Intraday Market Thoughts Archives

Displaying results for week of Feb 12, 2017Something Doesn’t Add Up

The US dollar is struggling but it shouldn't be. We look at why the dollar has been the worst performer in 2017. Stocks, bonds and currencies are sending different signals. The S&P 500 finished fractionally lower on Thursday after five days of records and a nearly 13% gain since the election. US 10-year yields are at 2.45% compared to 1.80% on election night. The mystery chart in the previous IMT is that of the gold bugs HUI.

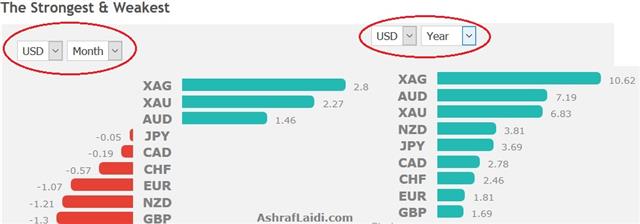

The US dollar, meanwhile, has tread water. It's up 2% against the euro since the election but down by more against the loonie. Overall, it's in the middle of the pack and the only big gain is the 6.6% rise against the yen. Looking at the data, the US dollar has been blessed. Confidence surged immediately after the election and it's beginning to translate into economic data. Retail sales and CPI were strong Wednesday and the Philly Fed made traders do a double-take on Thursday in a rise to 43.3 compared to 18.0 expected. It was the best reading in 32 years.

Stocks and bonds are saying that economic growth and higher interest rates are coming. In the past week the implied probability of a Fed hike in March has risen from 26% to nearly 40% yet the US dollar is the worst performer.

One reason as to why the greenback's in doldrums is that foreign investors, including foreign governments, just don't believe in Trump. Treasury holdings data from year-end show Japan and China as large sellers. The other reason is Trump's talk on the currency. He's promised action is coming and leaks suggest he's floating various ideas.

Consider where the US dollar might be if the data hadn't been so strong this year and the Fed wasn't so hawkish. It could be down as much as 5%. Right now the good news is disguising underlying long-term US dollar selling but it won't forever.

UK retail sales are due out this morning. Monday is a holiday in the United States so that could mean some clunky flows before the weekend.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 1.0% | -1.9% | Feb 17 9:30 | |

USD Reverses, AUD Jobs Next

Signs that better post-election confidence is beginning to translate into growth sent the US dollar initially higher but other questions reversed the move. The New Zealand dollar was the top performer while the pound lagged. The Australian jobs report is due up next. A new metals trade has been added to the Premium Insights, supported by three charts & details, bringing the number of commodity trades to three.

The general arc of an improving economy is that sentiment surveys improve first. That's followed by hard data but not always. Sometimes economic confidence fades and the expected growth pickup never materializes.

The US dollar rallied along with sentiment after the election but it stalled in part due to unease about whether better confidence would turn into growth. Hand-in-hand with that was uncertainty about what the new administration would deliver.

In the past week, Trump's 'phenomenal' tax plan offered a signal that real political action was coming and hard data has begun to improve. Today's January retail sales report was the best evidence yet. Ex-autos and gas rose 0.7% compared to a flat reading expected. The December report was also revised higher.

Along with that report, CPI beat estimates and the Empire Fed was at 18.7 compared to 7.0 expected. Initially, the US dollar surged as the probability of a March Fed climbed above 40%.

But there are signs the market has unanswered questions. A big one is wages as January year-over-year real wages were flat compared to a 0.8% rise in December. That's the kind of statistic that offers the Fed plenty of opportunity for patience. In addition, higher CPI is largely an artifact from the oil price recovery and that will slowly run off.

Finally, not all the data was good with January industrial production down 0.3% compared to a flat reading expected.

The US dollar began to reverse and went on to fall 50-80 pips from its peak. Overall, the data is still trending in the right direction but the market still has questions and there are also worries about the White House policy on a strong dollar. For now, this might just be a blip but it demonstrates how conflicted the market is on the US dollar. Meanwhile, it's full steam ahead for stocks as the S&P 500 hit a record in the sixth day of gains.

One chart that appears to be breaking out is AUD/USD as the bulls finally took 0.7700. But it could be a short-lived victory if today's jobs report struggles. The consensus estimate is for 10K new jobs with unemployment flat at 5.8%. If the numbers are strong, however, expect a break of the Nov 8 high of 0.7778 in what would be a 10-month high. The data is due at 0030 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (q/q) | |||

| 1.1% | 0.9% | Feb 16 21:45 | |

| Employment Change | |||

| 9.7K | 13.5K | Feb 16 0:30 | |

Yellen Dials Up Dollar

Janet Yellen made sure a March rate hike is on the table in the first day of her Humphrey Hawkins testimony. The Australian dollar was the top performer while the pound lagged. Australian vehicle sales highlight a light calendar later. Today's video below (for Premium subscribers) tackles the existing trades as well as the likely upcoming trades and the rational behind him. 2 remaining USD longs are in progress.

Yellen stayed clear of focusing on any date but highlighted that rate hikes (plural) are expected this year so long as the economy stays on track. What was notable is that she said those forecasts don't incorporate possible fiscal changes, so there are potential upside risks.

Looking at Fed funds implied probabilities, March ticked to 34% from 24% a week ago but most of the move came before the testimony as the market remains enamoured with Trump's tax plan. We may get more details tomorrow when Trump will meet with retail executives to talk about taxes and imports.

It won't take much more than the mention of the words “tax plan” to keep the rally going in the S&P 500. The index initially slid on Yellen but reversed to finish 9 points higher in the fifth consecutive day of gains.

The US dollar gained 50-100 pips across the board on the Yellen headlines but gave back a solid portion later, especially against the commodity currencies. That reflects the waning focus on the Fed and laser-focus on the White House. We will be watching the US Treasury extra closely in the days ahead after Secretary Mnuchin was confirmed yesterday.

