Intraday Market Thoughts Archives

Displaying results for week of Aug 29, 2021NFP will Put the Fed in a Bind

Wednesday's big ADP miss sparked jitters that continues Thursday and a slump in the US dollar. Some are also citing Homebase hiring data showing a drop in August for forecasts that non-farm payrolls could be 300-400K – far below the 750K consensus.

Others point to a surge in hiring intentions in the National Federation for Independent Business sentiment survey.

One usually solid NFP preview won't be delivered in time this month. The ISM services employment component often offers clues but it will be released 90 minutes after the jobs report. Even with the late release, it will serve as an important confirmation point and another look at the US economy.

In terms of trading strategy, a soft non-farm payrolls would disrupt chances of a taper signal at the Sept FOMC. The problem beyond that is there is no October Fed meeting and the November 2 Fed decision comes before the Nov 5 release of the October jobs report. So if today's NFP is soft, the Fed will only get one more number before the November FOMC, meaning there's a good chance at soft reading would rule out a Sept taper hint and a November taper announcement, pushing it all the way to December.

In addition, the signs of weakness in the US economy are mounting. The Atlanta Fed GDP tracker tumbled to 3.7% from 5.3% on Thursday. Morgan Stanley also slashed its Q3 GDP forecast to 2.9% from 5.3% and, importantly, didn't see any give-back in Q4. A key catalyst for both is that bottlenecks are leading to production slowdowns along with weaker sales to consumers, particularly in autos.

Add in generally crowded US dollar longs and there's a risk of a squeeze on Friday. At the same time, we suspect the dollar slide in the past two days has been position squaring. A +1m jobs report would reinvigorate Sept taper talk and the dollar. Ashraf sees EURUSD near 1.2050 in the short-term.Weak Dollar Awaits Jobs Rescue

The ADP employment report showed the US adding just 374K jobs in August compared to 640K expected. That was compounded by the employment component of the ISM manufacturing report falling below 50.

The pandemic-era history of the ADP report and the small size of manufacturing employment in the US make both metrics questionable but they underscored the market's focus on jobs at the moment. The dollar fell 30-40 pips across the board on the data in only a small preview of the decline should non-farm payrolls match the miss.

Another spot to watch is the weekly US natural gas storage report, which is expected to show a build of 20 bcf. Last week's surprise miss helped to send gas prices into high gear in the US and into overdrive in Europe and Asia. The base case for global central banks is that the flattening of energy prices flattens out inflation but natural gas – which is critical in home heating and energy generation – could add another front to watch on prices; and one that could present a big headache for politicians and central bankers. Moreover, this is not traditionally the peak of natural gas prices for the year with every recent seasonal spike coming in the cold months. So expect to hear much more about NG and LNG in the months ahead.Consumer Questions & Crucial Monthly Close

US consumer confidence fell to the lowest since February on Tuesday in a move that surprised economists and some market participants but not us. As we highlighted on Monday, drops in the index are highly correlated with the University of Michigan survey and that's precisely what happened. Confidence fell to 113.8 from 129.1; much lower than the 124.0 consensus.

The miss weighed on the dollar initially but month-end flows led to broad USD buying into the London fix.

In the days ahead, fixing demand will be long gone but questions about the consumer are only beginning. The assumption rate coming out of the pandemic was that a high savings rate and healthy consumer balance sheets would lead to a spending spree but higher prices due to bottlenecks are keeping people from buying cars and now covid is crimping demand again.

That paradigm could materially slow H2 growth and keep the Fed off balance. At some point it will weigh more heavily on the dollar but the timing on that trade is elusive.

For now, the market is focused on employment and inflation. We'll get two inputs on that Wednesday with the release of ADP employment and ISM manufacturing. The current focus on jobs will make ADP the highlight (despite its flaws) but the prices paid component of the manufacturing survey could also resonate.Live Price Reaction to US data ردة فعل السوق بعد البيانات الأميركية

Watch Gold & EUR Now

Monday's trade mostly featured consolidation with most currencies largely unchanged. A large and persistent bid entered into EUR/CHF at the start of European trading in what was likely the SNB taking advantage of less liquidity to push the price higher.

