Intraday Market Thoughts Archives

Displaying results for week of Mar 05, 2017Decisions & Fear of Heights

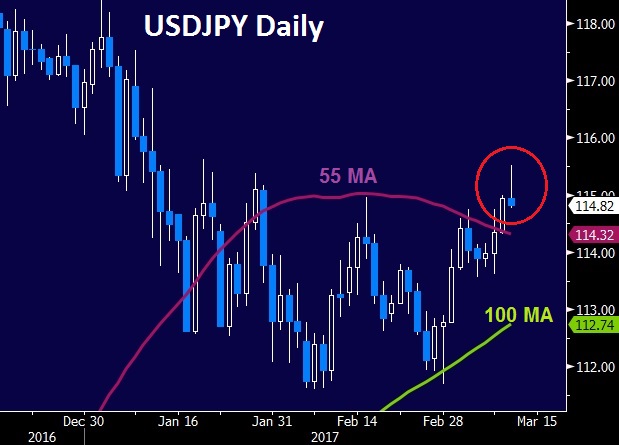

If you suffer from a fear of heights then careful when looking at the daily candle in USDJPY. After holding the long USDJPY Premium trade for over 2 months, we've finally taken profit at 105.45 from the 114.10 entry. The decision to close USDJPY long and allow EURUSD long to run (bought at 1.0540) was made 15 mins before today's NFP report. The decision to do so was about 90% technicals-related and less than 10% related to fundamentals as I had no idea the earnings figures would disappoint (0.2% m/m vs exp 0.3% m/m despite other positives such as falling Unemp rate to 4.8% from 4.7%, 235K NFP vs exp 200K consensus and NFP upward revision). But there's more to this.

While holding the USDJPY long (bought at 114.10) the position suffered extended unrealised losses (stop was 111), but as I made clear in the last 4-7 weekly Premium videos, the importance of the weekly candle to close at or above 112.40 support (50% fib of the Jun 2015-June 2016 move) that already worked as key support in Feb-Mar 2016) played a major role as it proved a solid foundation on the weekly candles from January to March 2017 (focus on weekly close not intraweek levels). After closing the USDJPY long, today's candle failed at the 50% retracement of the smaller move (Dec to Feb move).

Why I Let EURUSD Long Before NFP

A partial answer is my improved confidence with EURJPY after yesterday's break above its 55-DMA, which is the synthetic product of long EURUSD and long USDJPY. Another partial answer is related to the relationship between USDX and USDJPY, which I will explain in next week's Premium video ahead of the Fed decision. Meanwhile, yesterday's EURAUD pre-ECB long is 150-pips in the green while both gold and silver longs are left to run at a loss.اندماج التحليل الفني و الأساسي

Small Step for Draghi, Giant Leap for EUR

Draghi's introductory statement removed a pledge to use all the instruments available to meet its objectives. Removing it doesn't change anything; they will still use all tools if necessary. But, as Draghi later explained, it was removed to signal there is no longer urgency in taking further actions.

It wasn't as big of a step as some were expecting but the euro jumped to 1.0615 from 1.0550 on the change. One spot analysts were looking for a change was removing a pledge that rates could go lower if needed. That may be the next step but for now, the ECB decided to move slowly.

But the pace of change is less important that the direction. Today's press conference was a signal that the ECB believes they have reached the end of the easing cycle. Alone, that would be a sign of a bottom for the Eurozone economy. Whether it's a bottom for the euro will depend on how fast others move in the same direction.

Clues on how it will perform against the US dollar will come in the week ahead. Up first is non-farm payrolls but note how EUR/USD performed after ADP. The private jobs numbers in that report were sparkling and the correlation is high with NFP, yet after a momentary blip, the euro climbed higher and it remains 30 pips higher.

The euro has also been able to withstand a shift to a much more hawkish Fed with aggressive rate hikes priced in for this year. Non-farm payrolls could still be strong, wage growth could accelerate and the Fed could be upbeat but given that the euro has already withstood so much, it's tough to imagine it couldn't take a bit more.

