Intraday Market Thoughts Archives

Displaying results for week of Jan 31, 2016Dollar Finds a Footing Ahead of NFP

Middling economic data persisted in the US but markets showed some signs of stabilization ahead of non-farm payrolls. The Swiss franc was the top performer while the pound lagged after the BOE. Australian retail sales are up next. In the Premium Insights, the EURUSD long was closed with a 273-pip gain, while a new GBP trade was added shortly before the BoE announcement. At this point, 5 of 6 existing trades are currently in the green.

The US dollar fell hard in early New York trading and it looked like an extension of yesterday's rout. The Dec factory orders report fell 2.9% vs 2.8% expected and it was compounded by a 0.5 pp downward revision to the prior report. Initial jobless claims were at 285K compared to 278K expected.

The high of the day in EUR/USD was immediately after the data at 1.1238 but then the dollar bleeding stopped. The euro fell back to 1.1160 before finishing at 1.1200.

The Fed's Kaplan underscored the recent tentative tone, saying the Fed wants to normalize but it can't be forced. He also fretted about tightening financial conditions. The dollar barely recovered against the yen throughout the day but it made progress against CAD, climbing 100 pips from the lows. It was aided by a 59-cent drop in oil despite the usual OPEC jawboning and headlines about Syria.

The pound was extremely volatile. It fell hard on the 9-0 vote to hold rates as McCafferty abandoned his hawkish stance. It soon recovered as Carney talked up the prospect of rate hikes (eventually) but then fell back on weaker growth forecasts.

Position squaring ahead of non-farm payrolls might have also helped the dollar, and broader markets, stabilize. The consensus is for 190K new jobs but the momentum is a bit lower with some forecasts revised lower after the weak ISM non-manufacturing report, notably Goldman taking its call to 170K from 190K.

In any case, it's tough to see how the jobs report could be a game-changer for the Fed or the market.

What may end up being a bigger factor for markets is the Australian Dec retail sales report. It's expected to rise 0.4% and will be released at the same time as the RBA Statement on Monetary Policy, which is a more detailed breakdown of the RBA thinking than the monetary policy decision.

Canadian jobs will also be released on Friday.

Earlier in the week, we floated the idea that perhaps the developed commodity bloc is a more resilient to the bust than the market believes because of 15 years of savings, ample space for fiscal stimulus and the FX moves. Friday's data will help begin to answer that question.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Nonfarm Payrolls (JAN) | |||

| 190K | 292K | Feb 05 13:30 | |

| Retail Sales (DEC) (m/m) | |||

| 0.5% | 0.4% | Feb 05 0:30 | |

| RBA Monetary Policy Statement | |||

| Feb 05 0:30 | |||

Dollar Dumped, Oil Jumps

Dovish Fed comments and a soft ISM non-manufacturing index contributed to a massive run on the US dollar Wednesday. The dollar suffered 200 pip losses on multiple fronts as commodity currencies surged. Asia-Pacific traders have a relatively quiet calendar to sort through the wreckage. In the Premium trades, GBPUSD was stopped out, while all existing 6 trades are currently in the green.

Heavy US dollar selling began when an interview with the Fed's Dudley appeared on MNI. He warned that a continued financial tightening would weigh on the FOMC in a signal they could delay hikes.

That doesn't stray far from the recent FOMC script and it shouldn't be a big surprise given Dudley's dovish bent. The dollar declines were compounded by the ISM non-manufacturing index. It was at 53.5 compared to 55.1 expected. Tellingly, the employment component slipped to a one-year low of 52.1 compared to 56.3 previously. That could spell trouble for Friday's non-farm payrolls report.

Even with that news, the scope of the US dollar selloff was a surprise. EUR/USD rallied as high as 1.1145 from 1.0900 early in the day even as German 2-year yields hit a record -0.50%.

Two things contributed to the exaggerated move. The first was the overcrowded US dollar position. It became even more one-sided after the BOJ squeezed out yen longs and has been vulnerable to softening data and weakening conditions. It may have just been today's news that was the straw that broke the camel's back.

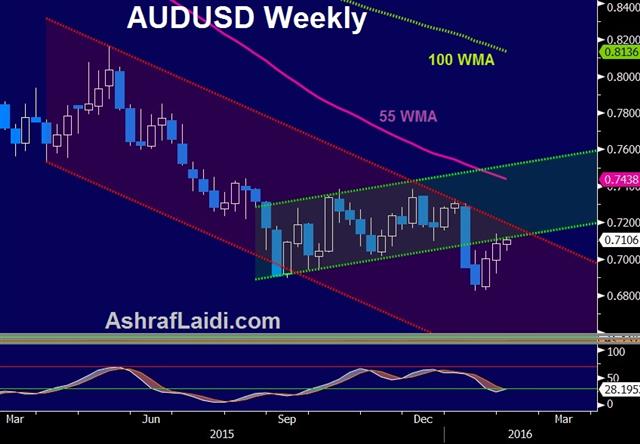

The second was technicals. EUR/USD faced a series of January highs in the 1.0980 range and a medium-term wedge. As those levels gave way, a squeeze got underway and momentum players jumped in. It was a similar story in other pairs, including AUD/USD, which traced out an impressive outside day.

