Intraday Market Thoughts Archives

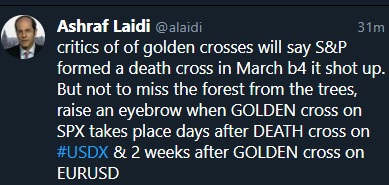

Displaying results for week of Jul 05, 2020Bonds vs Tech & Golden/Death Crosses

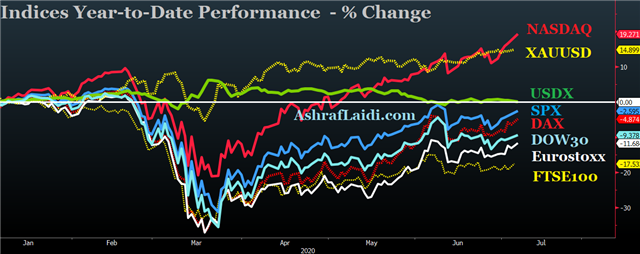

At 17:30 Friday London, Nasdaq is down -0.2%, while DOW30 and SPX are up more than 0.5%. Risk trades soured Thursday on stubbornly high US unemployment claims and troubling virus signs but after a minor rout, Nasdaq dip-buyers stepped in once again to limit the damage. However it was a different story in the bond market as 10-year Treasury yields fell 5 bps and 30s fell 8.6 bps as the steepener trade unwound. Long bond yields are now at the lowest since May 15 in a growing sign of the demand for safety.

CAD Shrugs Off Deficit & Why GBP

Leaks suggesting a +$300B fiscal deficit in Canada late Wednesday were borne out as finance minister Bill Morneau reported a shortfall estimate of $342B, smashing records. The numbers were wholly unexpected but the way the loonie shrugged off the deficit was a surprise. Morneau also offered no commentary on when a return to something resembling a balanced budget would come.

USD/CAD fell a full cent on the day to hit a two-week low. It also briefly broke the 200-dma near 1.3500.

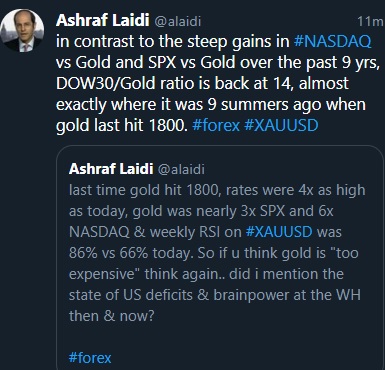

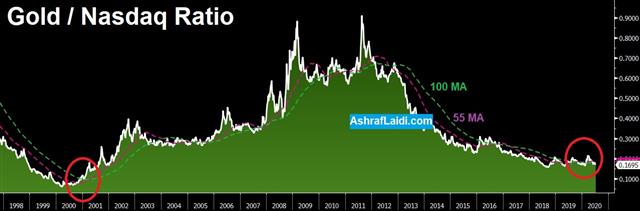

The fresh 9-year high in gold at $1808 also underscored the market's attitude towards deficits. There is no end in sight to government spending anywhere. In the UK Wednesday, Chancellor Sunak rolled out another round of targeted stimulus.

The broad market shrugged off a record number of virus cases in the US as well. Tech remains in a roaring bull market and Chinese shares – particularly Chinese tech – are doing the same. If the positive sentiment can last through Friday then the case for more easy-money trades will be strengthened.

Up next is the main US economic release is weekly initial jobless claims. The consensus is for another 1.375m applications for unemployment benefits. The numbers remain staggeringly high but the market has shrugged off unemployment concerns since the high of the pandemic.Gold Breaks 1800, USD Vulnerable to China

Ashraf adds that one of the factors weighing on USD specfically today, is the potential blowback by Beijing towards US assets in the event that US officials' treat to destabilise Hong Kong's USD peg see any fruition. How can the Trump administration seriously consider taking on the world's 3rd largest financial center, that is governed by the world's 2nd biggest economy, which also happens to be the world's 2nd largest source of US-deficit financing? And can we imagine what happens to USD value if a major USD-peg is attacked?

Back to Virus cases. The market initially cheered some US state coronavirus numbers released on Tuesday but the details tell a different story. Florida and Arizona both reported numbers below the 7-day average and the initial reaction was strength in equity markets. The market later soured and details of the numbers were one reason why. The declines in both numbers were entirely a result of lower testing, likely due to effects from the US long weekend. Both states recorded a higher percentage of positive cases including 33% in Arizona.

Deaths have also been gaining more attention but after just 235 in Monday's report, they rose to 322 Tuesday and for the day ahead Arizona and Florida alone have nearly matched the Monday total so expect a further rise. Note though that it's still far below the 3000 daily mortalities from April.