The flipside is that it gained 65 pips easily on a small hint from Draghi. So if any part of the US jobs report or the FOMC disappoints, the euro may find gains to the upside much easier. Of course, if the recent lows below 1.05 and 1.0350 give way, we may have to reevaluate.

Before the jobs report, we will be looking to continued headlines from the National People's Congress. The economic calendar is generally light but the 0030 GMT release of Australian home loans could make ripples in the Australian dollar. The consensus is for a 1.0% decline.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Home Loans (m/m) | |||

| -0.9% | 0.4% | Mar 10 0:30 | |

Monitoring Rising USD Patterns

As we approach Friday's US jobs report, deemed by some as instrumental in determining the already surging odds of a Fed hike next week (and by others as irrelevant), here are a few USD notes worthy of consideration. The 6-currency basket USDX is entering its 5th straight consecutive weekly gain, the longest string of rallies since the 6-weekly gains seen on Dec 2014-Jan 2015 when the Fed ended QE3. Interestingly, we haven't had many uninterrupted weekly USD gains. Here are the most recent ones.

The above pattern suggests that gains of more than 6 weeks in a row are relatively rare. Bearing in mind that next week's Fed meeting coincides with a possible 6th weekly gain, could the USDX top be attained next week? Also, keep in mind that the USDX reached topped out 1 day after the December Fed hike. What does this mean for our directional and tactical trades? Find out here.

ADP Jumps, Oil Slumps

A blockbuster ADP employment report helped solidify a Fed hike next week and ramped up speculation about more hikes to come. The other drama in the market Wednesday was a 5% drop in oil prices as US inventories continue to build. The ECB decision is coming up in European trading but Chinese and Japanese inflation-related data is first. A new EUR trade will be released ahead of tomorrow's ECB meeting.

Private US payrolls rose an astounding 298K in February according to ADP. That was the best reading since 2013 and handily beat the 190K consensus. Moreover, recent revisions in the ADP formula have helped it track non-farm payrolls more closely.

Notably, the US dollar was unable to take advantage aside from USDJPY. EUR/USD dipped 30 pips but rebounded within the hour. USD/JPY climbed to 114.75 from 114.00 but gave back half of the gains by the close. That suggests that even a strong non-farm payrolls report won't mean much upside with a March hike fully priced in.

The big market move on the day was in oil and USD/CAD. The EIA reported an 8.2m barrel build in crude supplies. That was largely expected after yesterday's API number but it proved to be a blow oil bulls couldn't take. It was the ninth consecutive storage build and WTI finished nearly $3 lower in the largest decline since July. The 100-day moving average gave way and oil is now flirting with the $50 level.

Predictably, the drop in oil boosted USD/CAD and the pair tested 1.3500 and erased the 2017 decline. Technically, the late-December high of 1.3600 is the level to watch if barriers at 1.35 give way.

Expect continued volatility in the day ahead with the ECB decision on tap. First though are some notable economic indicators from Asia. Japan releases labor cash earnings for January at 0000 GMT. The consensus is for just a 0.4% y/y rise in another demonstration that it will be tough for Kuroda to break deflation's grip.

At 0130 GMT, China releases February CPI. The consensus is for a 1.7% y/y rise. That's down from 2.5% in January as calendar effects from energy begin to run off. With leaders lowering the growth target and inflation headed lower, a weak number could be the first hint of more stimulus to come.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Labor Cash Earnings (y/y) | |||

| 0.3% | 0.5% | Mar 09 0:00 | |

| Consumer Prce Index (y/y) | |||

| 1.9% | 2.5% | Mar 09 1:30 | |

The Pre-Brexit Sag

The pound has fallen more than 300 pips in the past week as the market stares down the looming reality of the Article 50 trigger. Parliament and the House of Lords are bickering over some of the final details but once that wraps up an announcement could come without forewarning.

That's what's keeping pound buyers sidelined but like the Yellen confirmation on the rate hike, there is a chance for a buy-the-fact trade but only if the announcement is smooth, well-prepared and well received. The last thing pound bulls want to see is disorganization in the government but May has thus far run a solid ship.

