Intraday Market Thoughts Archives

Displaying results for week of Jun 09, 2019ماذا بعد كسر الذهب لمستوى 1350؟

إخترق الذهب 1350، وهو أعلى مستوى منذ 14 شهراً، فماذا بعد هذا الارتفاع؟ شاهد الفيديو المفصل عن فنيات و أسس الذهب بالإضافة الى آخر تطورات في سباق منصب الرئيس الوزراء البريطاني القادم

Gold Breaks 1350, Retail Sales Next

Gold hits 14-month highs with yen on top after weak Chinese industrial output data and renewed declines in yields. The first vote of Conservatives MPs revealed that Boris Johnson will at worst advance to a run-off for his party's leadership. Friday's upcoming US retail sales report has the potential to be a major market mover (more below). Below is the Premium susbcribers' video focusing on gold and indices, with a preview for next week's crucial set of developments.

Johnson received the support of 114 of the 314 Conservative MPs in the first round of leadership voting. Baring some kind of scandal that leads to MPs switching their vote, the worst he can finish is second. At that point, broader party leadership will have the opportunity to vote for one of the final-two candidates, or if polls show a decided favorite, the runner up might quit.

The real race over the next two weeks will be who he faces off against. Several names will fall off the ballot and a second vote will take place on June 18 with votes potentially continuing until June 22. Remainer Matt Hancock dropped out earlier this morning, leaving remainers Setwart and Hunt in the race. More on this from Ashraf here.

Coming second to Johnson was Jeremy Hunt, who had the support of 43 MPs, followed by Michael Gove at 37, Raab at 27 and Javid at 23. The results left a minimal impact on the FX market even though the betting odds of Johnson rose. That's a reflection of key divisions that persist in the party. Theresa May voted for Hunt along with influential ministers Liam Fox and Amber Rudd.

As we near today's US data, bond markets are firmly pricing 2 Fed rate cuts by end of September. This could change in the event of surprises in the May US retail sales report. The April report was weak with the control group flat compared to a 0.3% rise expected but March numbers previously were strong. The Fed has remained upbeat on consumers but this will be another test. The consensus for the headline retail sales is +0.6% but the spot to watch is the control group, which is forecast to rise 0.4%. A miss would weigh on USD and harden expectations for a rate-cutting signal while a strong number would add to volatility as risk assets weigh better news against the chance of no rate cuts.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.5% | 0.1% | Jun 14 12:30 | |

Johnson Leads, Trade War is on

As the Mexico episode dims from memory the market is turning towards the Federal Reserve and how it might handle the US-China trade war. Boris Johnson led the 1st round of ballots for the PM race (more below). The Swiss franc, CAD, silver and gold are the top performers, while AUD and NZD are the big losers. Here is a tweet below from Ashraf 3 weeks ago about the upcoming Fed policy error.

The Federal Reserve is in a tricky situation. An escalation in the US-China trade war appears to be coming but a deal could also materialize quickly. Many market watchers now expect the Fed to signal at next week's meeting that they will cut rates if a trade war erupts but there is a problem with that thinking.

Greg Ip in the WSJ on Wednesday compared the upcoming meeting to 2003 and the dawn of the US-Iraq war. The Fed was contemplating cutting rates in March but wasn't sure entirely sure it would break out. Shortly afterwards the bombs started falling and the Fed cut.

On the surface, it's an apt comparison but the problem with a trade war is that there isn't necessarily a clear demarcation on when it will come. Undoubtedly the US imposing fresh tariffs on the $300B of untaxed Chinese goods followed by a response from Beijing would qualify but what if the steps are smaller. Arguably we're in a trade war already.

What we will look for from the Fed is a better idea of the conditions necessary to cut. Would a small escalation from either side plus a slide in economic data be enough? Probably not and the market may be underpricing that risk. Markets are fully pricing two rate cuts by end of September.

The important point is that this event is binary in the way a shooting war is and the most-likely outcome is that we remain in the gray area. Until there is clarity expect heightened volatility, a focus on economic data and a modest risk-off tone. The time lag involved from the start of teh tariffs to the economic impact could also worsen the problem of the Fed policy error.

