Something Doesn’t Add Up

The US dollar is struggling but it shouldn't be. We look at why the dollar has been the worst performer in 2017. Stocks, bonds and currencies are sending different signals. The S&P 500 finished fractionally lower on Thursday after five days of records and a nearly 13% gain since the election. US 10-year yields are at 2.45% compared to 1.80% on election night. The mystery chart in the previous IMT is that of the gold bugs HUI.

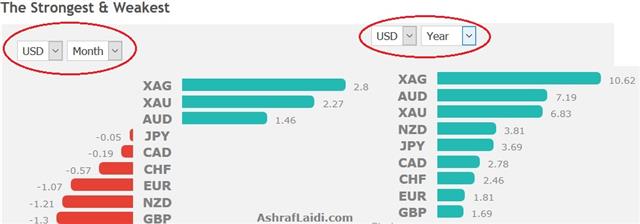

The US dollar, meanwhile, has tread water. It's up 2% against the euro since the election but down by more against the loonie. Overall, it's in the middle of the pack and the only big gain is the 6.6% rise against the yen. Looking at the data, the US dollar has been blessed. Confidence surged immediately after the election and it's beginning to translate into economic data. Retail sales and CPI were strong Wednesday and the Philly Fed made traders do a double-take on Thursday in a rise to 43.3 compared to 18.0 expected. It was the best reading in 32 years.

Stocks and bonds are saying that economic growth and higher interest rates are coming. In the past week the implied probability of a Fed hike in March has risen from 26% to nearly 40% yet the US dollar is the worst performer.

One reason as to why the greenback's in doldrums is that foreign investors, including foreign governments, just don't believe in Trump. Treasury holdings data from year-end show Japan and China as large sellers. The other reason is Trump's talk on the currency. He's promised action is coming and leaks suggest he's floating various ideas.

Consider where the US dollar might be if the data hadn't been so strong this year and the Fed wasn't so hawkish. It could be down as much as 5%. Right now the good news is disguising underlying long-term US dollar selling but it won't forever.

UK retail sales are due out this morning. Monday is a holiday in the United States so that could mean some clunky flows before the weekend.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 1.0% | -1.9% | Feb 17 9:30 | |

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46