things to come. In addition, global growth is mediocre and commodity-driven stocks have been smashed.

The stock market may be the worst place to be as the virtuous cycle trade of central bank printing reverses.

On the sidelines of the massive market moves today, one thing that caught our eye was AUD resilience once again. No doubt the lack of QE is bad for global growth and commodities but AUD/USD made an intraday reversal higher from 0.7290 to 0.7360. Its resiliency once again speaks to underlying demand.

Aussie bulls may get a reason to buy at 0030 GMT when the October retail sales report is released. It's expected to rise 0.4%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (OCT) (m/m) | |||

| 0.5% | 0.4% | Dec 04 0:30 | |

| Eurozone Retail Sales (OCT) (m/m) | |||

| -0.1% | 0.2% | -0.1% | Dec 03 10:00 |

| Eurozone Retail Sales (OCT) (y/y) | |||

| 2.5% | 2.6% | 2.9% | Dec 03 10:00 |

| Fed Minneapolis's Narayana Kocherlakota speech | |||

| Dec 04 21:00 | |||

Does Draghi's Coup Secure Yellen's Liftoff?

To some, the ECB has underdelivered today by not only cutting rates by a smaller than expected 0.10 bp in the deposit rate to -0.3% from -0.2% (vs exp -0.4%) but also disappointed most market players by only extending the duration of QE to an additional 6 months and not adding to the monthly $60 bn QE. The ECB's decision to opt for QE extension rather than QE expansion reflects the broad signs of improvement in German growth business surveys. Germany's IFO and various Eurozone PMIs and confidence surveys have hit 17 to 52-month highs.

The Car Example

We long said here that a rate cut of 10-20 bps would be a desperate move to drive down interest rates deeper into negative territory, but would be of no effectiveness, if not accompanied by any substantial rise in monthly purchases. In fact, even a rise of EUR 10-20 bn euros in monthly purchases would not have mattered beyond the odd 100-100 point rally in the Dax. Why? The ECB succeeded in unleashing its policy shock-&-awe (sharp rally in equities, positive shock in Eurozone system liquidity and a lasting decline in the euro's exchange rate) thanks to an increase in monthly asset purchases from EUR 0 bn to EUR 60 bn. That was in March. Today, any announcement of QE expansion from EUR 60 bn to EUR 75 bn or EUR 90 bn, would have been less effective, just as a car would more likely to be noticed accelerating from 0 to 30 km/hr than a car going from 50 to 70 km/hr.13 days is a long time in today's markets

Keeping powder dry in the form of interest rates and QE size is the evident excuse/explanation for the ECB's under-delivery. Yet, the more fundamental question is the following: “Will Draghi coup guarantee a US rate hike?” If today's USD declines are built upon with additional (possible) selling from a disappointing US November jobs report tomorrow, could well pave the way for December liftoff -- although I continue to have my doubts and stick with my prediction for no rate hike this month. The risk of a market-driven tightening (in the form of equity markets sell-off (this time from the US not China) may go so far in blocking a December rate hike. The earnings and manufacturing recessions in the US have been overshadowed by explanations and excuses of temporary phenomena. 13 days is a long time in today's markets. A 110K NFP figure coupled with a rise in the jobless rate and neutral average hourly earnings can go a long a way in transforming 70% odds of a December liftoff down to 40%.Many of our Premium subscribers had initially been sceptical towards our 052008 Parallel postulated in various charts of global indices. Today's market moves have further bolstered the theory, which could assault long established seasonals.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit US Services PMI (NOV) [F] | |||