Johnson Leads the 1st Ballot

Boris Johnson led the 1st ballot for the PM Race with 114 votes, followed by Jeremy Hunt (43), Michael Gove (37), Dominic Rabb (27), Sajid David (23), Matt Hancock (20), Rory Stewart (19). The 7 candidates progress to the next round of voting next week, but watch Sunday's televised debate on Channel 4. The final 2 candidates will face each other in a final vote later in the the month.Trump & Johnson Ready for NO-deals

Both Trump and Johnson are threatening (or readying) for a no-deal with China and Brexit respectively. So two things you need to know if you're trading any of our existing Premium trades: 1) global indices are down across the board; and 2) GBP rises broadly on comments from Boris Johnson and Labour's efforts to a block a no-deal. More below.

With regards to Trump, he announced that he's personally blocking a trade deal with China until Beijing returns to terms negotiated earlier in the year. “It's me right now that's holding up the deal” Trump said yesterday. Another important thing that augurs badly for markets: Trump threatened to raise tariffs on China if President Xi Jinping refuses to meet him at the upcoming Group of 20 summit in Japan. The last thing you'd want to do to a Chinese person is to threaten him publicly and corner him into possibly losing face. For an American leader to hint at humiliating China's head-of-state at the peak of his power in … JAPAN… will surely backfire.

As for Boris Johnson, he unveiled his campaign for PM by saying that a no-deal Brexit outcome is not his aim. Meanwhile, Labour, backed by the LibDems and Scottish National party will set up a motion in a debate today aiming at seizing control of the parliamentary agenda on June 25 in order to preventing the future PM from suspending parliament to force through a disorderly exit against the wishes of MPs. If this process advances successfully, all pledges by Tory leadership candidates to force through a no-deal exit on October 31 would eventually fail, including the implicit readiness to prorogue Parliament (ending the Parliament session and pass on decisions to the Queen). The vote on this cross-party motion will he held at about 11:00 Eastern (16:00 BST) and could potentially be positive for GBP if it passes.

GBPUSD tests last week's 3-week high of 1.3763 as it attempt to complete its first back-to-back weekly gain since March. Alot of work is yet needed for sterling bulls, but so far the foundation looks to be building up just fine. Our Premium long cable is currently +150 pips in the green.

مقاومة المؤشرات واحتمالات الفيدرالي الأمريكي

كلما شهدنا مكاسب في المؤشرات في الأيام المقبلة كلما ازدادت احتمالية خيبة الأمل من قرار الفيدرالي الأمريكي. فما هي احتمالية تخفيض الفيدرالي الأمريكي لسعر الفائدة؟ وكيف ستتأثر المؤشرات من الناحية الفنية بهذا القرار؟ تابعوا الفيديو الكامل

What to Watch in the UK Leadership Race

Decent UK jobs and earnings data gave the pound a temporary nudge but GBP attention shall remain drawn to the nine men and women participating in the race to be the UK's next prime minister -- in what will be a short and intense race. GBP is the day's strongest performer after earnings/pay beat estimate. A new trade was posted yesterday shortly before the NY close. Below is the range of different odds on the candidates provided by the different betting shops.

Candidates in the PM race are being peppered with questions about Brexit but they may do well to focus on the economy. At it stands, it will be difficult to beat Boris Johnson, who the bookies give about a 50% chance of winning the race, far ahead of any rivals.

Votes by MPs whittle the candidates down to a final-two before they're put to broad party membership. That means that most of the backstabbing and smearing will take place behind closed doors but some of it will surely spill into the open and that could leave GBP vulnerable. The first vote from MPs comes Thursday, crystalizing the field. The candidate with the lowest amount of votes and anyone with less than 5% support will be forced out. Others may drop out on their own or continue to votes on June 18, 19, 20.

Jeremy Hunt has emerged as a contender, followed by Andrea Leadsom, Sajid Javid, Michael Gove, Dominic Raab, Rory Stewart and handful of others. Like any election, it's unwise to place too much weight into any promises, especially surrounding Brexit.

