Intraday Market Thoughts Archives

Displaying results for week of Mar 19, 2017Learning from EURCAD Trade

The following is the rationale behind our long EURCAD trade issued to our Premium susbcribers last week, currently +100 pips in the green. The focus here is on the rationale behind the decision to go long as highlighted in the 7 reasons below. Considerations of technnicals, fundamentals, intermarket cross-correlations can benefit significantly when applied correctly.

Repeal-Replace Delayed

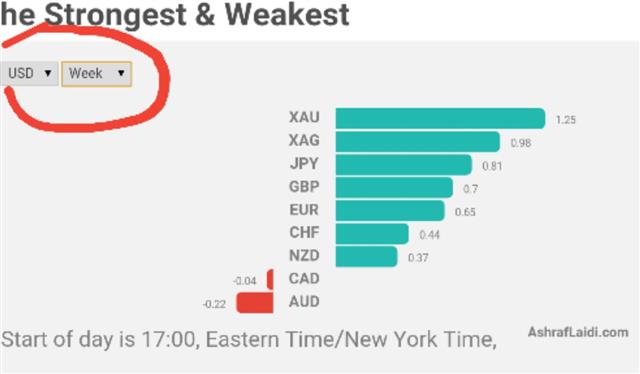

When in doubt, delay. Republicans delayed the vote on their first major piece of legislation as Tea Party supporters said it didn't do enough to eliminate Obamacare. The pound was the top performer while the Australian dollar lagged. Last night's Premium is now in progress joining 7 other trades. 2 trades in indices, 2 in commodities and 3 in FX.

Newspaper editors and TV talking heads love a political story and with markets focused on populism, they were pulled into the latest drama.

The story was framed as a referendum on Trump's agenda and even bond king Jeff Gundlach was sucked into predicting trouble if the vote failed. Yesterday we wrote that if the vote failed or was postponed, there will be selling but Republicans will quickly regroup and move forward. And we wrote that markets will recognize that.

The S&P 500 fell 10 points as questions arose but the market regrouped and finished off the lows, down just 2.5 points. USD/JPY finished slightly lower and Treasury yields ticked higher.

Expect similar themes to play out over the course of the coming four years. Trump is a different kind of politician but Washington is largely unchanged and grandstanding, threats, compromise and brinksmanship will never go away. At times markets will be rattled but the trade will increasingly be to fade the rhetoric and focus on fundamentals.

Looking ahead, the Asia-Pacific schedule is light. The lone number to watch will be the Nikkei Japan PMI for manufacturing. The prior reading was 53.3. Japanese manufacturing has picked up and the numbers will offer clues on whether factory managers believe it will last.

Aside from that, look for headlines on the healthcare bill. Meetings are expected deep into the Washington night and the vote could be delayed again.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash Manufacturing PMI | |||

| 54.2 | Mar 24 13:45 | ||

| Flash PMI Manufacturing | |||

| 53.3 | Mar 24 0:30 | ||

الإرهاب،عدم اليقين الاقتصادي وخروج بريطانيا

Why the House Health Care Vote Matters

The current version of Trump's healthcare plan will be dead-on-arrival in the Senate yet Thursday's vote in the House is a blockbuster. We explain why. The yen was the top performer on Wednesday while the Australian dollar lagged. A new Premium trade has been issued ahead of the House vote, backed by 4 technical reasons and 4 charts. 5 out of the 7 existing Premium trades are currently in the green.

The risk aversion in markets stopped on Wednesday but a more-accurate description was that it was on pause. The market is trying to figure out if the House vote on Thursday on the bill to replace Obamacare will pass or fail.

The bill itself isn't so much what's at stake. The market is increasingly viewing it as a test of Republican leadership. It's a barometer on whether Paul Ryan and Donald Trump can whip the House into supporting its agenda.

So what's at stake isn't necessarily this bill. It's the tough fights on tax reform, infrastructure and regulation that are ahead. The mantra of 'repeal and replace' Obamacare was the one thing seemingly every Republican agreed upon but exactly how that would work is proving to be a problem.

A risk we see here is that the market is overstating the problem. This isn't a Republican vote on Trump, his leadership or team unity. It's a vote on a specific piece of legislation and some Congressmen want it changed.

In that sense, buying something like USD/JPY or equities could have limited downside risks. If it passes, it's all upside. If the vote fails or is postponed, there will be selling but Republicans will quickly regroup and move forward. Markets will recognize that sooner than some think.

Changing gears to central banking, the RBNZ held rates at 1.75%, as expected. The anti-NZD jawboning continued and the message was largely unchanged. One small shift was language saying inflation will return to target in the medium-term, rather than 'gradually'. NZD initially dipped but is back to pre-RBNZ levels.

The rest of the Asia-Pacific calendar is light but it will pick up later with UK retail sales and Yellen on the agenda.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| -0.3% | Mar 23 9:30 | ||

حوار اشرف العايدي

Spring in the Market

The S&P 500 posted its worst day since Oct 1 on Tuesday in a 29-point fall. In FX, that meant selling on the yen crosses. USD/JPY briefly broke the bottom of the Feb/March range and whether it truly breaks will be the theme of the day ahead.

