Intraday Market Thoughts Archives

Displaying results for week of Jun 18, 2017One year after Brexit Referendum

One year after Britain voted to leave the European Union, the UK's woes have largely been manifested by political instability, but the economic challenges could soon be catching up.

Ever since the Conservatives' disappointing election performance, we no longer PM Theresa May's favourite Brexit mantra that “no deal is better than a bad deal”. Such severe loss of bargaining power with UK MPs and the EU is changing Theresa May's tune, which raises the likelihood for a “softer” Brexit, hence, temporarily supportive for the British pound, but challenging for the FX translation FTSE. Since last year's referendum, the FTSE100 is up 16% and 27% from Brexit low. GDP growth plummeted to a 3-year low of 0.3% in Q1 2015 (the quarter before the referendum), rebounded to 0.7% in Q4 2016, but a renewed slowdown in Q1 2017 to 0.2 raises questions about the health of economic activity ahead.

Earnings remain the worry as real wages (after inflation) turned negative to -1.2%, from 2.9% in summer 2016, suggesting UK consumer power would be the last item to help in any recovery.

Any detailed macro-economic analysis does not warrant more attention as the start of Brexit negotiations and UK election uncertainty have yet to show in the data. UK Bankers and most services industry will be looking (hoping) at the likelihood of staying in the Single Market to preserve passport rights, while most manufacturers require the continuation of the Customs Union.

Canadian Confusion

The Canadian dollar surged again Thursday after a strong retail sales report but the real question is when the Bank of Canada will hike. The AUD and EUR were laggards in the otherwise low-key day. The June Japan manufacturing PMI is up next.

شراء الانخفاضات أو بيع الارتدادت؟" [فيديو العربي للمشتركين فقط]

Canadian retail sales rose 0.8% compared to 0.3% expected. Excluding autos, sales were up 1.5% compared to 0.7% expected. The strong numbers have been ongoing for months and household consumption is now forecast to rise 5% this year.

In a surprise turn, the Bank of Canada shifted gears last week and switched to a hawkish stance after remaining stubbornly neutral for months. USD/CAD is down 3 cents since including more than a cent on Thursday.

In that same timeframe, odds of a BOC hike on July 12 has risen to 50/50 from 5%. Poloz has a reputation as someone who doesn't mind surprising the market.

But let's recap. All that Wilkins said is that the BOC “will assess whether all the stimulus in place as economic growth continues and, ideally, broadens further.” There is no urgency in that statement and a good retail sales report isn't enough to add any. Meanwhile, oil is down nearly 20% in a month.

The BOC will also have noted the recent decline in Toronto home prices. According to a preliminary realtor report released Wednesday, prices have tumbled 12% since April. By hiking, the BOC would be risking popping a bubble that's already deflating.

So come July 12, the trade will likely be to sell CAD ahead of the headlines but until then, it's tough to bet against an economy that's cranking out good numbers.

Another economy that's done well this year is Japan. The calendar is generally quiet in Asia-Pacific trading Friday but the Nikkei Japan PMI due at 0030 GMT could get some attention. The prior reading was 53.1.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 1.5% | 0.6% | -0.1% | Jun 22 12:30 |

| Flash PMI Manufacturing | |||

| 53.4 | 53.1 | Jun 23 0:30 | |

| Flash Manufacturing PMI | |||

| 53.1 | 52.7 | Jun 23 13:45 | |

Central Banks To Trip on Oil

Oil is working its way back into the central banking and economic equation with prices now down 19% since the May 25 OPEC meeting. GBP was the top performer Wednesday while CAD lagged. The RBNZ held rates at 1.75%, as expected. A new NZD Premium trade has been issued in addition to the 7 existing trades.

Especially worrisome about the $1.00 fall in WTI on Wednesday to $42.50 was how it got there. The news was constructive and technical support was in place, yet crude hit the lowest since August.

First, OPEC tried a bit of jawboning. Iran's oil minister Zanganeh said consultations were ongoing about a further production cut. That comment barely had a positive effect on prices. Second, the US inventory report was mildly bullish as oil inventories fell 2451K compared to 1200K expected. Initially, WTI climbed more than 50-cents on the headlines but the spike was erased in an hour and then crude prices stated to swoon.

Finally, WTI easily slid below the intraday lows, yesterday's lows and the important November bottom with barely a sign of buyers. The low on the day was $42.05 compared to $52 on the day of the OPEC meeting.

The combination of those factors made it an even worse day for oil than it seemed. It could also make for some bad days for central bank hawks. The drop in crude is deflationary and will undercut hopes for a return to 2% inflation any time soon. Yes, it's temporary but the optics of hiking rates with 1% headline inflation is a major turn off for all global central bankers.

What's more, is the risk of economic impacts. A prime potential victim is Canada and the timing couldn't be worse for the BOC as they've just shifted to a hawkish stance and declared that energy worries are behind the economy. A reversal in position would send USD/CAD sharply higher.

The US isn't immune either. Another round of layoffs in the shale industry would come at a delicate time and worries about corporate debt could re-emerge.To be sure, those factors aren't yet in play but if oil falls below $40, they will come to the fore.

In early Asia-Pacific trade, the New Zealand dollar jumped after the RBNZ said the growth outlook remained positive. They pledged to continue with accommodative policy and added some anti-NZD jawboning but it wasn't effective as NZD/USD rose 60 pips initially to 0.7260.

مقابلتي عن فضيحة بنك باركليز و العلاقة مع قطر

Dollar Slow to Warm to Hawks

The market is seemingly saying, “we've been burned by this before” as the dollar reluctantly rises on optimism from the Fed. USD led the way on Monday while the yen lagged. The central bank calendar is busy in the day ahead. CADJPY Premium trade will be kept as is but members are free to adjust the stop.

