Intraday Market Thoughts Archives

Displaying results for week of Apr 05, 2020OPEC Cuts 10 Cuts Deep, Oil Unimpressed

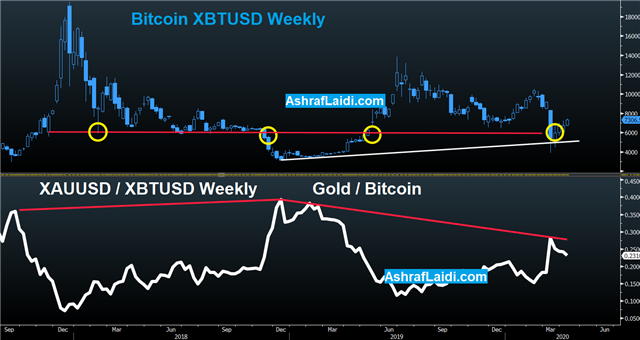

A few developments have occured last night since OPEC+ pledged to cut crude production by 10 million barrels per day starting in May as part of a global effort to balance the market. Mexico said it will not go with the cuts, before some OPEC members responded the deal will not go without Mexico. The Fed added $2.3 trillion in lending programs on a day when US jobless claims rose by another 6 million, accumulating to +16 million jobless in 3 weeks. The dollar lagged while AUD led the way. The Premium Insights' gold long hits its final 1690 target from the long 1540 entry. The chart below lays out Bitcoin's performance relative to gold ahead of next month's anticipated halving. The Premium Insight currently have a long on Bitcoin from 6200.

The war within OPEC ended Thursday as Russia and the group all pledged to lower production by 10 mbpd from April levels. Importantly, that cut includes the extra supply that's in the market this month, so it's not 10 mbps from Q1 levels. The deal is just for May and June but there is a tentative plan to cut from June to year end by 8 mbpd and 6 mbpd from Jan to April 2022.

The moves will go some ways towards balancing the oil market but the reaction in crude was telling. It peaked on the day at $28.36 on chatter about a 20 mbpd cut then fell to $23.19 to close near the lows of the day.

OPEC is looking for non-members to pledge to cut another 5 mbpd and the G20 will be tasked with that Friday. As always with the G20, commitments are soft.

In any case, the market remains easily oversupplied by 20 mbpd and more-likely 30 mbpd, so it will fall on the private market to do the rest – voluntarily or otherwise. There is no clearing price for crude once storage is full and there was a report Thursday of 25 oil tankers floating offshore in Europe. They had been expected to deliver crude but were asked to wait because refineries don't have anywhere to put it.

Political vs Economic Supply Action

Ultimately, this looks like a great political move that will shield OPEC and Russia from further criticism. They cut by 22% and until the rest of the world does the same, oil price are now their problem. It is important at this juncture to distinguish between political and ecomomic supply cuts. Cutting supplies for the purpose of reaching consensus and good faith, rathern than actual boosting of price.In the US, the huge jump in jobless claims was overshadowed by a series of new Fed programs, including one that will buy junk debt and another that will offer four year loans at 2.5-4% for 'main street' firms with less than 10,000 employees and $2.5B in annual revenue. The announcement gave a small lift to risk trades but was a big anchor on the dollar.

Gold rose $35 to $1684 and is now within easy striking distance of the March high. It also may have carved out an inverse head-and-shoulders pattern.

The EU also tentatively revealed a coronabond program. Without getting into the details, the takeaway is that government and central bank programs have crossed some new and extreme thresholds and that broad currency debasement is slowly becoming a reality.

OPEC+ Playbook

Thursday's OPEC+ meeting is a major risk to the oil market but it's ultimately only part of what needs to happen to rebalance crude. The Australian dollar was Wednesday's top performer, while the euro lagged on growing disagreements at the EU regarding Corona bonds. US Initial jobless claims will also command attention on Thursday (more on it below). A new trade for the Premium Insight's subscribers has been issued before the NY Close.

فيديو المشتركين لتوضيح الصفقة و بقية الفرص

In ordinary times, a 1-2 million barrel cut from OPEC would be major news but on Thursday the risk is that a 10 mbpd cut won't be enough. The US weekly oil inventory report showed that implied demand for crude was 14.446 mbpd last week compared to 21.86 pre-virus. That may flatter the global picture, but even at that level, it shows demand at 66% of normal. Extrapolate that globally, and it argues there is an excess of 35 million barrels per day.

