Intraday Market Thoughts Archives

Displaying results for week of May 29, 2016ECB Inflation Low, OPEC Sidelined

Draghi held back on the optimism and the ECB left inflation forecasts low Thursday, weighing on the euro. The yen was the top performer while the Australian dollar lagged. Japanese earnings data and services PMIs for China and Japan are due next. A new Premium trade was issued on Thursday and is already 105 pips in the money.

Draghi held off any action or hints of action as he retained a wait-and-see stance but low inflation forecasts left the door open for more easing if the economy stumbles. HICP inflation was revised to 0.2% from 0.1% this year but was left unchanged at 1.3% for 2017 and was lowered to 1.6% from 1.8% in 2018. That's despite some better economic news and the rise in oil prices.

Draghi also emphasized downside risks once again. There may not be a need for new measures but expectations for an extension of QE buying should continue to grow and hurt the euro.

A separate meeting in Vienna of OPEC was also a disappointment to the bulls. Rumors of new output caps proved untrue as officials refrained from pledging anything. Oil initially fell more than $1 but once again bounced back in an affirmation of the rock solid bid that seems to ignore fundamentals.

The economic calendar featured the ADP employment numbers ahead of Friday's NFP results but there was little drama on the release as it hit the 173K consensus.

The yen retained a solid bid despite an improvement in stock markets throughout the day. The S&P 500 opened 10 points lower but finished +6 and at the highest closing level in 7 months. The 2016 intraday high of 2010 is just 5 points away and will be a level to watch after non-farm payrolls.

Looking ahead, the Japanese labor cash earnings report is due at 0000 GMT and expected to rise 0.9% y/y in a slowdown from the 1.5% pace in April. It's unlikely to be a market mover.

At 0145 GMT, the focus shifts to China with the Caixin services PMI for May. The prior was 51.8 and baring a big miss, it's unlikely to sway markets. A report in the China Securities Journal said officials may soon lift limits on stock futures margin trading and that could be a boon to Shanghai stocks.

The final one to watch is the May Nikkei Japan services PMI at 0200 GMT. The prior reading was 48.9.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change (MAY) | |||

| 173K | 180K | 166K | Jun 02 12:15 |

June Hike Hopes Fall

The chance of a June hike is dwindling as mixed economic data continues. The yen was the top performer while the pound sterling lagged for a second day. Australian retail sales and trade balance are next. The Premium trades closed the short GBPJPY with a 230-pip gain.

فيديو الأسبوع العربي ما بين الين و الإسترليني

The Beige Book is the latest indication that the Fed doesn't need to rush a hike. The good news was that a tighter labor market was widely cited but modest growth and only modest growth in consumer spending give the Fed plenty of time to wait.

Growth hopes for Q2 also took a hit as construction spending fell 1.8% in the month compared to +0.6% expected. That was contrasted by ISM manufacturing at 51.3 versus the 50.4 consensus, however, the number was skewed by deliveries while all three orders categories fell.

The market has soured on the probability of a June Fed hike with futures now pricing just a 22% chance compared to 32% at the end of the day on Friday. The battleground is June, which has also ticked down but remains at 53%. The FOMC speculation will be all about signals. Yellen has also scheduled her Humprey Hawkins testimony for the week before the July meeting.

Looking ahead, Australia is in focus after the extremely strong Q1 GDP numbers on Wednesday. At 0130 GMT, trade balance numbers are due and expected to show a 2.1B deficit, which is a fractional improvement from the month before.

The more important Aussie release will be April retail sales, which are expected to rise 0.3%. However, the chance of a cut has plummeted recently and the GDP improvement underscored why. The market sees just a 6% chance of a move next week and 18% in July. August ramps up to 50% but there will be plenty of data before then.

The bigger event will be the ECB press conference. No action and a wait-and-see approach are overwhelmingly expected but the latest forecasts will be market movers. The current estimates are for 0.1% inflation in 2016, 1.3% in 2017 and 1.6% in 2018. Higher oil prices should boost the near-term numbers but may pull down longer term estimates because of the potential drag on growth.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Index (MAY) | |||

| 51.3 | 50.4 | 50.8 | Jun 01 14:00 |

Pollster’s Paradise

The power of polls was on display Tuesday as the pound sterling dropped after fresh numbers showed the 'leave' side in the lead. The New Zealand dollar was the top performer while GBP lagged. Australian GDP and the Chinese PMI are due up next. A new Premium trade has just been issued in GBP, backed by 2 charts and 5 reasons.

