Intraday Market Thoughts Archives

Displaying results for week of Oct 01, 2017The Problem With Dumping May

The pound has been battered alongside Theresa May's political career but there are reasons to think she will stick around. GBP continues to be the day's worst performing currency ahead of a speech from BoE's Haldane (13:00 London time) and the US/Canada jobs reports (13:30). Since US NFP will be skewed by the Hurricanes, the determinant factor will be on earnings, expected at 0.3% m/m from 0.1% and 2.5% y/y from 2.5% y/y.

Theresa May is increasingly unpopular, that's a bad thing for Conservatives but replacing her isn't exactly a good thing for the party. It doesn't change the impossible task of squeezing out a passable Brexit deal. The good news for the Conservatives is that they have four-and-a-half years before they need to call an election.

If you're a Conservative rival, this is an ideal situation. You can let Theresa May put together a Brexit deal – one that will almost-surely be unpopular – and then dump her with enough left to salvage an election win.

The worst thing could happen to a potential rival would be that she's forced out. In essence, that would mean that you forced yourself in. The good news is that you would be Prime Minister; the bad news is that you would still be forced to negotiate a Brexit deal, which would still be hopeless and would be the end of your political career.

The bottom line is that Conservatives are going to realize that someone (besides Cameron) is going to take the fall for Brexit, so it might as well be PM May.

At the moment, the pound is in freefall on the thinking that May will be forced out and some kind of civil war will take place as Barnier, Juncker and Merkel snicker to themselves. Anything is possible in politics but you have to assume Conservatives will tone down the backstabbing at some point.

That still leaves plenty of time for traders to refocus on the likelihood that Carney hikes rates this year. The question is: when does that happen? Right now the pound is flirting with 1.3070, which is the 61.8% retracement of the Aug-Sept rally. If that gives way, the bottom of the range is 1.2774.The next chapter will be written by non-farm payrolls and the USD side of the equation, so there's no sense in rushing in but we're probably at peak-May hysteria now.

Before the jobs report, the market will eye BoE chief economist Haldane at 13:00 London time for the latest assessment of odds of a November BoE hike, currently standing at 80%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Dudley Speaks | |||

| Oct 06 16:15 | |||

| FOMC's Kaplan Speaks | |||

| Oct 06 16:45 | |||

بيانات الوظائف وما وراء الأعاصير

What’s the USD Upside?

Another sizzling US economic data point was brushed aside because of storm-related effects but we evaluate how high the dollar could rise if the economy really is heating up. AUD was the top performer while CHF lagged. Aussie retail sales and trade balance are due up next. The latest Premium members video below charts how far and how long will the USD correction be. It also highlights the Premium trade issued today.

US ISM non-manufacturing survey hit a 12-year high on Wednesday. It was at 59.8 compared to 55.5 expected and 55.3 prior. It was coupled with a jump in the prices paid component. The dollar climbed at first but the survey chairman downplayed the strength, saying respondents were expecting work due to the storms. In addition, the rise in the prices paid component was driven by the climb in fuel prices around the time of the storm.

It was a similar story a day earlier when US auto sales climbed by the most since 2005. The US dollar hardly made any headway on two of the best headlines in months. Part of the reason might be that ADP employment fell to 135K from 228K in August but that was bang-on expectations.

Chances are, the market is right. That the hurricanes will skew economic data but that the trend hasn't changed. Still, the alternative is worth considering. What if the economy has turned a corner, wages are starting to pick up and a big tax cut is coming?

The USD upside would be substantial, especially against the yen because Japanese rates are pinned to the floor. Part of the reason for the dollar sluggishness has to be the Fed and the expectation that Trump will appoint a dove. If that's unfounded then there is a real possibility of three or more rate hikes in the year ahead. If so, USD/JPY could easily rally 10 cents from here and perhaps much more.

The odds of a tax cut are tough to evaluate but Warren Buffett said Tuesday he thinks it's higher than most believe. What if it comes at the same time as the economy is already heating up?

That will be a question to consider in the weeks ahead but in the hours ahead, the focus will be on the Australian dollar. It bounced Wednesday after two weeks of struggles but the next chapter will be written by data. The August trade balance and retail sales reports are due at 0030 GMT. The consensus is for a surplus of $850m and sales up 0.3%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 0.3% | 0.0% | Oct 05 0:30 | |

| ADP Employment Change | |||

| 135K | 131K | 228K | Oct 04 12:15 |

إلى أين حقائق الذهب؟

بدلاً من النظر إلى أسعار الفائدة أو عائدات السندات، يجب أن ننظر إلى المستوى “الحقيقي” لسعر الفائدة، أو سعر الفائدة مطروحاً منه التضخم التحليل الكامل

Cars the Latest Driver?

Stepping back momentarily from central banks & macro data, could the best month for US automakers since 2005 mean consumers are finding another gear? ADP slowed to 135K in September (meeting expectations) from a revised 228K partly due to the hurricanes. All currencies are up against USD since the close of Tuesday's NY session, with gold and GBP in the lead, CHF and CAD at the bottom. GBP got a lift from better than expected services PMI, keeping alive hopes of a November BoE hike. We turn to the US services ISM at 15:00 and Yellen's speech at 20:15 London time. A new Premium trade has been posted and sent.

US auto sales smashed expectations in September with sales at an 18.57m pace, up from 16.14m in December and beating the 17.4m estimate. Optimists will say consumers are opening their wallets, buoyed by a better jobs market and hopes for a tax cut. Pessimists will sale say that replacements after hurricane Harvey simply took place more-quickly than anticipated.