Those are the types of numbers OPEC+ members and others invited to the meeting will hear on Thursday. The official talks begin at 4 pm in Vienna (10 am New York) and aren't likely to be over quickly.

Oil Barrels Maths

Algeria's oil minister said OPEC+ cuts could reach 10 mbpd on Wednesday in a headline that boosted crude 10%. Contrast that with a Russian report that hinted at a 14% cut for everyone from Q1 levels. That would be 1.6mbpd and around 4 mbpd from OPEC. Add in the extra 2.5 mbpd from Saudi Arabia since the start of April and that's still only 7.5 mbpd.That gap could be bridged, but the OPEC meeting itself may be just the beginning. Saudi Arabia will also host a G20 conference on Friday. The risk is that OPEC cuts could have a conditional element that's taken to the G20. If so, more leaders could offer token pledges to manage oversupply but we suspect the market will sell soft commitments. Weekend risks loom large because Friday is a holiday in much of the world but draft texts from G20 meetings often leak beforehand so be on guard Thursday, especially late in the day.

Other events to watch for on Thursday are at 1230 GMT with the release of US initial jobless claims and Canadian employment. The consensus on US claims is for another 5m layoffs with a range around 2.5m-7.5m. The consensus on Canadian employment is -500K with 7.5% unemployment. The country has already announced more than 2 million job losses so there's an element of lag here but Statistics Canada in recent reports said they're trying to adjust, so the commentary will be an important part of the report.

Ray Dalio on Various Topics

Here are some thoughts by one of the world's most successful macro hedge fund managers on virus economics, investing, QE, bonds, cash, commodities and the US dollar. Full interview on Reddit.

The Problem with Trading Virus Stats

The current routine in the markets is to trade around various coronavirus statistics, but there's an underlying flaw in that thinking. (More below). AUD was the top performer on Tuesday, while USD lagged. Ashraf posted the weekly Premium Video, highlighting why the 1929 analog for indices may no longer be working as a comparable model analog for indices. Is it 1987, 2008, or which is it? There's also a focus on FX and last night's trade.

The S&P 500 suffered its worst intraday reversal since 2008 on Tuesday as it gave up a 3.5% gain to finish 0.2% lower. Even worse, the high was in the opening minutes and the low was at the close.

One of the reasons it fell was jump in deaths in the UK, New York and France, among other places. Another was a breakdown in oil. After trading higher for most of the day, crude crumbled by 9% in 90 minutes.

The virus numbers are obviously concerning from a human perspective, but daily infections and deaths aren't really telling us anything right now. We know it's a highly infections disease that's killing around 0.5-2% of those infected.

A number of places have proven it's possible to flatten the curve, including Italy which reported 3038 cases Tuesday, which is the lowest since March 13. From a human perspective, that's great news but it doesn't tell us anything about the economy and financial markets. The key question is: When can we reopen? Clearly that's after some flattening in the curve but if reopening leads to a fresh spike in infections then it's a blip at best.

The focus right now has to be on medical technology. The path to opening includes some combination of: 1) widespread infection testing 2) testing for antibodies to find out who has already been infected 3) Effective treatments to reduce symptoms/mortality.

A fund manager survey from BMO showed a median estimate on a broad US reopening at the end of May. Albeit possible, that will require major medical improvements. In the meantime, the virus stats are basically noise.

One market that is trading on fundamentals is oil. Thursdays' OPEC+ meeting is the major event of the week. The US is now trying to spin economically-driven cuts from US producers as participation and that might work. Up first is the weekly US inventory report at 1430 GMT on Wednesday. The consensus is for a 9 million barrel build, adding to last week's 13.8 million barrel climb in inventories.

ندوة الخميس الساعة 5 مساءا بتوقيت مكة المكرمة

توازن التنبوؤات الخرافية و التداول الواقعي . الكل لديه أفكار و نظريات عن اتجاه السوق. لكن كيف يمكن تحويل تألق في المخططات إلى صفقات واقعية؟ متى يتحول دور الذهب من بيع إجباري لتحصين الحسابات إلى دور ملاذ آمن؟ أي من العملتين وصلت إلى قاع موسمي مقابل الدولار؟ للإسترليني أو اليورو؟ كل ذالك و أكثر مع أشرف العايدي تحت رعاية إكس تي بي. للتسجيل

Johnson Hospitalised, Oil Awaits Treatment

Sterling slipped after UK Prime Minister Boris Johnson was moved to the intensive care unit for coronavirus treatment, but the broad risk trade remained strong on optimism with slowing growth in the number of Corona virus cases. The Australian dollar was the top performer while the yen lagged. As both gold and silver rally, the Gold/Silver ratio has fallen to as low as 107 from high 120s, when that famous ratio chart was posted 2 weeks ago here. The RBA decision is up next. A new Premium trade was posted at the close of the NY session, backed by 3 charts and notes.