Fundamentally, the US pending home sales and Dallas Fed manufacturing reports both missed estimates. The comments in the Dallas report were notable for a shift away from labor shortages and towards more worry about supply chain bottlenecks and raw materials shortages.

In the bigger picture, there's a growing pattern of soft US economic data that the market is reluctant to recognize. We're likely to get another example on Tuesday in the 1400 GMT release of US consumer confidence.

While the Fed is focused on inflation and jobs, it's the consumer that drives the US economy and recent indications show softness. Moreover, mobility data and airline bookings are showing stalled pandemic progress or weakness. With the eviction moratorium over and jobless benefits expiring this week, is the market and Fed focused on the wrong thing?

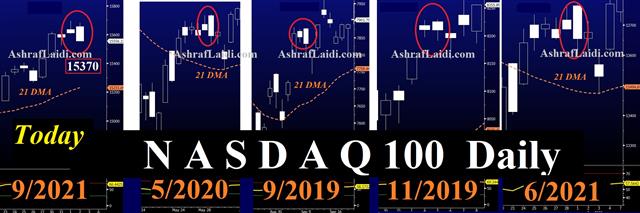

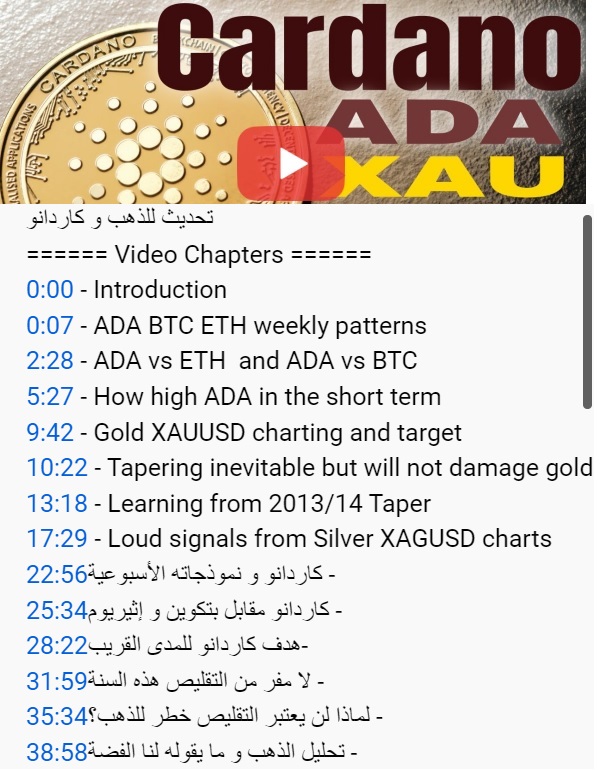

Ashraf's video offers a compelling setup in what could be a wake-up call for the market. WIll he be right? Let's see/watch.Today's Trading Opportunityفرصة تداول اليوم

Dollar Slumps on New Taper Message

A series of Fed speakers ahead of Powell highlighted various cases for tapering soon and at varying paces, but the Chair offered little. He said that at the most-recent FOMC meeting on July 27-28 he was of the view that the taper should start this year. Since then, he noted there was a strong jobs report but also the further spread of the delta variant. Without expanding on the relative weight of either of those factors, he said they will be carefully assessing incoming data.

The message the market took from that is to keep a close eye on economic data – especially this Friday's non-farm payrolls report --- but that even a strong report wouldn't lead to a Sept taper announcement.

The US dollar slumped 40-80 pips across the board, with the heaviest losses against the commodity currencies as US equities rallied 0.9% to fresh records.

The market now will shift to a hyper-focus on a Nov or Dec taper (there is no Oct meeting) but a one month difference is negligible in the larger scheme. What's longer-lasting is that Powell and the FOMC are in no reason to hike. He again highlighted that inflation should be transitory, noting that durable goods and energy together have added 1.8 pp to year-over-year inflation – factors that should level off or contribute disinflation later.

For the week ahead, it's a busy one leading up to non-farm payrolls but starts with a quiet US calendar featuring only pending home sales at 1400 GMT.