NFP jump, yields follow, stocks watch

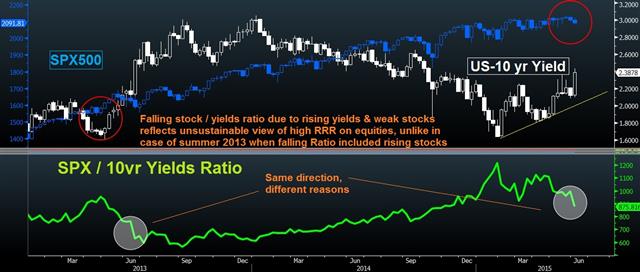

Bond bulls and USD bears find little to argue about in today's predominantly strong US jobs report, showing a 280K rise in May NFP (highest in five months), accompanied by a 21-month high in average hourly earnings (2.3% y/y). The rise in the unemployment rate to 5.5% from 5.4% was appeased by rise in the participation rate. The report bolsters the case for a Fed September rate hike, but the fact that the will be three more jobs report before Sep FOMC with inevitable erosion in the Treasury market, suggests Fed speakers will fill the airwaves with the message of an ultra-slow pace of rate hikes until liftoff becomes discounted to the extent of becoming a significant sell-of-the-fact. The charts below show the continued decline in the Stocks/Yields ratio, resulting from rising yields and falling stocks, which is more disconcerting development than in the May-June 2013 episode, when the ratio was dragged by a rise in both (yet faster pace for yields). Next week's US May retail sales report would be a crucial addition to USD sentiment if meeting expectations, but faster gains in yields towards the 2.60% resistance will continue to draw attention for the wrong reasons as long as Fed's core PCE price index doesn't play along.

New Premium trades for today were issued on EURUSD and EURCAD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Average Hourly Earnings (MAY) (m/m) | |||

| 0.3% | 0.2% | 0.1% | Jun 05 12:30 |

| Average Hourly Earnings (MAY) (y/y) | |||

| 2.3% | 2.2% | 2.2% | Jun 05 12:30 |

| Unemployment Rate (MAY) | |||

| 5.5% | 5.4% | 5.4% | Jun 05 12:30 |

Latest IMTs

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10

-

Typical Trading Errors

by Ashraf Laidi | Feb 12, 2026 10:04

-

Trade Tips from Washington DC

by Ashraf Laidi | Feb 11, 2026 9:56

-

The Signal is Finally Here

by Ashraf Laidi | Feb 10, 2026 11:09