Intraday Market Thoughts Archives

Displaying results for week of Jul 03, 2016Oil Drops ahead of NFP

Solid ADP and initial jobless claims were more evidence of a solid US economy ahead of Friday's non-farm payrolls report. The New Zealand dollar was the top performer while the Australian dollar lagged. We take a closer look at oil after it crashed to the lowest since May 11. Ahead of Friday's US jobs report, a new Premium trade has been issued in a global equity index, bringing the number of open trades to ; 5 in FX, 1 commodity and 2 equity indices.

The New Zealand dollar jumped early in the day after RBNZ Deputy Spencer said further rate cuts could pose a risk to financial stability. What he meant specifically, was the red-hot New Zealand housing market. He qualified that by saying that ultimately CPI will determine interest rates but the market had priced in a 65% chance of an OCR cut next month and that's now very-much in doubt.

The US outlook is also complicated. The Fed is certainly in wait-and-see mode but the hawks are already beginning to stir. Mester highlighted signs of wage inflation Thursday.

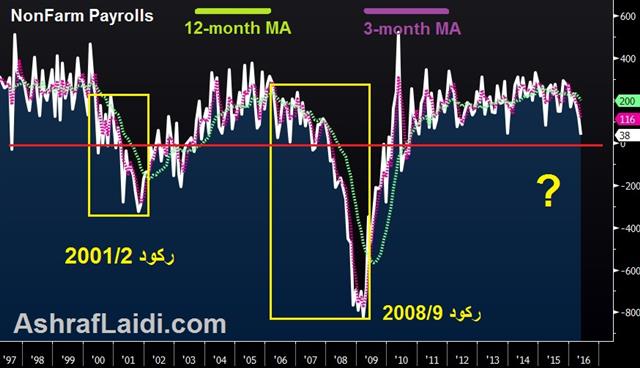

The pre-non-farm payrolls numbers have been solid. ISM non-manufacturing employment was upbeat Wednesday and today ADP employment rose 172K compared to 160K expected. Initial jobless claims fell to 254K from 268K; that's the best since April.

The May jobs report spooked the Fed but there has been virtually no confirmation of a sharp slowdown in US activity since. A Fed hike isn't priced in until Feb 2019 and although we see a hike in the foreseeable horizon as highly unlikely, the market (and the Fed) could dabble with a renewed hawkish bias in the months ahead.

Perhaps the most notable technical move Thursday was in oil as WTI broke below a triple bottom at $45.80. The trigger was bearish inventory data but also note the weak seasonals in H2. There have been a series of lower highs in oil for the past month and oversupply continues.

In the short term, the next items on the agenda are from Japan. At 2350 GMT, May current account numbers are due. Ten minutes later, the focus shifts to labor cash earnings but expectations for a pickup in wage gains are low, with economists looking for only a 0.5% y/y gain in May

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change (JUN) | |||

| 172K | 152K | 168K | Jul 07 12:15 |

| Challenger Job Cuts (JUN) | |||

| -14.0% | -26.5% | Jul 07 11:30 | |

| Initial Jobless Claims (AUG 02) | |||

| 254K | 268K | 270K | Jul 07 12:30 |

| Continuing Jobless Claims (JUL 25) | |||

| 2124K | 2168K | Jul 07 12:30 | |

Here's Ashraf in Madrid

Please find below Ashraf's presentation at last month's ForexDay event in Madrid.

The Trembling and the Trend

What's changed? That's the question traders are asking themselves in the post-Brexit world and answers are proving tough in some cases and clear in others. That's left some markets trending and others bouncing around; we celebrate the signal from the noise. One Premium trade is +300 pips and another in +210 pips in the green, both of which remain open. There are 7 trades currently in progress.

فيديو هذا الأسبوع - عادة مفتوح للمشتركين - مفتوح للجمهور فقط لهذا الأسبوع. عيد مبارك.

3 more UK property funds suspend trading

Three more UK property funds froze withdrawals by investors, namely, Henderson, Columbia and Canada Life, following the decision yesterday by Aviva, Standard Life and M&G to freeze a 1/3 of the £21 bn market. On Wednesday the Australian dollar was the top performer despite a slump in Asia-Pacific trading. The pound lagged again but stabilized and climbed higher after a sharp selloff early in the day.The main theme in US trading was a turnaround in stocks, oil, and most US dollar trades. What's increasingly clear is that the market is struggling to identify a playbook for the post-Brexit trade.

The strongest signal is in the pound, inarguably. It tumbled on the vote and has continued to slide because the UK-centric risks. The other somewhat-definitive signal is in bonds as global yields press to ever-lower lows on the idea that more QE is likely everywhere before any meaningful rate hikes.

Elsewhere, the picture is muddied. Commodity currencies were damaged by the fresh global risks from Brexit but have rebounded on dovish central banks and the potential for higher government spending. Stock markets are struggling with the same debate.

The bias in yen crosses has been lower but the BOJ is always in the back of the mind of traders. The last round of BOJ easing failed to boost yen crosses but they've proven to a relentless adversary declines that's always prepared to surprise.

So where does that leave us? The sentiment swings in outside of bonds and sterling make for challenging trades. Fundamental newsflow is largely noise as the market struggles with the bigger questions.

Ultimately, new themes and trends will develop but in the meantime uncertainty will remain high and it will be dangerous to fall in love with any trade.

In the short term, the Asia-Pacific calendar is light but we will tune into comments from the BOJ's Kuroda at 0030 GMT for any hints on what's coming next.

Cable crashes to $1.3000

Brexit fears ramped up as liquidity returned to markets Tuesday and the British pound tumbled to $1.30. The yen was the top performer while GBP lagged. The Asia-Pacific calendar is light. In the Premium trades, a short AUDJPY was opened last night 1 hour ahead of the RBA decision (trade remains open), followed by another trade in a major equity index.