A statement from 10 Downing said PM Johnson was taken to the ICU for precautionary reasons and that foreign minister Dominick Raab had been deputized to handle the PMs duties. Cable quickly fell 80 pips to 1.2215 on the report but held the lows from earlier in the day on the report in the Russian press that he had been intubated.

In the US, the S&P 500 rallied 7% and broke around a cluster of resistance at 2650. That level was the late-March high and the 38.2% retracement of the coronavirus drop. A Fox Business news report indicated that Congressional leaders had briefed Wall Street executives about a new $1.5 trillion stimulus package that's in the works, and will be ready by month end. It's another sign of the endless appetite for spending from governments to cushion the economic decline. It's also another reminder of the costs that will need to be paid one day, and that helped fuel gold by $40.

In OPEC news, the battle lines for cuts on Thursday continue to harden with more reports that OPEC+ wants the US to participate. They have to know that it's virtually impossible to execute a national US cut. If that's the case, then the entire call is a public relations exercise.

Given the stakes, this would be an odd time for that kind of stunt. A more-likely outcome is a cut and a statement that says they expect the US to join. When that invariably doesn't happen, they will have cover to cheat or hike when it suits their needs. Oil fell nearly 8% on the day.

Looking ahead, the RBA is entirely expected to leave rates unchanged at 0.25% in the 0430 GMT rate decision. The latest minutes said there was no appetite for negative rates and the central bank has already unveiled QE. In normal circumstances it would be far too early to anticipate any kind of further action but at the moment it's not out of the question. A statement indicating that the pace of bond buying could increase could weigh on the Aussie, but it's an outlier.

Gold's Quiet Ascent vs Oil Confusion

All currencies are recovering against the US dollar and yen as indices rally world-wide on broadening signs of leveling off in the numbers of new cases and deaths from Coronavirus in some global epicentres. Even GBP is regaining some ground, after having been dragged across the board last night on news of PM Boris Johnson's admission to hospital with coronavirus. Today the PM is said to be in goood spirits. Gold and silver are at the top, while JPY is the weakest. (more on gold and silver below). CFTC positioning showed an increasingly-crowded euro trade.

The action in metals is far quieter than in energy, but shows a steady run-up in gold and silver on a combination of putting money back to work and reduced margin-selling.

The other major weekend developments were at OPEC, where Monday's planned meeting was pushed back to Thursday. After the close on Friday Trump said the free market could sort it out in a strong hint that the US won't participate. Brent and WTI both opened down around 10% but the drama is likely to continue for a few days. Several OPEC members have hinted at cooperation and some countries outside of OPEC are sending positive signs.

One compelling argument to cut is that even with 10 mbpd less oil on the world market, the COVID-infected world is still vastly oversupplied. Even without US participation there is a compelling argument to cut because it might mean $30-$40 oil instead of $20. For US rivals, they can still bankrupt shale at those levels while cushioning the self-inflicted blow.

As we saw last week, it will be a headline-driven market and that's a constant pitfall.

Cable fell 40 pips at the open to 1.2230 on news that Johnson was in hospital after 10 days of persistent symptoms. A statement said the move was for precautionary reasons but he will spend at least one night in hospital. There are all kinds of rumors about his health. There are multiple reports from other government officials that he has been working lately but the virus can worsen quickly. We prefer not to speculate on anyone's health but given the agonizing infighting among Conservatives, a prolonged absence would hurt the pound.

As GOLD and SILVER regain their ascent, Ashraf urges you to watch his recent video (formerly for Premium susbcibers) on the signals he's watching in gold, silver and SPX to gain confidence for the next level high.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +76K vs +61K prior GBP +5K vs +11K prior JPY +18K vs +24K prior CHF +5K vs +5K prior CAD -22K vs -29K prior AUD -31K vs -25K prior NZD -16K vs -16K prior

Euro longs are now at the highest levels since June 2018. Underscoring the shift, as recently as Feb 25, shorts were at -114K. The appetite to bet on the euro now that carry trades have unwound is a bit of a puzzle. Otherwise, positioning is about what you would expect.