Intraday Market Thoughts Archives

Displaying results for week of May 31, 2015NFP jump, yields follow, stocks watch

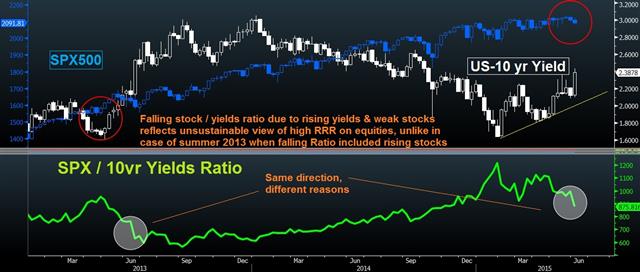

Bond bulls and USD bears find little to argue about in today's predominantly strong US jobs report, showing a 280K rise in May NFP (highest in five months), accompanied by a 21-month high in average hourly earnings (2.3% y/y). The rise in the unemployment rate to 5.5% from 5.4% was appeased by rise in the participation rate. The report bolsters the case for a Fed September rate hike, but the fact that the will be three more jobs report before Sep FOMC with inevitable erosion in the Treasury market, suggests Fed speakers will fill the airwaves with the message of an ultra-slow pace of rate hikes until liftoff becomes discounted to the extent of becoming a significant sell-of-the-fact. The charts below show the continued decline in the Stocks/Yields ratio, resulting from rising yields and falling stocks, which is more disconcerting development than in the May-June 2013 episode, when the ratio was dragged by a rise in both (yet faster pace for yields). Next week's US May retail sales report would be a crucial addition to USD sentiment if meeting expectations, but faster gains in yields towards the 2.60% resistance will continue to draw attention for the wrong reasons as long as Fed's core PCE price index doesn't play along.

New Premium trades for today were issued on EURUSD and EURCAD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Average Hourly Earnings (MAY) (m/m) | |||

| 0.3% | 0.2% | 0.1% | Jun 05 12:30 |

| Average Hourly Earnings (MAY) (y/y) | |||

| 2.3% | 2.2% | 2.2% | Jun 05 12:30 |

| Unemployment Rate (MAY) | |||

| 5.5% | 5.4% | 5.4% | Jun 05 12:30 |

Leaving CI إعلان

After three years with City Index and FX Solutions, I'm happy to announce that I will revert to my full-time role with Intermarket Strategy Ltd, where I will focus on trading and strategy. With regards to TV interviews, they will be done via the relevant TV studios in London and elsewhere. All strategy pieces and Premium trades will originate exclusively from AshrafLaidi.com.

بعد ثلاث سنوات مع سيتي اندكس و اف اكس سلوشنز، يسعدني أن أعلن أنني سأعود إلى شركتي انترماركت ستراستجي، حيث سأتخصص في تداول الأسواق و إدارة التحليلات الاستراتيجية. كل مقالاتي و توصياتي ستنشر في موقعي حصريآ.

Euro Finally Stalls, Greece Raises the Stakes

The euro squeeze hit 1.1380 before it finally stalled but then closed near the lows and continued down to 1.1214 in early Asia-Pacific trading. That came despite yet another compression in the spread of Treasuries over Bunds.

The catalyst for the most-recent 50 pips lower in EUR/USD has been increasing murmurs about trouble in Greece. As recently as yesterday, Greece had promised to pay a €312m loan due to the IMF on Friday. That changed late Thursday as Athens asked to skip the payment and instead pay at the end of the month.

What does it mean? It's beginning to look like a game of chicken. Greece may be saying that it will preserve what's left of its war chest if talks don't improve and default. An unnamed EU official cited by Reuters afterwards said it was “not a good sign” and that “it will be difficult from here”. That leaves the euro in a vulnerable place.

The day ahead will be massive in terms of news and data. Not only are EU leaders meeting (without Greece) in Berlin, but the OPEC decision is also due along with US and Canadian jobs reports.

Market participants will have a chance to digest and prepare during a relatively light Asia-Pacific session. The highlights are The Australian AiG performance of construction index and Japanese leading indicators but both rarely move markets.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Leading Economic Index (APR) [P] | |||

| 106 | Jun 05 5:00 | ||

| AiG Performance of Construction Index (MAY) | |||

| 47 | Jun 04 23:30 | ||

German-US Spread Breakout to 4-mth High

While bond yields rally across the board, Germany's 10-year bund yields lead the pack in the G10 world, breaking 0.95% and narrowing the gap with their US counterpart to the smallest level in four months. As the extended rally in German-US spread moves in tandem with EURUSD nearing the 1.1470 resistance, the relation is likely to be prolonged by further upgrades in German growth by the Bundesbank (tomorrow), faster rise in Eurozone inflation relative to US and a high bar of expectations in Friday's US jobs report (NFP, UnempRate, AHE). All this justifies our decision to go long EURAUD and EURCAD in the Premium trades of the past 6 days. EURAUD entry at 1.4290 hit its 1.4560 target, while EURCAD entry at 1.3820 remains in progress w/ +270 pips so far.