The Fed's Dudley took center stage on Monday as the market struggles to anticipate what's next from the FOMC. The market is pricing in just a 21% chance of a hike in Sept and 43.5% in December. According to the NY Fed chief, the outlook is far rosier than that. He said he was “very confident” in the economic expansion forecast wage growth would quicken. He showed none of the caution we heard from Kaplan Friday.

The dollar initially climbed 15 pips on his comments but a steady bid continued through the day that pushed USD/JPY up 66 pips and EUR/USD down to 1.1150. Both moves were enough to erase Friday's action.

The slow grind underscores the acrimonious history the market has with Fed hawks. The Fed has overestimated growth and inflation every year since the crisis. To start the year, the in-vogue trade was reflation but it's been a dud.

So the question is to bet on recent history and or bet on the Fed getting it right this time. The lack of conviction in both camps is going to make it a back-and-forth battle as the data rolls in.

What's especially interesting is that other central banks have increasingly similar views as the Fed. The minutes of the June RBA meeting are due at 0130 GMT and are likely to highlight a similar stance. At that meeting, Lowe brushed aside a weak Q1 and forecast better growth ahead. AUD has been a strong performer since.

The minutes are part of a day with a heavy central bank focus. The PBOC's Zhou will speak 30 minutes earlier and later highlights include Carney's Mansion House speech along with the Fed's Fischer and Rosengren.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Fischer Speaks | |||

| Jun 20 12:00 | |||

| FOMC's Kaplan Speaks | |||

| Jun 20 19:00 | |||

Fed Refocus, Euro Infatuation Grows

Macron put a final stamp on his electoral victory on Sunday by claiming a combined majority with his coalition partner. The US dollar will be in focus in the week ahead as nine Fed speakers are set to take the podium. CFTC positioning showed euro net longs at the most extreme since 2007. 3 new charts backing our existing EURUSD Premium trade +a detailed note on the OIS-Fed divergence are have been posted.

Macron with ally Mouvement Democrate are projected to win 355 to 356 out of 577 seats in French parliament with most of the votes counted. Alone, it also looks like his La Republique party will win a bare majority with 291 seats. In the past week Macron has made increasingly sweeping promises to reform France and unleash innovation. He certainly has the mandate to do it and any early successes are likely to underpin the euro.

The US dollar faces a volatile week ahead (and summer) as markets attempt to gauge exactly where the Fed stands. Dudley kicks off a week of 9 speakers with an appearance at 1200 GMT.

What makes it especially intriguing were late-Friday comments from Kashkari and Kaplan. Kashkari was the lone dissenter told a newswire other members shared his views but weren't quite ready to take a stand. Kaplan is seen as more of a hawk but said he will be “very cautious” about supporting a hike.

The comments from the pair of policymakers are more in line with the market's stance than what Yellen offered in her presser. The dollar could be heavily swayed if others highlight the same kind of aversion towards hiking before inflation and growth data accelerate.

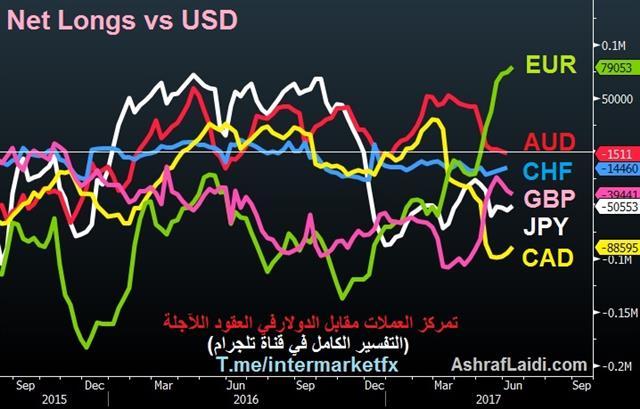

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

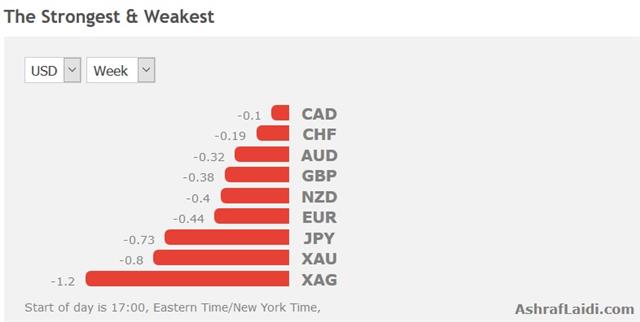

EUR +79K vs +74K prior GBP -39K vs -37K prior JPY -51K vs -55K prior CHF -14K vs -17K prior CAD -88K vs -94K prior AUD 11K vs 0K prior NZD +1K vs -2K prior

Euro net longs hit the most since 2007 as enthusiasm shaping buy-the-dips approach. EUR/USD was sold on Wed/Thurs after the FOMC decision but it's already recovered half the decline.

GBP traders await Monday's press conference from the first day of UK-EU talks at 17:230, followed by BoE's Carney Mansion House speech on Tuesday for his view on the biggest dissent in 6 years.

We also emphasize how vulnerable that CAD position suddenly looks. Few of those specs were anticipating a hawkish turn from the BOC last week and a big rethink may have only just begun.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Dudley Speaks | |||

| Jun 19 12:00 | |||

| FOMC's Evans Speaks | |||

| Jun 19 23:00 | |||