There wasn't a single catalyst for the change in mood but one worry is the lack of progress on Trump's promises on fiscal stimulus, tax cuts and deregulation. The first test is the repeal and replacement of Obamacare, which is the one thing that virtually every Republican agreed on in theory. Yet the first bill to replace it is facing a close vote in the House this week and will be defeated in the Senate.

That's something the market has known for days but the inability of Republicans to agree and implement what should be an easier part of their agenda is sparking questions about the rest of it.

Another worry is oil. For the past two days OPEC and Russia have floated some oil-positive stories. Both led to short-lived pops in crude that were erased in the following half-hour. Now, crude is re-testing the March low and API inventories showed another big build.

Another technical level to watch is the January high of 1.0829 in the euro. We've emphasized repeatedly how the US dollar struggled with good news like non-farm payrolls and the pricing in (and delivery) of a rate hike. Now the tide has turned and small doses of USD-negative news are having a big effect. That's a signal about an overcrowded trade that's thinning out.

Ultimately, central banks will write the next chapter but it's beginning to look like the good news is priced in for USD and others now have an opportunity. The BOJ's Funo and RBA's Debelle speak at 0130 GMT and 0140 GMT, respectively, and any hints at all about less-dovish policy will be met by JPY and/or AUD buying. Just after Debelle speaks, the Fed's Rosengren is in Bali to deliver remarks. We'll be curious to see if hawkish talk can stem the USD selling.Obvious is Scary

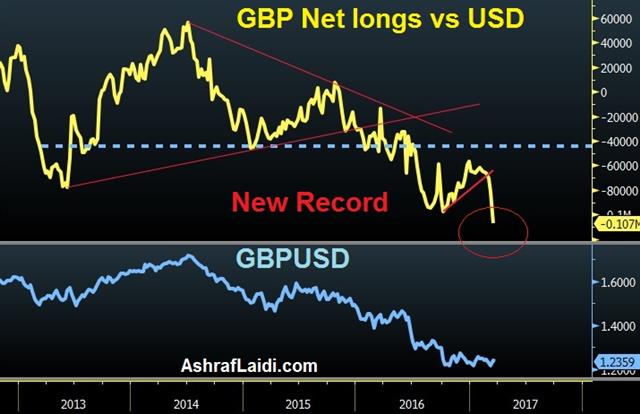

As we wrote about yesterday, the net cable short position is at the most extreme levels on record. Presumably, those are bets on a decline after Article 50. What's also notable is that in the past two weeks, the net short has nearly doubled. In that time cable has edged higher and that leaves many traders underwater.

The trade is so obviously setting up for a short squeeze that it scares us, making us think we've missed something. Goldman Sachs is out with some research saying specs tend to be right about the direction of GBP but we struggle to see it this time. There should be nothing surprising about Article 50; not only in financial markets but also on Main St. Or maybe we're overthinking it.

In any case, what we're sure of is that if a short squeeze starts after Article 50, it will get very violent, very quickly.

Turning to politics, an instant poll from Elabe showed that Macron was the most-convincing, followed by Melenchon with Le Pen tied for third. Those types of surveys tend to be flakey and with a large portion of the French electorate remains undecided though and the polls in the coming days will be market moving.

The exchanges on immigration and culture were the most heated but one of the things that was striking was how populist rhetoric is growing more refined in Europe and globally. An example was Le Pen shifting to promoting sovereignty in a move that echoed 'America First'. She said she wasn't running to be Merkel's Vice-Chancellor. That's the kind of talk that will increasingly strike a chord in a Eurozone where growth is unbalanced.G20 Rifts Open, GBP Shorts Hit Record

Headlines from the G20 meetings in Germany showed the new US administration beginning to assert itself and other leaders beginning to push back. The first French Presidential debate gets underway this evening, followed by the RBA minutes. Sterling fell sharply after UK PM May announced the date of Article 50 kickoff to be March 29, shedding all the gains from Thursday's hawkish dissent from BoE's Forbes. A new trade will be issued this evening to Premium clients.

The best way to look at the G20 is a barometer. Little is ever accomplished at the Summits but the topics of discussion and dispute are clues on which way the world is headed.

Baden-Baden was Mnuchin's first entry onto the world stage. In public comments, he was cordial and only offered small hints on what the administration was after. But behind closed doors other leaders hinted at frustration as Trump's team sets its own course.

The Communique removed a reference to resisting protectionism and leaders were unable to find a compromise on the language on trade as most pushed for free and open but Mnuchin insisted on a reference to fair.

After more than 50 days of Trump, we still have little idea on whether he's mostly talk or if his team truly plans to reshape global trade. The G20 may have been a small signal that it's Option #2.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -41K vs -58K prior JPY -71K vs -54K prior GBP -107K vs -81K prior CHF -9K vs -10K prior AUD +43K vs +51K prior CAD +21vs +29K prior NZD -6K vs -4K prior

The net short in cable is the most extreme since records began in 1992. It's been sold heavily from -60K in the final week of February. It's the clearest sign yet that specs are piling into shorts and looking for a quick profit on Article 50. That's the kind of thing that often blows up in the other direction.