USDX Index illustrating a clear case of Lower Highs (March 13, April 13 & May 27). Today, USDX closed below the 50 and 10 DMA (on the same day)

Tuesday's EURUSD 2.0% rise was the biggest percentage gain since March 18, but the main difference is that March 18 did not witness a rally in German 10-year bund yields (+30%) as back then. In fact, bund yields fell on March 18. The next biggest percentage daily drop in EURUSD before March 18 was on October 27, 2011, when ECB/EU/ IMF were ironing an agreement for Italy and Greece.

This week's bund yield rally erased TWELVE days of losses, suggesting the current s EURUSD gain is as much as it was a case of Eurozone data optimism (inflation differentials narrowing relative to the US) as it was a case of USD pessimism.

The USD side of things was highlighted by: i) US factory orders falling in 8 out of the last 12 months; ii) surprisingly dovish comments from Fed board governor Brainard on USD impact and soft US growth; iii) confluence of crucial factors (AUD/USD breaking out of its 2 week channel; iv) USD/JPY dropping more than 100 pips from psychological 125; v) GBPUSD bottoming at 50-10 DMA confluence.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Germany Factory Orders s.a. (APR) (m/m) | |||

| 0.5% | 0.9% | Jun 05 6:00 | |

| Germany Factory Orders n.s.a. (APR) (y/y) | |||

| 1.9% | Jun 05 6:00 | ||

Euro Soars in Bond Rout 2.0

The euro was in focus for Greece and the ECB decision but it was the Bund market that stole the show. The run on Bunds started Tuesday but stalled ahead of the ECB's decision. Expectations for action or meaningful rhetoric from Draghi were low but when he didn't deliver any dovish surprises, it was a greenlight for Bund sellers.

On the day, Bund yields rose 17 basis points to 0.88% -- the highest since October. The euro had a hiccup down to 1.1080 after Draghi expressed some disappointment in growth but as he blamed it on emerging markets the euro bounced back and then shot to 1.1285 and finished close to the highs of the day.

US economic data was mixed. ADP employment at 201K and virtually in line with estimates. The ISM non-manufacturing index disappointed at 55.7 compared to 57.0 expected but it's still well into expansionary territory. In any case, EUR/USD buying once again spilled over into broad US dollar selling leading to a retreat to 124.00 in USD/JPY from 124.60 and a complete retracement from earlier cable declines.

There remains a focus on Greece and Schaeuble said optimism about a deal is unjustified but at some point a squeeze like the Bund takes on a life of its own and becomes very difficult to fade.

In the short-term the focus may shift to Australian where the Aussie is in the midst of a two-day winning streak after the RBA and upbeat GDP numbers. Today's challenges are at 0130 GMT with the release of trade balance and retail sales. The latter is the main highlight and expected to rise 0.3%.

AUD/USD didn't participate in the NY squeeze on the US dollar but strong data may give it fresh life.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (APR) (m/m) | |||

| 0.4% | 0.3% | Jun 04 1:30 | |

| Eurozone Retail Sales (APR) (m/m) | |||

| 0.7% | 0.6% | -0.6% | Jun 03 9:00 |

| Eurozone Retail Sales (APR) (y/y) | |||

| 2.2% | 2.0% | 1.7% | Jun 03 9:00 |

| ADP Employment Change (MAY) | |||

| 201K | 200K | 169K | Jun 03 12:15 |

| ISM Non-Manufacutring Composite (MAY) | |||

| 55.7 | 57.0 | 57.8 | Jun 03 14:00 |

| Gross Domestic Product (1Q) (q/q) | |||

| 0.9% | 0.7% | 0.5% | Jun 03 1:30 |

| Gross Domestic Product (1Q) (y/y) | |||

| 2.3% | 2.1% | 2.4% | Jun 03 1:30 |

| Trade Balance (APR) | |||

| -$40.9B | -$44.0B | -$50.6B | Jun 03 12:30 |

| Trade Balance (APR) | |||

| -2,250M | -1,322M | Jun 04 1:30 | |

| Eurozone Unemployment Rate (APR) | |||

| 11.1% | 11.2% | 11.2% | Jun 03 9:00 |

Why the Dollar Dived

We look at three reason why the US dollar was battered on Tuesday and what it means. USD fell at least 0.5% right across the board while the Australian dollar led the way. A busy day is upcoming in Asia-Pacific trading, including Australian GDP. Ashraf's Premium Insights issued a new EUR-specific trade 3 mins ago with 2 rare charts, adding it to the long EURAUD, which is currently +110 pips in the green.