| 56.1 | 56.5 | 56.5 | Dec 03 14:45 |

| Markit US Composite PMI (NOV) [F] | |||

| 55.9 | 56.1 | Dec 03 14:45 | |

| ISM Non-Manufacturing PMI (NOV) | |||

| 55.9 | 58.0 | 59.1 | Dec 03 15:00 |

| PMI | |||

| 51.2 | 53.1 | 52.0 | Dec 03 1:45 |

| Eurozone Spanish Services PMI | |||

| 56.7 | 56.2 | 55.9 | Dec 03 8:15 |

| Eurozone Markit Eurozone Composite PMI (NOV) [F] | |||

| 54.2 | 54.4 | 54.4 | Dec 03 9:00 |

| Eurozone Markit Eurozone Services PMI (NOV) [F] | |||

| 54.2 | 54.6 | 54.6 | Dec 03 9:00 |

| Germany Markit/BME Germany Composite PMI (NOV) [F] | |||

| 55.2 | 54.9 | 54.9 | Dec 03 8:55 |

| Germany Markit Germany Services PMI (NOV) [F] | |||

| 55.6 | 55.6 | 55.6 | Dec 03 8:55 |

| Eurozone Minimum Bid Rate | |||

| 0.05% | 0.05% | 0.05% | Dec 03 12:45 |

| Average Hourly Earnings (NOV) (m/m) | |||

| 0.4% | Dec 04 13:30 | ||

| Average Hourly Earnings (NOV) (y/y) | |||

| 2.5% | Dec 04 13:30 | ||

What to Expect From the ECB

The ECB will push the limits of monetary policy on Thursday, but how far? The Swiss franc was the top performer on Wednesday while the pound lagged badly. We also review the themes after a busy day of trading. Ashraf's 3 short positions in GBP crosses have deepened in the green. A new Premium trade will be issued befire and after Thursday's ECB decision and Yellen's testimoney.

Broad expectations are that the ECB will increase QE by 10-20 billion per month for at least another six months. They will also lower the deposit rate by 10-20 basis points.

But it's much more complicated than that. There is reason to believe the ECB is supply constrained in terms of QE so pledging to buy as much as 660 billion more bonds isn't as straightforward as it seems. Officials have floated the idea of buying city/regional bonds or even bundled bank loans as options. That signals expectations may have gotten ahead of themselves.

Along those lines a leak from the ECB on Wednesday to Bloomberg indicated that ECB staff forecasts were barely changed with a reduction in the 2017 inflation forecast to 1.6% from 1.7% as the only notable change. They hinted that officials may highlight other risks as a reason to take more action but the hawks will have plenty of fodder to push back.

The deposit rate is an underrated tool. The Swiss experience has shown it to be a powerful weapon and the ECB could counteract a disappointing QE number with a larger deposit rate cut or a hint they will cut the deposit rate further in the future. The ECB had gone through the deposit rate floor was -0.20% but the Swiss and Danish experiences have shown it could be at least 55 basis points lower.

What's interesting is that any move on the deposit rate will be delivered in the ECB statement while a QE announcement wouldn't come until Draghi's press conference. If the deposit rate cut is larger than expected, the subsequent drop in the euro may prove to be the only opportunity to sell because the QE number could be a disappointment 90 minutes later. But then comes Yellen's testimony and Friday's NFP, which will likely limit any bounce for the single currency.

In the US, commentary from Yellen made it overwhelmingly clear that she favours a rate hike. The Fed has been looking for confidence on inflation moving back to 2% and Yellen emphasized more than once in her speech that she has it. Lockhart was also overtly hawkish while Brainard's dovish musings were largely ignored by the market (perhaps incorrectly). If there is a surprise at the Dec Fed meeting, it will be that the governors were dead against a hike.

Other developments in US trading including a stronger ADP report, an rather upbeat Bank of Canada and crude breaking $40 once again. The S&P 500 also posted an outside day after a 23 point fall.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Mester speech | |||

| Dec 03 13:30 | |||

| Eurozone ECB Monetary policy statement and press conference | |||

| Dec 03 13:30 | |||

| ADP Employment Change (NOV) | |||

| 217K | 185K | 196K | Dec 02 13:15 |

Fresh Dollar Questions, Aussie GDP Next

US dollar bulls were having second thoughts about the Fed after the softest ISM manufacturing report since 2009. The dollar and CAD lagged while the antipodeans led the way. Australian GDP and a key Fed speaker are due next. Our GBPAUD short in the Premium trades was closed with a 363-pip gain. : جدول محتويات فيديو العربي - مع تحذير الأسترالي و صفقة بيع الأسترليني مقابل الأسترالي قد أغلقت مع 362 نقطة ربح

ISM manufacturing fell into contractionary territory at 48.6 compared to 50.5 expected. The soft factor report adds ammunition to those who think the strong US dollar will crimp manufacturing in the near future. It's a good reason for the Fed to be cautious at the Dec meeting and coupled with additional soft releases could crack open the door towards another month of the Fed deciding to wait and see.