The Evolving Transition

Notably, GBP traders should watch the extent to which staunch Brexiters (Johnson, Gove, Raab & Leadsom) make the transition from sticking to the Oct 31 Brexit deadline at all costs (deal or no deal), towards becoming more flexible and campaigning in favour of exiting with a deal.Ashraf tweeted yesterday that "FX traders totally relaxed, showing increasing confidence of reaching #Brexit Deal as implied volatility dives to 5-wk lows. For a perspective, when #WithdrawalVote was rejected for 2nd time in late Mar, volatility soared to 3-year high...highest since referendum"

Ultimately, the one thing to watch for is Conservative unity. If the party remains splintered then it will continue to be deeply unlikely that a new leader changes the Brexit equation. Boris Johnson is particularly divisive so the pound may respond more positively if a candidate other than Johnson and Raab gain momentum.

Looking to the shorter term, the US calendar is light with the Fed in the 2-week blackout period. As it stands, there is a 76% chance for a 25-bp rate at the July meeting and over 80% chance of a similar move in September.

الذهب و المؤشرات بين التهديدات و المسرحيات

تحمست الأسواق في آخر جلستين بقرار الرئيس “ترامب” بعدم معاقبة المكسيك بالتعريفة الجمركية ، لكن هل يمكنها أن تحافظ على تفاؤلها على أساس الآمال في أن مجلس الاحتياطي الفيدرالي سوف يخفض أسعار الفائدة هذا الصيف وعلى “ترامب” التوصل إلى اتفاق مع الصين؟ التحليل الكامل

Fake US-Mexican Standoff Ends

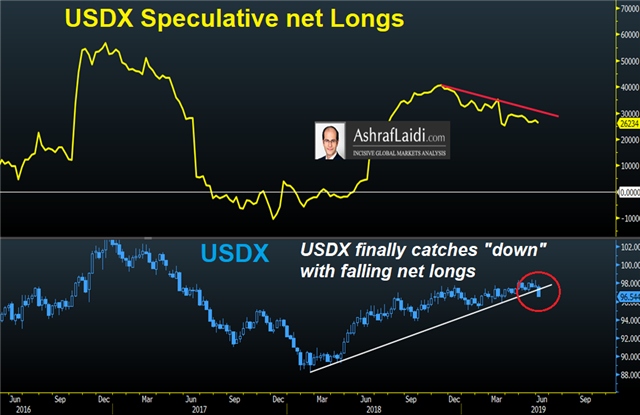

How long can global equity indices in and out of the US continue to rally on the hopes of looming Fed cuts and on a US President Trump's decision to called off planned tariffs on Mexico? The Premium short in DOW30 was stopped out while the other index trade remains in play. A poor US jobs report helped deepen 3 USD trades into the green. New Zealand dollar was the top performer last week while the US dollar lagged. CFTC positioning data showed aggressive GBP selling, further diverging away from the spot rate. The charts belows shows how USDX has finally converged with falling USD net longs. A new set of Premium trades will be issued ahead of the US Monday session.

Last week we wrote about why the Mexican peso was unusually placid in the face of the tariff threat while other asset classes showed more concern. The details of the deal raise further questions about what's coming next. Importantly, the New York Times reports that the deal announced Friday consisted largely of actions Mexico had already promised over the past several months.

Trump disputed that in a series of tweets but the entire saga increasingly looks like a political sideshow that the market had largely discounted. If that's the case, then the reasons for the fake brinksmanship are critical. They could be: 1) political theatre aimed at appeal to Trump's anti-immigration base and to further highlight his aggressiveness on the border; 2) An effort to normalize tariffs as a tactic and (more importantly) a strategy that wins.

If the first scenario is valid, then the market should easily move on but it's the second one that's a concern -- Trump said he will make a decision on hitting the final $300 billion in Chinese goods with tariffs after the G20 and that's just two weeks away.

It will be interesting to see how markets react throughout Monday. A sell-the-fact reaction would highlight the worries while a rebound in the US dollar and continued strength in equities would put the focus back on the Fed.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -88K vs -100K prior GBP -48K vs -32K prior JPY -44K vs -55K prior CHF -36K vs -35K prior CAD -42K vs -39K prior AUD -63K vs -66K prior NZD -11K vs -11K prior

Dollar longs remain a crowded trade despite last week's selling. A US-China trade war and the Fed strongly hinting at a cut at next week's meeting would certainly cause some soul searching.