Oil was a big part of the story as well. Another huge build in US supplies was overshadowed by talk of an OPEC/non-OPEC meeting and crude rallied 9% to wipe out the bulk of the declines in the previous two sessions.

We wrote yesterday about how impressed we were than CAD was hanging tough as oil slumped. It was a signal. The recovery in oil sent USD/CAD to a six-week low of 1.3760 from 1.4100 in a massive rout.

Gold once again proved to be a reliable safe haven in the thrashing sea of 2016 markets. That will add to its allure.

Is this Gold Bounce for Real?

Has the time come to buy gold, or is it another false bounce? Ever since its intermediate high of October 2012, gold descended in a long forming downtrend, interrupted by a series of five upward corrections, each lasting no more than 3 months. The yellow metal had been dragged down by a combination of eroding inflation and a raging US dollar. But as central banks become increasingly stuck at negative interest rates, and/or are unwilling to raise rates, then gold's substitute characteristic could help it higher over time. Or will it?

Despite the fresh bouts of QE from Japan in Q4 2014 and the ECB in Q1 2015, none of those currency debasing policies managed to trigger any meaningful rally in gold. Is it different this time? Will a retreat by the Fed on hiking rates in Q1 or/and Q2 be sufficient in dragging down the USD, to the extent of boosting gold?

What about gold stocks? Are they a preferable investment to bullion, or ETFs? Many strategists have offered confusing analysis about the bullion-goldbugs relationship, not clearly indicating, which leads what?

After issuing a new trade in gold to our Premium subscribers, we back up our idea with a special Premium Video, exploring: i) the lead-lag relationship between bullion and goldbugs; ii) how to use the GoldBugs ratio in assessing bullion's direction; ii) the cycle pattern of net long contracts in the Comex; and 6 other fundamental/technical forces acting on the prevailing trend. Access to the Gold Video & XAUUSD trade.

Déjà Vu All Over Again

It was Groundhog Day on Tuesday and the Bill Murray movie of the same name was a perfect description because it was a replay of theme and market moves we saw over and over again in January. The yen led the way as oil, stock markets and commodity currencies dropped. However the New Zealand dollar rebounded on a blockbuster employment report in early Asia-Pacific trading. Yesterday's Premium trade in gold was supported with technical charts and the relationship between bullion and in gold miners. A new JPY trade was added today.

فيديو العربي 59 دقيقة كاملة على البورصات، الذهب، العملات و النفط

The Fed didn't do the market any favours today as George continued to press for more hikes, although she qualified it by saying the Fed always evaluates the economic outlook. US data on car sales were a healthy sign for the consumer but those small positives could weigh a 6% decline in oil.

More energy market problems resurfaced by a second day of heavy downgrades and warnings in the oil sector from Standard & Poor's. The ratings agency cut Chevron and put the major US producers on credit watch for downgrades. More importantly, that same credit stress is hitting smaller indebted oil producers hard.

It's also hitting oil-exporting sovereigns and there is persistent talk that they will be forced to liquidate sovereign wealth fund holdings.

At the moment, the resilience in CAD remains impressive. Oil has fallen $5 from last week's highs and yen USD/CAD is just 150 pips above its lows.

What offers hope to the USD/CAD bears is something of a pattern developing in the developed-world commodity producers. In January, Poloz was upbeat on the non-commodity sector. Yesterday, Stevens was similarly positive on the outlook for the domestic economy (while expressing worries about emerging markets). Today, New Zealand announced a shocking drop in unemployment to 5.3% from 6.1% in Q4.

There is no doubt that parts of Canada, Australia and New Zealand will be hard hit by the commodity drop but we are keeping an open mind on the idea that other parts of the economy may prove resilient. That may be a factor of the exchange rate, economic flexibility or built-up savings from the 15-year commodity boom. Or it might just be a matter of time before they crack.

The next data on the agenda is Australian trade balance at 0030 GMT. It's expected at a deficit of 2.45m million but we will closely watch the breakdown of imports and exports. If exports rise, it could be a sign that a weak AUD is helping.

At 0145 GMT, the Caixin China services PMI is due for release. The prior reading was 50.2. It's not likely to be a big market mover.