Early Wednesday, Texas reported 10,028cases with hospitalizations hitting records in that state and California. The day ahead will be an especially stern test of the market's resolve because the testing will rebound and that could mean a doubling of cases. Under normal circumstances the market would have already anticipated that but lately the market tends to take things as they come.

Along the same lines, Atlanta Fed President Bostic introduced the idea that data was 'leveling off' on Tuesday in an interview with the FT. He later repeated the same line and so did Philly Fed President Mester with both highlighting high-frequency data. Watch for that talk to work its way up the Fed ladder to Governors, the chairman or even the FOMC statement on July 29. Again, the market should start to anticipate something along those lines, but if it's not coupled with significant Fed action, the market could recoil.Gold 1796, Aussie's Virus Return

The overarching reason for the latest round of US dollar weakness is risk appetite. The latest jolt came from China, where the Shanghai Composite gained 13% over the same stretch. Money may be returning to emerging markets more generally as sentiment improves.

Moreover, the US could be suffering from the effects of rising virus cases domestically. Every day where cases remain elevated in the US compared to other developed markets, it loses attractiveness – something we've been highlighting for awhile.

The dollar managed to recoup some losses Monday on a jump in the ISM non-manufacturing survey to 57.1 from 45.4, but is now under fresh pressure.

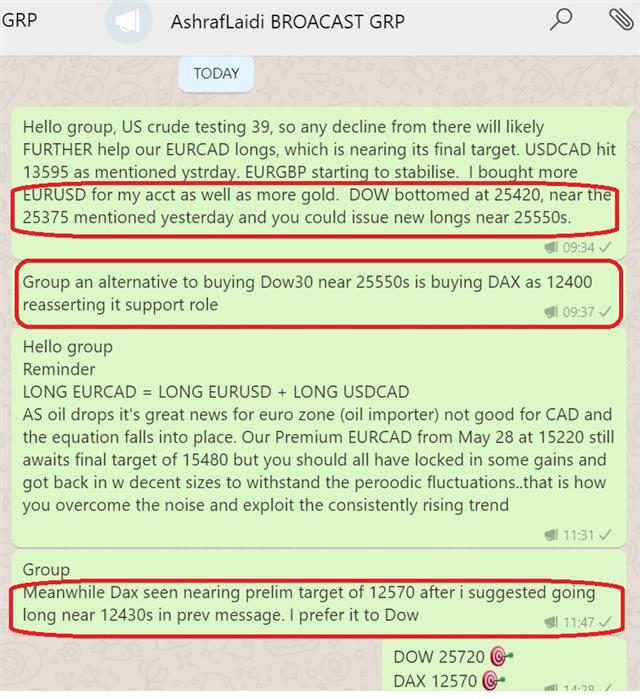

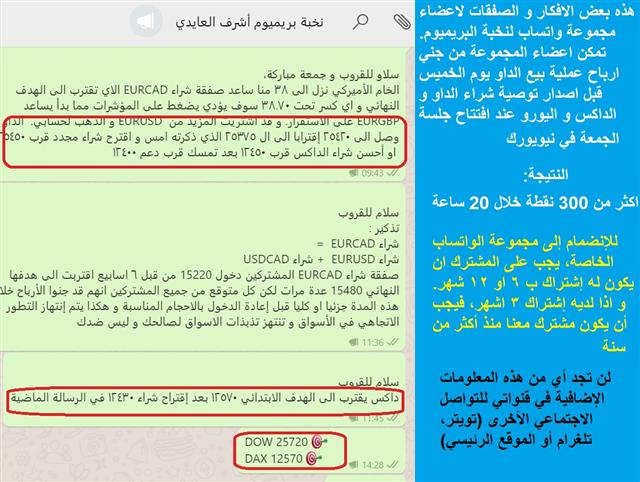

An initial retreat in oil has added to CAD's losses, which were built from yesterday's BoC survey. USDCAD may eye 1.3610 on deepening risk aversion, while EURCAD could retest 1.5420. Gold nears 1800, showing no sign of breaking below its medium term trendline support, while EURUSD risks correcting to 1.1240s.Summer Backslide

The jump in Australian cases along with flareups in China and Japan show how difficult COVID-19 will be to contain. On the weekend US cases rose again but the market has so far brushed it aside. Some of that is because of lower mortality rates but there are also signs of complacency as summer hits.

The tug-of-war between easy money and virus fears has turned into a summer stalemate. So far, the economic impacts of the lockdown and a rebound in economic measures on pent-up demand and massive government stimulus was predictable.

The more challenging task is figuring out the expiration of fiscal measures. Time certainly isn't on the economy's side in the pandemic, but no one is quite sure when time will run out. That should bring economic data to the fromt focus in the weeks ahead.

The Bank of Canada business outlook tumbled to -35.0 vs from 22.0, highlighting deeply negative coniditions across all regions and sectors due to the the pandemic and drop in oil prices.