NFP will Put the Fed in a Bind

Wednesday's big ADP miss sparked jitters that continues Thursday and a slump in the US dollar. Some are also citing Homebase hiring data showing a drop in August for forecasts that non-farm payrolls could be 300-400K – far below the 750K consensus.

Others point to a surge in hiring intentions in the National Federation for Independent Business sentiment survey.

One usually solid NFP preview won't be delivered in time this month. The ISM services employment component often offers clues but it will be released 90 minutes after the jobs report. Even with the late release, it will serve as an important confirmation point and another look at the US economy.

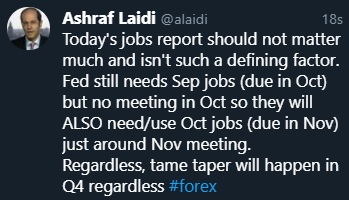

In terms of trading strategy, a soft non-farm payrolls would disrupt chances of a taper signal at the Sept FOMC. The problem beyond that is there is no October Fed meeting and the November 2 Fed decision comes before the Nov 5 release of the October jobs report. So if today's NFP is soft, the Fed will only get one more number before the November FOMC, meaning there's a good chance at soft reading would rule out a Sept taper hint and a November taper announcement, pushing it all the way to December.

In addition, the signs of weakness in the US economy are mounting. The Atlanta Fed GDP tracker tumbled to 3.7% from 5.3% on Thursday. Morgan Stanley also slashed its Q3 GDP forecast to 2.9% from 5.3% and, importantly, didn't see any give-back in Q4. A key catalyst for both is that bottlenecks are leading to production slowdowns along with weaker sales to consumers, particularly in autos.

Add in generally crowded US dollar longs and there's a risk of a squeeze on Friday. At the same time, we suspect the dollar slide in the past two days has been position squaring. A +1m jobs report would reinvigorate Sept taper talk and the dollar. Ashraf sees EURUSD near 1.2050 in the short-term.Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46