Intraday Market Thoughts Archives

Displaying results for week of Sep 08, 2019ندوة أشرف العايدي مع أوربكس مساء الثلاثاء

هل سيخفض الفيدرالي الفائدة بمقدار 0.25 أو 0.50 نقطة؟ سجلوا في ندوة الكترونية من تقديم خبير الأسواق العالمية أشرف العايدي يوم الثلاثاء 17 سبتمبر في التاسعة مساءً توقيت مكة لمناقشة النتائج و التداعيات المحتملة. للتسجيل من السعودية فقط و للتسجيل من باقي الدول

After the ECB

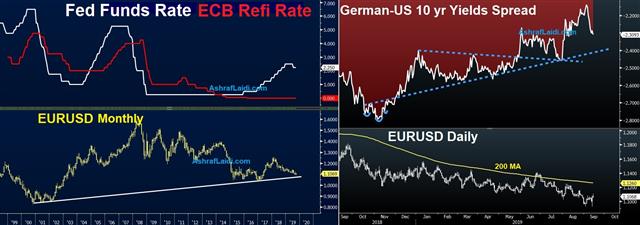

Can the euro extend gains despite the latest rate cut and fresh QE from the ECB? EURUSD is on its way to complete a 2nd weekly gain. It has not 3 consecutive weekly gains since June 2018. Could next week prove positive in the aftermath of the Fed? Read on here.

What’s Priced in for the ECB?

We have been getting questions about exactly what's priced in for the ECB and it's not as straight-forward as it might seem. The euro dipped back to 1.1000 on Wednesday ahead of the decision and eurozone bond yields ticked lower. Along with the ECB decision also comes a key US CPI report. A new Premium trade has just been issued with 2 supporting charts & detailed notes.

There are five main moving parts to the ECB decision and that's what makes it so tricky. Let's break them down one-by-one.

1) Deposit rate

The headlines from the decision will be what happened to deposit rate, which is currently at -0.40%. The consensus is a 0.10% cut to -0.50% but it's far from assured. The OIS market is pricing in 14 bps of easing, which equates to a 40% chance of a 20 bps cut.2) QE

This is a major wild card. The consensus of economists is for a new 30 billion per month bond buying program. However as series of speakers and 'sources' reports – including one last week from MNI – suggest that bond buys may be reserved in case of deeper economic problems. If that's the case, it might be signaled for October but the market reaction will depend on how clear that signal is.3) Forward guidance

The current guidance from the ECB is to keep rates at or below current levels at least through H1 2020. The consensus is for something like 'through mid-2020' but policymakers may find it easy to push that even further, especially if QE is left out.4) Tiering

Eurozone banks are struggling and one of the reasons why is that negative deposit rates and a flat yield curve crush net-interest margins. Tiering (expempting banks with particular reserves from negative rates) could alleviate the problem but it could also complicate it, creating winners and losers among banks. On Wednesday, Dutch parliament passed a motion against tiering in a sign of how difficult it will be to find a consensus. Economists expect some help for banks here but it's a wild card.5) Verbal guidance

Even with all the moving mechanical parts, the press conference may be what determines the market reaction. Both the market and the central bank are pivoting towards a reliance on fiscal policy for euro direction. Draghi has emphasized this point since he started as President but we're fast approaching the time when the ECB is tapped out. Draghi may choose this moment to draw a line in the sand and say to governments with a more forceful tone that it's time to step up.With all these considerations, handicapping the euro is difficult. Ultimately, we think right now that growth matters far more than the level of rates or miniscule changes in policy. The framework for viewing the decision may ultimately come down to how much confidence the central bank inspires that it can generate growth itself, or prod governments into doing more.

Bond Binge Busts

Rising Treasury yields are telling a story of a market that's rethinking the path of interest rates and the global economy. The US 10-year yield up 10% so far on the week, the biggest weekly percentage move since November 2016--the week of Trump's presidential victory. 4 weeks ago, yields posted the biggest weekly decline since 2012. Euro is the weakest currency ahead of tomorrow's ECB decisions while gold attempts to regain 1500. The long Premium trade in DAX30 was closed with a 620-pt gain. A Treasury auction on Wednesdays will be a test of real demand for bonds. This week's Premium Video (posted for subscribers below) focus on the existing oil & JPY trades & what's next for indices following the DAX trade.

The trend of rising Treasury yields gathered momentum on Wednesday with yields rising about 9 basis points across the curve. That brings the cumulative total to 10-year yields since the lows of last week to more than 30 bps with a yield at 1.74%.

The uniformity of the move across the curve suggests it's less about near-term Fed expectations and more about a falling demand for safety. The market continues to completely price in a Sept 18 FOMC cut with another 25 bps move 60% priced for October.

Yet, the tone around US-China talks continues to improve. The South China Morning Post outlined more details of talks and revealed that officials are circulating a text for a short-term deal on delaying tariffs in exchange for agricultural purchases. That's been floated before but it was coupled with talk on a broader offer of better IP protection and a cut in excess industrial capacity in exchange for dropping complaints about subsidies and reform of state-owned enterprises.