The Fed's bias is to see good news as real and bad news as temporary so the numbers are more-likely to strengthen the case for a December rate hike, especially because the buying wasn't entirely limited to hurricane-hit areas. Odds of a December Fed hike remain little changed at 70%. Yellen's speech today fires up an avalanche of speeches from Fed members this week (Williams, Harker, George, Bostic, Dudley, Kaplan & Bullard).

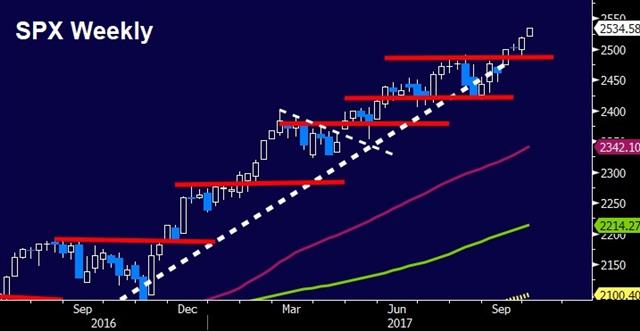

S&P 500 hit yet-another record high, climbing 5 points to 2534. NASDAQ is now at 4800.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change | |||

| 135K | 131K | 228K | Oct 04 12:15 |

| Final Services PMI [F] | |||

| 55.1 | 55.1 | Oct 04 13:45 | |

| ISM Non-Manufacturing PMI | |||

| 55.5 | 55.3 | Oct 04 14:00 | |

| Fed Chair Yellen Speaks | |||

| Oct 04 19:15 | |||

| FOMC's Powell Speaks | |||

| Oct 05 13:10 | |||

Central Bank Inertia

A quite Tuesday in the markets following a fast-moving risk-on Monday and a busy rest of the week. Germany is closed for a public holiday. The ISM manufacturing index jumped to the highest since 1988 but it might be a different detail in the report that grabs the Fed's attention. NZD is the day's worst performing currency after a 2% decline in the dairy auction.The RBA reiterated its concerns with Aussie strength to the extent ot reducing all odds of a 2017 hike. Tuesday's Premium GBP trade is now in the green. The chart below is one of the 3 charts backing this trade.

The ISM manufacturing index rose to 60.1 compared to 58.1 in September and that gave a slight lift to the US dollar. What could lend a more-lasting bid is a hawkish tilt from the Fed. What they're watching for is a genuine sign of inflation. An early one came in the prices paid component, which was at 71.5 compared to 63.0 expected. That's a six year high.

The quick take is that hurricanes caused a temporary spike (and the mild USD reaction gives that theory weight) but it's still a move in the direction the FOMC wants to see.

Other positive signs for the dollar were construction spending at +0.5% versus +0.4% prior, a rise in the Atlanta Fed GDP tracker to +2.7% from +2.3% and another record for stock markets.

GBP broadened losses as interest rate hike speculation took a back seat to the feeling of confusion and lack of unified Brexit message from the Party Conference underway this week. Disappointing manufacturing and construction PMIs sped up GBP selling, raising scrutiny over tomorrow's release of the important services ISM and speeches from BoE's Mcafferty and Haldane.

The RBA reinforced its view that a stronger AUD is "weighing on the outlook for output and employment" and is expected to continue to "subdue" price pressures, which means an RBA hike is unlikely in the next 3 months. Meanwhile the RBA made a rate cut non-viable as it would further fuel household debt relative to income.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final Services PMI [F] | |||

| 55.1 | 55.1 | Oct 04 13:45 | |

| ISM Non-Manufacturing PMI | |||

| 55.5 | 55.3 | Oct 04 14:00 | |

| Germany Final Services PMI | |||

| 55.6 | 55.6 | Oct 04 7:55 | |

Does Euro Care About Catalonia?

Nearly 1000 people were injured in a voting crackdown Sunday in Catalonia as the central government aimed to stop an independence referendum. After having been the top performer in September, the pound is the day's worst performer amid growing concerns with PM May's authority ahead of this week's annual Conservative Party conference. US manufacturing ISM is up next. The Premium shorts in DAX and USDCAD were both stopped out. Here is a look at today's DAX chart. Could it be a case of "market is irrational longer than you can be solvent?"

Spain's central government attempted to shut down voting as Catalonia aims to split in what's likely to be an acrimonious process. The challenge for Catalan leaders is to form a legitimate government and gain international recognition. The government will aim to enter into negotiations but given the violence and the deployment of police from outside the region, the days ahead are sure to be acrimonious and tense.

Will the euro suffer? Early indications are that it won't and so long as it doesn't spark a broader chord of anti-euro sentiment or a national crisis in Spain, then the headlines can be safely ignored. Catalonia's contribution to Spain's economy has been growingtremendously, but Spain's structural backing to Catalonia is also considerable.

A more-likely driver early in the week will be solid numbers from China. The official manufacturing PMI was at 52.4 compared to 51.6 expected while the services PMI soared to 55.4 versus 53.4 previously. In a sign that officials are loosening policy, China also loosed the RRR for some banks.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +88K vs +62K prior GBP +5K vs -10K prior (1st positive in nearly 2 years) JPY -71K vs -51K prior CHF –1.8K vs -1.5K prior CAD +75K vs +59K prior AUD +77K vs 72K prior NZD +8K vs +12K prior

The power of central bankers has been on display in the cable data. GBP was deeply net short a few weeks ago and now the market is betting Carney will deliver a rate hike. Euro longs also rebounded after a dip last week as the market finds support near 1.17. The bounce shows how eager specs are to buy the dips.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final Manufacturing PMI [F] | |||

| 53.0 | 53.0 | Oct 02 13:45 | |

| ISM Manufacturing PMI | |||

| 57.9 | 58.8 | Oct 02 14:00 | |

| Eurozone Final PMI Manufacturing [F] | |||

| 58.1 | 58.2 | 58.2 | Oct 02 8:00 |