Intraday Market Thoughts Archives

Displaying results for week of Sep 06, 2020DOW30's Intraday Inflection Points

Sample of today's messages to the WhatsApp Broadcast Group.

FX Tectonic Plates Shifting

Brexit talks are going off the rails and the pound was sold hard in response. The EU set an end-of-month deadline to withdraw legislation that would violate the Brexit withdrawal agreement. In addition, Barnier published a scathing statement on the stalled negotiations and stubborn UK position.

In response cable, fell 230 pips to stabilize the June high – a level we highlighted at the start of the week.

The ball is clearly in Boris Johnson's court at this point and if he backs down there will be a sterling bounce. Beyond that, it's now clear that we're in a period of elevated Brexit tensions and that's going to make it tough for cable to break the August highs.

The other big story on Thursday was Lagarde's press conference. Lane put her in a tough spot on the currency because there was no real path towards threatening action to combat the euro rise. She was repeatedly asked about the euro and said they're monitoring it closely, but only in terms of its effects on inflation. The result was a 50-pip jump in the euro, which was eroded alongside indices ahead of the London fixing.

BoC's Macklem was also asked about the currency and delivered a response along similar lines. The difference was that expectations were low for him and there was no FX response.

Mixed in with all the news was another negative jolt to risk appetite. The US dollar was soft early in the day as stocks opened solidly higher but sentiment crumbled and the dollar surged. In spite of all the macro news – including a soft jobless claims report – equity sentiment is the overriding day-to-day driver. The S&P 500 touched Tuesday's low late in the day and closed just above it; that's going to be the key level on Friday.

So what/where are the flows today?

Ashraf laid out his Friday plan for DOW30 and SPX after Thursday's close to the WhatsApp Broadcast Group, backed up with notes and charts earlier today. The plan is based on a manifestation of intraday cyclicals, which are so far holding. Will update you later in the day.

Ashraf in the TradersSummit

Don't miss this one. A traders summit including some big names. Sign up for my presentation on Sunday 27 September at 9:00 eastern (14:00 London).

Two Rookie C-Bank Leaders, One Question

The ECB and BOC leaders will both be in the spotlight today and both are facing the same question: How will strengthening currencies affect their plans. EUR and CAD are both up about 10% from the March lows and both currencies are near notable lines in the sand as EUR/USD nears 1.20 and USD/CAD flirts with 1.30.

The BOC decision was on Wednesday and it offered no hints on policy. Rates and QE were left unchanged as was the forward commitment to leaving rates on hold until 2% inflation is “sustainably achieved.” The statement noted stronger economic activity but warned on pandemic risks and highlighted inflation near zero.

BOC Governor Macklem will take questions at 1630 GMT and currency strength is sure to be one of them.

Up first is the ECB decision at 1145 GMT and Lagarde's press conference at 1230 GMT. Like Canada, nothing is expected at this meeting but there's a larger chance of more QE in December if inflation continues to undershoot. At the same time, the economic data has been stronger than anticipated and Bloomberg reported that a slight improvement in economic forecasts is coming.

Interestingly, the BoC has usually adopted more of a laissez-faire stance on currencies.

ECB chief economist Lane also put FX on the table on the same day EUR/USD hit 1.20 with a comment that “the euro-dollar rate does matter.” That helped to send the currency swiftly lower.

More importantly, it raised expectations that Lagarde will offer some jawboning regarding the currency. If she stays silent, the default will be for the euro to rise.

Overall, it sets up an interesting day ahead. Two rookie central bank leaders will be asked virtually the same question about strengthening currencies and low inflation. How they respond will be fascinating.

Saying too much is a minefield that would beg for follow-up action or a loss of credibility. Saying too little would be an endorsement of unwanted currency strength. Finding the right balance is almost impossible.Britain Breaks Brexit Law

Cable fell more than 100 pips Monday after Johnson set an Oct 15 deadline for the framework of a deal. So far progress on the stick parts of an agreement has been almost nil.

Even worse, the EU warned Johnson against reneging on parts of the withdrawal agreement after his government drew up new rules that could violate pledges on Northern Ireland. The UK PM said he is willing to walk away rather than compromise on core Brexit principles.

For now the market is showing some concern but we've been through the threats so many times before. Brinksmanship is part of the game and all of the tabloid-driven fearmongering has hardly bruised the economy over the past three years.

The makes it more of a question of when to buy a dip, not when to sell a rally. Near term eyes will be on 1.30 followed by 1.28.

The US and Canada are back from holiday on Tuesday but the economic calendar is empty.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +197K vs +212K prior GBP +6K vs +5K prior JPY +30K vs +24K prior CHF +12K vs +12K prior CAD -27K vs -29K prior AUD 0K vs -4K prior NZD +7K vs +4K prior

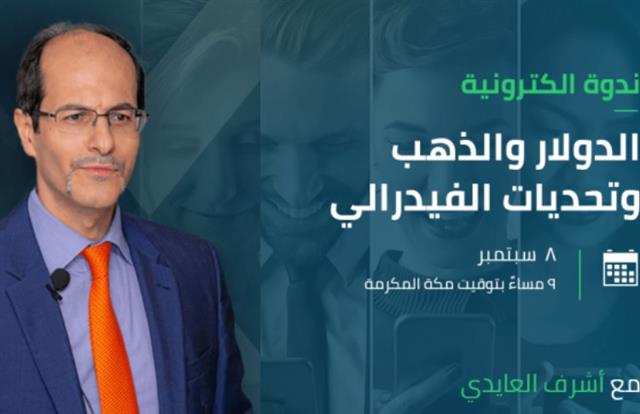

There is a large concentrated bet in EUR/USD but little else on the speculative front. Note that every currency is in a net long position versus the US dollar, except CAD and AUD.ندوة مساء الثلاثاء مع أشرف العايدي

سأناقش معكم في ندوتي القادمة عن تأثير الذهب والدولار على الأسعار وجنوح السوق إلى التضخم أو الإنكماش وكيفية يتعامل الفيدرالي مع تحديات السوق. موعدنا يوم الثلاثاء 8 سبتمبر في الساعة 9 مساءً بتوقيت مكة. سجل حضورك في الرابط المناسب: للتسجيل من السعودية فقط و للتسجيل من باقي دول العالم

Key Support Levels مستويات الدعم الحاسمة

We opened access to Thursday's Premium video. Save yourself time and jump straight to part 4:50 mins of the video for those key levels on the Dow30 and DAX30. Then check Friday's price action. لا تضيع وقتك: إذهب مباشرة الى مقطع 11:45 دقيقة من فيديو مساء الخميس لتجد ما قلناه حرفيا و رقميا عن الداو و الداكس. بعد ذالك تأكد ما حدث يوم الجمعة من حيث التصحيحات