Few in markets believe any deal will last but Trump is difficult to handicap and the situation could easily get better before it gets worse.

That brings us back to bonds. The swan dive in yields began when Trump announced tariffs at the start of August. The 10-year is now nearing the 50% retracement of that move at 1.76%. That's a first level to watch but a bigger one may be the 61.8% level at 1.84%. If that breaks, it would be a sign of a broader rethink rather than a simple retracement. Yen traders are watching rates closely. USDJPY is on the cusp of testing its 100-DMA for the first time since May near 108.19

ECB's Next Challenge

Thursday's ECB meeting is perhaps the least straight-forward central bank decision in recent memory. All currencies are currently weaker vs USD except for CHF. The rebound in risk trades extends to European indices as US equities edge back in futures activity. UK jobs creation slowed in August but wages growth of 4% continue to outpace 2% inflation.

تحديث النفط، الين و الإسترليني - فيديو المشتركين

Markets featured light USD selling on Monday as Treasury yields ticked higher. The pound benefited from a strong GDP report in a rally to a five-week high. UK parliament will now take a break until mid-October as Johnson failed to trigger an election. He will attempt to obtain a deal from the EU, which remains far-fetched.

Upbeat economic news continued Tuesday as wage growth grew at a faster pace than expected. UK politics will continue to weigh heavily on FX but the short-term intrigue surrounds Thursday's ECB decision.

The latest hints from the ECB suggest rate cuts and perhaps no further QE. The aim may be to lower short-term rates while keeping the longer end higher in order to stimulate lending. If so, the result could be to sell the euro. At the same time, the market has been conditioned to expect a 'surprise' from the ECB so it's difficult to agree on what's priced in. Forecasts for a rate cut range from -10 to -25 bps.

One scenario is for the ECB to disappoint, raising questions about the health of the Eurozone economy, in which case, the euro could underperform in the medium term after a short-term pop.

Part of the strategy is surely to nudge governments into expanding fiscal policy to pick up the slack in the economy. There is an increasing idea in markets that a harder line will be a hallmark of Legarde's presidency and Draghi may help to usher that in with less-stimulative action.

That message may already be filtering through as the euro climbed Monday on a report saying Germany's government may set up special entities outside of the budgetary system in order to borrow and invest in infrastructure and green projects. Expect those types of reports to increasingly steal the FX spotlight away from tapped-out central banks.

Overlooked Hints from Powell

Powell didn't grab any headlines in Zurich but his Friday speech had more hints that the easing mode will last. GBP is the best performer of the day and the month amid hopes of closing the gap between Boris Johnson and his Irish counterpart on the Backstop. Parliament will be suspended today after one more vote on holding elections is held (most likely will be voted down again). FX traders will shift attention to the ECB later this week on whether a new paclage of stimulus/easing is announce. CFTC positioning showed a spike in favour of GBP longs. US indices are less than 1% away from their record high and the VIX broke below key MAs, testing 15.0. The Premium index trade is currently more than 500 pts in the green, while the other two trades are in the red.

The headlines around Powell's appearance in Switzerland centered on two comments: 1) That the Fed isn't forecasting a recession and, 2) that the Fed will act as appropriate to sustain the expansion. Neither statement is news as both stray into the obvious.

What was important was a change of tone on inflation. Powell talked about how the Fed's strategy is to avoid inflation expectations slipping with inflation stuck into the 1.5-2.0% zone. That's a strong hint on plans to cut rates, and on how they will be justified. Further he spoke about the fading relationship between economic tightness and inflation --an indication that the Fed will keep rates low after they cut, even if the trade war 'uncertainty' remains unresolved.

On the weekend, China's August trade surplus narrowed on an unexpected drop in exports. The surplus narrowed to $34.8B, about $10B smaller than expected. That came after exports fell 1.0% compared to a 2.2% rise expected. Imports fell 5.6%. More than the narrowing of the surplus, the story here is overall slowing trade and that's a worrisome sign.

But markets are looking ahead, hoping that last week's PBOC cut to the RRR along with central bank easing and lower rates will boost growth. Will markets sustain their optimism ahead of what could be another disappointing announcement from the ECB this Thursday?

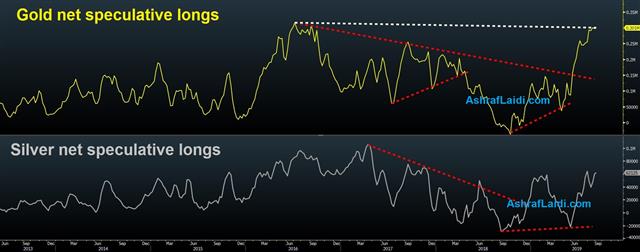

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -49K vs -39K prior GBP -85K vs -89K prior JPY +28K vs +34K prior CHF -6K vs -4K prior CAD +5K vs +11K prior AUD -59K vs -61K prior NZD -31K vs -26K prior