The WSJ had a story about a potential Commerce Dept change that would allow US companies to claim unfair subsidies for weak currencies. It's preliminary and would cause trouble at the WTO but at the very least it's strong evidence that Trump will take FX action one way or another.

The Asia-Pacific calendar is light in the session ahead. The lone indicator to watch is the Aussie January report on new vehicle sales. The prior reading was +0.2% y/y. Tough to see that one moving the market.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed Chair Yellen Testifies | |||

| Feb 15 15:00 | |||

| FOMC's Harker Speaks | |||

| Feb 15 17:45 | |||

Canada-US Tweak, China Inflation Next

The first meeting between Trump and Trudeau clarified the US President's position on the northern border. The pound was the top performer while the euro lagged. Chinese CPI and a speech from Kuroda are due up next. The Premium short EURUSD was closed with a 130-pip gain, leaving 2 USD trades and 5 others trades in progress ahead of Yellen's testimony.

Canadian politicians and CAD traders have been scrambling for signs about how Trump saw the Canada-US relationship and we got the clearest signs yet on Monday. In a joint press conference at the White House, Trump said trade problems between the countries were “much less severe” than Mexico and elsewhere and that tweaks are coming, not an overhaul.

USD/CAD fell to the lows of the day at 1.3060 on the comments. The pair fell a half-cent in North American trade, despite a 2% fall in crude prices. The generally-positive assessment from Trump on trade and his commitments to easing cross-border commerce mitigate a key CAD risk and clear the way for another test of 1.3000.

Otherwise, newsflow was light to start the week before Tuesday's widely anticipated semi-annual testimony from Dr Yellen. We noted a New York Fed consumer survey that showed inflation expectations rising to 3% for the year ahead from 2.8%. We will be looking for an assessment from Yellen in tomorrow's testimony.

First, the focus shifts to China with the release of January CPI numbers at 0130 GMT. Some skews begin to drop out of the data and the year-over-year number is forecast to rise to 2.4% from 2.1%. The PPI is also expected to rise to 6.5% from 5.5%. China has fallen off the market's radar with all the political drama but an inflation problem could raise fresh risks.

The other event to watch is a Kuroda speech at 0430 GMT. There is speculation in some parts of the market that he will start to shift away from yield curve control but that would immediately risk unwinding the modest progress he's made on inflation.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (y/y) | |||

| 2.4% | 2.1% | Feb 14 1:30 | |

| Fed Chair Yellen Speaks | |||

| Feb 14 15:00 | |||

| FOMC's Kaplan Speaks | |||

| Feb 14 18:00 | |||

الفارق الفرنسي-الالماني و تداول اليورو

USDJPY Advances on Diplomacy 101

At its core, 21st century politics is the art of making people like you. What's now clear after Abe traveled to meet the US President is that he is one of the world's masters. On the strength of Abe's US charm offensive, the yen opened lower to start the week as USDJPY breaks to 114.15. We look at what that says about the future of politics and trading. CFTC positioning data showed a fifth week of dollar selling. All 3 USD Premium trades are currently in the green, one of which will be locked in ahead of Yellen's Tuesday testimony.

For most of the past 30 years diplomacy was less-consequential. There were minor benefits when a leaders liked one another but the globalized trade rules were largely written in stone.

That's changing as Trump and populism reshuffle the deck. Abe's performance and the market reaction to start the week shows that diplomacy is now tradeable. USD/JPY opened the week 50 pips higher.

It's clear the Japanese leader had a plan ready ahead for a Trump victory. He quickly traveled to New York with the gift of a gold-plated golf club, reflecting a shared interest. He then found a way to get to the front of the line in terms of official visits.

The two were all smiles during the two-day meeting and Abe achieved all his goals. He drew US support for Japanese control of the Senkaku Islands and turned Trump's gaze away from yen weakness. That's a big win for Japan and surely a few other world leaders will have wished the cozied up to Trump so quickly despite the objections of some of their domestic voters. Theresa May tried pulled off a similar coup.

The performance and Trump's warm reception of a major exporting competitor, highlights that Trump is a leader who deeply cares about personal relationships. As Australia's Turnbull already discovered, he can be petty and quick-tempered.

In the weeks ahead, we will be watching how he interacts with leaders from China, Canada, Europe and the rest of the world.

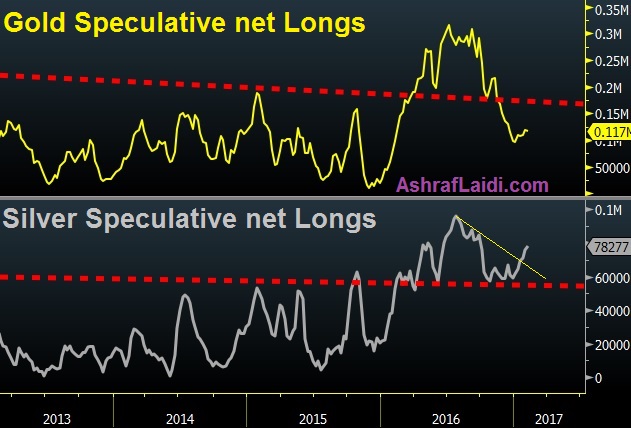

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -45K vs -46K prior JPY -55K vs -58K prior GBP -64K vs -62K prior CHF -14K vs -17K prior AUD +17K vs +12K prior CAD +4.7K vs +3K prior NZD -2K vs -1K prior

The Australian dollar is beginning to get some traction in the speculative market but few believe the run-up in iron ore prices will last. The RBA is firmly on the sidelines. More broadly, the moves were small on the week but continuing the 2017 theme of paring USD longs.