Cable sank more than 250 pips on Tuesday as it broke the post-Brexit low and touched 1.30 for the first time since 1985. There was no headline behind the selling. The UK services PMI data was a touch better than expected but Carney encouraged British banks to lend while the 3 leading property funds in the UK froze $12 bn worth of redemptions. Those events led to a bump in cable to near 1.32 from 1.31 but ultimately the downside prevailed and cable touched 1.3000 at the low.

The market continues to digest the Brexit vote and evaluate what will happen next. The first round of Conservative leadership voting took place and two candidates dropped out. Theresa May has what looks like a commanding lead. Once the race is down to two candidates – likely May and Andrea Leadsom – party members will vote by mail.

In the meantime, sentiment is deteriorating. Flows and holidays have skewed trading so far in July and today was the first real look at underlying momentum. Commodity currencies, GBP and stock markets suffered but the most noteworthy move might have been in bonds.

Treasuries, gilts and bund yields all hit record lows at various spots on the curve. The market is screaming that central banks will be forced hold rates down. The old mantra of 'lower for longer' has been replaced by 'never forever' regarding hikes.

The Fed's Dudley said it was still early to evaluate the Brexit vote but argued for patience on interest rates. Williams was more hawkish but it's clear that the core of the FOMC is in no hurry to hike. Soft factor orders underscored the point at -1.0% compared to -0.8% expected.

A final spot to watch is oil. Crude has been consolidating for the past month but a 5% decline on Tuesday knocked it close to the lower end of the range. A breakdown would give USD/CAD a fresh boost and signal new concerns about the strength of the global economy.

Eid Saeed to our Muslim readers as three days of holidays begin to celebrate the end of Ramadan.

RBA Has a Tough Decision

The RBA is forced to weigh election uncertainty and the Brexit vote in today's decision. Trading was thinned by the US holiday on Monday but the commodity currencies rallied. Aussie retail sales and services PMIs from Japan and China are due ahead of the RBA decision. EURAUD Premium was stopped out at 1.48. A new trade in AUD will be issued ahead of the RBA decision, which is due at 4:30 GMT, 5:30 London time.

The Australian dollar has rallied in five consecutive sessions ahead of Stevens at 0430 GMT today. The OIS market priced as much as a 40% chance of a cut in the post-referendum fears but that has dwindled to 8.5%.

However, Stevens has the opportunity to surprise given the Brexit volatility and election uncertainty. Vote counting restarts today but a hung parliament remains the most likely outcome.

If the RBA doesn't move today, the market will be looking for signals about August. At the moment, OIS prices in a 53% chance of an Aug cut.

If that's to be the case, Stevens may want add in some guidance into the statement. The current language doesn't offer any clear hints about what the RBA plans to do next. The one factor that's likely to prompt a move is inflation, which the statement describes as 'quite low'.

The argument for continuing a wait-and-see stance is that economic data has been solid. The latest employment report was okay with 18K new jobs and 5.7% unemployment and credit continues to expand. The latest numbers on inflation expectations also rose and yesterday's MI inflation measure rose to 1.5% y/y from 1.0%.

Two final pieces of economic data arrived at 0130 GMT with May trade balance and retail sales. Those probably won't prove pivotal for the decision but they are certain to influence the guidance.

Technically, AUD/USD is in the middle of its three-month range but at levels the RBA has consistently frowned upon.

Overall, look for the RBA to maintain a wait and see stance but leave the door open to an August cut. It's early days in the post-election/post-Brexit world and they will want to assess further before acting.

Other data to watch includes the 0145 GMT Caixin China services PMI. It was previously at 51.2. Fifteen minutes later the Nikkei Japan services PMI is due. It was at 50.4 in June.

Aussie Hung Up on Election, Silver Breaks $21

The possibility of a hung parliament is weighing on the Australian dollar in early-week trading. The New Zealand dollar was the top performer last week while sterling lagged. Weekly CFTC positioning data showed GBP shorts heading for the exits. On Friday, we took a 179-pt gain in silver and opened a new trade later in the day. Silver has nor broken above the $21 level.

Malcolm Turnbull's gamble to call an early election may have backfired with his coalition possibly losing majority status. He's ahead in 66 seats but needs another 10. At the moment, the uncertainty is hurting the Australian dollar. Vote counting resumes Tuesday and final results may be unclear until the end of the week.

AUD/USD is down a third of a cent early on worries that Australia could lose its AAA-rating. The thinking is that a flimsy government is far less likely to employ fiscal discipline. In general, election worries tend to be overstated and if there is a significant fall in AUD, there will be an opportunity to buy a dip.

However, the RBA decision will be the dominant factor in the day ahead. The market is pricing in a 13% chance of a cut in Tuesday's decision. Signals about the August meeting will be key because the market is pricing in a 57% chance of lower rates then.

Perhaps the election uncertainty will give the RBA a reason to cut or be dovish. Data points to watch are Melboune Institute inflation expectations for June. The prior reading was just 1.0%. At 0130 GMT, the focus is on Australian building approvals for May; they are expected to fall 6.4% y/y.

Overall trading is likely to be thin to start the week with the US and Indonesia on holiday.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -62K vs -61K prior JPY +60K vs +52K prior GBP -43K vs -52K prior CHF +11K vs +15K prior AUD -2K vs -7K prior CAD +8K vs +3K prior NZD -3K vs -3K prior

This is the first look at post-Brexit positioning but given the volatility, the only thing it tells us is that longer-term shorts have taken profit. In the overall scheme, yen longs are increasingly comfortable.