Intraday Market Thoughts Archives

Displaying results for week of Nov 07, 2021Gold vs DXY - Unusual but not Impossible

It's increasingly well-understood that supply chain bottlenecks outside of chip production aren't due to covid-imposed snags. Rather, they're due to demand for goods that well above pre-covid levels. The shifts in consumption have exposed the lack of spare capacity, particularly in a world of on-time shipping. Combine that with companies running lean inventories and we have a demand shock at a time when consumer balance sheets are in extraordinarily good shape.

Inflation may escalate or it may fall back in the way central bankers outline. If it runs, hiking rates or cutting government spending are relatively easy and well-understood solutions. The threat of a runaway wage-price spiral while central banks remain paralyzed is remote.

In all likelihood, the future will unfold with ongoing strong demand or some level less due to central banks tightening. Some asset prices are undoubtedly high but there's no visible path to an outright reversal.

China is certainly a risk as it continues to try to engineer a soft landing in the property sector but the real global risk is in bonds, which are the greatest bubble in human history. The amount of debt that's trading with a negative nominal or real return is terrifying. This week we've seen volatility in Treasuries rise to the highest since April 2020, including the largest 30-year auction tail in at least 20 years.

So while the unfolding paradigm of better growth, low rates and fiscal largess can keep the party going for years, it will ultimately end. The shape of the reverberations from a doubling or tripling of borrowing rates is tough to see but it's undoubtedly catastrophic.1890?

US CPI rose 6.2% y/y compared to 5.8% expected. It was the highest pace since 1990 and just two ticks from the highest pace since the early 1980s. Core measures were similarly strong as housing inflation picked up.

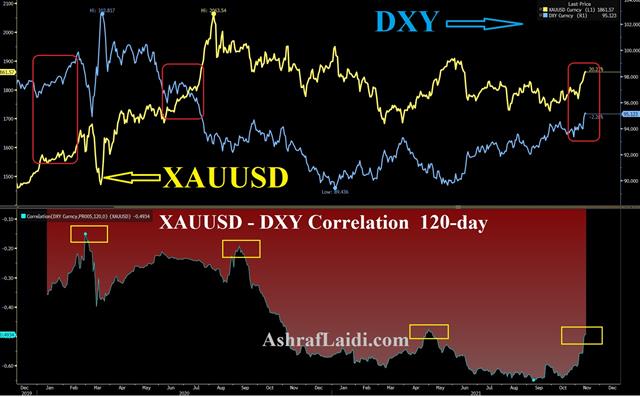

The US dollar surged on the headlines and legged even higher after a US 30-year bond auction tailed by a stunning 5.2 basis points. The moves in bonds are reminiscent of the pops in UK, Canadian and Australian markets after the recent central bank surprises. US 5s rose 16 bps to 1.225%, which is the largest one-day move since the dawn of the pandemic.

Technically, the biggest moves were range breaks in EUR/USD and GBP/USD. The fall in the euro below 1.1500 puts it at the worst level since July 2020 while cable erased the 2021 gain.

The moves threaten a US dollar breakout more broadly. We would only caution that inflation is a global phenomenon. If the Fed shifts more hawkishly, so will other global central banks. That will add considerable volatility.

At the same time, the shift higher in rate expectations caused a second day of selling in US equities, particularly in tech. If that continues to unfold, risk aversion will offer more of a bid for the dollar, yen, Swiss franc and euro against the rest of the field.

With markets being steered by bonds, Thursday will offer an interesting dynamic. It's Veteran's Day in the US but the only market closed for it is bonds. That will leave the rest of the market to fly blind and the US economic calendar is bare.Real Yields are a Real Problem

The yen was the top performer on Monday while the Australian dollar lagged. The theme in the FX market continues to be yield-spread compression as central banks push back on inflationary concerns.

What's concerning is that US real yields in 10s and 30s are at all-time lows. In 30s, TIPS hit a record low of 0.578% on Tuesday while nominals trade at 1.82%. That difference reflect average inflation of 2.4% over that timeline and signals that owning either asset will result in a substantially negative real return.

It also makes a compelling argument that the bond market is the greatest bubble in human history with $22.1 trillion in Treasuries outstanding and an order of magnitude globally priced against it.

Should inflation normalize at 2.4% it should prompt a Fed normalization over time, crunching long-dated bonds and quickly threatening to invert the yield curve. That's something that would imply lower inflation and boost real yields. Alternatively, long-end nominal rates could push higher on sustained high inflation and crush outright bond longs.

That's something to ponder over the longer term but in the days ahead, volatility in the bond market remains elevated and that's something that could spill over. The calm and enthusiasm in the equity market is masking deep issues in bonds. As usual, bonds will win out.

A potential breaking point is only hours ahead with October CPI due at 1330 GMT. There were no clues in Tuesday's PPI report, which was largely in line. The CPI data is expected up 5.3% y/y, a slowing from 5.4% in September. Core m/m inflation is expected at 0.3%.

A Receptive Audience for now

Markets turned last week after Powell and other top global central bankers offered a consistent and cohesive view on high prices – that they will dissipate in time.

Many market participants disagree but middling levels of conviction are revealed by how easily the market is moved by talking points we've heard before. The reason that traders have been saying 'don't fight the Fed' for generations is because it's difficult.

The stakes in the inflation debate are enormous and it will ultimately be the data that leads, not the Fed. With that in mind, PPI and CPI in the next two days loom large. PPI can at times offer clues to the PPI report so we'll be watching closely on Tuesday.

Other signals come from markets, where yields have moved back into a range showing lower inflation and a slower path of rate hikes. A potential is also in play above the series of summer tops stretching to $1833.ما يعني كسر مثلث تمركز عقود الذهب؟

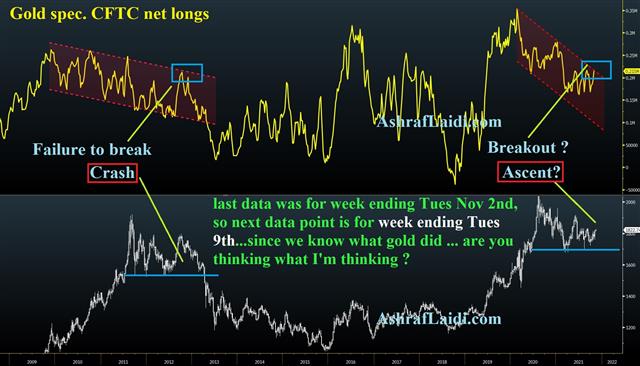

Upcoming Breakout in Gold Longs?

We know that Gold's commitment reports from the Comex is for the trading working period ending in a Tuesday. The last data point in the yellow graph is for the week ending last Tues (Nov 2nd), so the next data point (due this Friday) is for the week ending Tues 9th. Since we know what happened to gold over the last 6 days, the next data point will likely show a breakout in net longs. For more background, see a recent video about net Comex commitments.