CAD Shrugs Off Deficit & Why GBP

Leaks suggesting a +$300B fiscal deficit in Canada late Wednesday were borne out as finance minister Bill Morneau reported a shortfall estimate of $342B, smashing records. The numbers were wholly unexpected but the way the loonie shrugged off the deficit was a surprise. Morneau also offered no commentary on when a return to something resembling a balanced budget would come.

USD/CAD fell a full cent on the day to hit a two-week low. It also briefly broke the 200-dma near 1.3500.

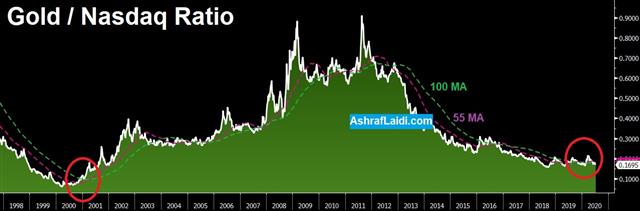

The fresh 9-year high in gold at $1808 also underscored the market's attitude towards deficits. There is no end in sight to government spending anywhere. In the UK Wednesday, Chancellor Sunak rolled out another round of targeted stimulus.

The broad market shrugged off a record number of virus cases in the US as well. Tech remains in a roaring bull market and Chinese shares – particularly Chinese tech – are doing the same. If the positive sentiment can last through Friday then the case for more easy-money trades will be strengthened.

Up next is the main US economic release is weekly initial jobless claims. The consensus is for another 1.375m applications for unemployment benefits. The numbers remain staggeringly high but the market has shrugged off unemployment concerns since the high of the pandemic.Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46