In economic news Tuesday, the US trade balance met expectations at a deficit of $48.5B in January. Trading was calm despite some volatility in commodities. The five-day drop in gold since the start of March has caught our attention but it's largely a reflection of a more-hawkish Fed.

Oil tried the upside again but was beaten back after a +11 million barrel build in supplies in the API report. The IEA also downwardly revised its demand forecast and Saudi Arabia said it was too early too early to say if quotas would be extended.

The focus will shift back to Asia now and China's National People's Congress. A PBOC official there said one goal is for China to steadily grow and promote the yuan globally. We will get some insight into trade at approximately 0200 GMT when trade figures are released. Exports are expected up 12.3% y/y and imports up 20.0%.

The other numbers we will be watching are from Japan where the final Q4 GDP reading is expected at +1.5% q/q annualized, up from 1.0%. That will be released alongside January trade balance and current account balance data.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final GDP (q/q) [F] | |||

| 0.3% | 0.4% | 0.2% | Mar 07 23:50 |

أشرف العايدي على سكاي نيوز عربية

Dollar Snapped Up

The sell-the-fact dollar dip bottomed out on Monday and then the US dollar made a slow climb as factory orders beat estimates. As Ashraf anticipated on Friday evening immediately after Yellen's comments, USD was sold after the fact and bought again at the start of the week. The performance chart below shows that as of 14:15 London/GMT, all currencies and metals are down vs USD with the exception of AUD, which was boosted by a neutral-positive RBA statement. GBP is the worst performing currency as more Brexit debate gets underway at the House of Lords. The Gold Premium trade has finally been filled, joining silver and four other trades.

The US dollar is showing signs of a renewed strength but in less likely places. The dollar recovered all of the Friday dip against the commodity currencies and the pound on Monday. The gains highlight what could be another round of Fed-driven trading.

Expect rising Fed expectations to keep a dips shallow in the lead-up to the March 15 FOMC so long as the jobs report doesn't disappoint badly. The fresh concerns about China could also hurt commodities. The market is trying to understand exactly why certain long-held references to maintain a generally stable yuan meant. It may mean that the 2% daily band is removed and the currency is allowed to be more unstable.

That's inevitable in the long-run but in the short run it could trigger swift capital moves that destabilize trading and raise uncertainty.

Earleir today, the US trade deficit widened to $48.5 bn, the largest since March 2012. Economic news was light to start the week but was highlighted by the February factory orders data. It rose 1.2% compared to 1.0% and the prior was revised higher. The key durable goods numbers were also bumped upwards.The data helped to put a modest bid into the US dollar and it finished near the best levels of the day.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Factory Orders (m/m) | |||

| 1.2% | 1.1% | 1.3% | Mar 06 15:00 |

China Cuts Growth, Specs Squeezed on CAD

Expect a healthy dose of China comments in the week ahead as the National People's Congress continues. The early news was that Premier Li Kequiang set a 2017 growth target of “around 6.5%, or higher if possible.” That's a downgrade from 7% previously.

The market has taken the news in stride so far but it will create some jitters that could turn into yen buying and commodity currency selling if any other growth-curbing news is announced..

A separate China headline from the PBOC's Yi said the yuan will remain 'relatively strong' in a slight jab at the US administration.

Other weekend news included a capital raise from Deutsche Bank. That's something the banking giant said it wasn't going to do but the 8-billion euro move to shore up capital will be seen as good news for the Eurozone. Scattered reports of a capital raise helped to boost the euro Friday and make it the best performer last week.

CFTC Commitments of Traders

Forex speculative futures positioning. + denotes net long; - denotes net short

EUR -51K vs -58K prior

GBP -71K vs -66K prior

JPY -50K vs -50K prior

CHF -12K vs -9K prior

CAD +30K vs +25K prior

AUD +52K vs +33K prior

NZD +3K vs +3K prior

Speculators buying AUD and CAD last week picked a bad time to do it. The loonie was the worst performer as the BOC dug in on neutral-to-dovish policy despite solid data. The Australian dollar also fell to a one-month low.