The catalyst for the initial move was the euro. Eurozone CPI was higher than expected but Greece was the main driver. Murmurs about a deal were abundant and that set off the squeeze a EUR/USD that caused so much dollar selling that it spread to other dollar pairs and began to feed on itself.

The reality of the Greek situation was much less clear. Greece and Eurozone creditors submitted competing proposals to each other and reports suggest a wide gulf remains. Dijsselbloem said creditors were 'still far from a deal' but the market believes otherwise.

The second reason for USD weakness – and the reason it turned into a rout – was positioning. The kind of we saw Tuesday is only possible on highly-unexpected news or when one side of the trade is overcrowded. CFTC positioning numbers have underscored the infatuation with USD and the recent one-way gains in the US dollar turned a crowded trade into an overcrowded one.

The final reason was a speech from Fed Governor Brainard. It's her first speech to touch on how she feels about the economy and monetary policy and it was abundantly clear that she's dovish. She fretted about consumer spending, exports, foreign demand and said the slowdown may be more significant than expected.

Despite the large moves in the dollar, it's no reason to change underlying views. The risk of a squeeze is ever-present in a trend and it's a reminder to manage risk. It comes down to economic data and perhaps the most-important news on the day was a strong report on US May autosales.

The focus will remain on economic data in the hours ahead. The main release is at 0030 GMT when Australia releases Q1 GDP data. The consensus is for 0.7% q/q growth. Estimates moved up in the past few days but it may just be a shift in timelines as capex intentions are falling. Fade moves on GDP, which is already 2 months old. At the same time, the BOJ's Shirai holds a speech.

Other data includes the Japanese Markit services PMI and HSBC China services PMI.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Net Exports of GDP (1Q) | |||

| 0.5 | 0.0 | 0.7 | Jun 02 1:30 |

| Gross Domestic Product (Q1) (q/q) | |||

| 0.7% | 0.5% | Jun 03 1:30 | |

| Gross Domestic Product (Q1) (y/y) | |||

| 2.1% | 2.5% | Jun 03 1:30 | |

| Eurozone CPI Estimate (MAY) (y/y) | |||

| 0.3% | 0.2% | 0.0% | Jun 02 9:00 |

| Eurozone CPI - Core (MAY) (y/y) [P] | |||

| 0.9% | 0.7% | 0.6% | Jun 02 9:00 |

| Fed's Evans Speech | |||

| Jun 03 18:15 | |||

| Markit PMI Composite (MAY) | |||

| 56.1 | Jun 03 13:45 | ||

| Markit Services PMI (MAY) | |||

| 56.5 | 56.4 | Jun 03 13:45 | |

| ISM Non-Manufacturing PMI (MAY) | |||

| 57.0 | 57.8 | Jun 03 14:00 | |

| Markit Services PMI (MAY) | |||

| 51.3 | Jun 03 1:35 | ||

| PMI (MAY) | |||

| 52.9 | Jun 03 1:45 | ||

| Eurozone Markit PMI Composite (MAY) | |||

| 53.4 | 53.4 | Jun 03 7:45 | |

| Eurozone Markit Services PMI (MAY) | |||

| 53.3 | 53.3 | Jun 03 8:00 | |

Euro powers on data flow vs stock

Without the help of special effects or Greece rumours, it was the perfect storm of inflation-positive German and Eurozone inflation and German unemployment, which lifted 10-yr German bund yields by 30% to 0.67% today. The yields breakout above the 2-week trendline implies a possible extension towards 0.77%. Full charts & analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Spanish Unemployment Change | |||

| -118.0K | -115.4K | -118.9K | Jun 02 7:00 |

| Germany Unemployment Change (MAY) | |||

| -6K | -10K | -9K | Jun 02 7:55 |

| Germany Unemployment Rate s.a. (MAY) | |||

| 6.4% | 6.4% | 6.4% | Jun 02 7:55 |

| Eurozone Unemployment Rate (MAY) | |||

| 11.2% | 11.3% | Jun 03 9:00 | |

USD/JPY Breaks Higher, RBA Up Next

The market proved that it's hungry for good US dollar news once again as it rallied hard on positive news and had only a shallow dip on negative news. The dollar was the top performer on the day while the loonie lagged. The RBA decision is due up next. Ashraf's EURAUD Premium long was +100 pips in the green and is now +85 pips in the money so far.

News is the best way to judge the enthusiasm of a market. Given two pieces of news -- one good, the other equally bad – the underlying bias of a market is often revealed. An example arguably appeared on Monday. First, the PCE report was soft with core inflation rising 1.2% compared to 1.3% expected and spending on the soft side. That led to a 20-30 pip decline in the US dollar.