The US dollar fell across the board on the release but the bond market was even more frightened as 10 year yields fell 6 bps to 2.14% and erased the entire November gain. The Australian dollar was particularly strong against USD after the data as it climbed above 0.73 to finish up a cent on the day. We wrote yesterday about background signals that were positive for AUD and continued RBA optimism, upbeat building approvals, plus a strong exports report accelerated the gains.

The Aussie will remain in the spotlight in the hours ahead with Q3 GDP data due. So far Q3 trade has been strong but that may be balanced by weak capex and construction spending. The market is now leaning towards a 0.8% in Q3 GDP in the 0030 GMT release. If it's soft and AUD doesn't back off much it's yet another signal about underlying demand.

The other events to watch in Asia-Pacific trading are central banks. The Fed's Brainard speaks at 0100 GMT. There has been little spoken from Fed Governors recently and they represent the silent majority at the Fed. In the unlikely event that she casts doubts on a Dec cut, it could open up a world of hurt for the US dollar.

The BOJ's Iwata out at 0130 GMT. The Bank of Japan is in a clear wait-and-see mode on further QE, so we don't expect much here.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Net Exports of GDP (Q3) | |||

| 1.5 | 1.2 | -0.6 | Dec 01 0:30 |

| ISM Manufacturing (NOV) | |||

| 48.6 | 50.5 | 50.1 | Dec 01 15:00 |

| ISM Prices Paid (NOV) | |||

| 35.5 | 40 | 39 | Dec 01 15:00 |

| FOMC's Brainard Speech | |||

| Dec 02 1:00 | |||

| Fed's Lockhart speech | |||

| Dec 02 13:10 | |||

| Fed's Yellen Speech | |||

| Dec 02 16:00 | |||

| FOMC's Williams speech | |||

| Dec 02 20:40 | |||

| Fed's Yellen testifies | |||

| Dec 03 | |||

| Building Approvals (m/m) | |||

| 3.9% | -2.4% | 2.3% | Dec 01 0:30 |

| Construction Spending (OCT) (m/m) | |||

| 1.0% | 0.6% | 0.6% | Dec 01 15:00 |

Ashraf's Interview on BNN

Onto China PMIs & RBA Decision

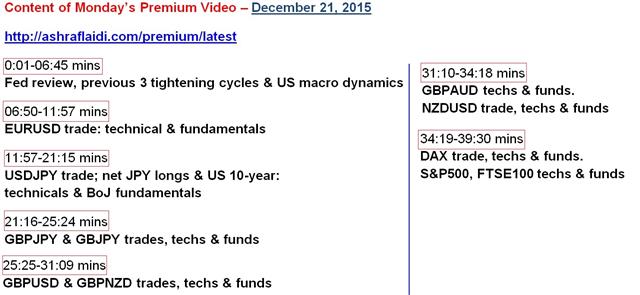

We take a closer look at the Australian dollar with the RBA decision just a few hours away. We also look at cross-asset November performance. On the day, the kiwi led the way while the euro lagged. China's Nov manufacturing and services PMIs are both due at 1:00 GMT/London. The Caixin PMIs are due out 45 mins later. The Premium Video Analysis on the existing trades and other situations is due out. The table of content is posted below.

A top fact from November that stands out to us is this: the CRB commodity index fell nearly 7% in November and the Australian dollar was the top performer. The Aussie was bolstered by a strong employment report early but managed to hold the gains despite some soft construction and capex numbers later in the month.

One of the best indicators of underlying strength is when something can rally despite bad news. That's the case with the Australian dollar at the moment but there a two big risks in the day ahead.

The first is the RBA decision at 0330 GMT. Expectations are unanimous for no change. At the start of November the RBA highlighted that monetary policy needs to be accommodative while indicating that prospects for the economy had firmed 'a little' over recent months.

