Overlooked Hints from Powell

Powell didn't grab any headlines in Zurich but his Friday speech had more hints that the easing mode will last. GBP is the best performer of the day and the month amid hopes of closing the gap between Boris Johnson and his Irish counterpart on the Backstop. Parliament will be suspended today after one more vote on holding elections is held (most likely will be voted down again). FX traders will shift attention to the ECB later this week on whether a new paclage of stimulus/easing is announce. CFTC positioning showed a spike in favour of GBP longs. US indices are less than 1% away from their record high and the VIX broke below key MAs, testing 15.0. The Premium index trade is currently more than 500 pts in the green, while the other two trades are in the red.

The headlines around Powell's appearance in Switzerland centered on two comments: 1) That the Fed isn't forecasting a recession and, 2) that the Fed will act as appropriate to sustain the expansion. Neither statement is news as both stray into the obvious.

What was important was a change of tone on inflation. Powell talked about how the Fed's strategy is to avoid inflation expectations slipping with inflation stuck into the 1.5-2.0% zone. That's a strong hint on plans to cut rates, and on how they will be justified. Further he spoke about the fading relationship between economic tightness and inflation --an indication that the Fed will keep rates low after they cut, even if the trade war 'uncertainty' remains unresolved.

On the weekend, China's August trade surplus narrowed on an unexpected drop in exports. The surplus narrowed to $34.8B, about $10B smaller than expected. That came after exports fell 1.0% compared to a 2.2% rise expected. Imports fell 5.6%. More than the narrowing of the surplus, the story here is overall slowing trade and that's a worrisome sign.

But markets are looking ahead, hoping that last week's PBOC cut to the RRR along with central bank easing and lower rates will boost growth. Will markets sustain their optimism ahead of what could be another disappointing announcement from the ECB this Thursday?

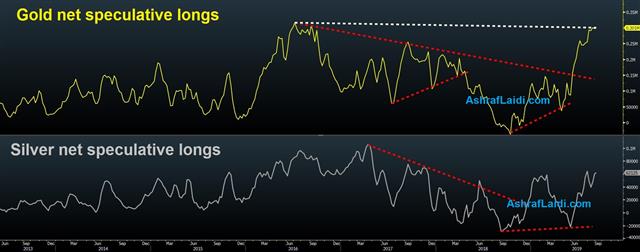

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -49K vs -39K prior GBP -85K vs -89K prior JPY +28K vs +34K prior CHF -6K vs -4K prior CAD +5K vs +11K prior AUD -59K vs -61K prior NZD -31K vs -26K prior

Latest IMTs

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10