Ninety minutes later, the ISM manufacturing report was slightly stronger at 52.8 compared to 52.0 expected and construction spending data was +2.2% compared to +0.7% with positive revisions. That led to a complete reversal of the earlier losses and 60 pip US dollar rally.

The example isn't perfect and there are never truly two pieces of economic news that are equal but it's instructive. Especially in the case of USD/JPY as the pair hovered near 124.14, which was the 2007 high and hadn't definitively broken.

The market could have gone either way but surged higher and closed at 124.78, in the first bona fide close above that important level. It's a sign that the market is hungry for US dollars, especially against the yen. We saw that kind of enthusiasm in the CFTC report as yen shorts jumped. If the Fed tips its hat toward rate hikes, we'll get another level of that enthusiasm.

But in the short-term, the focus is on the free falling Australian dollar. It's down in 11 of the past 13 sessions and the RBA is up at 0430 GMT. There is no serious talk of a rate cut so the focus will be on the bias. Most traders think the RBA is in a wait-and-see mode after the latest decision but Stevens would relish the opportunity to knock AUD down another level and through the April low of 0.7553.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Prices Paid (MAY) | |||

| 49.5 | 42.5 | 40.5 | Jun 01 14:00 |

| Construction Spending (APR) (m/m) | |||

| 2.2% | 0.7% | 0.5% | Jun 01 14:00 |

USD boosted by trifecta; RBA, Ezone CPI awaited

A crucially positive trifecta for USD emerged via a higher than expected May ISM manufacturing, ISM's employment component and construction spending, boosting the greenback across the board. The figures had followed an earlier release of slower than expected US personal consumption and core Personal Consumption Expenditure price index (Fed's preferred inflation gauge). We now turn to the RBA and flash Eurozone CPI. Full charts & analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone CPI (MAY) (y/y) [P] | |||

| 0.2% | 0.0% | Jun 02 9:00 | |

| Eurozone CPI - Core (MAY) (y/y) [P] | |||

| 0.7% | 0.6% | Jun 02 9:00 | |

| ISM Prices Paid (MAY) | |||

| 49.5 | 42.5 | 40.5 | Jun 01 14:00 |

| Construction Spending (APR) (m/m) | |||

| 2.2% | 0.7% | 0.5% | Jun 01 14:00 |

| Core PCE Price Index (m/m) | |||

| 0.1% | 0.2% | 0.1% | Jun 01 12:30 |

China PMI Next, Yen Shorts Pile In

The focus is on China after the wild swings in the Shanghai Composite last week. A government researcher was in the state-sanctioned Securities Journal and said there is room for a cut in traditional rates and the RRR.

Other weekend news included comments from the SNB's Jordan, who once again said the franc was significantly overvalued and threatened intervention “if required”. The market has reacted in early trading.

It's a holiday in New Zealand but other markets will be busy with a full slate on the calendar including Japanese Q1 capex; Australian TD Securities inflation; Australian building approvals and Q1 inventories. But the main item on the agenda is the Chinese official PMIs, especially the manufacturing number at 0100 GMT. The consensus estimate is 50.3, an uptick from 50.1 in April. If it rises as expected, it could diminish pressure for a rate hike but also watch the non-manufacturing PMI, which was previously at 53.4.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -172K vs -168K prior

JPY -62K vs -22K prior

GBP -26K vs -23K prior

AUD +6K vs +7K prior

CAD +7K vs +4K prior

CHF +8K vs +9prior

The market wasn't shy about piling into yen shorts after the break to the highest since 2002. We maintain a close eye on the 124.13 level, which was the 2007 high. USD/JPY close virtually on that mark on Friday. We'd like to see a definitive close above to confirm the momentum higher.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (MAY) | |||

| 54.2 | 53.8 | Jun 01 13:45 | |

| ISM Manufacturing PMI (MAY) | |||

| 52.0 | 51.5 | Jun 01 14:00 | |

| Nomura/ JMMA PMI Manufacturing (MAY) | |||

| 50.9 | 50.9 | Jun 01 1:35 | |

| SVME - PMI (MAY) | |||

| 48.4 | 47.9 | Jun 01 7:30 | |

| PMI (MAY) | |||

| 50.2 | 50.1 | Jun 01 1:00 | |

| PMI (MAY) | |||

| 53.4 | Jun 01 1:00 | ||

| PMI (MAY) | |||

| 49.2 | 49.1 | Jun 01 1:45 | |

| TD Securities Inflation (MAY) (m/m) | |||

| 0.3% | Jun 01 0:30 | ||

| TD Securities Inflation (MAY) (y/y) | |||

| 1.4% | Jun 01 0:30 | ||

| Building Approvals (APR) (m/m) | |||

| -2.0% | 2.8% | Jun 01 1:30 | |

| Building Approvals (APR) (y/y) | |||

| 23.6% | Jun 01 1:30 | ||