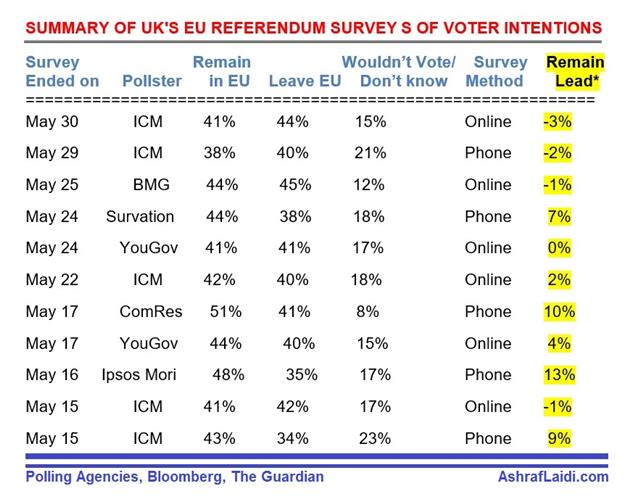

From now until June 23 there will be a heavy emphasis on Brexit polls. The importance was on full display Tuesday. Cable was creeping higher in US trading and at 1.4650 but an ICM/Guardian poll crossed and the pair dropped 80 pips quickly and then continued to slide all the way to 1.4465 in the remainder of trading.

There were two polls, the one conducted by telephone showed 45-42% in favor of leaving and one online was at 47-44% for leaving. The undecided votes were left out and that's a critical detail. In many, similar historical situations, including the Scottish separation vote, a wave of fear on voting day almost always grips the undecided voters and some of those in favour of change.

Bookies continue to show the 'remain' side far ahead and that argues for buying GBP dips but the timing and levels are critical. The decline Tuesday brushed up against the uptrend since April and the 55-day moving average is about 100 pips lower followed by the 100-dma and May low, which are both near 1.4340.

For the month of month of May, the US dollar was easily the top performer, followed by the pound in a sign of the waning Brexit hopes. The Australian and Canadian dollars were the laggards.

At 0100 GMT, it's the official China manufacturing PMI. No one ever really knows exactly how the Chinese economy is doing but worries have ebbed in the past two months. They could flare up quickly on a soft reading. The consensus is 50.0 and the Caixin reading is due 45 minutes later and is expected at 49.2.

The big release of the day is at 0130 GMT with Australian GDP. The consensus is for a solid 0.8% q/q rise, but markets have likely adjusted higher since yesterday's very strong export figures in the current account report. It may take a reading as high as 1.0% to get AUD moving (and send the RBA to the sidelines).

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI (MAY) | |||

| 49.3 | 50.9 | 50.4 | May 31 13:45 |

Euro Thoughts, CFTC Positioning

The euro is in the midst of testing the 200-day moving average and the uptrend since December. On Monday, it got some help from Germany and France. German HICP rose 0.4% m/m in May compared to 0.3% expected. That took the country out of deflation in year-over-year terms. France reported Q1 GDP at 0.6% q/q compared to the 0.5% consensus. Better investment was behind the beat.

Overall, they're two small improvements but the ECB has placed itself firmly in a wait-and-see mode. The progress in the right direction will be welcomed and is likely to be cheered in Draghi's press conference after the ECB decision on Thursday.

The five-cent drop in the euro this month may partly reverse if nearby support holds. The ebb and flow of economic data will be critical beginning with French CPI Tuesday but also with the wave of data due from the US this week.

The yen started the week softly after the official announcement of the consumption tax delay. It was well-telegraphed so that wasn't likely to have been the reason but it does push Japan further towards the fiscal abyss and closer to monetization.

There have been some good recent signs in economic data and Abe will hope that continues at 2330 GMT with Japanese household spending and industrial production. Japanese data has been all over the place lately, including strong GDP, trade and machine orders numbers. Jobs data is due as well but it's not a market mover in Japan.

At 0130 GMT the focus shifts to Australian building approvals The Aussie housing machine is slowing with approvals expected down 6.7% y/y. It's not a big market mover but AUD traders are unsure when the RBA will cut and this could add a small bias.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -38K vs -23K prior

JPY +22K vs +59K prior

GBP -33K vs -38K prior

CHF +4K vs +4K prior

AUD +0.1K vs +25K prior

CAD +20K vs +23K prior

NZD +4.6K vs +7K prior

What stands out is how quickly positioning has shifted in favor of the US dollar. That makes sense given the news flow but the magnitude of the market move doesn't match the aggressiveness of speculative buying. That's a recipe for disappointment.

We've been carefully and cautiously expecting US dollar strength since the FOMC Minutes and, evidently, the speculative market has been as well. Yellen put more gasoline on the fire with a hawkish speech Friday and yet the dollar hasn't really gathered momentum. We remain patient but ignoring the dollar's tepid reaction for too long would be unwise.