Fifteen minutes later, the Japan PMI for services is out. The prior reading was 51.5.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit PMI Composite (JAN) | |||

| 53.7 | Feb 03 14:45 | ||

| Markit Services PMI (JAN) | |||

| 53.7 | Feb 03 14:45 | ||

| ISM Non-Manufacturing PMI (JAN) | |||

| 55.1 | 55.3 | Feb 03 15:00 | |

| PMI (JAN) | |||

| 50.5 | 50.2 | Feb 03 1:45 | |

Cable Jumps, Fischer Backtracks, RBA Next

The Fed has suddenly rediscovered its data dependency as part of a slow walk-down from a March hike. The pound leaped higher on Monday while the US dollar lagged. The Australian dollar now moves into focus with the RBA up next. The Premium Insights issued a new trade in gold, with 8 technical and fundamental reasons supported by 3 charts.

The Fed won't hike in March so officials are now working to re-establish credibility. Officials have suddenly rediscovered data dependency, which was something that didn't seem to matter when inflation was low and commodities falling in the weeks leading up to the December FOMC.

Less than a month ago the Fed's Fischer was talking about 'something in the ballpark' of four hikes this year. On Monday he said hiking four times was just one number that has been bandied about. He said inflation might be lower and that the Fed is data dependent.

It wasn't overtly dovish but the market senses the shift in rhetoric that will continue at next week's Humphrey Hawkins. The result was a broad slump in the US dollar.

Cable took advantage in a rally as high as 1.4448. That's nearly 300 pips from the low late on Friday and breaks above a recent series of highs to the best level in two weeks.

Most surprising was the Canadian dollar as it gained a half cent despite a 6% drop in oil prices. Flows may have been a factor to start the month because that divergence can't continue.

The commodity currency in focus in the hours ahead is the Australian dollar with the RBA due at 0330 GMT. Expectations for a change in policy are very low so the focus will be on rhetoric. Jobs growth and business sentiment have been resilient, as has the domestic economy on the whole. Stevens likely wants to preserve a dovish outlook, so expect him to emphasize risks from abroad. That likely won't be enough to hurt the Australian dollar and if he takes a more constructive outlook, AUD could rally.

Yen Extends Slump, China PMI Next

Risk trades roared right into the finish on Friday. The upbeat mood continued early in the week with dollar leading and yen lower. Chinese purchasing manager's indexes are due later. Back in early November, Ashraf alerted clients how the S&P500 and FTSE100 displayed highly similar technical developments to those in early May 2008, alerting that the November bounce would be temporary before further losses ensued. Indeed, the Santa rally of December 2015 proved temporary before the damage unravelled in January. On Friday, Ashraf issued a new set of charts, highlighting a crucial parallel, supported by 4 technical elements. The details are available to Premium susbcribers here.

USD/JPY tacked on another quarter-cent of gains in early trading after surging on Kuroda. The BoJ helped to spark the broad risk trade as well and the S&P 500 surged 47 points Friday.

The move may have been overstated by portfolio rebalancing as index trackers were forced to sell bonds and buy stocks to keep allocations balanced after the January rout in stocks.

What could keep the rebound going is dovish rhetoric from the Fed. Kaplan emphasized patience in comments Friday and said it was significant that the FOMC removed the reference to 'balanced' risks in the statement. Williams said he sees rate hikes a 'smidgen' slower. On Tuesday, Fischer speaks in what might offer a hint at what the core of the Fed believes.

The immediate focus is on China in the last week of trading before lunar new year holidays. At 0100 GMT, the official manufacturing and non-manufacturing PMIs are due. The manufacturing one is expected to slip to 49.6 from 49.7. A check on it comes 45 minutes later with Caixin manufacturing PMI. It's expected at 48.1 from 48.2.

An event to watch later in the day is a speech from Draghi at 1600 GMT. There are murmurs that pockets of the ECB are upset with the near-commitment to fresh stimulus in March. If he appears to backtrack, the euro could rally.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -127K vs -137K prior JPY +50K vs +38K prior GBP -47K vs -39K prior AUD -33K vs -36K prior CAD -67K vs -66K prior NZD -5K vs -3K prior

The yen not long underscored the wisdom of a surprise rate cut from Kuroda. The 250 pip rally Friday left virtually every spec short underwater and will leave traders wary against buying yen...for now.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (JAN) | |||

| 52.7 | 52.7 | Feb 01 14:45 | |

| ISM Manufacturing PMI (JAN) | |||

| 48.5 | 48.2 | Feb 01 15:00 | |

| PMI (JAN) | |||

| 49.6 | 49.7 | Feb 01 1:00 | |

| PMI (JAN) | |||

| 54.4 | Feb 01 1:00 | ||

| PMI (JAN) | |||

| 48.0 | 48.2 | Feb 01 1:45 | |

| Eurozone Markit PMI Manufacturing (JAN) | |||

| 52.3 | 52.3 | Feb 01 9:00 | |

| Fed's Stanley Fischer speech | |||

| Feb 01 18:00 | |||

| Eurozone ECB President Draghi's Speech | |||

| Feb 01 16:00 | |||