Given the mixed picture of economic data, expect similar economic rhetoric from the RBA or a bias towards an even clearer shift to neutral from dovish. That could be offset by AUD jawboning. The current statement only says the Aussie is adjusting to significant declines in commodity prices. However, the market has proven to be relatively immune from Stevens' jawboning without the threat of rate cuts so a dip may be short-lived.

AUD buyers on or before the RBA also have to consider Q3 GDP numbers on Wednesday. Before they're released, trade data is due today at 0030 GMT. A weak reading will add to the negative bias in the numbers that's already been tipped by soft capex and construction spending. The current consensus for GDP is +0.7% but the market is probably closer to +0.5% and the RBA could hint at that softer growth because they've likely got a preview of tomorrow's GDP numbers.

Overall, the RBA has weathered an impressive storm in November and that sets it up for a strong finish to the year if it can successfully navigate the next two days.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI (NOV) | |||

| 48.7 | 54 | 56.2 | Nov 30 14:45 |

| Markit Manufacturing PMI (NOV) | |||

| 52.6 | 52.6 | Dec 01 14:45 | |

| ISM Manufacturing PMI (NOV) | |||

| 50.3 | 50.1 | Dec 01 15:00 | |

| PMI (NOV) | |||

| 49.8 | 49.8 | Dec 01 1:00 | |

| PMI (NOV) | |||

| 53.1 | Dec 01 1:00 | ||

| PMI (OCT) | |||

| 48.3 | 48.3 | Dec 01 2:45 | |

| Eurozone Markit PMI Manufacturing (NOV) | |||

| 52.8 | 52.8 | Dec 01 9:00 | |

| Construction Spending (OCT) (m/m) | |||

| 0.5% | 0.6% | Dec 01 15:00 | |

| RBA Commodity Index SDR (NOV) (y/y) | |||

| -19.8% | Dec 01 5:30 | ||

| Eurozone Unemployment Rate (OCT) | |||

| 10.8% | 10.8% | Dec 01 10:00 | |

Three Things That Could Steal the Show

Traders are strapped in for a jam packed week of economic news and data headlined by the ECB decision and non-farm payrolls. Monday's IMF decision on China's SDR future and the OPEC meeting also rank among the headlines of the week. The US dollar was the top performer once again last week while the Swiss franc lagged on speculation the SNB could react to a move from Draghi. The China SDR decision is up first in a busy week but we shift our gaze to some of the themes and events that could drive bigger market moves than the ECB/Fed. There are 5 Premium trades currently open, 3 of which are in GBP pairs.

Lost in the US holiday late last week was a 5.5% fall in the Shanghai Composite on Friday. A crackdown on brokerages and soft industrial profits helped to spark sales. There is also talk that Beijing has pulled its campaign to support stocks.Market moves in China can get disorderly very quickly. At any point in December, foreign investors could begin withdrawing investment because of Fed hike speculation, year end or fears about the economy. Worries about China materialize quickly and hit like a tsunami. We stay on guard.

Murmurs out of Switzerland have also caught our attention. A weekend report from the local press quoted officials from the tourism lobby pushing for a 1.15 EUR/CHF cap. Others point to comments from SNB leader Jordan last week who said negative rates “have proved very useful” as a signal he may cut the deposit rate further below -0.75%. The market has sniffed out some kind of plot as USD/CHF hit a six-year high on Friday.

The final spot to watch is oil. OPEC meets on Friday but all indications are there will be no change in quotas. We'd expect that to be fully priced into the market but it was a similar situation a year ago at the OPEC meeting and when they didn't provide support WTI crude fell to $45 from $75. Oil is precipitously close to support at $38-39 as we start the week and a breakdown could get ugly very quickly.

In the immediate term, watch for German retail sales and inflation data on Monday along with Chicago Fed. But first up is Kuroda, who hasn't given any indications lately that he's prepared to cut rates or that he wants a weaker yen. Expect more of the same when he speaks at 0100 GMT. The China SDR decision has no set time but we don't expect it to have market implications. It's been widely tipped that it will be included in the IMF basket.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Germany Retail Sales (m/m) | |||

| 0% | Nov 30 7:00 | ||

| Germany Retail Sales (y/y) | |||

| 3.4% | Nov 30 7:00 | ||